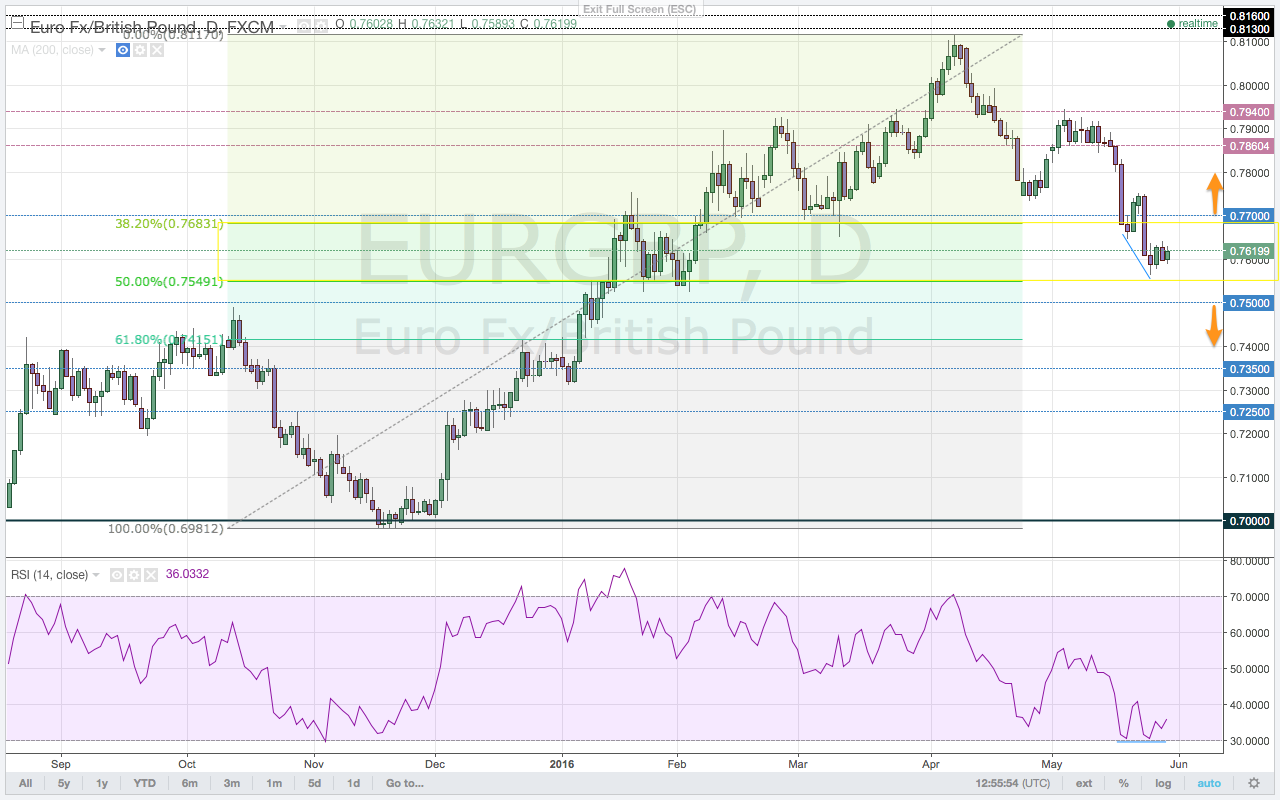

This was our look at the EUR/GBP at the beginning of the week, ahead of the ECB:

The recent consolidation in the EUR/GBP was signaled by the bearish divergence at the highs. Now, the end of this move lower is being signaled by a bullish divergence at the lows on the RSI of the daily chart. The EUR/GBP starts the new trading week bouncing along the bottom of the buy zone. Buyers continue to keep price bid as momentum builds despite being in bearish territory. Though not a true bullish divergence because price is not at new lows on the daily chart, it is noted that momentum is no longer making new lows despite the new lows to 0.7564. This may be a nascent signal of bullish price action in this new trading week. Furthermore, after the move to 0.7564, the subsequent higher lows coinciding with building momentum on the RSI give the EUR/GBP a bullish bias. Despite the recently bearish price action, the EUR/GBP targets a move to the upside in the new trading week. A continuation of the rally is confirmed on a close above the key 0.7700 level.

Premium trade setups with targets and stops are published in the EUR/GBP Outlook for the Week in Volume 64, this week's Quid Report.

Recent free content from Lydia Idem Finkley

-

USD Leaves Markets in Suspense

— 6/15/16

USD Leaves Markets in Suspense

— 6/15/16

-

Cable is Breaking but Not Really

— 4/19/16

Cable is Breaking but Not Really

— 4/19/16

-

Remember, The Euro is a Safe Haven

— 4/17/16

Remember, The Euro is a Safe Haven

— 4/17/16

-

NEW: The Monday Morning Calls

— 4/11/16

NEW: The Monday Morning Calls

— 4/11/16

-

Carry is the Aussie’s Best Friend

— 2/24/16

Carry is the Aussie’s Best Friend

— 2/24/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member