The markets started on a down beat last week, slipping below 2070. As discussed in last week's Market Forecast, there was support below 2070. Buyers started to trickle in on Tuesday, and got bolder on Wednesday as the Fed kept interest rates unchanged. On Friday morning, SPX climbed above 2114, then, we saw some profit-taking ahead of the weekend.

For the week, the Dow was up +121.93 points; SPX added +24.28 points; Nasdaq gained +39.65 points. Oil was up most of the week, but, gave the gains back on Friday. WTI closed around $47/barrel. Gold fell slightly, trading just below $1100/ounce. At the time of this writing, Asian markets were mostly down. Let's take a look at the US markets after Friday's close:

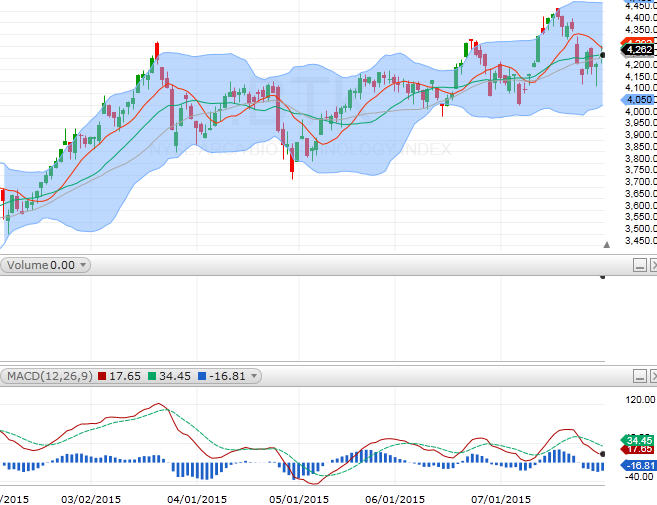

SPX

SPX slipped 4.79 points to close at 2103.84. It closed just above its daily MAs. The MACD was little changed.

Nasdaq

Nasdaq fell just 1/2 a point to close at 5128.28. It closed just below the 10-day MA> The MACD was flat.

Both SPX and Nasdaq closed near their respective 10-day MA, a neutral stance. For the new week, stocks may be under pressure to start as China's latest economic data soured the global markets' mood. However, Japan's Nikkei was holding up quite well, as I was composing this paragraph.

Although more earnings are coming in, people might be distracted by the jobs data coming near the end of the week. Nevertheless, here are some notable earnings dates:

MON: (AM) DO; (PM) AIG CTRP, QLYS, BMRN, THC

TUE: (AM) MGM, CVS, AET, INCY, REGN, CHTR, MLM; (PM) DIS, Z, FSLR, DVN, PAYC, ETSY, ATVI

WED: (AM) PCLN, CTSH, RL, ATHM; (PM) TSLA, GMCR, RIG, HLF, AGU, ZU, TSO

THUR: (AM) MBLY, KORS, DDD, TDC, APA, AGN; (PM) ANET, BITA, ESPR, MDVN

FRI: (AM) GRPN, JD

SPX has resistance between 2110 to 2115, and immediate support comes in at around 2090. Below 2090, we are back looking at 2070 to 2050 for support.

Sector Watch

FAS (financial)

FAS closed right at its 10-day MA. MACD was flat. It's showing a neutral stance. GS looks a bit weak, but, JPM, WFC, and BAC all look neutral. V and MA were strong, but, pulled back from their respective new highs on Friday. We should be careful if FAS falls below its daily MAs, or below $33.

BTK (biotech)

BTK is also looking neutral. AMGN's strong earnings last week did help prop up the sector. INCY, REGN, AGN, MDVN, ESPR are among the biotechs reporting this week.

FDN (internet)

FDN was riding along its 10-day MA last week, not budging. EXPE's earnings on Friday helped, but, was offset by LNKD's earnings reaction. GOOG was weak, but, NFLX was strong.

IGV (software)

IGV closed above its daily MAs. It is neutral, but, with a slight bullish bias. ADBE is holding strongly. CTXS's earnings pop helped. MSFT and RHT are neutral.

I'm looking at the above sectors because these have been the strongest in the past few months. Since more and more I feel that buyers are shying away from driving the markets higher, I want to see how these stronger sectors look and if they can keep propping the broader market up. I'll be watching these sectors throughout the week. If any of these sectors give way, we will see increasing pressure on the sell side.

Happy weekend and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member