All week I’ve been pretty vocal about why I want to be buying US Treasury Bonds down here, particularly the 30yr futures $ZB_F and the $TLT ETF. I keep getting asked about the Fed and whether or not they do this or that, who said what to who, etc. I don’t know what any of this has to do with our goal: to make money in the market. I can’t keep up with the gossip, and would prefer not to anyway, so instead we focus on the only thing that actually pays anyone: price.

The negative correlation between bonds and rates is well known obviously. So when we talk about bonds, we want to look at rates. Here’s the 10-year Note Yield going back to the lows in 2010. This 2.3%-2.4% area is the big one. There’s a ton of market memory here as you can see:

Looking a bit more short-term, we are also running into a key downtrend line from the late 2013 highs. Notice how up here is where the noise is getting the loudest about rates going up. See how this works?

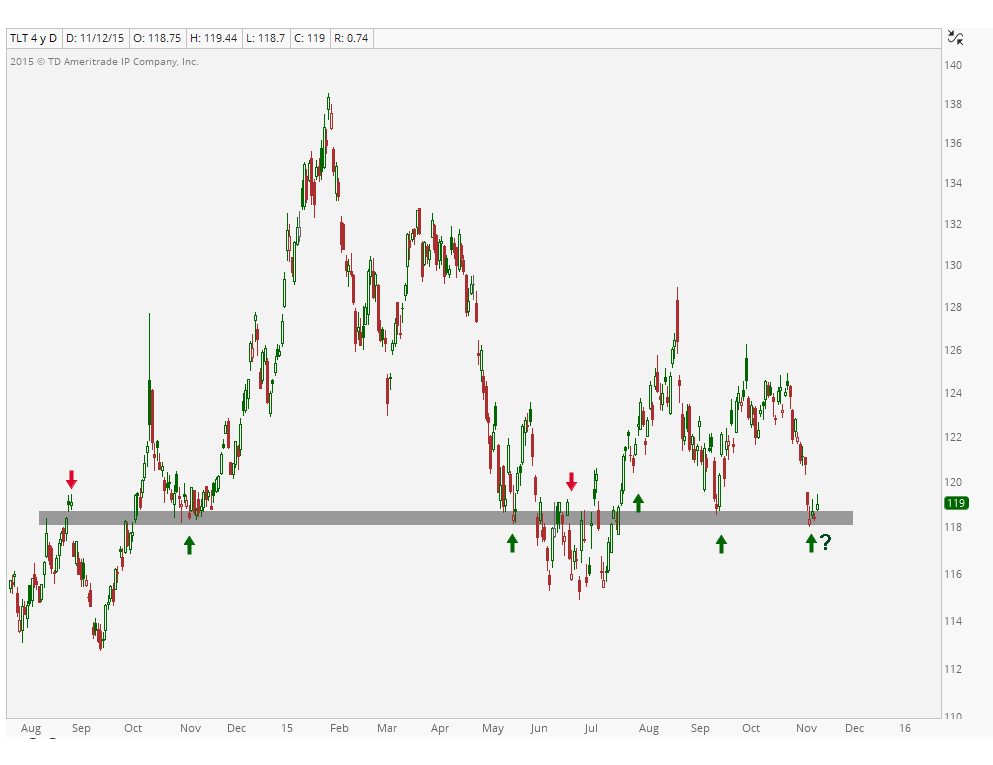

Now from an execution standpoint, we like the $TLT and 30-year Futures ZB_F. The levels have been clear. We’ve only liked $TLT on the long side if it’s above 118 (30-yr futures only above 151’10). This has been key support and resistance over the last year and gave us a solid risk vs reward this week:

You can see the periscope from this week where I explained this in more detail here:https://katch.me/allstarcharts/v/037d7f15-a788-36f5-9d40-51bfac5398ae

From a risk management perspective, the line in the sand is very well-defined. This is really all that matters to us anyway: the answer to the, “where am I wrong? scenario”. Looking at rates, if this downtrend line gets taken out to the upside and rates are holding above 2.4, then we will have to reevaluate this thesis. Although keeping an open mind (always), I think this is the lower probability outcome. I like buying bonds this week.

What do you guys think. Rates heading lower or what?

***

Click Here for full access to my research. Feel free to look through our different packages. There’s a weekly research report here for everyone depending on your goals and approach to the market.

Recent free content from J.C. Parets

-

Support & Resistance 101: Apple Edition

— 11/10/15

Support & Resistance 101: Apple Edition

— 11/10/15

-

Video: Technical Analysis Webinar by JC Parets

— 10/01/15

Video: Technical Analysis Webinar by JC Parets

— 10/01/15

-

Find Your Edge: The Autumn 2015 AlphaShark Trading Symposium with a Presentation by J.C. Parets

— 9/25/15

Find Your Edge: The Autumn 2015 AlphaShark Trading Symposium with a Presentation by J.C. Parets

— 9/25/15

-

Can Financials Correct 30% From Their Highs?

— 9/24/15

Can Financials Correct 30% From Their Highs?

— 9/24/15

-

Where Is The S&P 500 Heading Now?

— 9/09/15

Where Is The S&P 500 Heading Now?

— 9/09/15

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member