Market Outlook

It was an excellent week for the bulls as Yellen's language wizardry was very well received. The market blasted higher with several major indices tagging new all-time highs.

This price action officially put an end to the minor correction we saw in the early part of the month. The path of least resistance is now up and, as I often say, there is no need to second guess this trend.

In the short-term it looks like the S&P has room to 2130-2150. After this the technical picture gets murky as it looks like the S&P is within a six month "rising wedge" pattern and, as any technician will tell you, these are typically bearish.

The Nasdaq is back above 5000, but it too is within a rising wedge and now bumping up against the upper trendline.

Technically speaking, the Russell is the strongest major index right now. It had a clean breakout from a long consolidation base and seems headed to infinity.

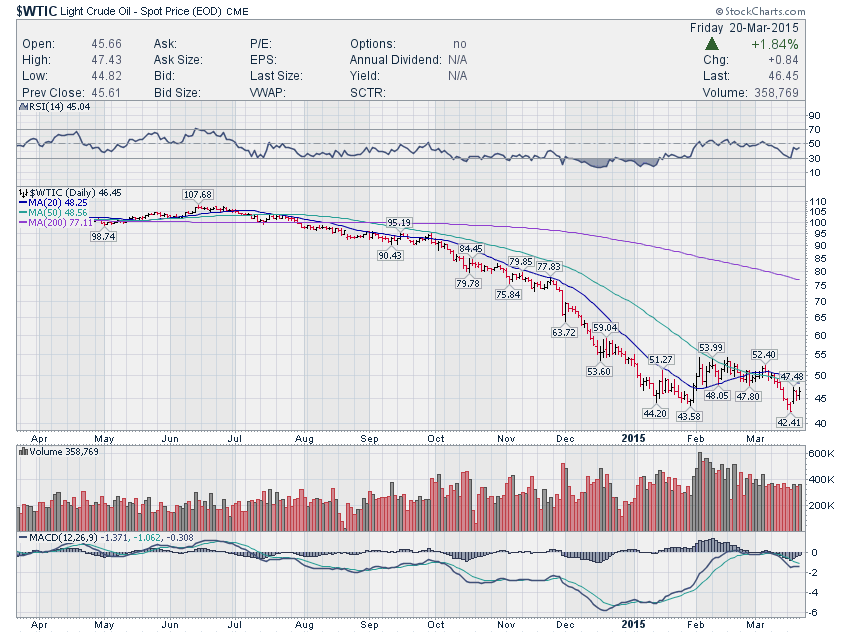

Commodities also reacted favorably to the Fed. Oil in particular flushed to new lows earlier in the week and put in a bullish reversal. It now seems like it is working on a possible double bottom although it is too early to declare one with any conviction.

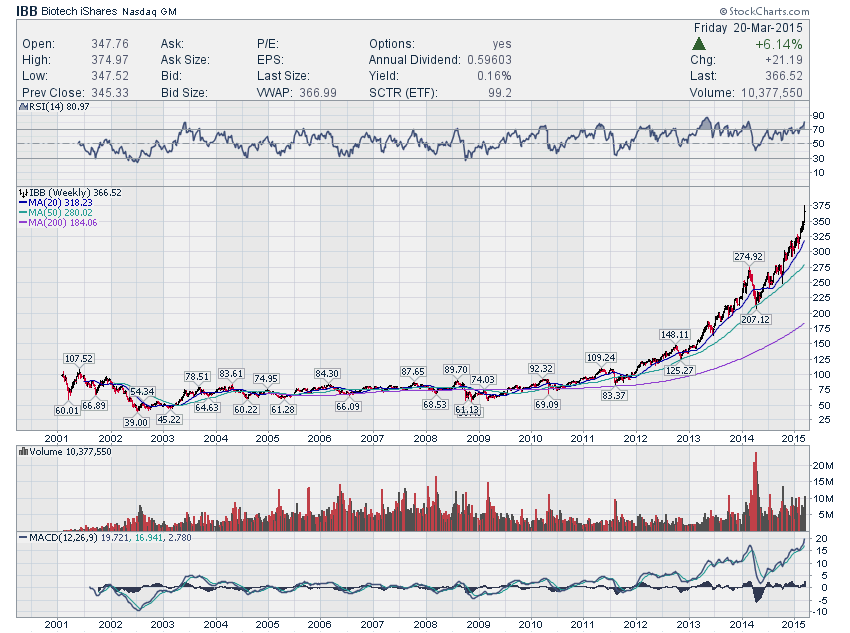

Finally, much ink has been spilled speculating about the possible "climax" or "blow off" top in the biotech sector. The longer term chart and especially the bearish reversal on Friday seem to support this notion, but we now need downside confirmation.

