Yesterday after the market, BRCM reported stellar earnings with a $2.26 billion revenue for the third quarter. Its shares popped +5.46% and traded as high as $40.68. We picked up both October and November calls yesterday, and scored profits as high as +285% overnight!

In my Ecstatic Plays Portfolio, I bought October 37 weekly calls at 87 cents and cashed them out this morning at $3.35!

| BRCM Options Sell to close 10.00 (1.74%) of BRCM Oct 24 2014 Call 37.0 at 3.35000 | 285.06% ($2,480.00) Profit |

| BRCM Options Buy to open 10.00 of BRCM Oct 24 2014 Call 37.0 at 0.87000 |

|

In my Happy Trades Portfolio (This product will soon become available. This portfolio is for "part-time" investors/traders, who would like to trade just several times a month and make some extra cash. If you'd like to find out more about this product please stay tuned. You can message me with your full name and your Marketfy login so I can add you to the Leads List. Or, you can become a lead under the Ecstatic Plays Product, as I will be making announcements there as well.), I bought November 37 calls at $1.34 and sold them at $3.5 today:

| BRCM Options Sell to close 10.00 (3.21%) of BRCM Nov 22 2014 Call 37.0 at 3.50000 | 161.19% ($2,160.00) Profit |

| BRCM Options Buy to open 10.00 of BRCM Nov 22 2014 Call 37.0 at 1.34000 |

|

YHOO also delivered a strong quarter earning $6.8 billion for the quarter. Besides a windfall from Alibaba, it also reported strong revenue from mobile devices. YHOO shares were up +4.53%. But, things were not all rosy today. CREE missed its earnings estimates and saw its shares tumble more than 17%! BIIB reported a strong quarter, but, the company also reported a patient died while taking its top-selling multiple sclerosis drug Tecfidera. BIIB shares gapped down almost $45 before slowing recovering throughout the day. Still, BIIB ended the day down 5.42%. ISRG reported quarterly numbers that topped analysts' estimates. However, ISRG shares fell 2.82%.

After the market, YELP stock tumbled more than 13% after disappointing investors with its Q4 forecast, although it did report a strong Q3.

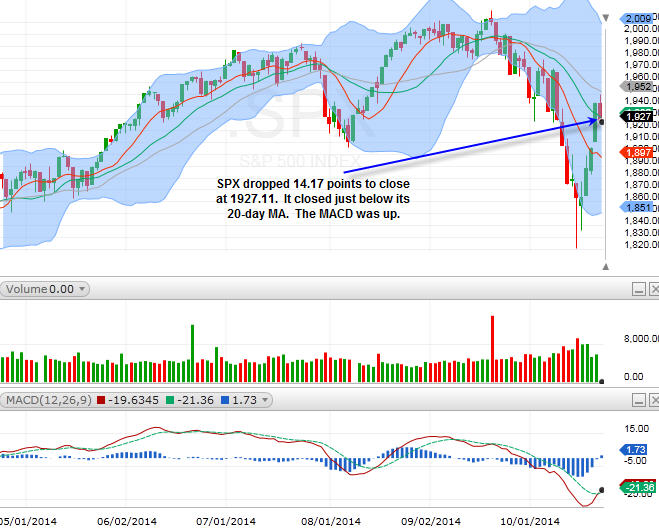

The Dow was down 153.49 points; SPX fell 14.17 points; Nasdaq lost 36.63 points:

Most sectors were down today. Gold miners (GDX) were down 3.13%. Oil Services (OIH) lost 2.66%. Energy (XLE) was weak again, falling 1.9%.

SPX

SPX dropped 14.17 points to close at 1927.11. It closed just below its 20-day MA. The MACD was up.

Nasdaq

Nasdaq fell 36.63 points to close at 4382.85. It managed to stay above the 20-day MA.

The markets had some strong bounces in the past few days. It was not surprising that we saw some profit-takers today. Many stocks fell even after the companies delivered strong quarterly reports. BA, which reported a solid quarter and a strong forecast, was another example; its shares opened up, but, ended down 4.46% for the day. There may be all sorts of opinions out there "trying" to explain earnings reactions. But, more often than not, the reasons are in the technicals. BA, for example, had been rising sharply ahead of the earnings report for four days! It was short-term overbought. It would take a much greater effort to drive it even higher. On the other hand, a quick way to make the most money of BA's earnings report was to drive its stock back down. BA has support at $118.

For SPX, the support at 1910-1900 is very important. If the market retraces back below this support, we may hear the bears roar again! For Nasdaq, the respective support is at 4350-4330.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member