I will be on vacation next week, so there will be not “Morning Comments” next week and no “Weekly Top 10” next weekend. Thank you very much.

THE WEEKLY TOP 10

Table of Contents:

1) Liquidity has still been the key driver...even for the mega-cap techs.

1a) Any changes in the “allocation of excess liquidity” will be important going forward.

2) The stocks of great companies can (and do) see serious corrections from time to time.

2a) Tesla’s chart looks eerily similar to AMZN’s in 1998/99.

2b) The mega-cap techs have become VERY over-valued, over-bought and over-loved.

3) Mini-breakout in the Russell 2000, but it needs more upside follow-through.

4) The dollar is still flirting with key support, but many commodities are overbought (near-term).

5) Wondering about the consumer? Watch Visa (V).

6) Housing stocks look great, but the extremes in lumber may cause them to take a breather.

7) Looking at the charts of key global markets (China, Germany & the U.S.).

8) Predicting Biden’s running mate. (Looking for someone who can attack.)

9) John Lewis: A true American hero.

9a) Congratulations to “Captain Tom.”

10) Summary of our current stance

Short Version:

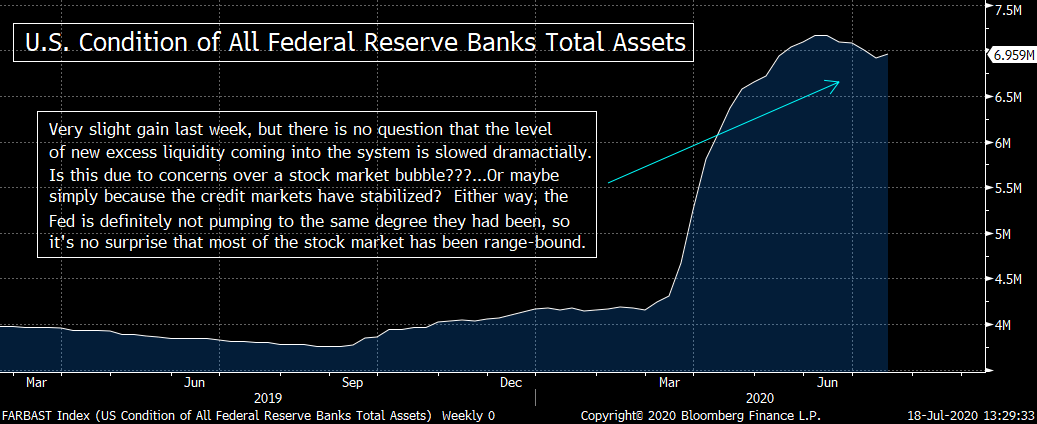

1) The Fed’s balance sheet grew very, very slightly last week, but it remains lower than its early June highs. In other words, the level of new liquidity being pushed into the system has slowed dramatically since early June That, in our opinion, is why most of the stock market has been range-bound for six weeks. It’s also a big reason why the mega-cap tech stocks have outperformed. Yes, they are looked upon as “win-win” stocks, but the rally has also been fueled because there is a lot less new liquidity coming-in...and most of that it has been going into those 7-8 names. However, now that they’ve become so extremely overvalued and overbought, we could/should see a shift in where that (lower level) of excess liquidity is going.

1a) In other words, no matter how much the stay at home stocks SHOULD benefit from a re-closing of parts of the economy...and no matter how far these mega-cap tech stocks will run over the long-term...a shift in the “the allocation of excess liquidity” could/should have a serious impact on these names over the coming months. Therefore, since these stocks have become very overvalued and very overbought, investors will have to remain very, very nimble...and be ready for a surprisingly deep correction in the mega-cap tech stocks by Labor Day.

2) The biggest problem we have right now is that too many investors do not understand that the mega-cap tech names CAN see serious corrections (of 15%-25%) EVEN if they are going to go higher before too long. When even the best stocks...of the best companies...become SO extremely over-valued, overbought & over-owned...they can get absolutely clobbered NO MATTER HOW GOOD THEIR LONGER-TERM FUNDAMENTAL PROSPECTS MIGHT BE! Therefore, investors will need to be nimble in these names...and be willing to “trade around” their positions...if they want to maximize their returns.

