Markets pulled back last week. AAPL earnings disappointed investors on Tuesday and pressure the tech stocks. Energy stocks stayed weak. Stocks were especially weak on Friday, as SPX pulled back 1.07% and closed just below 2080.

However, we traded very well, and booked winning trades on both up and down sides. Our TSLA calls early in the week gave us an intraday +74% gain. NXPI calls after the pullback gave us +68.28% profit. We also played SPY puts, which scored as high as +80% win. Here are the closed trades for the week:

My Ecstatic Plays portfolio is up +235% in the past 365 days, up +48% so far in 2015, and up +29% in the past 90 days. I have been working on a new portfolio called Happy Stocks. This portfolio is up a whopping +70% in the past 90 days. If you are interested in finding out more about Ecstatic Plays, please CLICK HERE. To find out more about Happy Stocks (this portfolio will trade stocks as well as options and the trade sizes will be bigger than Ecstatic Plays), please CLICK HERE!

For the week, the Dow was down 517.92 points; SPX fell 46.99 points; Nasdaq dropped 121.51 points. Oil (WTI) fell to $48/barrel. Gold dropped as well, but, bounced on Friday and was trading higher, to almost $1100/ounce, this evening at the time of this writing. Asian markets were lower this evening, with Hong Kong down about 2.5%, as I composed this article. Let's take a look at the US markets:

SPX

On Friday, SPX fell 22.5 points to close at 2079.65. It closed below its daily MAs. The MACD turned down.

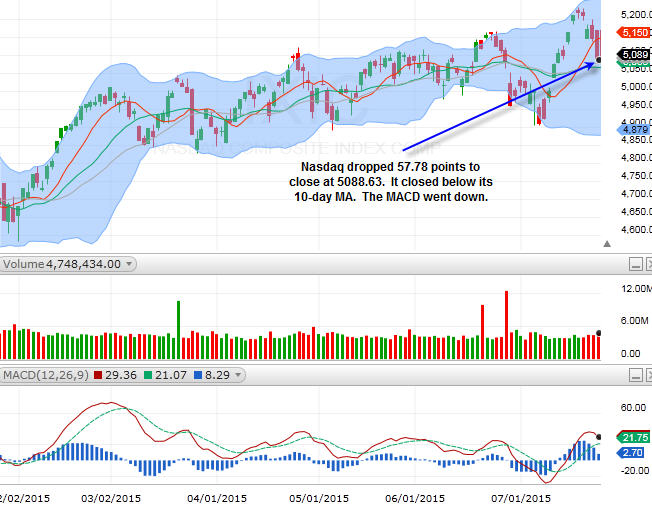

Nasdaq

Nasdaq dropped 57.78 points to close at 5088.63. It closed below its 10-day MA. The MACD went down.

Markets were really weak on Friday. SPX went all the way down to close below 2080, and below its daily MAs. For the new week, we have a lot more earnings coming in:

MON: (AM) CYOU; (PM) BIDU, SWN

TUE: (AM) GLW, BP, UPS, PFE, CMI, NOV, MRK, PCP; (PM) YELP VDSI, GILD, TWTR, X, BWLD, APC, AKAM, ESRX, IACI, CTXS, NCR

WED: (AM) DATA, MA, LVLT, SNCR, GRMN; (PM) FB, CAVM, NOW, SCTY, QRVO, NXPI, WFM, WYNN, SKX, MET, AEM

THUR: (AM) VLO, TASR, MPC, TEVA, CI, TWC, OXY, LLL; (PM) LNKD, AMGN, EXPE, FEYE, BRCM, DECK KLAC

FRI: (AM) XOM, CVX, STX

A lot of energy companies are reporting in the coming week: BP, NOV, SWN, XOM, CVX, FLO, MPC. I think the energy companies will stay weak. Even if the earnings are not as weak as expected, people may sell on any bounce. Biotechs fell quite a bit last week, especially on Friday, as BIIB plunged 22%! If biotechs continued to show weakness, there is a good chance that the broader market is in for a correction. Internet sector will also be in focus as YELP, TWTR, FB, IACI, EXPE, and LNKD are all reporting.

SPX has support between 2070-2050. On the upside, 2100 could pose as a resistance. I think we may see continued weakness and perhaps some consolidation to start the week. Then, we will have to see how the earnings hold up.

Sector Watch

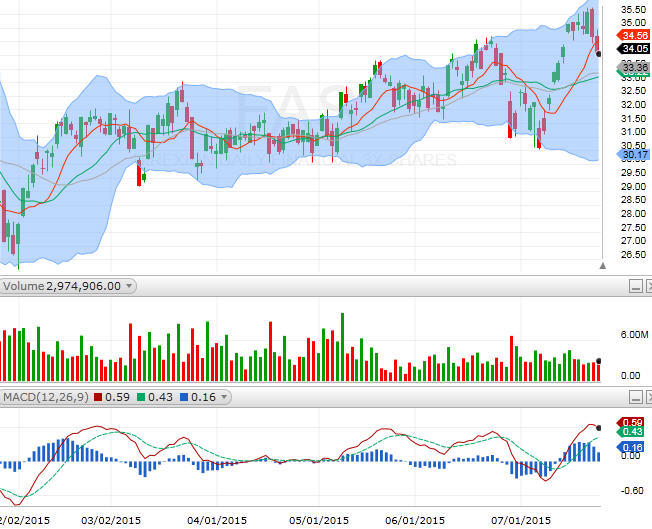

FAS (financial)

FAS fell below its 10-day MA. GS has turned bearish. JPM, WFC, and BAC are holding up well. V popped on Friday on good earnings. MA will report on Wednesday morning.

XLE (energy)

It's amazing how far this sector has come down since end of April. Oil is still falling. As mentioned above, many energy companies will report this week. I think this sector will stay weak for sometime.

FDN (internet)

Internet managed to keep most of its gains this week, even though the broader market fell back. Lots of names reporting this week as discussed earlier.

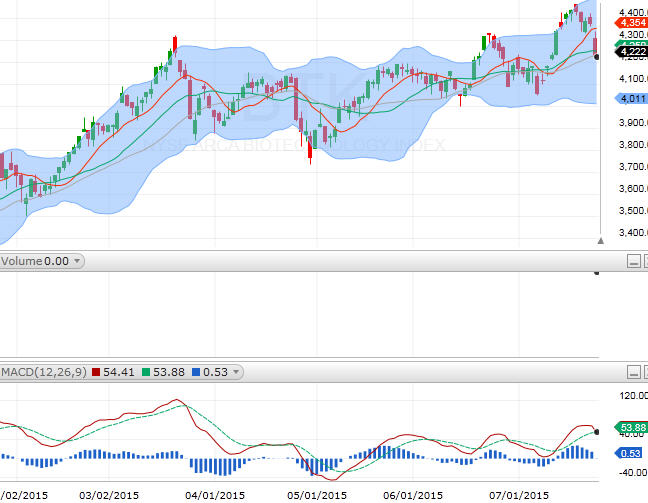

BTK (biotech)

BIIB's 22% plunge on Friday pushed the rest of this sector lower. This week, we will hear from GILD, AMGN, PFE, and MRK. If biotech's weakness persists, it will form a top, technically. Then, we can expect some short-term correction in the broader market.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member