Weekly Wrap-Up + Market Forecast + Sector Watch: SPX, Nasdaq, FAS, BTK, XLE, GLD, GS, STI, PNC, APA, APC, EOG, OXY, SLB, HES, BIIB, BMRN, MDVN, GEVA, KITE, CLVS

Last weekend, in my Market Forecast, I wrote:

"With the weakness in energy and financial stocks, it does look like the market may need a few days to consolidate. But, I still think Nasdaq will test 5,000 in March sometime. SPX has support at 2100, and then 2080. So, it seems that the markets may be range-bound again, until perhaps later in the week."

Indeed, things happened pretty much accordingly. On Monday, tech stocks propelled Nasdaq to above 5,000. However, profit-taking started on Tuesday. Wednesday morning saw a quick drop, then, buyers came in again. Thursday was quiet, ahead of the unemployment report. On Friday, US jobs data showed that the unemployment rate dropped to 5.5%, renewing speculation that the Fed may raise rates in June or September. Stocks pulled back, with SPX closing barely above 2070.

Things were volatile and I was being extra careful. But, in retrospect, perhaps we should have taken most of the week off. Although we made some good quick trades, I don't necessarily think it was worth the trouble of monitoring the market through the volatility. Our big trade on BA calls did really well. VXX calls were good, but, we may have sold early. By the end of the week, the Ecstatic Plays portfolio was at a new all-time high (which has been climbing higher week after week).

