Last weekend, in my Market Forecast, I wrote:

"I think the market will pause to consolidate to begin the week. Tuesday's election will likely affect the market. Lots of earnings are coming in. If the markets hold their levels after the election, the focus should be back on earnings. SPX 2010 should now be a support."

Indeed, on Monday, the market opened lower and almost touched SPX 2000 in the morning. But, buyers soon came in and drove SPX above 2010 for the close. For the rest of the week, stocks just floated higher.

We did pretty well with most of closed trades being profitable:

| VLO Options Sell to close 20.00 (1.22%) of VLO Nov 22 2014 Call 50.0 at 1.30000 | 2.36% ($60.00) Profit |

| AMZN Options Sell to close 5.00 (1.59%) of AMZN Nov 14 2014 Put 297.5 at 6.85000 | 23.42% ($650.00) Profit |

| AMZN Options Sell to close 5.00 (1.62%) of AMZN Nov 14 2014 Put 297.5 at 7.00000 | 26.13% ($725.00) Profit |

| FAS Options Buy to open 10.00 of FAS Nov 07 2014 Put 114.0 at 2.45000 | EXPIRED |

| NFLX Options Sell to close 5.00 (2.22%) of NFLX Nov 07 2014 Put 390.0 at 9.80000 | 46.27% ($1,550.00) Profit |

| NFLX Options Sell to close 5.00 (2.05%) of NFLX Nov 07 2014 Put 390.0 at 9.00000 | 34.33% ($1,150.00) Profit |

| EXPE Options Sell to close 10.00 (1.30%) of EXPE Nov 07 2014 Call 84.0 at 2.80000 | 40.70% ($810.00) Profit |

| GPRO Options Sell to close 5.00 (1.09%) of GPRO Nov 07 2014 Call 80.0 at 4.70000 | 62.07% ($900.00) Profit |

| GPRO Options Sell to close 5.00 (0.98%) of GPRO Nov 07 2014 Call 80.0 at 4.20000 | 44.83% ($650.00) Profit |

| LNKD Options Sell to close 5.00 (1.54%) of LNKD Nov 07 2014 Call 227.5 at 6.60000 | 16.81% ($475.00) Profit |

For the week, the Dow was up +183.41 points; SPX added +13.87 points; Nasdaq climbed +1.79 points. Gold had a huge bounce on Friday and traded near $1160/ounce; but, it fell again on Monday to close just above $1153/ounce. Oil continued to decline and closed just above $77/barrel on Monday. Asian markets were mostly higher on Monday, led by the Shanghai Composite Index. Here are how the US markets looked after Monday's close:

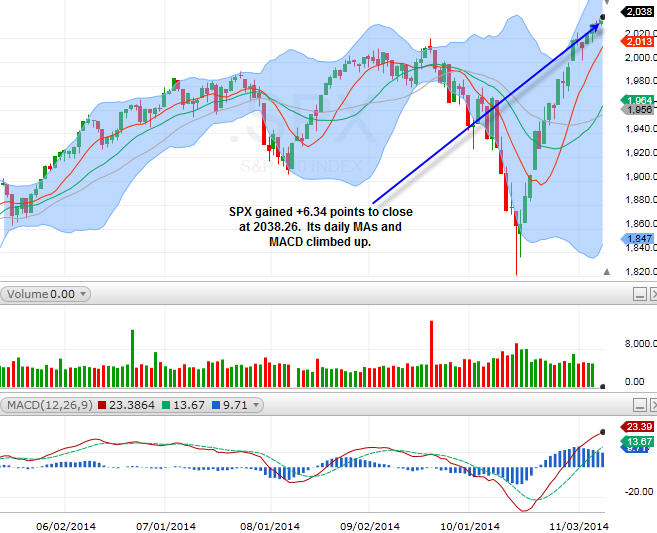

SPX

SPX gained +6.34 points to close at 2038.26. Its daily MAs and MACD climbed up.

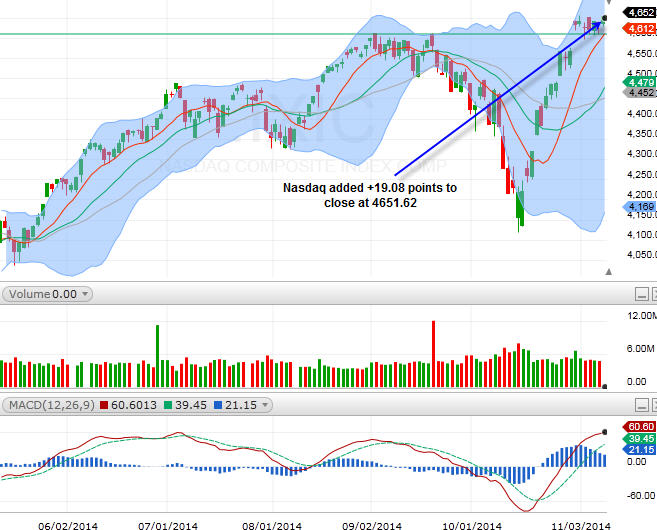

Nasdaq

Nasdaq added +19.08 points to close at 4651.62.

Both SPX and the Dow made new all-time highs today. Nasdaq also climbed higher. For the new week, it does seem like buyers are still trickling in. But, there's definitely caution on the market, as stocks have risen quite far in a month. Financials are still strong, but, the sector could need a breather. Biotechs were strong again on Monday. Internet stocks are still attracting buyers, even after some recent, unfavorable earnings reactions.