2a) To better get a picture of what we’re talking about with these mega-cap names, we thought it would be good to compare today’s chart on Tesla to the chart of Amazon back in 1998/99. Just over 20 years ago, AMZN was on its way to becoming a dominant company and an unbelievable stock. However, when it reached incredibly extreme levels (much like TSLA showed early last week), it still experienced some severe declines. TSLA should be no different this time around.

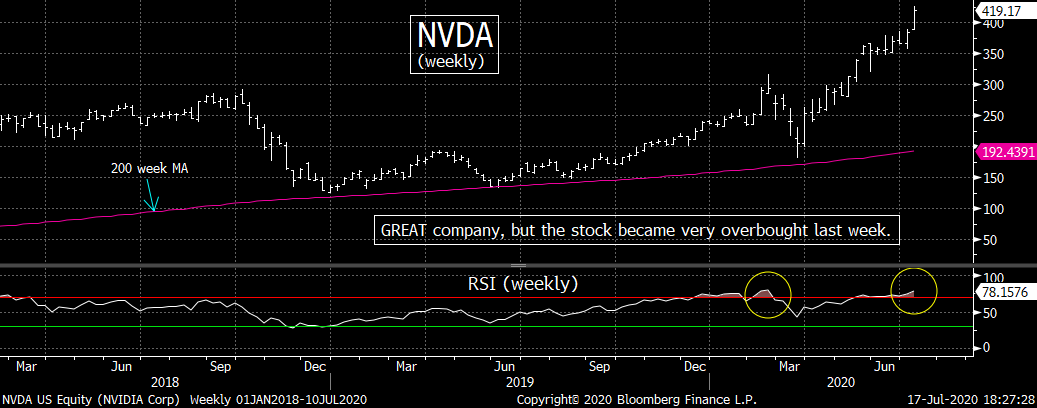

2b) In this bullet point, we give more details about how extremely overbought TLSA had become early last week...and we also highlight the extended chart on NVDA. We’re not looking for the same kind of massive declines these stocks saw in Q1, but we believe that most of these names had reached a level early last week that made them SO over-loved, SO overbought and SO over-owned that a deep correction by Labor Day is all but inevitable...........Last Monday was the warning shot across the bow...a more direct hit will come before too long.

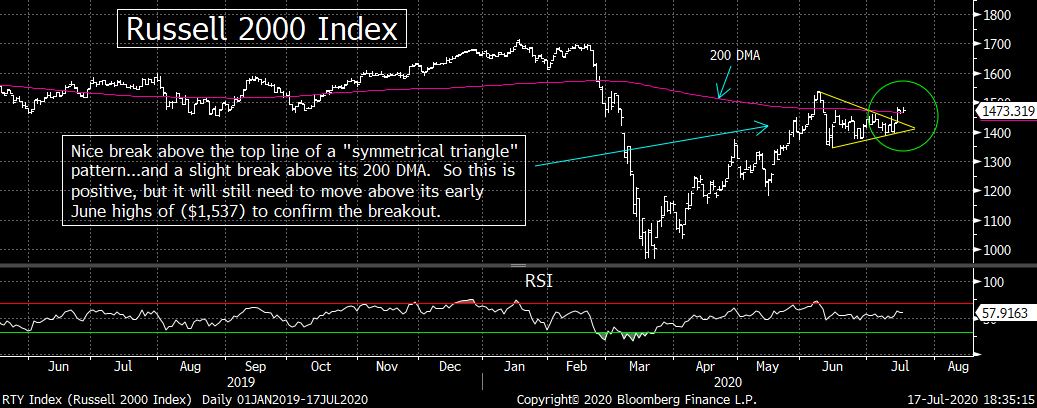

3) Some of the rotation out of the mega-cap stocks we saw last week was bullish for the small-cap Russell 2000...as it broke out of a “symmetrical triangle” pattern and closed slightly above its 200 DMA. It will need more upside follow-through to confirm the breakout, but it was definitely a good week for the small caps.....One defensive sector, the consumer staples, also saw a mild breakout last week, so any further upside movement will be bullish for this group as well.

