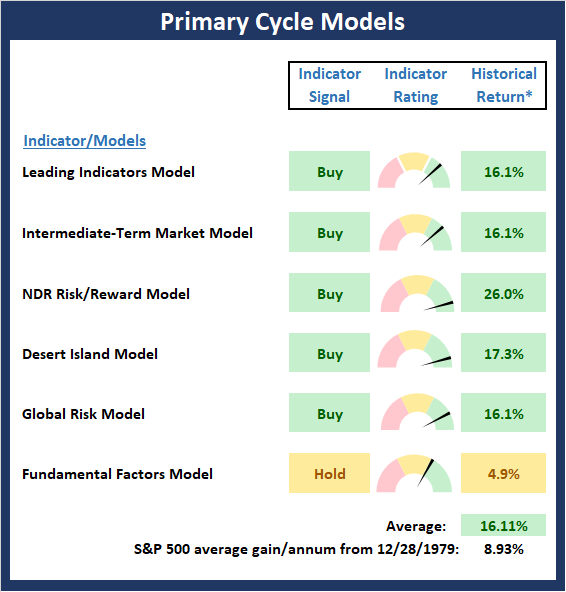

As a reminder, the market's primary cycles generally do not change often. However, I still like to start each week with a clear understanding of what type of market we are dealing with. For me, a quick glance at the color of the Primary Cycle board and the weekly/monthly S&P graphs below tells me an awful lot about the "state" of the key market cycles.

My Current Take...

There are no changes to the Primary Cycle board this week. And with the board predominately green it is easy to argue that the bulls are large and in charge. But my biggest question/concern from a big-picture point of view is if the bullish argument is getting a little "too easy" to make these days!

View the Primary Cycle Model Board Online

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

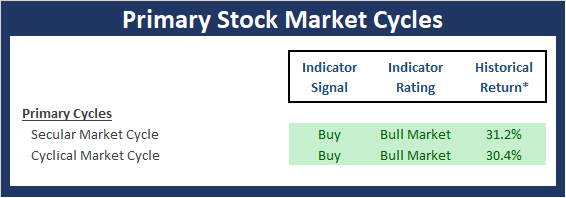

Checking In On The "Primary" Cycles

While I don't often make portfolio adjustments based on the long-term trends in the stock market (aka the "primary cycles"), I have found over the years that checking in on state of the cycles and the weekly/monthly charts helps to keep the big-picture in perspective.

View the Primary Cycles Board Online

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The Secular Market Cycle

Definition: A secular bull market is a period in which stock prices rise at an ...