The News – After last week’s Blast, the market received news that the outlook for the U.S. economy brightened over the fall, boosted by stronger consumer spending and falling gasoline prices, according to the Federal Reserve’s “Beige Book” report, released later that afternoon.

Falling gasoline prices was a common theme within the report, affecting everything from auto sales and restaurant spending to manufacturers’ long-term planning. Oil prices have continued to decline this week, which should cause gasoline prices to fall even further.

Important economic data was also released on Friday. The Labor Department announced that employers had created 321,000 jobs in November, the most since the start of 2012, putting the economy on pace for its best yearly job gains since 1999.

The unemployment rate remained unchanged at 5.8 percent.

The Market – The stock market is slightly lower since last Wednesday’s Blast. Yesterday and today’s combined price action should tell the tale of the market’s net short-term move.

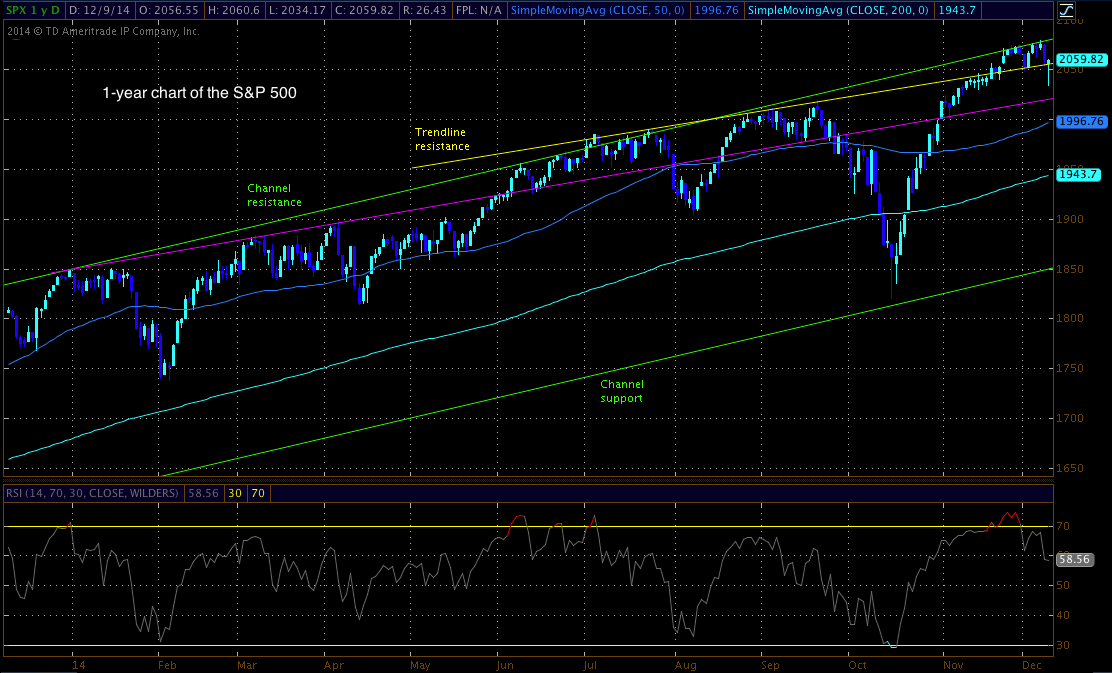

Let’s start with the S&P.

The S&P tested its channel resistance again before declining down to the trendline support. Yesterday the S&P breached its trendline significantly, but rallied nicely for the rest for the day.

If the S&P’s turn around is to continue, a move above 1260 should signal it. However, a solid close below the trendline most likely means more selling to come

The NYSE Composite still has not hit a new high since July. The 30-stock DOW hitting new highs is fine, but the broader 2000+ NYSE refusing to do so is concerning. As long as this persists, caution is advised.

Before making any trading decision, decide which side of the trade you believe gives you the highest probability of success. Do you prefer the short side of the market, long side, or do you want to be in the market at all? If you haven’t thought about it, review the overall indices themselves. For example, take a look at the S&P 500. Is it trending higher or lower? Has it recently broken through a key resistance or support level? Making these decisions ahead of time will help you decide which side of the trade you believe gives you the best opportunities.

No matter what your strategy or when you decide to enter, always remember to use protective stops and you’ll be around for the next trade. Capital preservation is always key!

Recent free content from Christian Tharp, CMT

-

Biotech Breakdown: Positive Signs Are Building (11/25/15)

— 11/25/15

Biotech Breakdown: Positive Signs Are Building (11/25/15)

— 11/25/15

-

Biotech Breakdown: Market Still Pulling Back (11/12/15)

— 11/12/15

Biotech Breakdown: Market Still Pulling Back (11/12/15)

— 11/12/15

-

Biotech Breakdown: Market Pullback Before New Highs (11/6/15)

— 11/06/15

Biotech Breakdown: Market Pullback Before New Highs (11/6/15)

— 11/06/15

-

Biotech Breakdown: Market Correction Over? (10/22/15)

— 10/23/15

Biotech Breakdown: Market Correction Over? (10/22/15)

— 10/23/15

-

Biotech Breakdown: Markets Up, Biotechs Finally Take Part (10/16/15)

— 10/16/15

Biotech Breakdown: Markets Up, Biotechs Finally Take Part (10/16/15)

— 10/16/15

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member