Overview

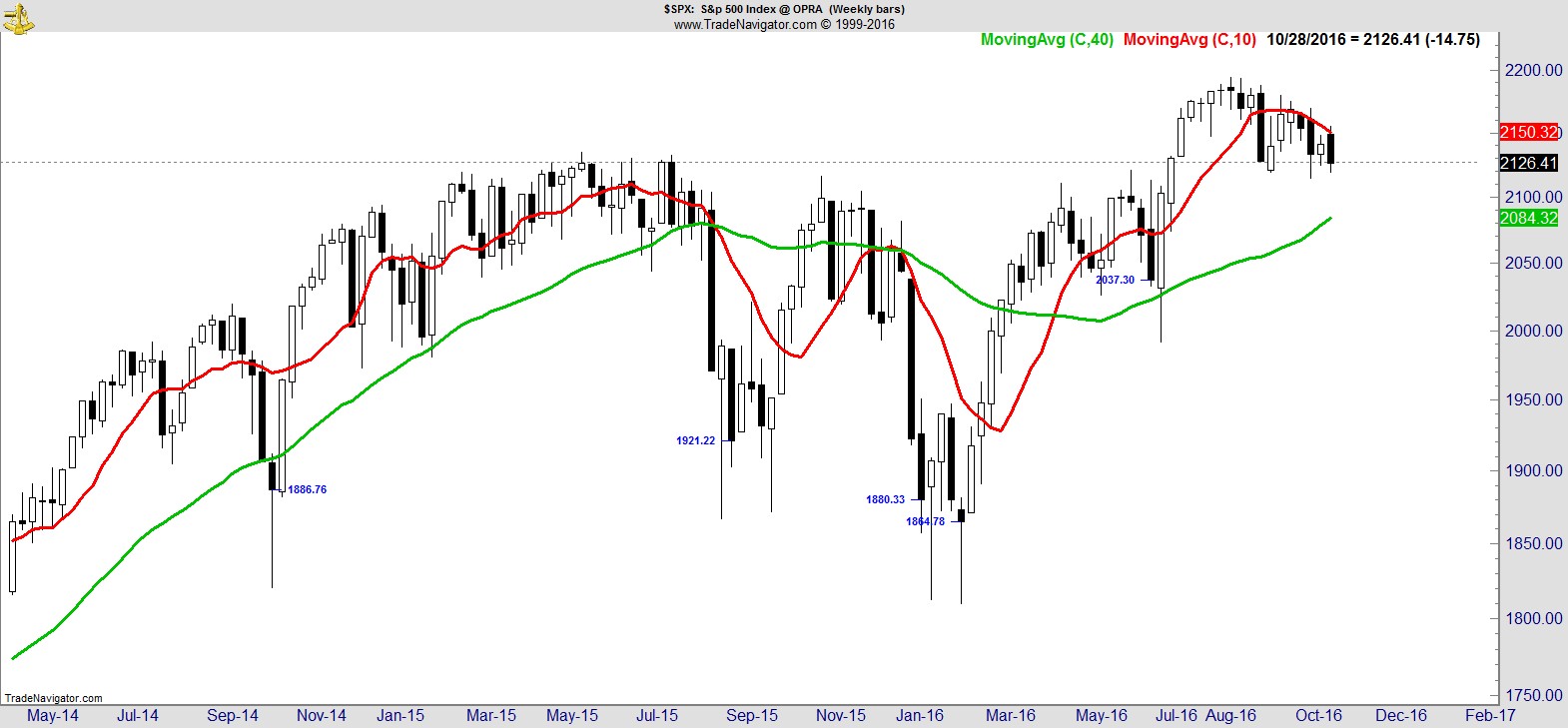

The theme of the last few weeks is still in play. US markets remain mixed, with the S&P 500 continuing to retest its breakout levels from July on a daily, weekly, and monthly basis. The outperformance in small caps seen since February is now under pressure, and breadth has deteriorated further but not to any significant degree.