Top Setups for the Coming Week

My weekend review of individual stocks didn't really come up with a tremendous number of setups and there are definitely many biotech stocks looking tired or downright bearish.

To me this means that, even though we are in an uptrend, we should be approaching all new positions with caution.

Here is a random sample of six I will be watching tomorrow:

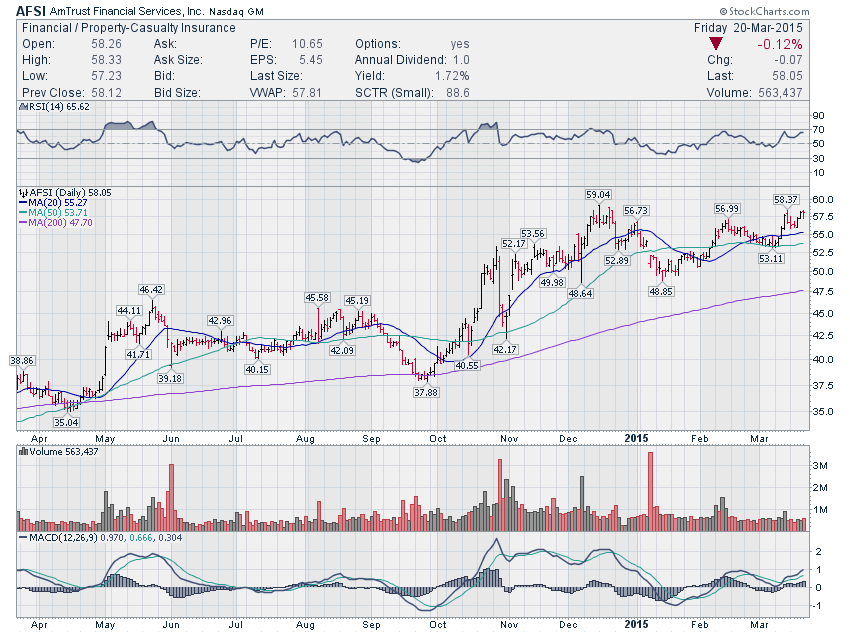

AFSI - Consolidating near the breakout point from a well developed four month base, now needs to clear the 58.50-59 area

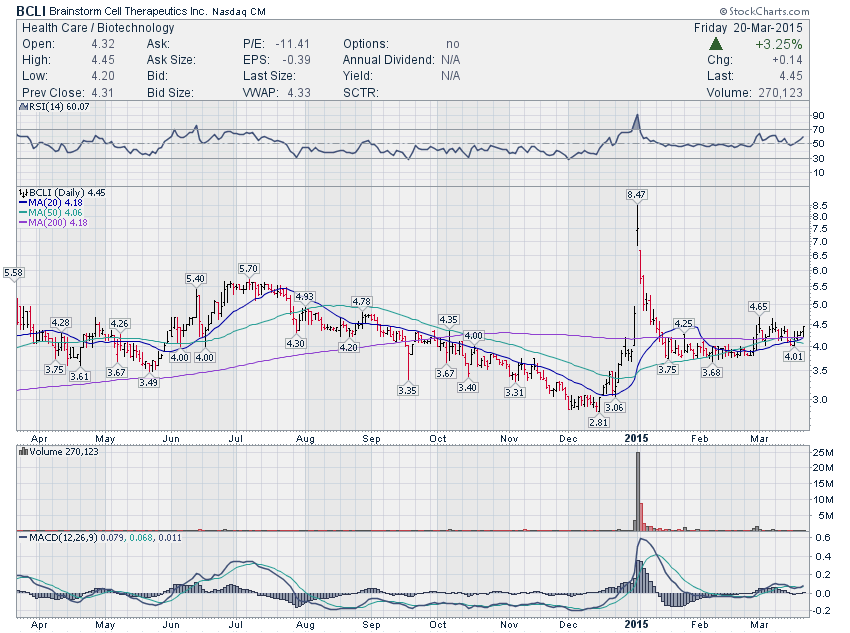

BCLI - Nice consolidation above 4 and the key moving averages. It is a small speculative bio stock, so I would avoid unless it had a push through 4.50 with very high volume