4) The DXY dollar index closed slightly below its first key support level of 96. It will take a move below 95 to confirm a trend-reversal, however. We do need to point out that several commodities have become quite overbought on a technical basis, so they not react immediately if the dollar does indeed fall further. However, a weaker dollar should be decidedly bullish for commodities, so if we actually see commodities decline along with a falling dollar over the short-term, investors should not be deterred. A lower dollar should push commodities higher before long...and investors should act accordingly.

5) We are seeing several signs that the consumer is starting to pull in their horns a little bit. The fading high frequency data and this past week’s Beige Book from the Fed lead the list of indicators on this subject. One excellent indicator for the consumer has also been the action in Visa (V). It’s ability to bounce back in April was a great positive indicator for the consumer & the markets. It has been stuck in a range for a while now...so whichever way it breaks out of that range should be important this time as well.

6) The housing stocks had a very nice week last week...with the help of the better-than-expected NAHB Housing market data. This helped the ITB home construction ETF breakout of the sideways range it had been in for 5-6 weeks. So that’s quite bullish.....However, we do need to point out that lumber became extremely overbought mid-week last week. So if should see a pull-back over the near-term...and that could create a short-term headwind for the ITB. However, last week’s breakout is still quite positive...and any pull-back in the group should provide another buying opportunity for the sector.

7) Let’s review the charts on three of the globe’s more important stock markets. First, our call on China last week worked out very well...and it did indeed fall hard last week. We think it has further to fall before we’d move back into that one.....Germany’s DAX is testing the top line of an “ascending triangle” pattern, so any further upside follow-through will be very bullish for Europe’s most important stock market.....Finally the S&P 500 is STILL range bound (albeit at the top of its range). If it can breakout just after its recent “golden cross,” it will be quite positive.

8) We’re going to have some fun...and put out our prediction for who we think will be Mr. Biden’s VP nominee. We hate to go with what seems to be the consensus, but we believe it will be Kamala Harris. The VP nominee hasn’t decided the election in 60 years (when Johnson helped Kennedy carry Texas & win). So the Biden campaign will go with somebody with national experience who can also be effective in attacking the Trump campaign. Elizabeth Warren and Kamala Harris seem best suited for that role...and given the back-drop of today, it won’t be Senator Warren.

9) It was very sad to hear about the passing of John Lewis. He is a true American hero. If you ever want to learn just how willing he was to put his life on the line to fight the racial injustices in this country, just watch how he was beaten in Selma, Alabama...AND see what he went through with the Freedom Riders a few years earlier. (“The American Experience” has a powerful show on the Freedom Riders which is absolutely amazing.).....America definitely has its problems, but it is true heroes like John Lewis who still make it the greatest country in the world.

9a) Congratulations to Tom Moore. The 100 year old WWII veteran from Great Britain was knighted by Queen Elizabeth on Friday for his efforts in raising money to fight the coronavirus pandemic...and for providing inspiration for millions of people around the world during the healthcare crisis. We must admit that we don’t have the foggiest idea what the qualifications are for knighthood in the UK, but we cannot think of a person who deserves it more than this hero. So congratulations to “Captain Tom”...who will now forever be known as “SIR Captain Tom”!!!!!

10) Summary of our current stance.......The S&P 500 remains at a critical juncture and we still have to wait to see which way it breaks out of its 3,000-3,235 six week range before we can determine its next important move. It is nice to see that some rotation took place last week...and thus the decline in many of the mega-cap tech names did not cause the broad market to decline. However, with Fed liquidity less plentiful right now (as seen by the flattening of their balance sheet), a more significant decline in those names will be hard for the market to ignore.....We believe that these names have become so overvalued, so overbought and so over-loved that they have become ripe for deep corrections by Labor Day. If/when that happens, the S&P will likely see a meaningful decline as well.....Over the near-term, we’ll be watching the 30 DMA on the Nasdaq Composite. A break below that line would rise the odds that a correction in the tech sector will not be isolated to just the 7-8 mega-cap names.