Sector Watch

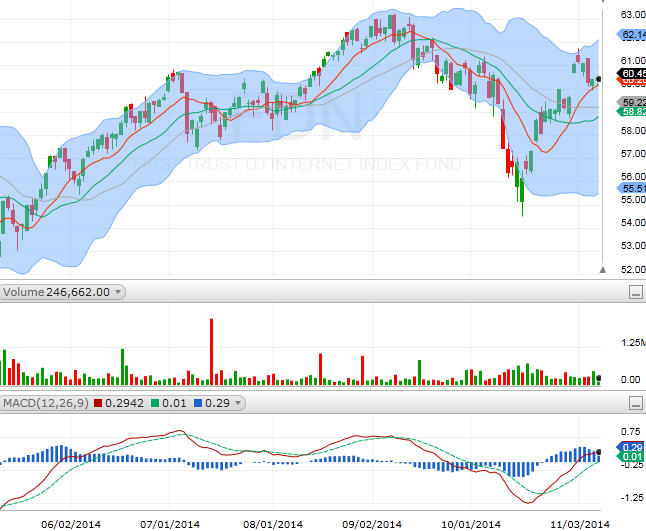

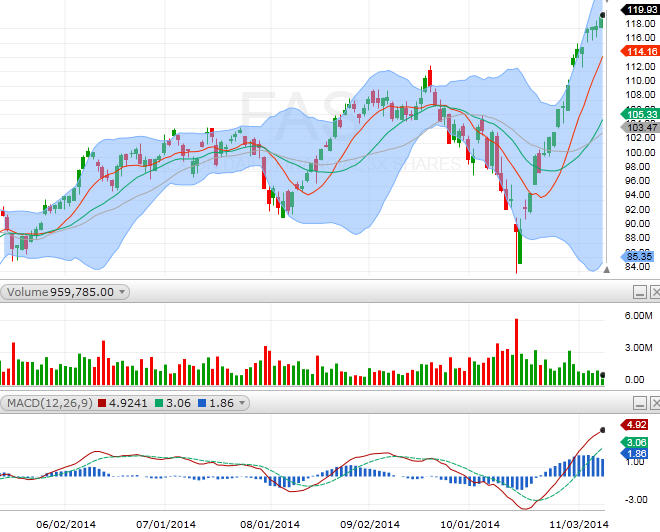

FDN (internet)

FDN pulled back last week, but, managed to stay above its daily MAs. Today, PCLN bounced more than $25. GOOG was also up after last week's pullback. Both AMZN and NFLX continued to bounce as well.

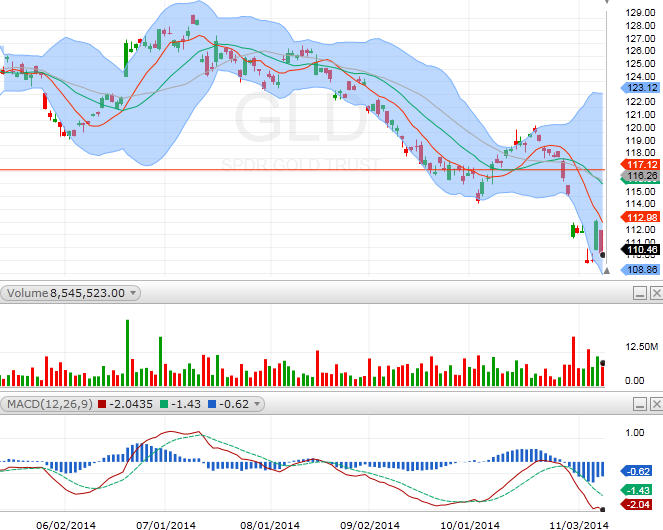

GLD (gold)

GLD made a big bounce on Friday, but, pulled back again today. We'll keep a close watch on this and see if it creates a base. Gold miners also fell today.

FAS (financial)

Financials are still strong, even after last month's incredible rise! V and MA finally saw some profit-taking. But, the big banks, GS, JPM, WFC, and BAC are still chugging along!

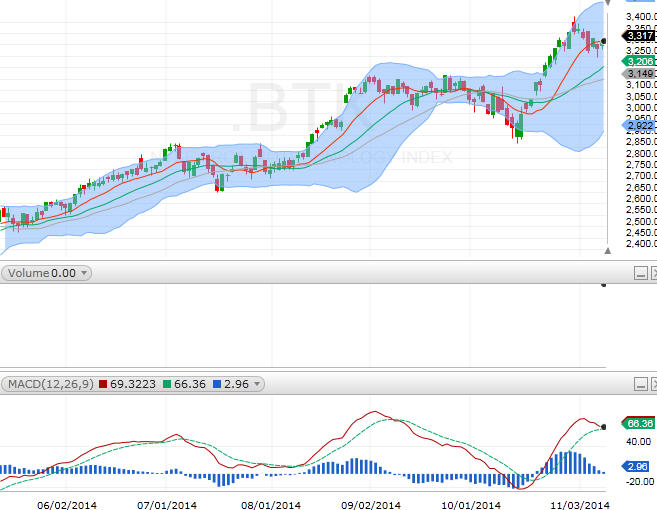

BTK (biotech)

BTK fell below its 10-day MA on Friday, but, today it bounced right back above it again. BIIB, CELG, and LLY could go for new breakouts. CLVS had a wild day on Friday, but, is trading above $60 again today!

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member