Stocks recorded another losing week last week. In my Market Forecast, I wrote:

"We will definitely get a feel from the financials, which could drive the broader market one way or the other. We have support at SPX 2000 and resistance at 2080."

Indeed, financials were very weak and dragged down the broader market. Things fell on Monday. Tuesday was a volatile day with a "head-fake" pop in the morning, only to close lower. Wednesday and Thursday were a struggle to hold below SPX 2000. Finally, on Friday, some buyers trickled in and the market saw a little bounce.

We had a busy week. Gold calls and energy puts gave us some nice profits. Here are the closed trades:

| GLD Feb 20 2015 Call 120.0 | $4.775 | $1,300.00 | 37.41% | 01/16/2015 |

| EOG Feb 20 2015 Call 87.5 | $6.175 | $1,050.00 | 20.49% | 01/16/2015 |

| VXX Jan 23 2015 Call 35.0 | $2.625 | $275.00 | 11.70% | 01/16/2015 |

| GILD Feb 20 2015 Put 100.0 | $5.225 | $-450.00 | -7.93% | 01/16/2015 |

| AMZN Jan 23 2015 Put 292.5 | $7.675 | $325.00 | 9.25% | 01/15/2015 |

| AMZN Jan 23 2015 Put 292.5 | $7.35 | $162.50 | 4.63% | 01/15/2015 |

| Z Feb 20 2015 Put 100.0 | $7.85 | $525.00 | 15.44% | 01/15/2015 |

| HLF Jan 17 2015 Put 32.5 | $2.065 | $-185.00 | -8.22% | 01/14/2015 |

| AMZN Jan 17 2015 Put 292.5 | $4.875 | $287.50 | 13.37% | 01/14/2015 |

| GS Jan 17 2015 Put 185.0 | $4.75 | $927.50 | 64.08% | 01/14/2015 |

| VLO Feb 20 2015 Put 47.5 | $3.975 | $705.00 | 21.56% | 01/14/2015 |

| VLO Feb 20 2015 Put 47.5 | $3.75 | $480.00 | 14.68% | 01/14/2015 |

| SCTY Feb 20 2015 Call 50.0 | $3.65 | $-75.00 | -2.01% | 01/13/2015 |

| BA Feb 20 2015 Call 130.0 | $3.825 | $-2,587.50 | -31.08% | 01/13/2015 |

| AAPL Feb 20 2015 Call 110.0 | $4.875 | $-1,425.00 | -22.62% | 01/13/2015 |

| V Jan 17 2015 Put 260.0 | $0.85 | $-3,700.00 | -81.32% | 01/13/2015 |

| GLD Jan 17 2015 Call 117.0 | $2.02 | $70.00 | 3.59% | 01/13/2015 |

| OXY Jan 17 2015 Put 75.0 | $1.03 | $-5.00 | -0.48% | 01/13/2015 |

| OXY Jan 17 2015 Put 75.0 | $1.355 | $320.00 | 30.92% | 01/12/2015 |

| GLD Jan 17 2015 Call 116.0 | $2.77 | $955.00 | 52.62% | 01/12/2015 |

| TSLA Jan 17 2015 Put 205.0 | $7.525 | $1,150.00 | 44.02% | 01/12/2015 |

For the week, the Dow was down 225.8 points; SPX fell 25.39 points; Nasdaq lost 69.69 points. Gold, once again a "safe haven", got a nice pop, closing at around $1277/ounce. Oil traded down to below $45/barrel, but, clawed its way back to close just below $50/barrel. At the time of this writing, Asian markets were mostly higher, although on Monday, China was down nearly 7% on new margin regulation for stock brokerage accounts. Here's where the US markets stood after Friday's close:

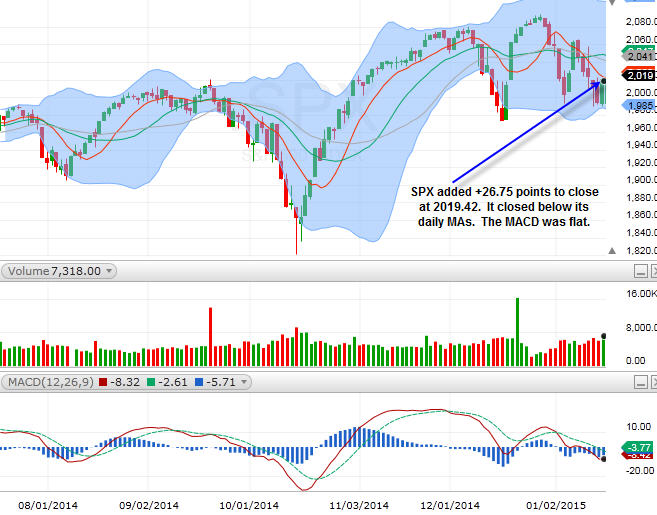

SPX

On Friday, SPX added +26.75 points to close at 2019.42. It closed below its daily MAs. The MACD was flat.