Long Version:

1) The Fed’s liquidity program is still in tact, but when we look at the Fed’s balance sheet, we can see that the amount of liquidity being provided by the central banks has flattened out significantly. This does NOT mean that the Fed has abandoned its massive stimulus program by any means. It simply means that there has been less excess liquidity pushed into the system over the past month and a half. This, we believe, is a key reason why the S&P 500, the DJIA and the Russell 2000 have remained range-bound over that same time frame. However, the Nasdaq has continued to rally...and thus a divergence has developed recently (although that divergence did correct by a small amount last week).

One of the reasons that the tech-laden Nasdaq has outperformed the rest of the market for much of the past six weeks is the fact that investors believe that a small number of these names provide “win/win” situations. If the economy improves, they’ll do well (just like they did in 2019)...and if we see another lock-down (or semi lock-down) these names will also continue to benefit from effects of the re-closing policies of politicians and the stay at home practices of the general public. (Oops, we meant to call them “re-closings”...not renewed “lock-downs”....sorry!)

However, we would argue that the most important reason for the divergence between the S&P 500 and the Nasdaq over the past six weeks has to do with the fact that there is a lot less liquidity that is available. Since there is not the same kind of massive liquidity available...that will raise “all boats” like it has in April and May...investors have been pushing the (small level of) liquidity that is now leftover into a small number of stocks (that will work well even in an economy that is starting to “re-close” to a material degree). In other words, even though the there is a legitimate fundamental argument behind why the tech group has outperformed, the action we’ve seen over the past 6-7 week is still being determined by the Fed’s liquidity in our opinion.Therefore, the size of the outperformance we’ve experienced lately is not as justified as some pundits would like to portray.

This presents a problem for those investors who have been loading up on the mega-cap tech names....because the 7-8 names that have pushed the Nasdaq higher had become extreme over-valued and extremely over-bought by last Monday......If investors decide that they don’t want to chase these handful of tech names anymore due to their extreme valuation and technical conditions...and they decide to spread the (now) limited level of excess liquidity into hundreds of stocks...instead of just 7-8 names...the mega-cap tech names are going to get hit pretty hard...and the Nasdaq will go through a multi-week (and maybe even an multi-month) period of underperformance.

(We go into more detail about the overbought condition of these stocks...and why they are quite vulnerable...EVEN if they’re going to go a lot higher eventually...in point #2. In this bullet point, we’re trying to show that there are a couple of reasons...some that go beyond any fundamental issues...that have pushed these tech stocks higher...and that this might not continue over the short/intermediate term.)

1a) What we’re saying is that the issue of “the allocation of excess liquidity” that is being provided by the Fed is vitally important right now for investors...and they HAVE to adjust their portfolios early...if/when a shift in the “allocation of excess liquidity” takes place.

Just look what happened six weeks ago. Those who saw that less liquidity was being provided...and realized that the less plentiful level of liquidity would go towards the a very small number of “win/win” stocks...outperformed very nicely!

Another great example of how the “allocation of excess liquidity” can have an impact on the market actually took place back in 2011. In the spring of that year, the commodity markets were flying. This caused food prices to skyrocket...which, in turn, created some serious political unrest in certain parts of the world. It wasn’t just countries with small economies. There were riots in places like Paris over the much higher food prices as well. The problem was that some of the excess liquidity being provided by the Fed was going into ALL risk assets...including commodities! Fed Chairman Bernanke (and other FOMC members) publicly complained that too much of their excess liquidity was going into these commodities. There were complaining because although higher asset prices in stocks and other areas were helping the global economy bounce-back, higher commodity prices were HURTING that effort.

What happened next? Well, suddenly the CFTC raised margin requirements on several commodities...and did so on more than one occasion in both May and June of that year. Of course, the Fed does not control margin requirements, but we knew who was behind the move. We saw the writing on the wall at the time and turned wildly bearish on commodities. We knew that the excess liquidity had taken commodity prices well above their fundamental values...and had also taken them to extremely overbought conditions. Now that the Fed (oops...we mean the CFTC) decided to do something to shift the flow of excess liquidity away from commodities and more towards other risk assets like stocks, we knew the jig was up for commodities. (We weren’t the only ones. Glencore...one of the biggest commodity brokers in the world KNEW that commodities had moved well above their fundamental values...and they decided to sell the company...by going public that spring.)

