With the majority, myself included, expecting more downside the market did what it does best: the unexpected.

The S&P staged a nice oversold bounce and closed well above the 2080 area, while the other major indices basically did the same. However, today's price action merely returns the indices into their respective consolidation areas, but was not enough to negate last week's damage.

At this point we are in a no-man's land and in the frustrating state of indecision.

The following are eight of the setups I will be watching tomorrow.

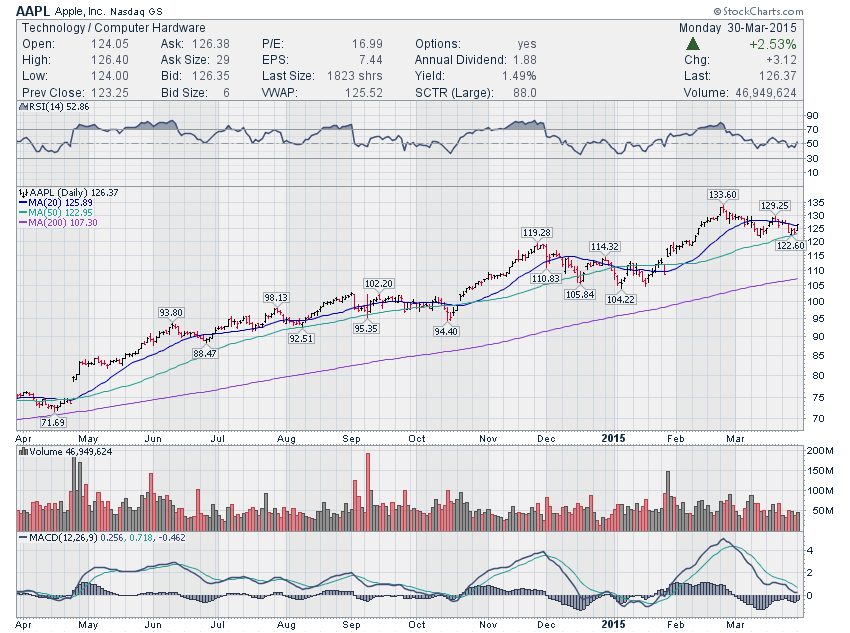

AAPL - Bullish bounce off support at 125 and the 50dma, expecting continuation toward 130

