Stocks spiked again on Wednesday with the S&P 500, DJIA, NASDAQ Composite, S&P Midcap, and Russell 2000 indices all finishing at new all-time highs. Once again, investors can thank Mr. Trump for the increased value of their brokerage accounts and 401K's as it was the mere mention of a "massive" tax plan that got the markets moving again yesterday.

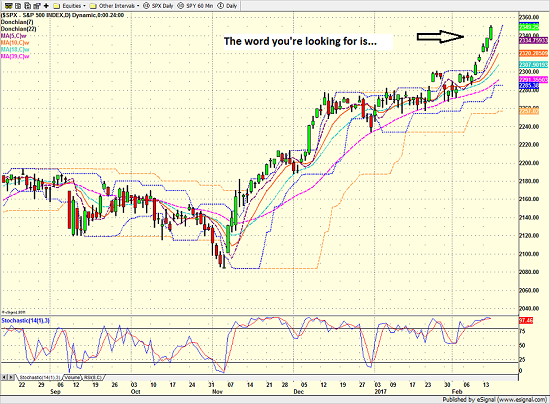

After a nearly 5% rise in the S&P 500 so far in 2017 (+4.93% through Wednesday, to be exact) and the longest string of consecutive all-time highs for the three major stock market indices seen since 1992, the word that you may be looking for to best describe the recent market action is, "meltup." For those not familiar, this was a term that was used frequently in the late 1990’s, when a steady stream of new highs was commonplace. But after the prolonged sideways action seen from late 2014 through February of last year, this type of joyride to the upside may be foreign to many investors.

S&P 500 - Daily

View Larger Image

In terms of what is driving the action, there is really nothing new to report. As we've been saying for months now, the stock market is, and always has been, a discounting mechanism of future expectations. And the bottom line is that investors are currently jumping on the bull bandwagon in anticipation of improved economic growth, better earnings, and a purportedly "massive" (or did he say "fantastic," I'll have to check) tax reform plan.

Janet Yellen may have said it best in her testimony to the House Financial Services Committee Wednesday. "I think market participants likely are anticipating shifts in fiscal policy that will stimulate growth and perhaps raise earnings," Yellen said. Yep, that pretty much sums it up.

Speaking of the Fed, Ms. Yellen's merry band of central bankers has been on a mission for quite some time now. In fact, it was Bernanke & Co. that actually began the quest to create some inflation in the economy. Or more accurately, to avoid a Japanese-style deflationary cycle that has proved to be uber-difficult to stop once it gets started.

It is for this reason that first Bernanke, then Yellen have done everything imaginable to keep rates low, to get "asset prices" (i.e. stocks and real estate) moving up, and to get the economy moving forward on a sustainable path.

Along the way, this quest morphed into getting inflation "up" to the Fed's target level. As I've said many times over the years, until just recently the "problem" of inflation was always too much, not too little. And as someone who came into the business as Volcker was declaring war on inflation, the idea of the Fed trying to push inflation higher was borderline comical.

But of course, the Fed really only has two mandates: full employment and stable prices. As such, the only way the Fed could justify continuing their efforts to get the economy moving once the jobs market improved was through the idea of an inflation target.

Don't look now fans, but inflation is back. This week's PPI/CPI reports have confirmed as much with both measures of inflation now above the 2% level on a year-over-year basis. And while Yellen's crew prefers to monitor the PCE, it is only a matter of time until the Fed can declare victory on the task of moving inflation up to the targeted level.

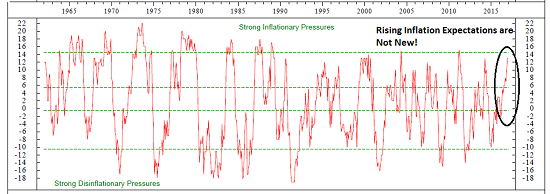

On that note, I received a couple of notes from folks wondering if I was surprised to see inflation "suddenly" back over 2%. The short answer is, no. On one call I said, "If you have been following my weekly indicator updates, which include a review of both inflation and inflation expectations, you would not be surprised to see inflation perking up either."

Below is one of the charts I monitor on a weekly basis.

View Larger Image

Source: Ned Davis Research

As you can plainly see, inflationary pressures have been rising for quite some time and have recently moved up toward the "strong inflationary pressures" zone. (P.S. You can sign up to receive the reports here.

So, is the inflation situation surprising? Absolutely not. Remember, this has been the GOAL of central bankers around the world for many moons now. And if I've learned anything in my 30+ years of managing money for a living, it is that the Fed usually gets what the Fed wants.

And since Janet Yellen has said that it is okay for the economy to "run hot" for longer than normal in order for the economy to achieve a normal growth path, the real question is if the real "inflation problem" will become THE topic of conversation again at some point soon.

Thought For The Day:

"Simplify, simplify." - Henry David Thoreau

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies

2. The State of the U.S. Economy

3. The State of Global Central Bank Policies

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member