The commodity market began a bear market in May of that year...that has lasted ever since. The stock market saw a mild decline that spring...and then saw a full correction as QE2 was winding down. However, after Operation Twist was announced in September, the stock market bounced-back in a powerful way. Commodities did not. The higher margin requirements were still in place...and the excess liquidity continued to move away from that asset class...and towards ones that were more beneficial to the economy (like stocks).

Needless to say, the 2011 example is not an apples to apples comparison to what is taking place right now. However, it does show that when “excess liquidity”...and not “underlying fundamentals”...is the main driver fueling a rally, a change in how that excess liquidity is allocated can have a big impact on investment returns. Back in 2011, a change in margin requirements created a big change in how the existing excess liquidity was allocated the rest of that year (and beyond). Today, it looks like the extended technical levels and the levels of valuation could/should fuel a change in how the (now more limited) excess liquidity is being allocated in terms of the mega-cap tech stocks. If that is indeed the case, these stocks could be in for a bigger decline than most people are thinking is possible right now. This especially true given the fact that the momentum-driven algos don’t care which way the momentum tells them to go.

Another big difference between 2011 and now is that we do not believe that any change in the allocation of excess liquidity will be anything close to what we saw back then in terms of time. Once the mega-cap techs work-off their extreme readings, they should be fine. However, it will take more than a 10% correction to achieve that balance in our opinion. Therefore, traders will have to remain VERY nimble in the second half of 2020...and long-term investors will need to jump back-in too quickly.

2) There was definitely some technical damage done to the mega-cap tech stocks last Monday. The huge intraday reversal in the FAANG names (plus the other high flyers like MSFT, TSLA & NVDA) raised a yellow warning flag on these names after the HUGE rallies they seen since the March lows. (It also shows that our bearish call on AMZN on a technical basis last weekend turned out to be quite prescient...as the stock fell 7.4% last week.) All of these stocks have outperformed the S&P 500. GOOGL has lagged the rest of the FAANG’s...with its 42% rise, but the other seven names are all up 60%-75% from their March lows! That is great, but they had become very overbought and very over-valued....which made them ripe for significant pull-backs. In fact, it has made them all ripe for meaningful corrections of at least15%-20%.

Having said this, we do not want to get ahead of ourselves. We did see three of the above mentioned eight mega-cap stocks fall below their Monday lows by the end of the week (AMZN, MSFT & NFLX). This kind of “lower-low” after a sharp sell-off does not bode well for these names over the near-term (next two months or so). This will be especially true if their “lower-lows” become more significant ones...and if most of the rest of those names see similar declines.

The biggest problem we have right now is that too many investors do not understand that these names CAN see serious corrections (of 20%-30%...or more) EVEN if they are going to go higher before too long.Yes, most investors DO realize that high flying stocks can see deep corrections, but too many people believe that the narrative is too strong right now for these stocks to see serious declines this summer. They do not understand that when even the best stocks...of the best companies...can become SO extremely over-valued, overbought & over-owned...they can get absolutely clobbered NO MATTER HOW GOOD THEIR LONGER-TERM FUNDAMENTAL PROSPECTS MIGHT BE!

Just look at AMZN in the late 1990s. It rallied 1,415% in 18 months...but during that 18 month rally, it also saw declines of 28%, 21%, 45%, 51%, 56%, 38% and 29%. So if you had sold the AMZN at its highs over those 18 months...and then bought it back two months later and rode it back up...you would have made a lot more money than you would have if you just held it for those 18 months. (Those who sold the stock...and then shorted it for two months each time would have done even better.)

Of course, nobody would be able to time the stock perfectly...or even come close. However, that does not mean people should not try to trade around a large position in a stock like AMZN or TSLA (or any of the other mega names) from time to time...when they reach extremes on a fundamental & (especially) a technical basis. Yes, trying to pick all seven of those tops would have been impossible, BUT picking the three most extreme tops was not very difficult as one might think. The three times AMZN’s weekly RSI chart got up to 80 or so, it provided a GREAT opportunity to lighten up on ones positions in a meaningful way. If investors then waited two months to let those extreme positions work themselves off, it provided a great opportunity to buy the position back.