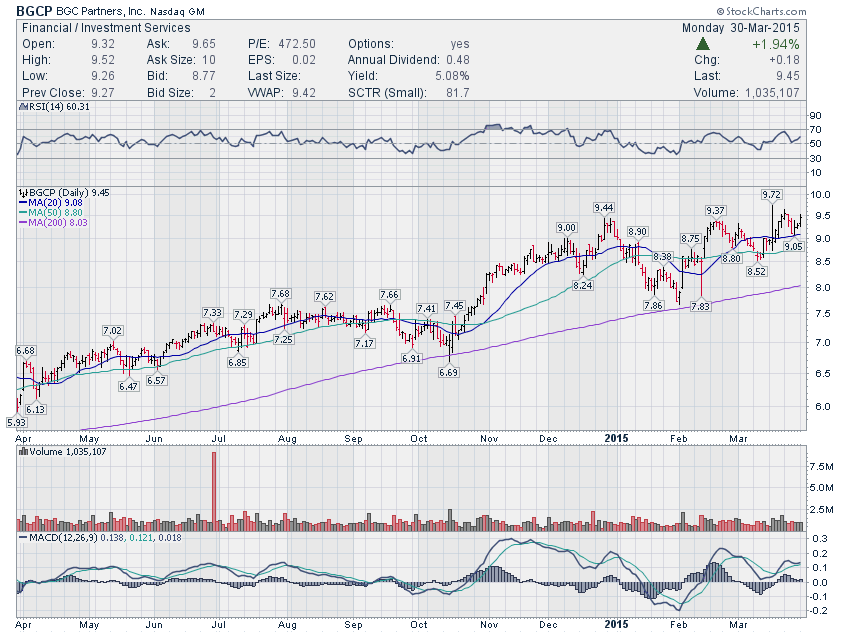

BGCP - Flagging for a breakout from a three month base and a push toward 10

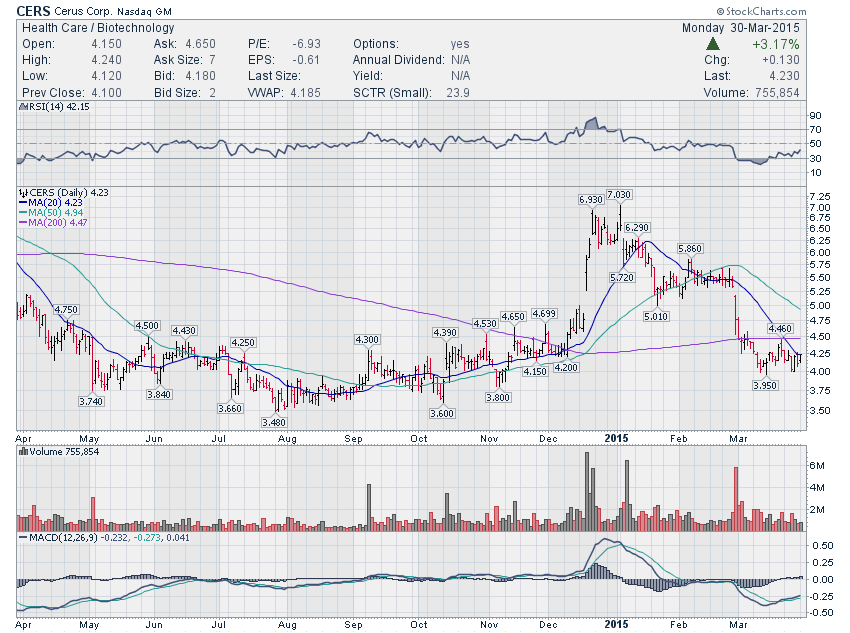

CERS - Long and somewhat sloppy pullback to support, expecting a push toward 4.50+

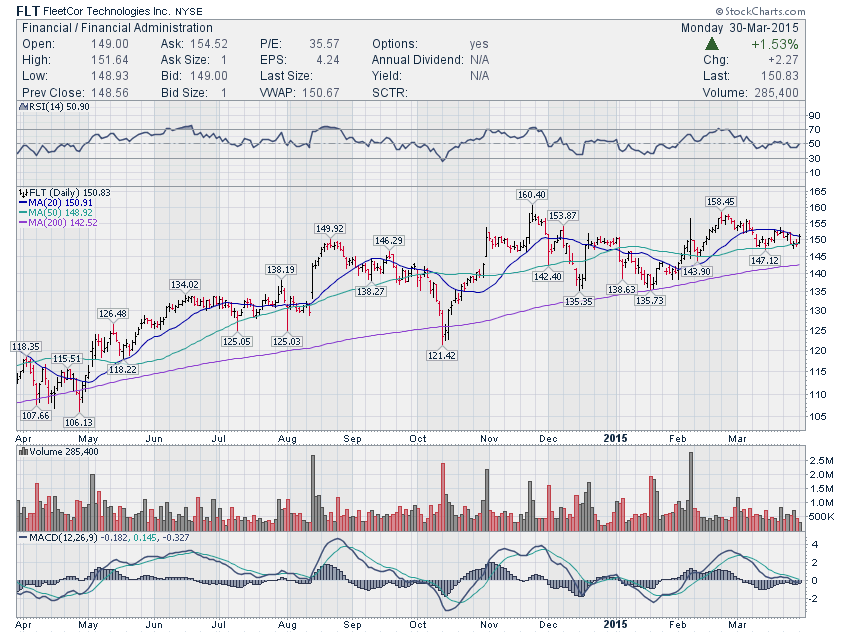

FLT - Bullish bounce off 50dma and 150 and a close at the 20dma, will be looking for continuation toward 155

