Click Here for this Week's Full Letter - February 24, 2015

Greetings,

It took two US Cabinet secretaries, three Governors, the Mayor of Los Angeles and several Congressional leaders to resolve the dispute between shipping lines and the dockworkers’ union that stalled transportation at 29 West Coast ports for over nine months. The ports, which handle 50% of all US maritime trade and more than 70% of the country’s imports from Asia, are back working at full speed, but it will take months for the backlog to clear.

Meanwhile, the East Coast continues to be pounded by extreme winter weather. The Boston-Washington corridor, home to 18% of Americans, produces more economic activity than Germany. This winter’s blizzards are having a material drag on economic activity and straining budgets. Snow removal alone has cost Boston more than $30 million. Of the 52 snowstorms rated as “high-impact” on the NESIS scale since 1956, five have occurred this winter.

Goldman Sachs estimates US GDP will take a -0.5% hit due to weather in the first quarter. Which isn’t a disaster considering last year’s “polar vortex” sent first quarter GDP growth into negative territory at -2.1% Y/Y.

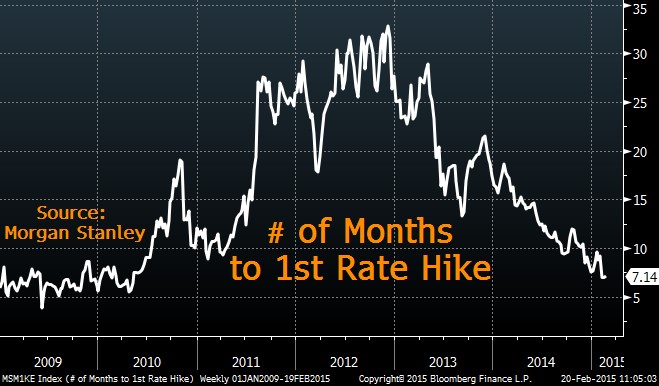

The combination of the West Coast labor dispute and East Coast weather won’t send the economy into recession this year, but it’s a great excuse for the Fed to hold off on its first rate hike. While journalists seem fixated on whether or not the Fed will hike in June, the market is pricing in the first increase around September – October (chart above).

Janet Yellen takes center stage today as part of her semiannual “Humphrey-Hawkins” testimony, although the Fed’s January minutes already showed she’s willing to wait and see what the first quarter data looks like before making any decisions. In the meantime, the US dollar, which is still around its highest level since 2003, is actively tightening monetary policy for the Fed. The stock market is setting up for a sizable correction within the next 18 months, but that doesn’t mean ultra-stimulative monetary policy in the developed world can push prices substantially higher before then.

The Cup & Handle Fund was roughly flat again last week, up 11% since inception. Two of my new positions were actually +5% within 24 hours, but those gains were offset by losses in longer-term holdings. Foreign currency seems to be the go-to market for trending moves these days, so that’s where much of my attention is focused. With that being said, my February investment letter focused on a commodity stock, which has already rallied 6% since the recommendation went out – if you’d like to start receiving these letters click here.

Today’s letter will cover several topics, including:

- The Gas Trade

- Chicken Fingers Are Back!

- Israel Strong

- Chart of the Week

With that, I give you this week's letter:

February 24, 2015

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member