Click Here for this Week's Letter

Greetings,

This edition of Cup & Handle is a little different than the notes you’re familiar with because it’s the last… for now. My business partner and I have decided to return to active money management, which will preclude me from writing Cup & Handle for the time being. I want to emphasize that this newsletter is likely just on hiatus, not disappearing forever. And there is information at the end of this section that will ensure you’re at the forefront of Cup & Handle 2.0 should you be interested.

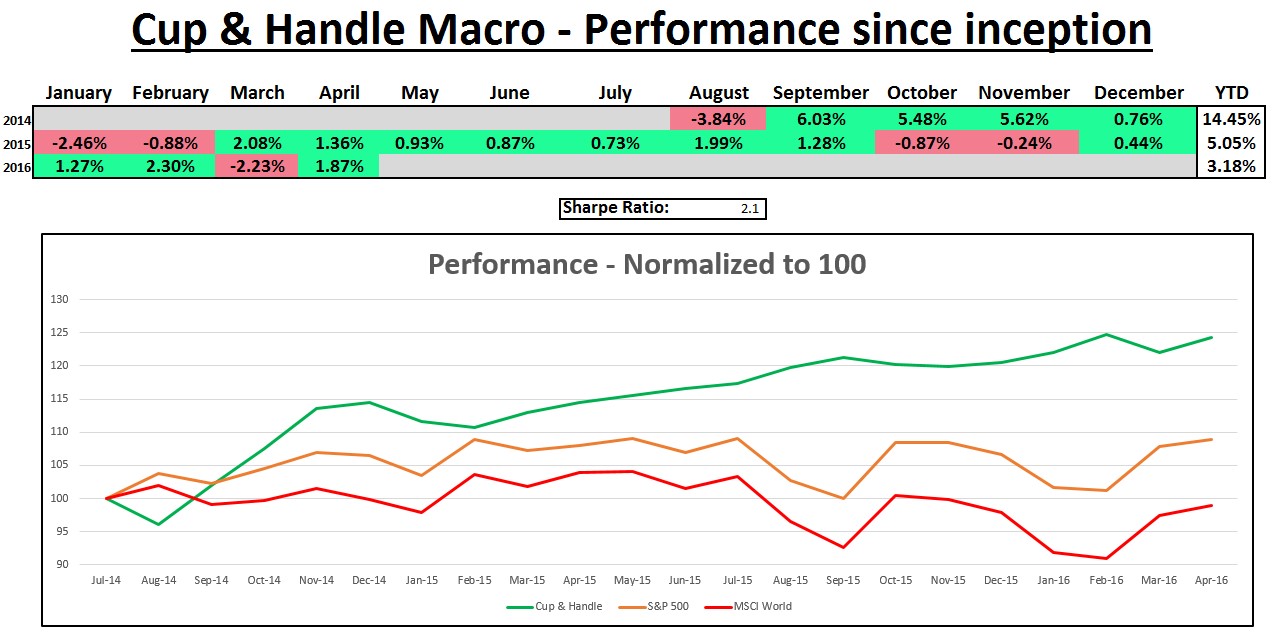

In five years, I think we’ll look back on the period between August 2014 and April 2016 as the most difficult macro environment in recent memory. Over that period the Cup & Handle portfolio consistently turned out positive returns, so in that regard it was a success. On the other hand, macro is about home run returns. We were able to catch a big chunk of the decline in oil starting in late 2014, the slowdown in emerging markets, and even the gold miners more recently. However, they weren’t huge, concentrated positions because agility seems to be more valuable than conviction these days.I’ll refrain from making forecasts in this farewell edition. There are simply too many variables to accurately predict where assets are headed in the next year or even six months. Astute readers know which direction I believe they are headed, but these themes take a long time to play out – and then happen very quickly. The US election has been perhaps the most unpredictable in history, which is the wildcard for this year that nobody knows how to read. I will say that my “Five Bold Predictions for 2016” are holding up well after four months, and I have strong conviction that 3 or 4 will come to fruition. Brazilian President (for now) Dilma Rousseff has described the country’s impeachment proceedings as a coup, so we’ve got one in the bag already.

To conclude I want to thank all the readers for making this such an enjoyable experience. This was really the first forum where I made my investment views public. Writing in other public venues, like Forbes, you learn quickly via the comments section that the internet doesn’t understand nuance. To invest, if your views are correct 51% of the time, you’re a world beater. Strong returns are more about effective bobbing-and-weaving than having the correct view. I always felt that Cup & Handle readers understood that concept and it was much appreciated.

NOTE TO ALL SUBSCRIBERS:

If you currently receive Cup & Handle through Marketfy and want to get it in the future, you need to enter your email address: HERE. Otherwise I won’t have a way to contact you during a reboot. You won’t start receiving spam, email addresses are the lifeblood of a newsletter and they’ll sit in a spreadsheet until Cup & Handle returns to life. If you have any questions or concerns about your subscription, please contact Marketfy by calling 1-877-440-9464 or emailing support@marketfy.com.

At the end of every intro section there has been this sentence:

“As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.”

That email address will still be active, and I’d like to keep interacting with readers during this hiatus. Comments or questions on the market will always be welcome and encouraged. Responses might not be as quick as they have been previously, but I will respond thoughtfully to all.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

The Fundamental Bounce - March 9, 2016

— 3/08/16

The Fundamental Bounce - March 9, 2016

— 3/08/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member