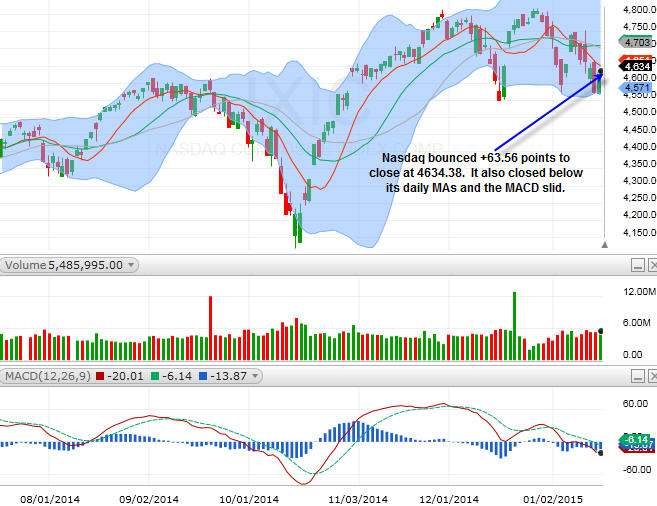

Nasdaq

Nasdaq bounced +63.56 points to close at 4634.38. It also closed below its daily MAs and the MACD slid.

Both SPX and Nasdaq closed below their respective daily MAs. For the new week, a bulk of earnings reports are going to come through:

Tues: (AM) ATI, DAL, HAL, JNJ, MS, SAP; (PM) CA, CREE, IBM, NFLX

Wed: (AM) ASML, USB, UNH; (PM) AXP, EBAY, FFIV, SNDK, XLNX

Thurs: (AM) CP, CY, JCI, PCP, LUV, TZOO, UAL, UNP (PM) ALTR, SWKS, SBUX

Fri: (AM) BK, GE, HON, KSU, MCD, STT, SHPG

Airlines could be very interesting. NFLX and IBM after market on Tuesday could set the tone for the week. A lot of smaller, regional banks are report, but, AXP on Wednesday could be very influential for the financials. ASML, CY, and ALTR will be important for the semiconductors.

The market is still within the wide trading range, ie. SPX 1990 to 2080.

Sector Watch

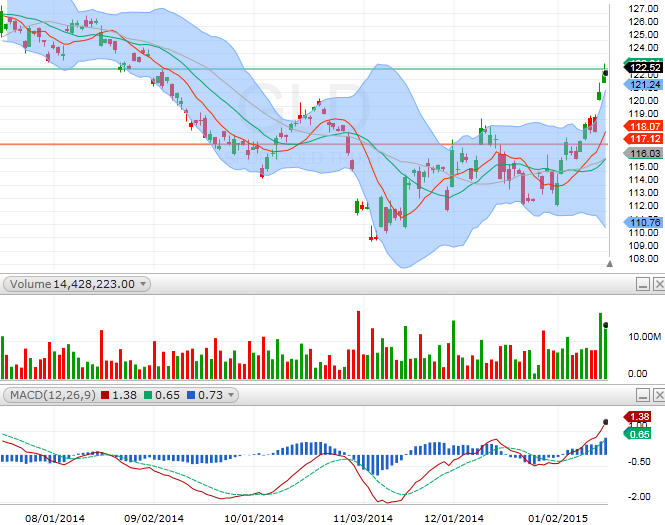

GLD (gold)

GLD got a solid pop last week, closing right at the resistance around $122.5. It looks like GLD could challenge $130 within the next couple of weeks.

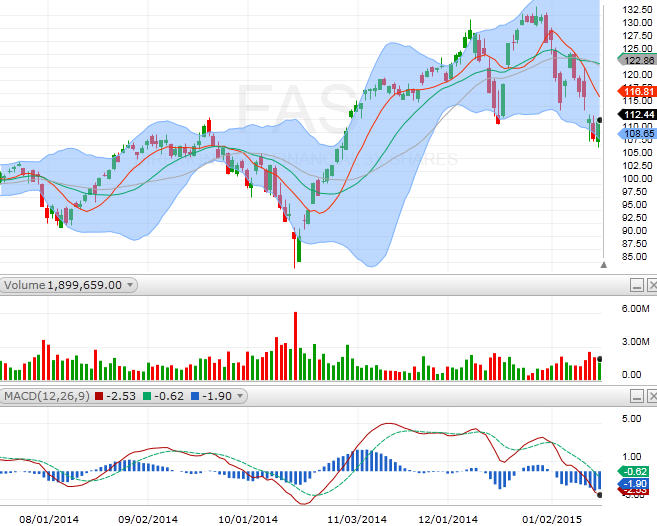

FAS (financial)

FAS took a nosedive last week. Its chart is very weak. A lot of smaller banks will be reporting. MS comes in on Tuesday morning. AXP should be very important as well. V and MA charts are getting weaker.

XLE (energy)

XLE is trying to bounce. There was definitely buying last week. HAL will report on Tuesday morning. HAL, OXY, APA and EOG seem to be drawing a base.

FDN (internet)

FDN's chart is also very weak. NFLX leads off on Tuesday after the market. Then, we get EBAY on Wednesday and TZOO on Thursday.

Overall, the market is still on the weak side, although things seem to be trying to make a near-term bounce. I will likely look to add downside plays on strength.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member