The News – Last Wednesday brought Fed “patience” following renewed signals from the Federal Reserve that an increase in short-term rates is unlikely in the near future and that increases will be moderate once they begin.

Oil prices seem to have stabilized over the last week. We’ll just have to see if the low holds.

Yesterday, the final estimate for 3rd quarter U.S. economic growth was revised up to a 5 percent annual pace, its quickest in 11 years and easily topping expectations for growth of 4.3 percent.

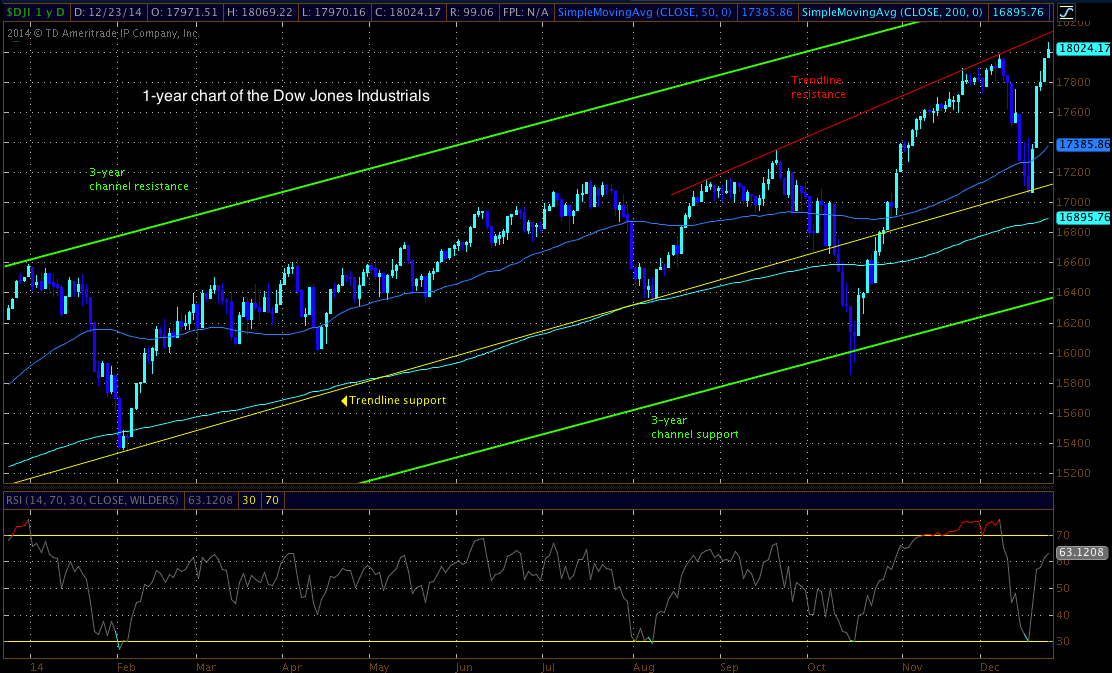

The Market – Turns out, the DOW held the market up, and in turn, sent the overall market skyrocketing higher.