To give you an idea of how much of a difference “trading around a position” can make...when a stock gets to a technical extreme...lets look a the difference between holding AMZN from the spring of 1998 to the spring 1999...and “trading around the position.” (The ultimate top came in late 1999, but this one year window is still quite enlightening.)......If you bought AMZN in the middle of 1998 and just held onto it, would have seen a gain of 1,415 a year later%. However, if you sold it when its weekly RSI got to 80 and bought it back two months later, your return would have been whopping 5,500% over that one year!!!

Again, we readily admit that the second scenario we just highlighted is totally theoretical...and it uses the exact tops and bottoms...and assumes you sold everything at those tops and bought it all back the bottoms. Nobody could have done that. However, if still you sold a good chunk when the stock got extremely overbought (with a weekly RSI reading of 80)...and bought back the stock two months later...you would have received a MUCH larger return than merely holding on to the full position throughout those huge moves. So even though one’s returns would not have been as eye opening at the 5.500% gain we just highlighted above by “trading around” one’s position at that time, we hope that it still illustrates that investors can enhance their returns dramatically when become more active with their holdings at certain times (when big holdings become very extended by several measures).

2a) In other words, even though it can be very, very hard to “time the market” (nobody was going to be able to successfully catch all of the big moves AMZN made back in 1998 & 1999)....they CAN be enhance their returns by “trading around a position.” When a stock gets well ahead of itself over the short-term basis, investors CAN take advantage of the situation by some sensible “trading”...even if it is going to head a lot higher over the longer-term. This is especially true for tech stocks...which tend to have the potential to get well ahead of themselves more often...when their new technological advances are deemed to be something that will change the world.

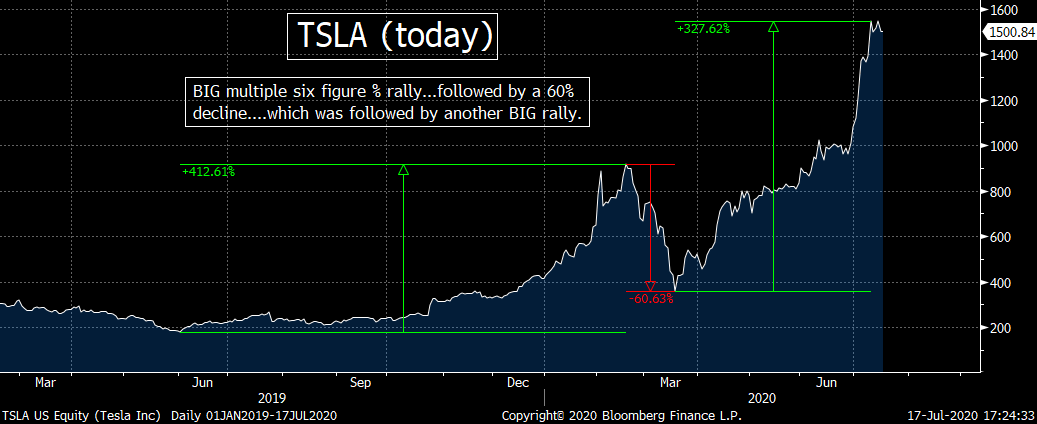

In the first few charts below, we compare this year’s action in TSLA...to the action back in the late 1990s in AMZN. It is very similar...and we think it gives you a good picture of what could easily happen to TSLA (and/or some of the other mega-cap names) later this year...EVEN if they end up trading A LOT higher over the next 3-5 years). In other words, it should give you a more detailed picture of what we’ve been trying to say.

This year, TSLA saw a huge multi-month rally going into the February highs (a gain of multiple six figures in terms of percentage gains). That was followed by a 60% decline. After bottoming, it then rallied in a major way to new all-time highs this month. The problem is that this move took the weekly RSI chart on TSLA to a very extreme reading well above 80 early last week.........Back in 1998-99, AMZN saw a very similar multi-month/multi-six figure percentage rally...which was followed by a 50%+ decline. It then rallied very strongly once again to new all-time highs...but it’s weekly RSI chart became VERY extended (just like TLSA’s is today). What followed was ANOTHER decline of more than 50%. This took place EVEN though AMZN saw yet one more huge rally to its multi-year highs later in 1999. (That final surge to its late ’99 highs is not shown on the charts we provided.)

