Click Here for this Week's Letter

Greetings,

We’re roughly three weeks away from the highly anticipated September Fed meeting and the market is still pricing in (as I type) a 50/50 chance of higher overnight interest rates. I’ve gotten a lot of questions recently about whether I think Janet Yellen will pull the trigger, but Jon Hilsenrath is the only person outside the Fed who has any idea. Sure, the Chinese devaluation and stock market weakness leads many to believe that they’ll hold off tightening, but who knows. The Fed has repeatedly said their decision will be “data dependent” and there’s little reason to believe they’re lying. If non-farm payroll data for August is a blockbuster number next week, they’ll probably raise rates 25bps.

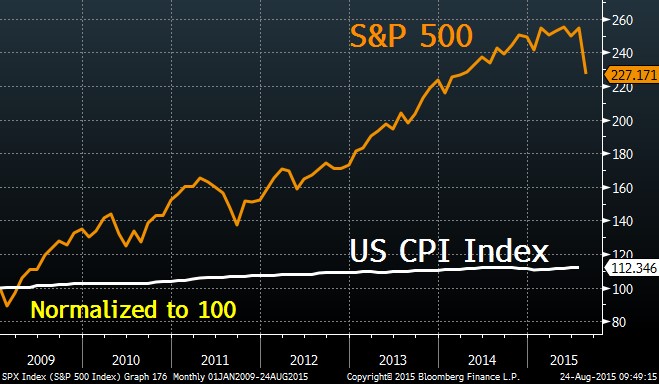

While the job market certainly warrants tighter monetary policy, the consumer price index (CPI) rising +0.2% Y/Y does not. However, as I’ve written before, we need to draw a distinction between CPI and asset price inflation – let’s call this API. Lower rates, QE, and forward guidance have all failed to stimulate CPI, but they’ve done wonders for API. Baseball teams are fetching more than $2 billion, Picasso’s are worth $200 million and now parking spaces in Manhattan are going for $1 million. However, if the S&P 500 is any indication, we could be on the precipice of our first asset-price deflation in a while.We’ve been saying for several months the Chinese economy was weaker than almost anyone thought. China’s Flash PMI for August, the first economic reading for the month, came in well below expectations at 47.1 – implying outright contraction in the manufacturing sector. In theory, a weaker currency should give manufacturers a boost, but CNY will need to drop a lot more than 3% for any meaningful recovery.

China and the possibility of higher rates in the US are the clear catalysts for this API deflation, but thus far it has spread unevenly. It started off in commodities and has wrecked the earnings of miners and agriculture companies like John Deere (DE). Next it spread to currencies, culminating in the world’s second-largest economy “breaking” a longstanding peg against USD. And now it’s spreading to equities. It’s hard to count the collapse in Chinese stocks because that was related to a huge buildup of margin debt, but equities in Korea, Taiwan, and Europe are in free-fall. Even the S&P 500 has developed the dreaded Death Cross (50d MA breaking through 100d and 200d) on the daily chart.

If the weakness spreads to bonds, specifically EM sovereigns or corporate junk, things could really get nasty. US Treasuries, German Bunds and other high-quality debt will be fine (and likely rally), but there could be widespread defaults globally in low-grade bonds. I’m watching the iShares EM Bond ETF (EMB) very closely to see whether this API deflation can be contained.

The Cup & Handle Fund is up around 10.0% YTD, and +35% Y/Y. I still think these results are highly disappointing considering how correct my directional view was (is). My investment pick for August is already +15% in our favor, as is July’s. Neither show any sign of slowing down. If you’d like to start receiving these letters click here.

Today’s letter will cover several topics, including:

- Borat Loses Purchasing Power

- Corn Diplomacy

- South Pacific on Fire

- Chart of the Week

With that I give you this week's letter:

August 24, 2015

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member