The recent trend of intraday strength being met with selling continued yesterday. As an indication that the action remains sloppy and conflicted, I present the fact that stocks have now flip-flopped between gains and losses on a closing basis for nine consecutive sessions now.

And yet, the bears can't be terribly happy with their efforts here. Sure, the market action has been weak, stocks appear to be in some sort of a downtrend, and there has been a plethora of issues for traders to contend with on a daily basis. However, it is important to note that (a) the S&P 500 is only 2.3% away from the August high and (b) stocks usually decline during the mid-August through October period anyway.

Thus, the bulls will contend that stocks have actually held up fairly well during the historically weak seasonal time frame.

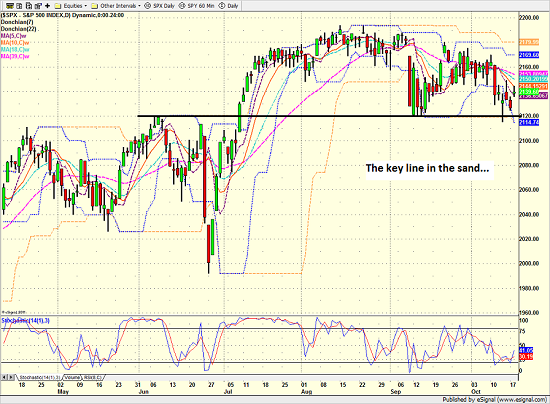

It is also encouraging that the bulls have been able to hold the line from a technical standpoint. And while important levels on a chart can snap like toothpicks when the trend-following algos start to roll to the downside, so far at least, the key line in the sand on the chart has not been violated on a closing basis.

S&P 500 - Daily

View Larger Image

One of the issues that may have kept the seasonal sloppiness intact this year has been the view that stocks are overvalued. Just this week, billionaire hedge fund manager David Tepper said that the market is "fully valued" and that he remains cautious on stocks. Tepper clarified that while he is not bearish, he isn't taking excessive risks either.

On the same day, Carl Ichan, who never misses an opportunity to talk his book in front of the cameras, didn't mince words. The famed activist investor said that stocks are overvalued. But then again, this isn't exactly a new position for Mr. Ichan.

Valuation Primer

In fact, there can be little argument that stocks are overvalued when looking at the tried and true, traditional valuation metrics. Price-to-Earnings, Price-to-Dividend, and Price-to-Book Value ratios are all currently at very high levels from an historical standpoint while other metrics are at either all-time high levels or levels only seen during the bubble periods.

One question investors may have is if everybody agrees that stocks are overvalued, why aren't stocks in a bear market? Why is the S&P still less than 3% below its all-time high? Shouldn't we all be running for the hills?

The answer to the latter question is no. And the rationale is really pretty simple. First, remember that there is no real competition for stocks these days. With cash and CD's yielding next-to nothing and investors being rewarded at the rate of 1.76% per year for lending money to the U.S. Government for 10 years, why not take the dividend of those big-name stocks instead? As such, the demand for stocks, while hardly robust in this environment, remains steady.

Another way to look at the valuation issue is that when viewed relative to the level of interest rates - and particularly over the last 25-30 years - valuations are actually attractive at current levels.

The Bottom Line

Sparing you all statistical backup to my points, the bottom line is that from a macro point of view, money tends to go where it is treated best. So, with new capital being created each and every month by central banks around the world, there is effectively a giant pool of excess funds sloshing around the global financial system each month. And since a fair amount of that money seems to consistently find its way to the U.S. stock and bond markets, well, you have a positive demand versus supply situation. And from my seat, this is why the bears haven't been able to produce the type of destruction seen in the 2000-02 and 2008 periods.

So, from a big-picture standpoint, I will contend that while the action is indeed sloppy, this remains a bull market until proven otherwise. And investors looking to put capital to work may want to consider buying the dip here.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the Earnings Season

2. The State of Global Economies

3. The State of Global Central Bank Policies

4. The State of U.S. Dollar

5. The State of German/European Banks

Thought For The Day:

Be as you wish to seem. -Socrates

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member