Click Here for this Week's Letter

Greetings,

After receiving several questions related to the impact of the Paris attacks on financial markets, I decided it would be easiest to give my thoughts here instead of responding individually. This week’s rally in defense stocks and decline in tourism-related companies is fairly predictable, but the broader market’s reaction is impossible to predict until we know the impact on consumer confidence – something that should be watched closely going forward. However, it is clear that the West is going to respond forcefully against ISIS and other terrorist networks.

The G-20 might spar with Russia over the fate of Bashar Al-Assad in Syria, but even Putin seems to be onboard against ISIS after they brought down a plane carrying 225 Russians in Egypt. The question is: how will the West strike such an amorphous organization? In my opinion, the best and most politically palatable option is cracking down on terrorism funding to starve the beast. French forces have already started bombing ISIS’s oil refineries, but their big money comes from Saudi Arabia and other Gulf states. In a 2009 memo, then Secretary of State Hillary Clinton said "Donors in Saudi Arabia constitute the most significant source of funding to Sunni terrorist groups worldwide."That didn’t stop the Clinton Foundation from accepting $10-$25 million in donations from the Saudi Kingdom and $5-$10 million from Kuwait, but that’s another matter. If the US starts cracking down and freezing assets, it could mean big trouble for a Saudi economy that is already reeling. The massive decline in oil prices has crippled 80% of government revenues, FX reserves have dropped by $100 billion since last year, and the country’s current account deficit is thought to be around -20% of GDP. Standard & Poor’s downgraded Saudi Arabia’s credit rating last month, and yet the kingdom will increase debt levels to as much as 50% of GDP within five years, up from a forecasted 6.7% this year. They’re issuing debt to fund subsidies that prevent the populous from turning on the Monarchy.

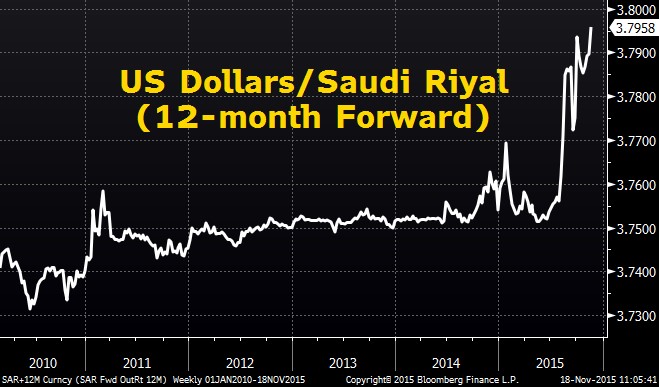

The situation is so bad that payments to government contractors have been delayed until the budget is set for next year as the government seeks to preserve cash. Officials are not predicting a severe drop in non-oil GDP growth next year. But business observers say the impact on the economy of lower spending has undermined confidence in a private sector heavily reliant on government expenditure. Remember, Saudi Arabia maintains a currency-peg against USD, meaning the latest rally is tightening monetary conditions at exactly the wrong time. The USD/SAR peg is already under heavy pressure, and it won’t abate anytime soon if the US gives a cold shoulder to its longtime ally.

The US hasn’t been able to stand up to the Saudi Kingdom in the past because of its oil needs. However, America’s oil imports have decreased significantly as domestic production increases. And Iran, which has improved relations with the West, will be exporting 1.6 million barrels of oil per day in early 2016, up 45% from current levels. Saudi Arabia is still the world’s largest oil exporter, but its clout is diminishing every day. It’s hard to play the USD/SAR unless you have a prime brokerage account, but ETFs like GULF and KSA, both tied to Middle Eastern stock indices, could come under pressure. It’s a theme that might take a while to play out, but will have huge ramifications.

The Cup & Handle Fund is up around +4.5% YTD, and +6% Y/Y. The tough base effect on Y/Y performance reaches its nadir this week. Stocks are as unpredictable as I can remember, but FX is working, so we’ll stick with that. I’m starting to brainstorm for the December letter. November’s theme hasn’t worked at all yet, but October’s is on fire. If you’d like to start receiving these letters click here.

With that I give you this week's letter:

November 19, 2015

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member