One of the biggest themes for me over the past few years has been the consistent underperformance out of Emerging Markets relative to U.S. Stocks. This is the exact opposite of what had been such a nice trend for so many years. From 2003-2007 Emerging Markets were where you wanted to be, and not the United States. But since then we have seen a tremendous bottoming out of that trend where now it’s the US hitting fresh 9-year highs relative to Emerging Markets and it’s Latin America that is a big part of the reason for this struggle.

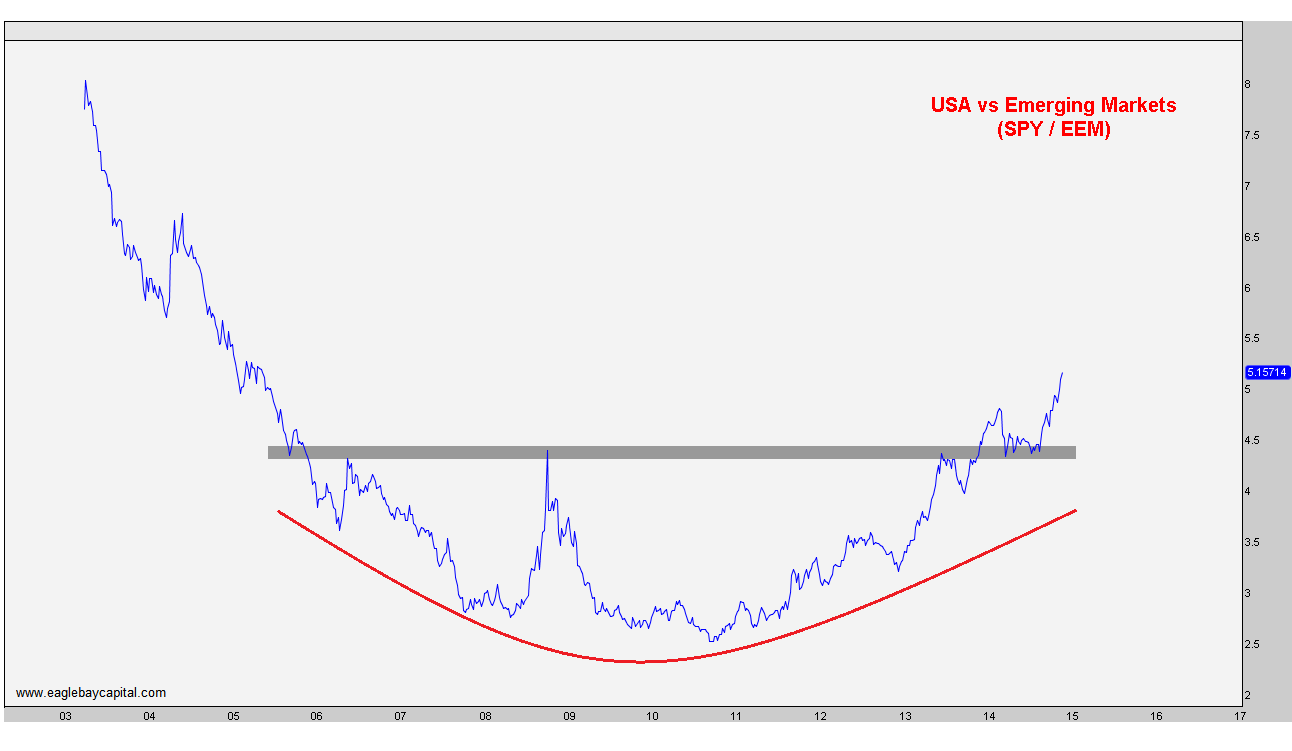

First of all, here is a long-term chart of the S&P500 vs Emerging Markets. We are using SPY to represent the U.S. and EEM to represent the MSCI Emerging Markets Index, which consists of 21 Emerging Market countries. These include China, South Korea, Taiwan, India, Brazil etc. Look at the nice bottoming process and structural breakout (and successful retest) earlier this year:

