Sujan Lahiri: MicroCap Analyst at SecretCaps.com

What's Ahead:

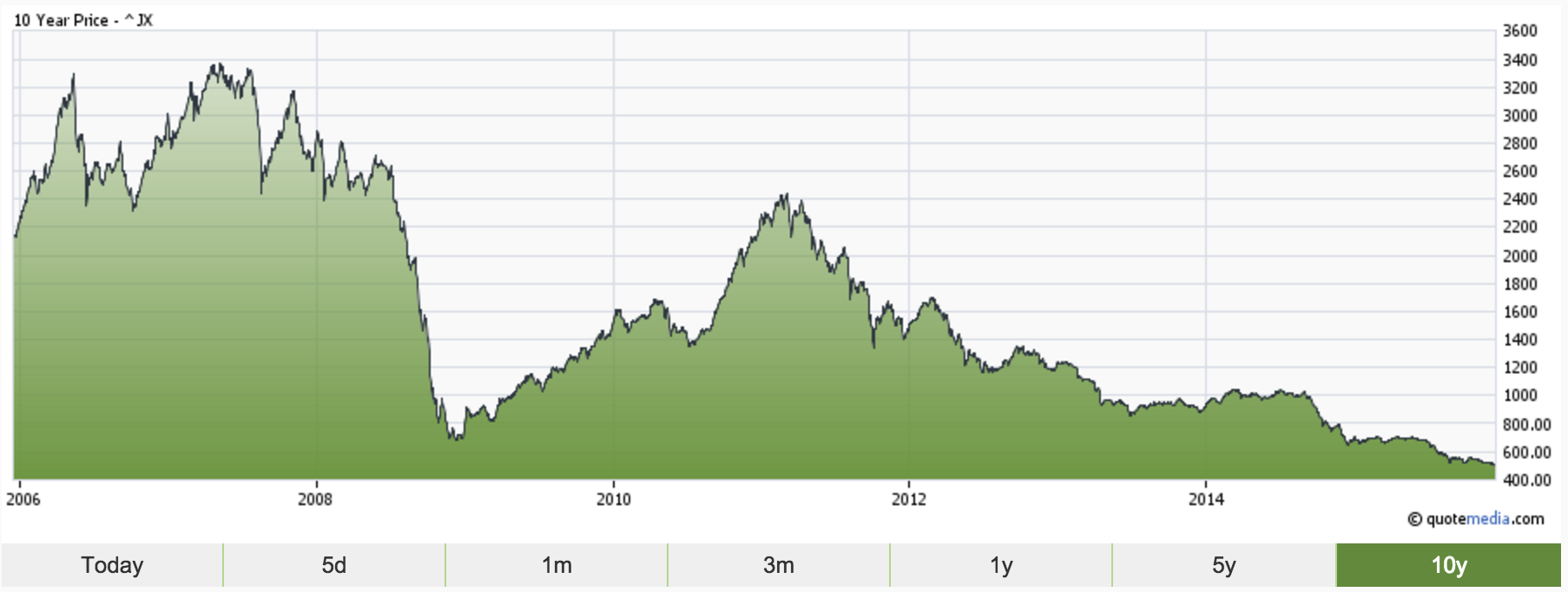

As 2016 is on our doorstep, we should be looking at what opportunities lie ahead of us. This short essay elaborates on the horrible performance of the Toronto Venture Exchange (TSXV) and why this actually brings about great buying opportunities. Take a look at the next chart, showing the TSX Venture exhchage at all time lows.

Whereas the US indices rose sharply in the past couple of years, the Canadian counterpart got hammered by almost 80%. Of course, the Venture Exchange is laden with mining stocks, which explains most of the selling. The index even reached a point now that its total market cap is substantially lower than at the height of the financial crisis in 2008! It has to be the most beat up developed country index.

But even during a collapse, it is possible to make money by very carefully pick your plays. SecretCaps has seen two of our TSXV picks double, while our other two long-term plays have stood their ground despite the TSXV's sell off, demonstrating their very solid foundations, backed by strong theses.

Why The TSXV Now:

Why exploring this index now? A rule of thumb is that when an index drops 80%, a bottom will more or less be hit. I've seen indices double or triple soon after such a bottom. The solar index (TAN) crashed 80%, and then tripled. Akin for the Russian country index. Or the NASDAQ in 2003. A huge index crash actually reduces downside risk, because the market risk already materialised big time. Be a contrarian investor here. Even the good companies are dragged down during a multi-year bear market. At some point, the sellers are simply done selling. At some point, stocks trade at cash level, making a further slide completely illogical. It's about timing….and about conducting some thorough due diligence.

But still, the difference between the US and Canada is striking. Why is this? Besides the different composition of the index, we think Canadian stocks are severely overlooked. Most stocks on the Venture Exchange, an exchange that hosts not less than 1900 companies, receive no coverage whatsoever. A key element in making money in the stock market is getting in early.