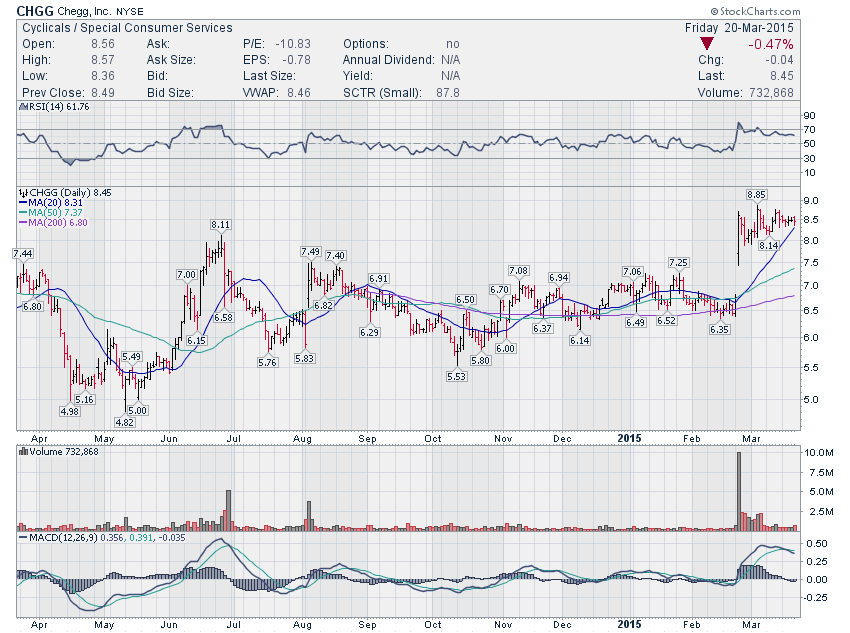

CHGG - Have been watching this one for several days now, very nice consolidation base and now a four week flag, expecting a push through 8.60

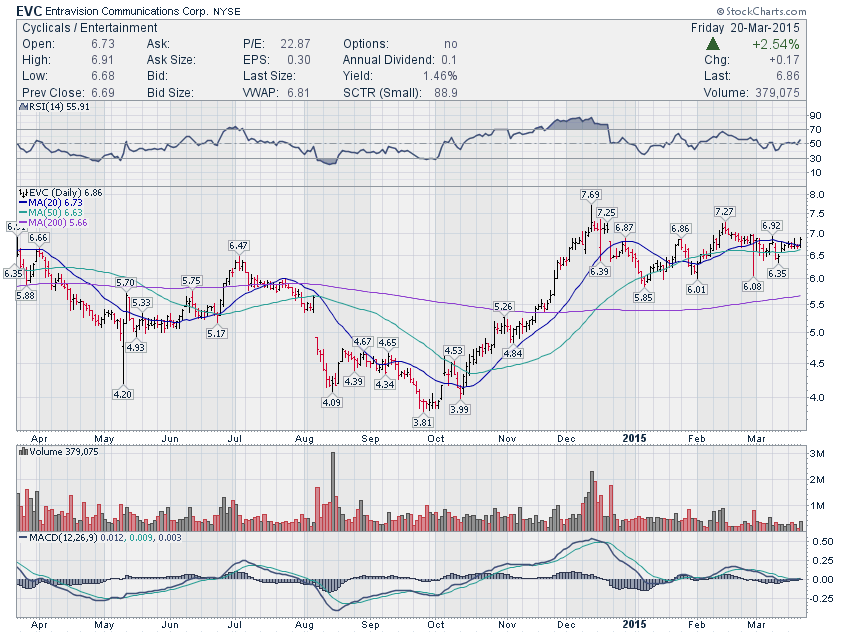

EVC - Bullish bounce off support within a constructive consolidation pattern, now needs continuation through 7