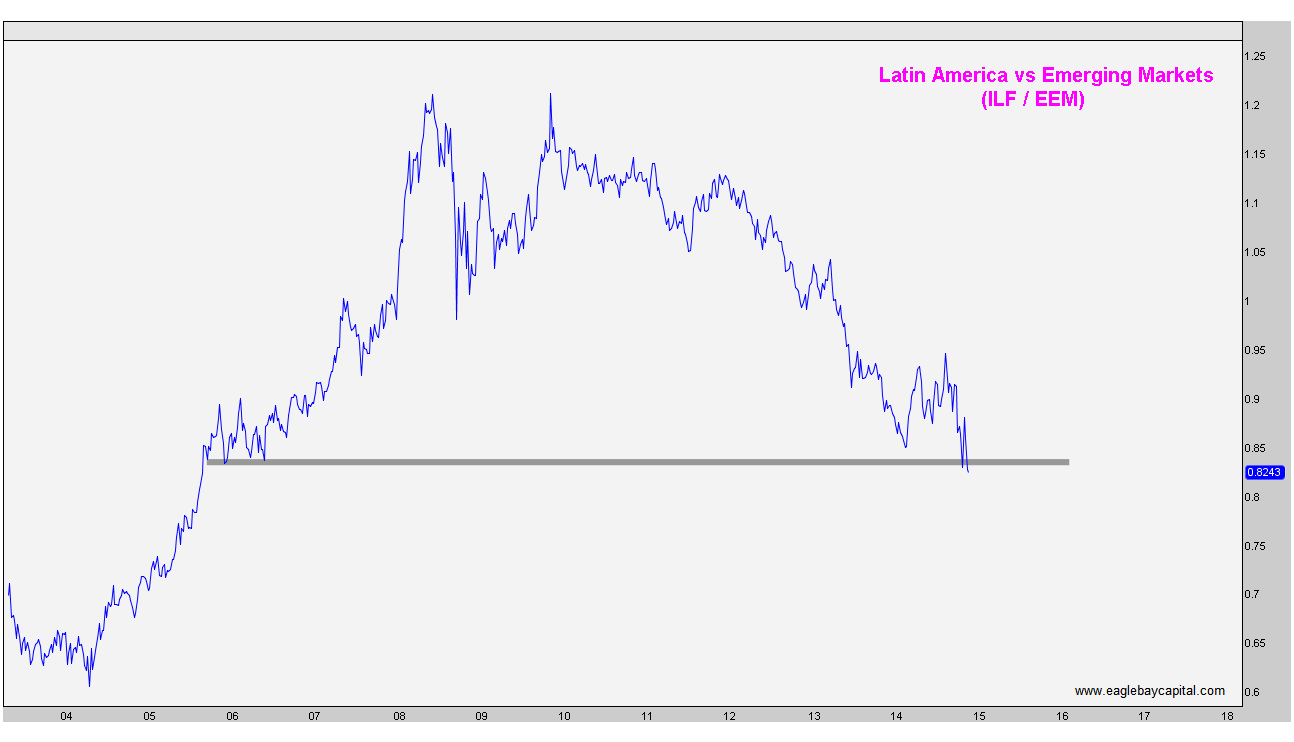

Next, here is the chart of Latin America vs Emerging Markets. We are using ILF which represents the S&P Latin America 40 Index which has 52% Exposure in Brazil, 30% in Mexico and the rest split between Chile, Peru, Colombia etc. Notice how we are currently hitting levels in this spread not seen since 2005:

The point of this ratio analysis is for us to get a structural perspective on where money is flowing. I’m not controlling Billions of Dollars (yet), but those that do move markets in trends like these. It takes time for a cruise ship to turn around; it’s a process. Same thing with Billions, or sometimes Trillions, of Dollars. Seeing these shifts in money flow and huge structural reversals like these are evidence of that shift in money flow. I think these trends are likely here to stay for now and see little reason to believe that emerging markets are where we want to be, particularly on a relative basis.

These are some bigger picture trends that I wanted to point out, but Members of Eagle Bay Solutions receive updates on these charts on a weekly basis, which also includes shorter-term tactical analysis. Make sure you’re registered to receive our Weekly Global Reports.

Recent free content from J.C. Parets

-

Emerging Markets Are Still A Problem

— 9/28/15

Emerging Markets Are Still A Problem

— 9/28/15

-

U.S. Stocks Hit 10-Year Highs vs Emerging Markets

— 8/06/15

U.S. Stocks Hit 10-Year Highs vs Emerging Markets

— 8/06/15

-

Was That A Failed Breakout in China ?

— 2/04/15

Was That A Failed Breakout in China ?

— 2/04/15

-

The Nifty 50 Hits All-time Highs, Now What?

— 1/21/15

The Nifty 50 Hits All-time Highs, Now What?

— 1/21/15

-

BNN Appearance: Crude Oil, Home Builders, and Bonds

— 1/12/15

BNN Appearance: Crude Oil, Home Builders, and Bonds

— 1/12/15

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member