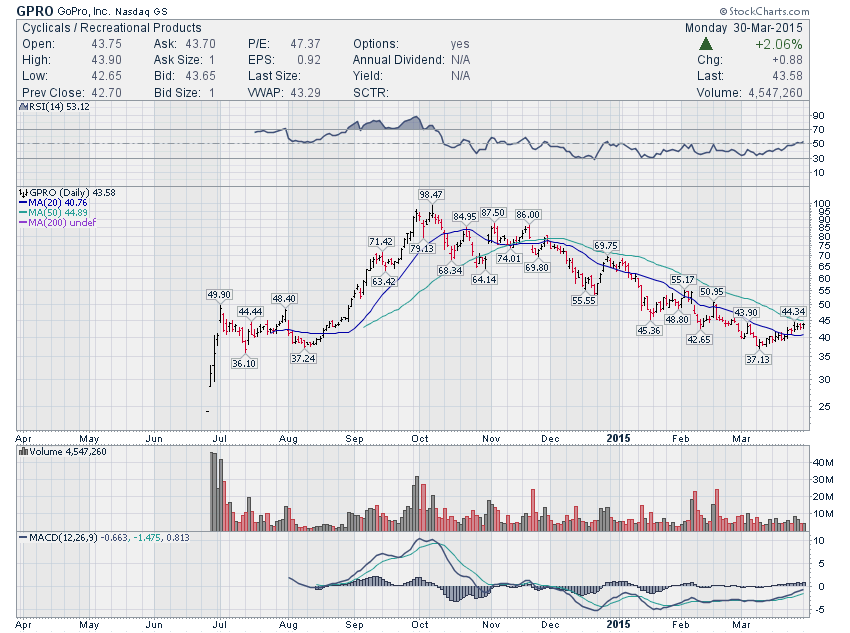

GPRO - Week long narrow consolidation after getting through the 40 level and the long downward trendline, seems to be getting ready for a push to 45+