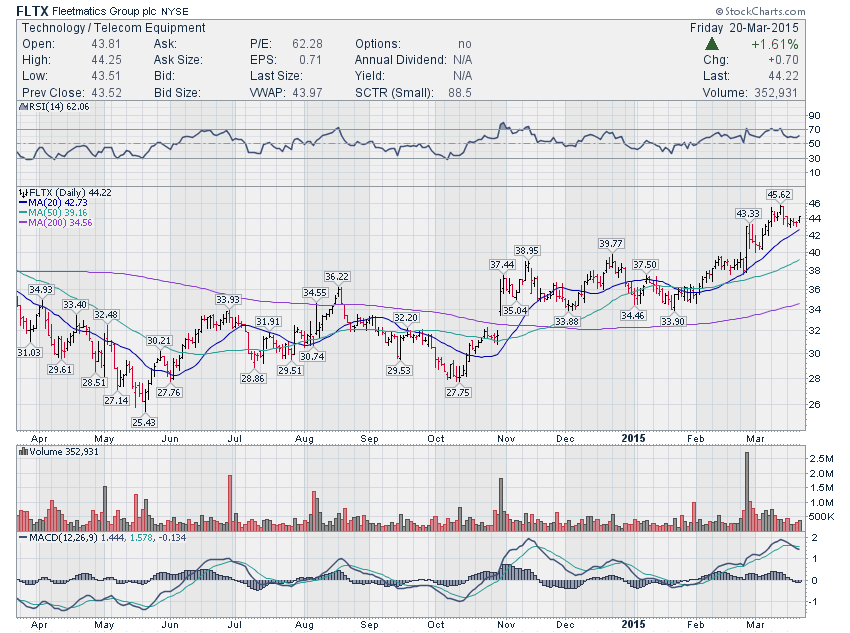

FLTX - Conviction breakout from a base in February followed by a follow-through to new highs, now seems to be flagging for a push to 46 and beyond

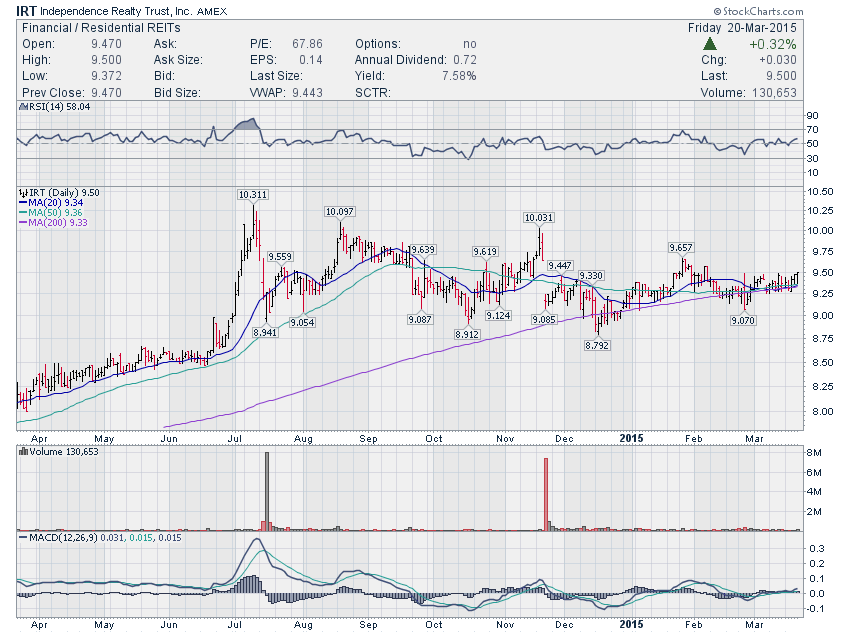

IRT - Working on a very well defined consolidation base, looks like it could be getting ready to start rising alongside right side of it now

Recent free content from Noanet Trader

-

Ignoring the Greco-German Noise

— 6/21/15

Ignoring the Greco-German Noise

— 6/21/15

-

June 18 Recap

— 6/18/15

June 18 Recap

— 6/18/15

-

All Eyes on the Russell

— 6/14/15

All Eyes on the Russell

— 6/14/15

-

Preparing for June

— 5/31/15

Preparing for June

— 5/31/15

-

Preparing for the Week of May 18

— 5/17/15

Preparing for the Week of May 18

— 5/17/15

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member