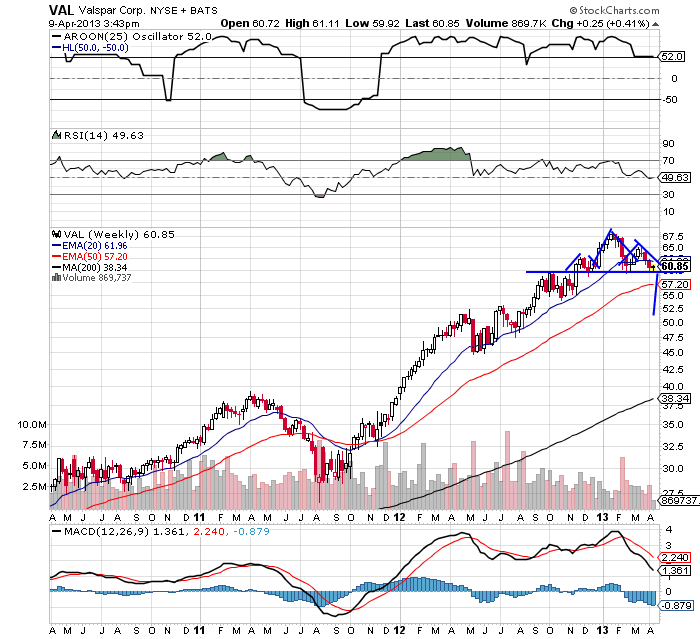

Valspar (VAL)- Short Set-up Under $60.

Weekly shows H&S pattern forming with $60 neckline. Targeting $52.50 if it breaks down.

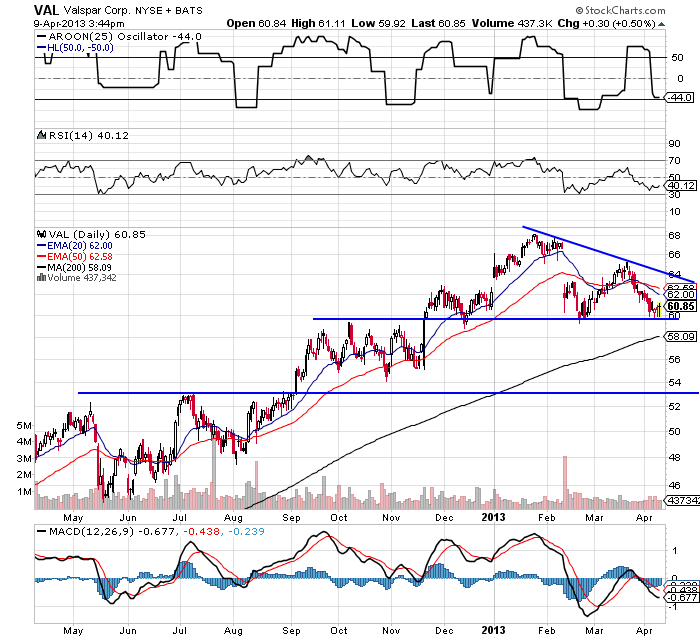

Daily chart shows a descending triangle with $60 support as well. MACD is below zero line and RSI is under 50 both bearish. A breakdown under $60 would trigger a short entry.

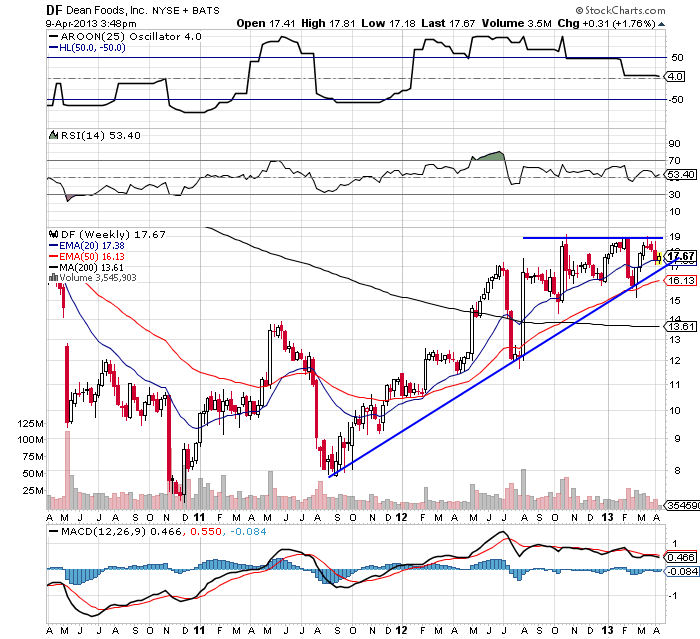

Dean Foods (DF)- Long Set-up Over $19.

Weekly shows multi-month resistance at $19. MACD is showing some slight bearish divergence, but the RSI is in bullish territory giving conflicting signals.

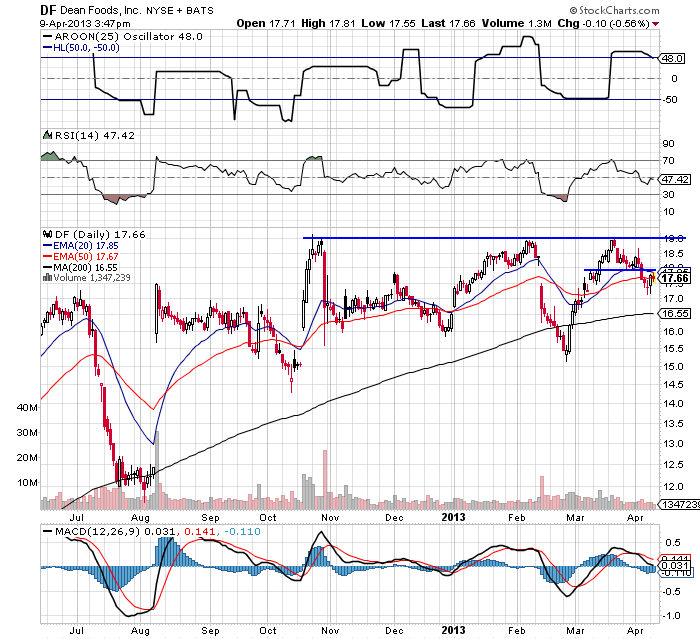

Daily chart shows a recent breakdown under $18 support. The sharp V-shaped recovery patter in late February is a bullish sign. Look for a breakout above $19 for a long entry.

Recent free content from Zack Armstrong

-

Final Trade

— 5/06/13

Final Trade

— 5/06/13

-

Play The Channel Breakout In These Two Set-Ups

— 4/25/13

Play The Channel Breakout In These Two Set-Ups

— 4/25/13

-

Popular (BPOP) Long Set-Up

— 4/25/13

Popular (BPOP) Long Set-Up

— 4/25/13

-

Jamba Juice Trade Set-up

— 4/10/13

Jamba Juice Trade Set-up

— 4/10/13

-

AIG Long Set-up

— 4/08/13

AIG Long Set-up

— 4/08/13

No comments. Break the ice and be the first!

Error loading comments

Click here to retry

No comments found matching this filter

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member

Want to add a comment? Take me to the new comment box!