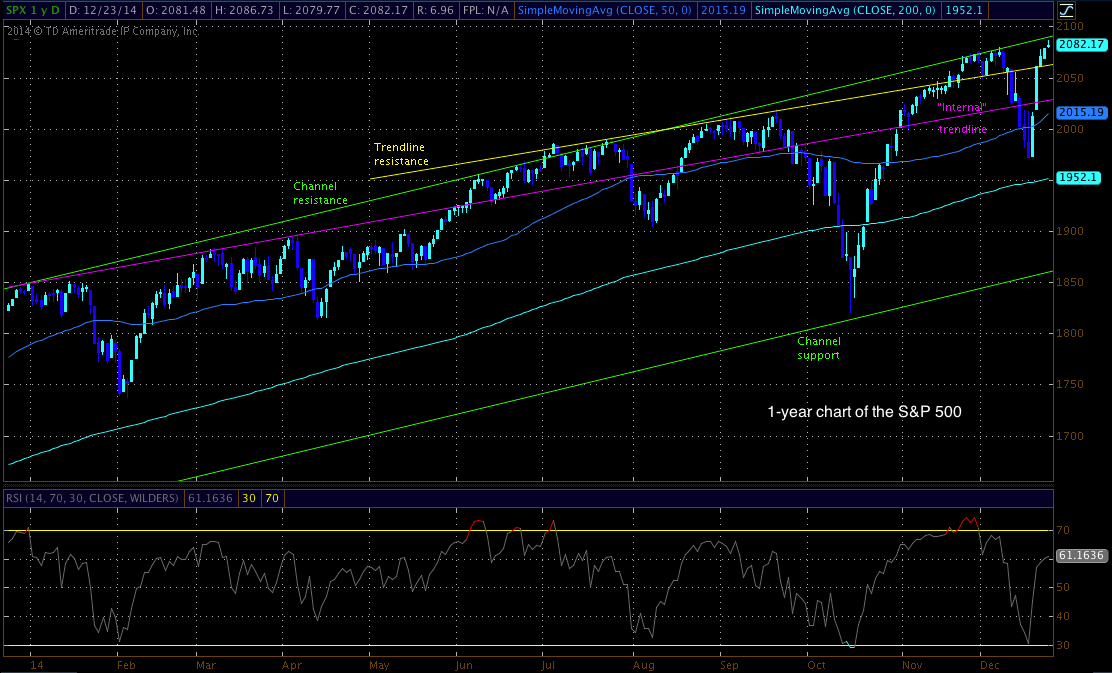

Let’s start with the S&P.

At last week’s writing the S&P seemed as if it could continue to fall down to its 200-day MA. Luckily, the DOW put the kibosh on that one and the largest 2-day rally since 2011 followed.

The S&P is now approaching its channel resistance (green), again. If that line does what it has done every other time over the last 3 years, it should send the S&P lower.

The DOW was sitting right on its trendline support (yellow) when last week’s report was written. Support held, and up the market went. There isn’t a whole lot standing in the DOW’s way of moving higher, but the S&P should have something to say about that.

Up is the word, and the Santa Claus rally appears to be in full effect. However, can Santa finally give the market the gift of an S&P channel resistance breakout?

Before making any trading decision, decide which side of the trade you believe gives you the highest probability of success. Do you prefer the short side of the market, long side, or do you want to be in the market at all? If you haven’t thought about it, review the overall indices themselves. For example, take a look at the S&P 500. Is it trending higher or lower? Has it recently broken through a key resistance or support level? Making these decisions ahead of time will help you decide which side of the trade you believe gives you the best opportunities.

No matter what your strategy or when you decide to enter, always remember to use protective stops and you’ll be around for the next trade. Capital preservation is always key!

Good luck!

Christian Tharp, CMT

@cmtstockcoach

Recent free content from Christian Tharp, CMT

-

Biotech Breakdown: Positive Signs Are Building (11/25/15)

— 11/25/15

Biotech Breakdown: Positive Signs Are Building (11/25/15)

— 11/25/15

-

Biotech Breakdown: Market Still Pulling Back (11/12/15)

— 11/12/15

Biotech Breakdown: Market Still Pulling Back (11/12/15)

— 11/12/15

-

Biotech Breakdown: Market Pullback Before New Highs (11/6/15)

— 11/06/15

Biotech Breakdown: Market Pullback Before New Highs (11/6/15)

— 11/06/15

-

Biotech Breakdown: Market Correction Over? (10/22/15)

— 10/23/15

Biotech Breakdown: Market Correction Over? (10/22/15)

— 10/23/15

-

Biotech Breakdown: Markets Up, Biotechs Finally Take Part (10/16/15)

— 10/16/15

Biotech Breakdown: Markets Up, Biotechs Finally Take Part (10/16/15)

— 10/16/15

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member