Click Here for this Week's Letter

Greetings,

Ben Bernanke got back into the blogging game this week, writing that the Fed would likely turn to negative rates should the economy slow down. Quantitative easing by the Fed is more effective than anywhere else in the world because USD is the reserve currency, and maybe the same would hold true for negative rates. However, the shift to negative rates in Japan and Europe has not gone according to plan. For now, the BoJ has backed away from negative rates and is actively looking for ways to expand its QE purchases, because it doesn’t make sense to buy more JGBs (more below). They’re even asking financiers to develop ETFs comprised of companies that are increasing capital spending, expanding spending on R&D or boosting what the BoJ calls “human capital” – in a move that reeks of central planning.

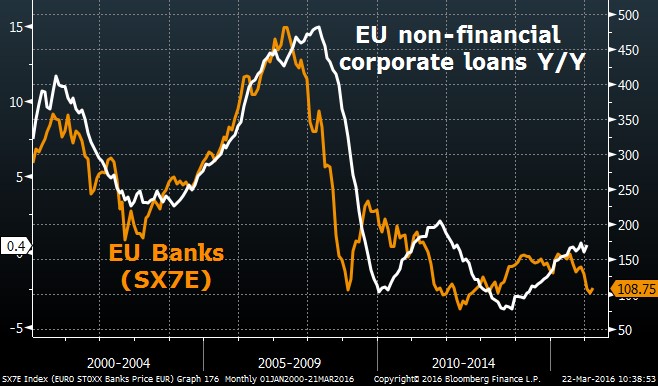

Meanwhile, the ECB seemingly acknowledged that negative rates put too much pressure on banks, and compromised by debuting their new TLTRO program on 3/10. The lending scheme seems mundane, but essentially pays bank to lend. EU banks that raise their lending above a certain target will be paid as much as 0.4% to borrow from the ECB, with the actual rate depending on how liberally money is splashed around. That’s quite a subsidy for one of the world’s most despised sectors and it will only work if there’s demand for credit, which is far from certain considering the correlation between bank stocks and lending.

For now, the Fed doesn’t have to worry about negative rates because stocks are flying and economic data looks better. Despite stagnant wages and M2, core CPI printed +2.3% Y/Y in February, which led to inflation warnings from Fed Presidents Lacker, Bullard and even former Chairman Alan Greenspan. Consumer prices are rising but corporate profits are not. JPMorgan expects Friday’s 4Q 2015 GDP report to show that corporate profits fell -5% Y/Y, which would be the worst reading since the expansion began in 2009.

A decline of that magnitude signals a 90% chance of recession within three years. Wages are picking up, productivity growth is non-existent and as a result margins continue to decline. Historically that has signaled an end to the expansion. Now, three years is a long time and the Fed is expecting rates to rise above 3% over that period according to the dot plot, which would give them a reasonable cushion to absorb an economic slowdown. Except the market doesn’t believe that 3% projection at all. In fact, 30Y Treasury’s are yielding only 2.7% suggesting there’s not much of a cushion.

The bull argument is that the slump in profits and margins is “just energy.” It’s true that operating earnings in the S&P 500 excluding energy has been merely flat since late 2013, versus a steep decline when you include energy. However, it’s foolish to dismiss the energy profit decline because, after all, the profit decline that began in 2000 was "just high-tech" and the decline in 2007 was "just financials." If and when a US recession does appear we’ll learn whether or not negative rates really are more effective in the US.

The Cup & Handle Fund is up around +2.0% YTD, and +8.0% Y/Y. We continue to wait out this relentless stock market rally that’s progressing with minimal volume. It’s a hard move to explain other than the increased support from central banks, which is so hard to fight. We added some new positions last week that give the portfolio more balance, but should also work if our structural views play out as expected. I’m starting to work on the monthly letter for April soon, so expect that in your mailbox early next month. If you’d like to start receiving these letters click here.

With that I give you this week's letter:

March 23, 2016

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

The Fundamental Bounce - March 9, 2016

— 3/08/16

The Fundamental Bounce - March 9, 2016

— 3/08/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member