In August 2015, I wrote an article, titled "It's Time to Migrate Out of Oil". Oil is now approaching the $30 mark and USO is single-digit! Solar stocks have recent jumped. This trend will likely continue.

As I said in the previous article, "Governments around the world are already making stricter policies on carbon emissions, and they will likely get tougher in the years to come." In December 2015, global leaders finally agreed on a climate change deal to cut down emissions world-wide. Things are quickly changing. Oil stocks are tumbling. Names such as SLB, EOG, NOV, and PSX are hitting new multi-year lows. Offshore drilling are very weak, which I had discussed back in August. RIG is just above $10 now. I think it is very likely that offshore drilling will be banned in the next few years, or at least, it will more costly comparing to new ways of harnessing renewable energies.

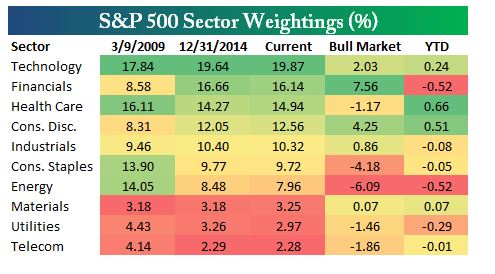

As you can see in the chart below, the energy sector's weighting in the SP500 has been decreasing in the past 3 years:

On the other hand, technology has been increasing. Solar stocks, interestingly, are not energy stocks, but, technology stocks.

The "de"-coupling of the solar stocks from the oil stocks have finally happened, and in quite a big way. We can see in the chart below that in December 2015, TAN (solar stocks) made a big jump as USO (oil) continued to fall:

This dichotomy may continue to become more pronounced.

The markets have been weak since the start of the year. With obscured views of the global economy, investors decided to lock in profits from 2015. Solar stocks, along with the broader market, have also pulled back.

I think oil stocks will continued to be weak. But, it may not be quite just the time to jump back into solar stocks either. The markets have been very volatile. We may have to wait until mid-February to make long-term investments.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member