| VXX Mar 20 2015 Call 27.0 | $1.815 | $287.50 | 18.82% | 03/06/2015 |

| KITE Apr 17 2015 Call 65.0 | $7.45 | $300.00 | 8.76% | 03/06/2015 |

| NFLX Mar 13 2015 Put 460.0 | $7.20 | $462.50 | 14.74% | 03/06/2015 |

| FEYE Mar 20 2015 Call 45.0 | $0.875 | $-1,900.00 | -68.47% | 03/06/2015 |

| SNDK Mar 20 2015 Call 82.5 | $1.215 | $-1,255.00 | -50.81% | 03/06/2015 |

| BIDU Mar 20 2015 Put 217.5 | $6.825 | $862.50 | 33.82% | 03/06/2015 |

| VXX Mar 20 2015 Call 27.0 | $1.54 | $170.00 | 28.33% | 03/06/2015 |

| BIDU Mar 20 2015 Put 217.5 | $6.40 | $650.00 | 25.49% | 03/06/2015 |

| VXX Mar 20 2015 Call 27.0 | $1.495 | $147.50 | 24.58% | 03/06/2015 |

| KITE Apr 17 2015 Call 65.0 | $7.20 | $175.00 | 5.11% | 03/06/2015 |

| VIPS Mar 20 2015 Call 25.0 | $0.975 | $25.00 | 2.63% | 03/06/2015 |

| LNKD Mar 13 2015 Call 267.5 | $5.40 | $468.75 | 9.51% | 03/06/2015 |

| LNKD Mar 13 2015 Call 267.5 | $4.70 | $-231.25 | -4.69% | 03/06/2015 |

| NFLX Mar 13 2015 Put 465.0 | $5.975 | $-575.00 | -16.14% | 03/05/2015 |

| GPRO Mar 20 2015 Call 42.5 | $1.45 | $-975.00 | -40.21% | 03/05/2015 |

| LNKD Mar 13 2015 Call 267.5 | $4.575 | $-625.00 | -12.02% | 03/05/2015 |

| FB Mar 20 2015 Call 80.0 | $2.57 | $815.00 | 46.44% | 03/05/2015 |

| CSIQ Mar 20 2015 Call 30.0 | $3.10 | $825.00 | 21.57% | 03/05/2015 |

| FB Mar 20 2015 Call 80.0 | $2.185 | $430.00 | 24.50% | 03/04/2015 |

| NFLX Mar 06 2015 Put 470.0 | $4.775 | $-450.00 | -15.86% | 03/04/2015 |

| CSIQ Mar 20 2015 Call 30.0 | $2.10 | $-675.00 | -17.65% | 03/04/2015 |

| VXX Mar 20 2015 Call 27.0 | $1.57 | $-425.00 | -21.30% | 03/04/2015 |

| FB Mar 20 2015 Call 79.0 | $1.83 | $80.00 | 1.48% | 03/04/2015 |

| AMZN Mar 13 2015 Put 385.0 | $6.00 | $-537.50 | -15.19% | 03/03/2015 |

| GMCR Mar 13 2015 Call 130.0 | $2.675 | $-1,275.00 | -13.71% | 03/03/2015 |

| FB Mar 13 2015 Call 79.0 | $1.325 | $-962.50 | -22.51% | 03/03/2015 |

| VXX Mar 06 2015 Call 26.0 | $1.235 | $-1,767.50 | -41.71% | 03/03/2015 |

| BA Mar 13 2015 Call 152.5 | $4.375 | $3,500.00 | 66.67% | 03/03/2015 |

| BA Mar 13 2015 Call 152.5 | $4.475 | $1,850.00 | 70.48% | 03/03/2015 |

| FB Mar 13 2015 Call 79.0 | $1.425 | $-712.50 | -16.67% | 03/03/2015 |

| BA Mar 13 2015 Call 152.5 | $4.075 | $2,900.00 | 55.24% | 03/03/2015 |

| PCLN Mar 06 2015 Call 1255.0 | $12.10 | $-2,000.00 | -24.84% | 03/02/2015 |

For the week, the Dow was down 275.92 points; SPX shed 33.24 points; Nasdaq fell 36.16 points. Oil was flat, closing above $51/barrel. Gold took a tumble on Friday after the jobs report, closing below $1170/ounce. At the time of this writing, Asian markets were mostly lower. Let's how the US markets looked after Friday's close:

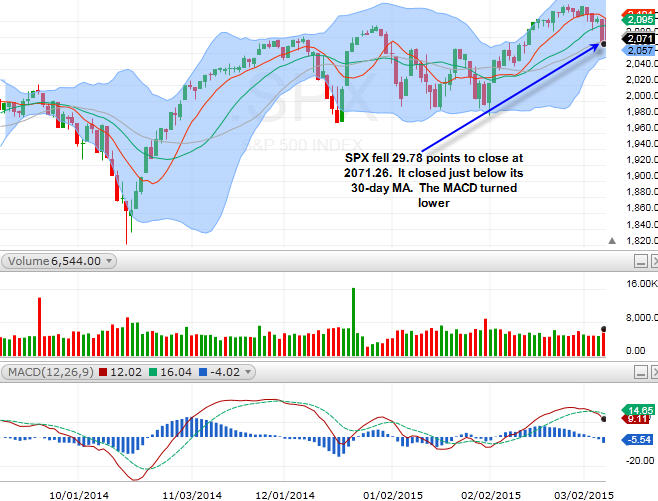

SPX

On Friday, SPX fell 29.78 points to close at 2071.26. It closed just below its 30-day MA. The MACD turned lower.

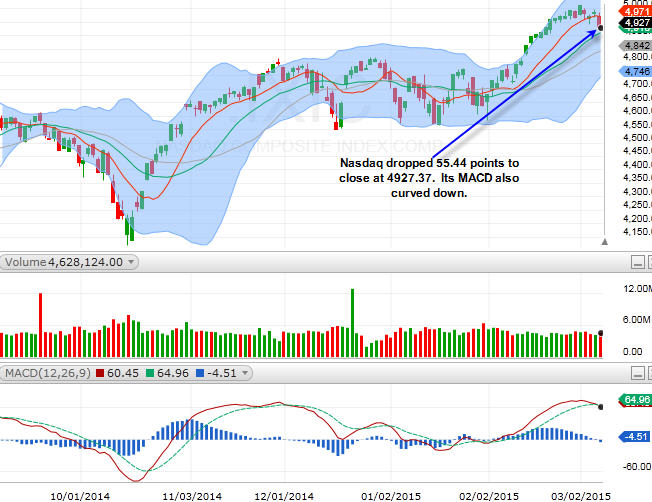

Nasdaq

Nasdaq dropped 55.44 points to close at 4927.37. Its MACD also curved down.

SPX fell quite far on Friday. So, the Dow, dropping nearly 280 points. Nasdaq was much stronger, falling just 1.11% on Friday, and held up really well earlier in the week. For the new week...

If you'd like to read the rest of the articles, please subscribe to my Ecstatic Plays product (Click Here).

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member