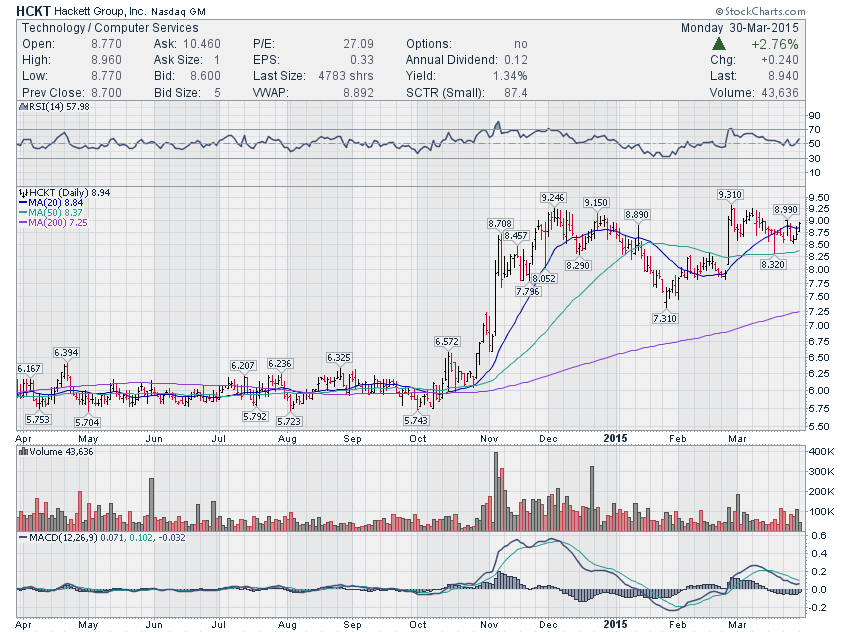

HCKT - Seems to be flagging for a breakout toward 9.50+

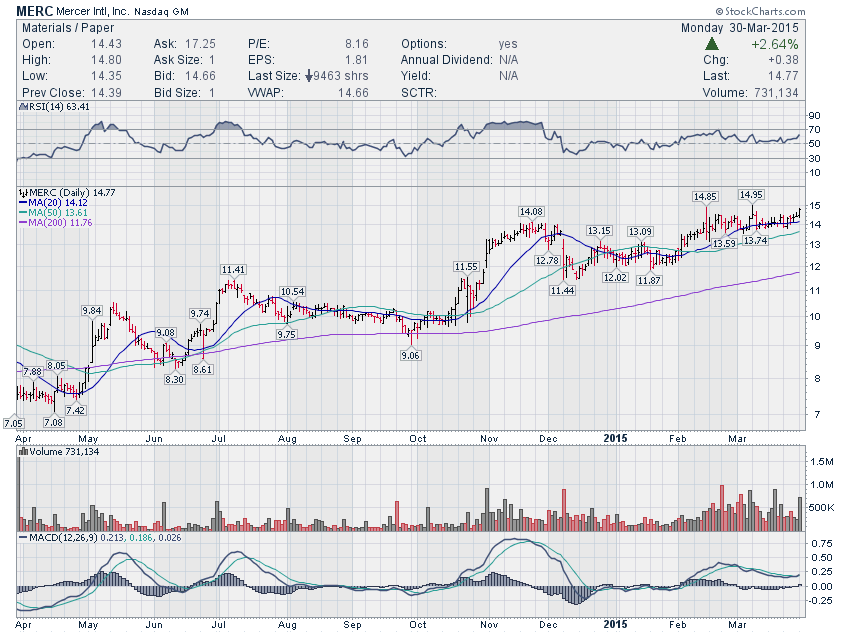

MERC - In process of breaking out from a well developed base, expecting continuation through 15

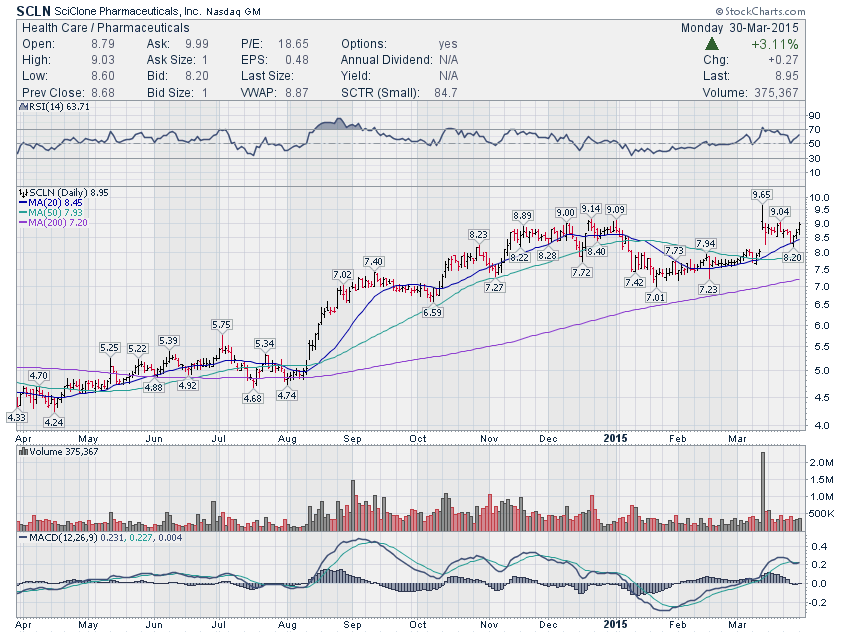

SCLN - Somewhat sloppy flag, but looks like it's getting ready for a push toward 9.50

Recent free content from Noanet Trader

-

Ignoring the Greco-German Noise

— 6/21/15

Ignoring the Greco-German Noise

— 6/21/15

-

June 18 Recap

— 6/18/15

June 18 Recap

— 6/18/15

-

All Eyes on the Russell

— 6/14/15

All Eyes on the Russell

— 6/14/15

-

Preparing for June

— 5/31/15

Preparing for June

— 5/31/15

-

Preparing for the Week of May 18

— 5/17/15

Preparing for the Week of May 18

— 5/17/15

No comments. Break the ice and be the first!

Error loading comments

Click here to retry

No comments found matching this filter

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member

Want to add a comment? Take me to the new comment box!