No, we are not saying that TSLA is about to fall another 50% soon (in the way AMZN did in 1999). We’re merely showing that even the stocks of some of the greatest companies in the world can (and do) see massive declines on their way to much higher levels...and on their way to becoming dominant companies on the domestic and global scenes. What we just described on AMZN in the late 1990s is very similar to what the stocks of AAPL, MSFT and other great companies have experienced IN THE MIDDLE of their rise to dominance as well.....So we’re not calling for a complete disaster for TSLA, but we ARE saying that it (and other high flying tech stocks) have now become vulnerable to a similar kind of wild volatility that AMZN experienced in the last 1990s.

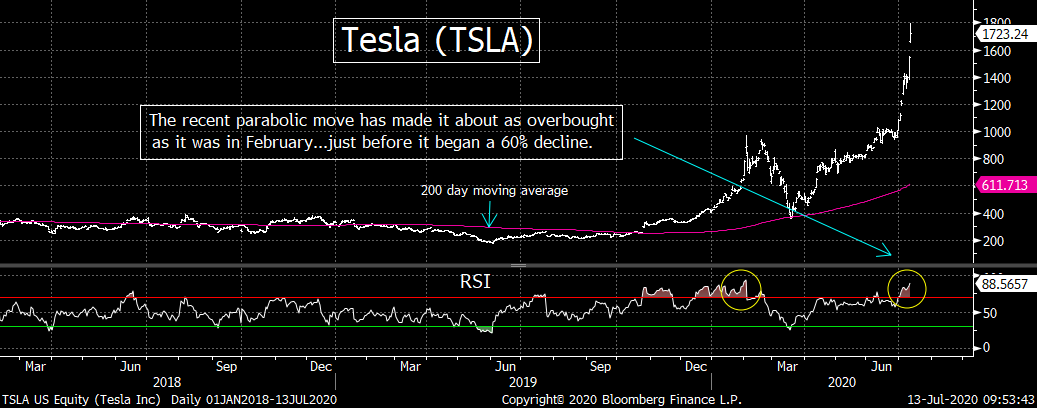

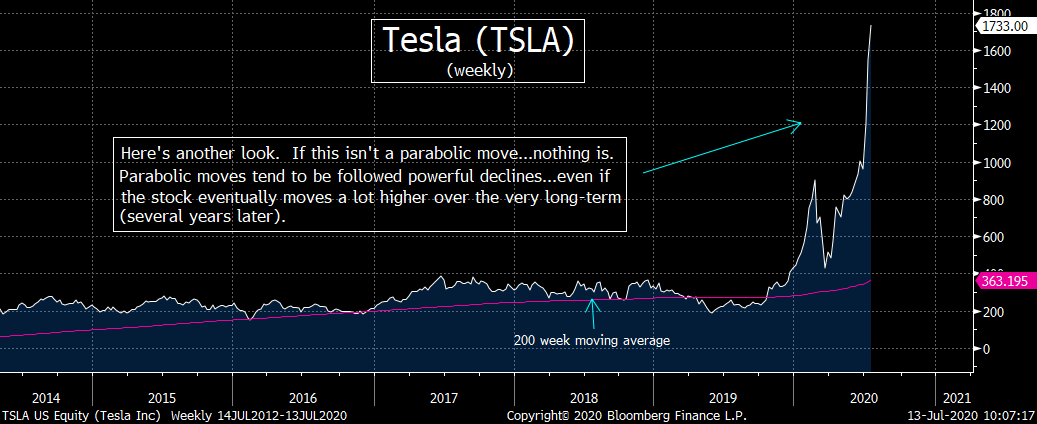

2b) In the chart in point #2, we showed how AMZN had become extremely overbought on its weekly RSI chart several times back in 1998 and 1999. In this bullet point, we want to show you why we believe that many of the other mega-cap tech stocks have reached very similar (and extreme) levels right now...just like AMZN did back then. We don’t want to inundate you with too many charts, so we’ll give you a couple on TSLA (the stock that had become RIDICULOUSLY overbought early last week)...as well as one on NVDA.

