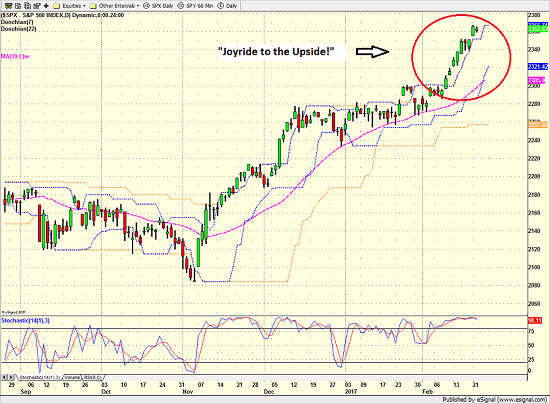

The current joyride to the upside in the stock market is apparently one for the ages. Exhibit A here is the fact that of Tuesday's close, the S&P 500 has gained 13.4% since the pre-election, November low. Next, the Dow's current nine-day consecutive win streak is apparently the longest in 30 years. And from the inception of the current cyclical bull, which began on February 11, 2016, stocks (as measured by the S&P) are up 29.3% in just over a year. Impressive.

There are all kinds of indicators that suggest the current bull run, is likely to continue. Not the least of which is history. According to Ned Davis Research, the median gain for cyclical bull markets that occur within a secular bull trend (the current run began on March 9, 2009), is 77.2%, while the mean return is 106.7%. So, if the current rally is anything like its historical brethren, there could be a fair amount of upside still to come.

S&P 500 - Daily

View Larger Image

However, there is also no denying that stocks are overbought and that sentiment has become overly upbeat, a combination that tends to accompany meaningful pullbacks in the stock market. I've also argued that we are currently seeing a "good overbought" situation as markets that get overbought and stay overbought tend to run longer than the bears can tolerate. As such, I've learned that betting against the bulls in this type of situation can be a painful experience. Hence the famous John Maynard Keynes quote, "The market can stay irrational longer than you can stay solvent."

But on the other hand, I have been pointing out that many big-picture market models and indicators - especially those that include the state monetary conditions - isn't exactly peachy keen at the current time. I've gone so far as to suggest that this is NOT a low-risk environment. And while it is perfectly fine to stay in your seat on the bull train, investors might want to take their foot off the gas a bit.

For those macro thinkers out there that are busy scanning the investing landscape for the "trigger" to the next meaningful decline (i.e. something more than a garden variety 3%-5% pullback), yesterday's FOMC minutes may have provided an idea to consider.

The premise here is simple. Currently the stock market is "expecting" 2-3 Fed rate hikes this year. And in terms of timing, it would appear that the May/June meetings are the most likely targets.

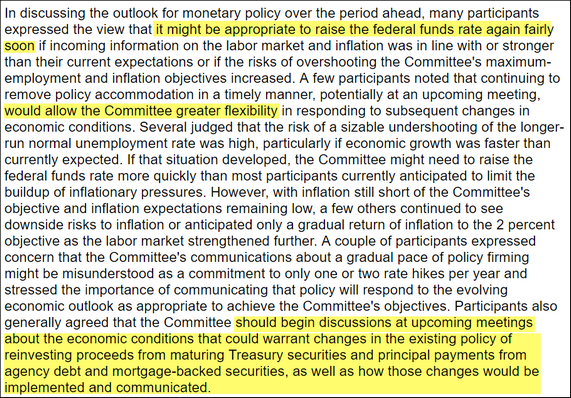

However, the minutes from the most recent gathering of Yellen & Friends suggest that the committee is in agreement that the next hike should come "fairly soon."

Below is a little something the WSJ put together to make this point.

The problem is that the market is not "pricing in" a rate hike next month. According to futures contracts, the odds of the Fed hiking rates in March are currently just 34%. And this was AFTER the FOMC minutes were released.

Thus, one could argue that a rate hike in March could "surprise" the markets and become the catalyst the bears have been looking for to get something going to the downside.

To be clear, I am NOT suggesting that I expect the Fed to hike rates in March OR that the stock market would decline if they do. I'm simply pointing out that markets hate surprises and while it does seem hard to fathom, a rate hike next month could actually qualify as a surprise. Something to keep in mind, I think.

As for how to "play" such an event, my stance hasn't changed. Until something changes (economic momentum, tax reform disappointment, etc.) and/or the ECB/BOJ stop printing money, this remains a buy-the-dip environment.

Thought For The Day:

"What shapes our lives are the questions we ask, refuse to ask, or never think to ask. " - Sam Keen

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies

2. The State of the U.S. Economy

3. The State of Global Central Bank Policies

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member