Are You Ready For A Pullback? BIIB, AMGN, GILD, CELG, UTHR, JAZZ, GOOG, FB, NFLX, APA, APC, EOG, PANW, DO, RIG

Stocks reversed the morning gains today and ended lower. The Dow was down 120.72 points (-0.69%); Nasdaq fell 83.5 points (-1.62%); SPX dropped 16.28 points (-0.78%).

In this week's Market Forecast, we discussed the possibility of leading sectors (biotech, internet, software, financial) finally falling back and pulling the broader market down.

I have been saying for a while now that the broader market will not pull back, unless biotechs pull back. Today, biotechs suffered a steep loss, contributing much to Nasdaq's 1.62% fall. BIIB was among the weakest, losing $18.81, or 5.61%. Here are some other biotech names and their losses today: JAZZ -3.99%; ESPR -7.75%; AMGN -3.84%; GILD -2.83%; CELG -3.52%; UTHR -4.14%; CLVS -3.89%.

Internet stocks started out the day quite strong. AMZN was up $5 in the morning, but, ended down $7.55. FB was up more than $2 and ended down $1.32. PCLN, GOOG/GOOGL, and NFLX held up pretty well.

Software group was also weak. IGV just made a new all-time high yesterday, but, gave it all back today. CRM -2.9%; RHT -3.12%; MSFT -2.02%; ADBE -1.43%.

Financials were only down slightly.

While these leaders pulled back today, energy stocks made a bounce. DO and RIG led the way, up +6.54% and +12.16%, respectively. SLB added +1.32%; APC gained +2.89%; EOG climbed +2.09%; APA popped +4.86%. It does seem like the energy stocks can bounce higher from here.

Tomorrow, we will get the latest unemployment rate and nonfarm payrolls. It will be interesting to see how the market reacts. But, from today's selling, I sense that there are some big sellers out there. Biotechs were liquidated across the board. Other techs were sold off as well. PANW, for example, was down more than 8%, which was easily the biggest down day for PANW in years! Buyers are more and more reluctant to drive stocks higher. Instead, big sellers loom after a few strong days.

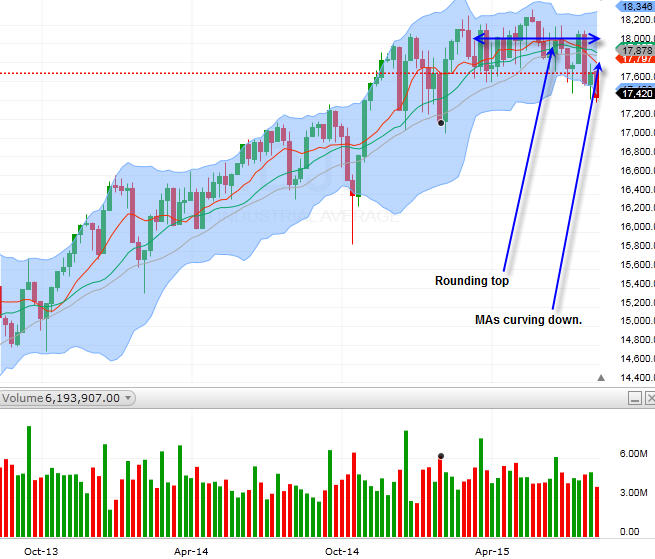

One chart in particular has been flagging warning signs to me for a couple of weeks now. Let's take a look at the Dow's weekly chart:

This is a 2-year, weekly chart for the Dow. You can see that there's a rounding top and falling MAs. We have not seen this type of "topping" development in at least a couple of years. Both Russell 2000 (RUT) and SPX are showing the potential of the same formation. RUT is basically there already.

So, while the bounce in energy stocks and the dip-buyers may prop up this market for a little longer, I think the selling pressure is building up. I do not think, however, this is all about the Fed's intention to raise rates starting in September. I think this is more that things are just getting too overbought, technically, to be keep heading higher. We will need to see a pullback before drawing more buyers back into the market.

Some people are saying that a lot of traders are still on vacation, and, when they return, stocks will rally again. I think otherwise. I think "if" the market does not pullback soon, when the traders are back from their vacation, they will drive the markets down. There is no point in buying an overbought market that is teetering on a cliff, so to speak.

So, are you ready for a pullback?

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member