Last Monday morning, the weekly RSI chart on TSLA moved above the 88 level. No that’s not an all-time record for TSLA, but it’s VERY close. Also, it reached a premium of a whopping 375% premium to its 200 week moving average...which IS an all-time record (by a long shot).....Finally, the fourth chart shows how the weekly RSI chart on NVDA has reached a very high level last week (just below 80)...which was commensurate with the high we saw back in February...just before the stock began a 37% decline.

We’re not looking for the same kind of massive declines these stocks saw in Q1...and the mega-cap stocks could hold up a bit longer before they roll-over. However, we believe that most of these names had reached a level early last week that made them SO over-loved, SO overbought and SO over-owned that a deep correction by Labor Day is all but inevitable...........Last Monday was the warning shot across the bow...a more direct hit will come before too long.

3) One of the big issues that many investors are asking one another is whether any further decline in the mega-cap tech names will be bullish for some other groups. For instance, will the “rotation” out of some of those names...and into areas like the small-cap Russell 2000 or the defensive XLP consumer staples ETF continue to play out (like it did last week). Well, it’s hard to think that these groups will rally strongly if the tech names get hit as hard as we described above, but if the situation in the tech group turns out to be a mild “breather” instead of a deep correction, these areas could/should indeed benefit.

In fact, the Russell 2000 is now testing a key resistance level...and any further upside follow-through should be bullish for this part of the stock market going forward. The Russell 2000 index rallied 3.6% last week and outperformed the other major averages nicely. On top of this, the Russell was also able to break out of a “symmetrical triangle” pattern and closed slightly above its 200 DMA...so last week was certainly a good one for the small caps.

We’ll need to see some upside follow-through to confirm the move in the Russell. We’ll be watching the early June highs of 1537 (153 on the IWM). If the Russell 2000 can break above that level in any significant way, it will give it an important “higher-high” and confirm that the small cap stocks have finally got some momentum behind them once again.

Another area that had a good week last week was the consumer staples. The XLP consumer staples ETF rallied more than 2% last week...and has gained almost 8% over the past two weeks. Like the S&P 500 Index, this sector of the market place has been stuck in a sideways range. In fact, it has been stuck in that range for a longer period of time...since April...and it is now breaking slightly out of that range. Therefore if it rally further and breakout of that multi-month sideways range in a more significant way, it should be very bullish for the sector on a technical basis.

Of course, since the consumer staples are a very defensive group, a breakout in this sector may not be the most bullish development in the world for the broader market, but it should still give the XLP some nice momentum...in the momentum-driven market we live with today.

4) The DXY dollar Index has fallen below the 96 level...which means it has made a slight “lower-low” and has broken below its trend-line going all the way back to early 2018. This is only a very slight “break-down” so far, so we don’t want to make too much of this development. Besides, it will take a move below the March lows of 95 to confirm a change in the longer-term trend for the greenback. However, there is no question that the cracks in the foundation of the bullish dollar are growing wider...and it’s now causing us to raise a yellow flag on our currency. Therefore we will be watching the currency market very, very closely going forward...as any change in the long-term trend for the dollar will have important implications for several other asset classes (like commodities and emerging markets).

Having said this, we do have to mention that several of the best performing commodities have become very overbought on a short-term basis. First and foremost, copper reached some pretty extreme readings last week, so it looks like it’s going to have to take a “breather” over the very-near-term unless the dollar completely breaks-down. The daily RSI chart on “the Doctor” moved above 87 early last week...which is the second highest reading it has recorded since 2006 (only exceeded in late 2016)......Also, its weekly RSI reached 70 last week...which has been followed by several short-term pull-back over the past dozen years.....This development could cause some confusion because we are definitely seeing some signs that economic growth is stalling out. Thus it’s going to be hard to determine if any decline in copper is due to a slow-down...or merely something that is working off an overbought technical condition. In other words, it mig

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member