The News – The Fed began its two-day meeting yesterday with its announcement and rate decision due this afternoon. Fed-watchers anticipate the central bank will remove its longstanding pledge to keep interest rates at near zero for a "considerable time" in its announcement.

Economists then expect the first interest rate hike as soon as the second quarter of 2015 after rates have sat for years at an artificially low level.

And then, of course, is the biggest question on investor’s minds: When will oil stop its current slide? Oil is one of those scenarios where you don’t try to pick a bottom; you wait for a reversal to happen.

The Market – The final phrase from last week’s report was: “caution is advised”. Since that writing the market has dropped more than 4 percent.

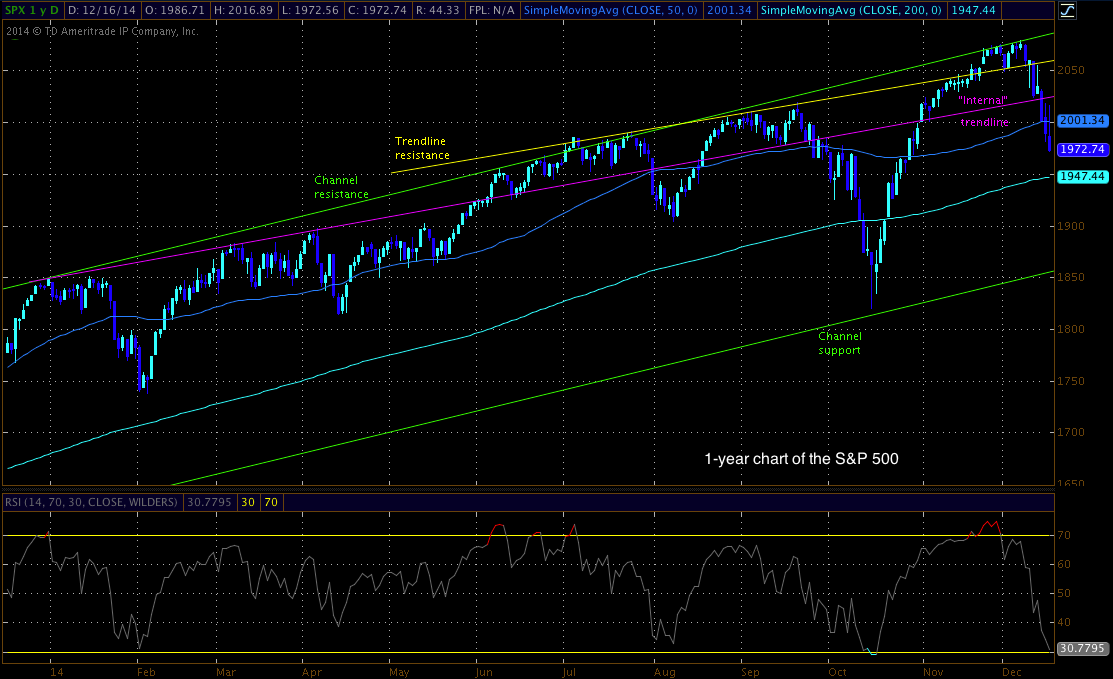

Let’s start with the S&P.

We ended last week’s S&P breakdown with “a solid close below the trendline most likely means more selling to come”. The S&P closed below the trendline that day, broke the internal trendline 2 days later, and has fallen lower ever since.

The S&P is oversold and could turn around at any time, but it sure looks like the index is making a run at its 200-day moving average. Until something positive develops, the expectation will be for lower prices.

After hitting its trendline resistance, the DOW has been dropping persistently. Currently, the index sits on a long-standing trendline of support. A break of that line, which looks imminent, means a further drop to at least the 200-day moving average. Below that obviously sits the very important channel support.

Before making any trading decision, decide which side of the trade you believe gives you the highest probability of success. Do you prefer the short side of the market, long side, or do you want to be in the market at all? If you haven’t thought about it, review the overall indices themselves. For example, take a look at the S&P 500. Is it trending higher or lower? Has it recently broken through a key resistance or support level? Making these decisions ahead of time will help you decide which side of the trade you believe gives you the best opportunities.

No matter what your strategy or when you decide to enter, always remember to use protective stops and you’ll be around for the next trade. Capital preservation is always key!

Good luck!

Christian Tharp, CMT

Recent free content from Christian Tharp, CMT

-

Biotech Breakdown: Positive Signs Are Building (11/25/15)

— 11/25/15

Biotech Breakdown: Positive Signs Are Building (11/25/15)

— 11/25/15

-

Biotech Breakdown: Market Still Pulling Back (11/12/15)

— 11/12/15

Biotech Breakdown: Market Still Pulling Back (11/12/15)

— 11/12/15

-

Biotech Breakdown: Market Pullback Before New Highs (11/6/15)

— 11/06/15

Biotech Breakdown: Market Pullback Before New Highs (11/6/15)

— 11/06/15

-

Biotech Breakdown: Market Correction Over? (10/22/15)

— 10/23/15

Biotech Breakdown: Market Correction Over? (10/22/15)

— 10/23/15

-

Biotech Breakdown: Markets Up, Biotechs Finally Take Part (10/16/15)

— 10/16/15

Biotech Breakdown: Markets Up, Biotechs Finally Take Part (10/16/15)

— 10/16/15

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member