Overall Exchange Bringing Down All Companies:

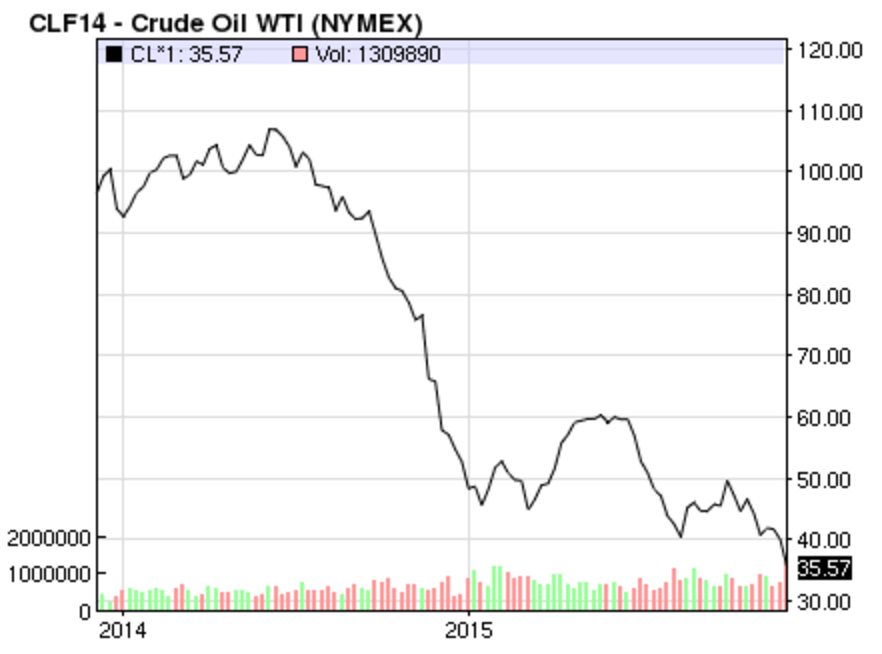

With materials and energy accounting for 70%+ of the TSX Venture exchange, the sharp decreases in the values of these sectors has helped to crush the exchange. Along for the ride are companies that have nothing to do with energy or materials. Examples include solid technology companies, many of which are gems brought down by the overall exchange they are apart of. Locating these gems can offer fruitful, multi-bagger opportunities. At the forefront to the declines in Canada’s exchanges is the sharp decrease in the price of Oil, see chart.

Exchange Rates Benefit Canadian / US Linked Companies

The dramatic weakening of the CAD due to oil and certain political moves versus the U.S. dollar has created substantial opportunities for companies incorporated in Canada that are conducting business in the U.S., and then converting the funds back.

An example of this is with SecretCaps’ recent conviction play research report profile. As a Canadian based company, the company’s customer acquisition rate is a negative 17% due to the current exchange rate. Further, SecretCaps' second technology play in Canada is undergoing triple-digit growth in their U.S. sales force. The associated income with these revenues can be converted to CAD in the future, to the enormous benefit of the company.

We recently sold Telesta Therapeutics up 100% as a short term play. Although SecretCaps' third technology play in Canada is already up 100% and we are holding onto this play. We also recently released a new play taking advantage of the TSXV, and are working on another play as well.

Due Diligence Is Key:

Conducting due diligence takes a lot of effort. A vital element is reaching out to management for example, a time-consuming endeavor. SecretCaps does all the hard work for you. We are currently sifting this market for hidden gems, reaching out to management teams of similar nano-cap plays that are totally undiscovered and ready for a strong rebound in 2016.

We like Canadian management teams, they seem to be more prudent and less promotional compared to American management teams. So stay tuned, because 2016 will be a very exciting year for the hidden gems on the TSXV.

Reminder, Marketyfy's portfolio function does not allow us to add international tickers, but we always keep our members updated in our digests. ____________________________________________________________

Disclosure: This post is strictly informational and educational and is not investment advice. Do not trade or invest based upon this content.

Recent free content from SecretCaps PRO

-

SecretCaps: Operational Update

— 10/31/16

SecretCaps: Operational Update

— 10/31/16

-

Total Telcom: A Virtually Unknown NanoCap With A Spark

— 9/28/16

Total Telcom: A Virtually Unknown NanoCap With A Spark

— 9/28/16

-

Spindle’s Experienced Management Overhaul Has Caught Our Attention

— 8/31/16

Spindle’s Experienced Management Overhaul Has Caught Our Attention

— 8/31/16

-

MicroCaps: Seriously, The Last Frontier

— 6/30/16

MicroCaps: Seriously, The Last Frontier

— 6/30/16

-

MicroCap Digest: Atman's Acquisition and BeWhere's Insider Buys

— 6/10/16

MicroCap Digest: Atman's Acquisition and BeWhere's Insider Buys

— 6/10/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member