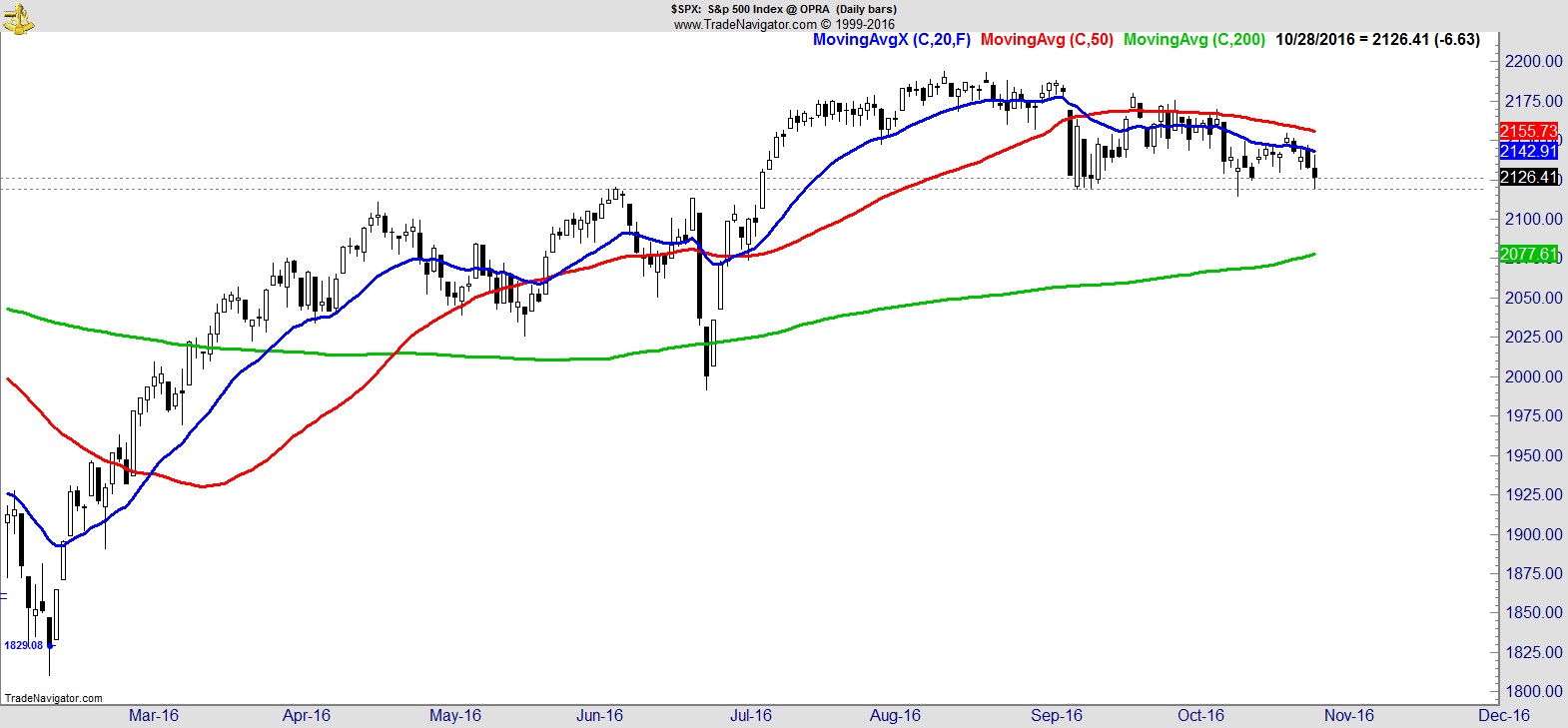

Here's the story of the S&P this week:-

It started brightly and steadily gave back its gains, turning negative as the week progressed before accelerating lower on Friday afternoon. On the daily and weekly you can see we're still retesting the July breakout levels.

.

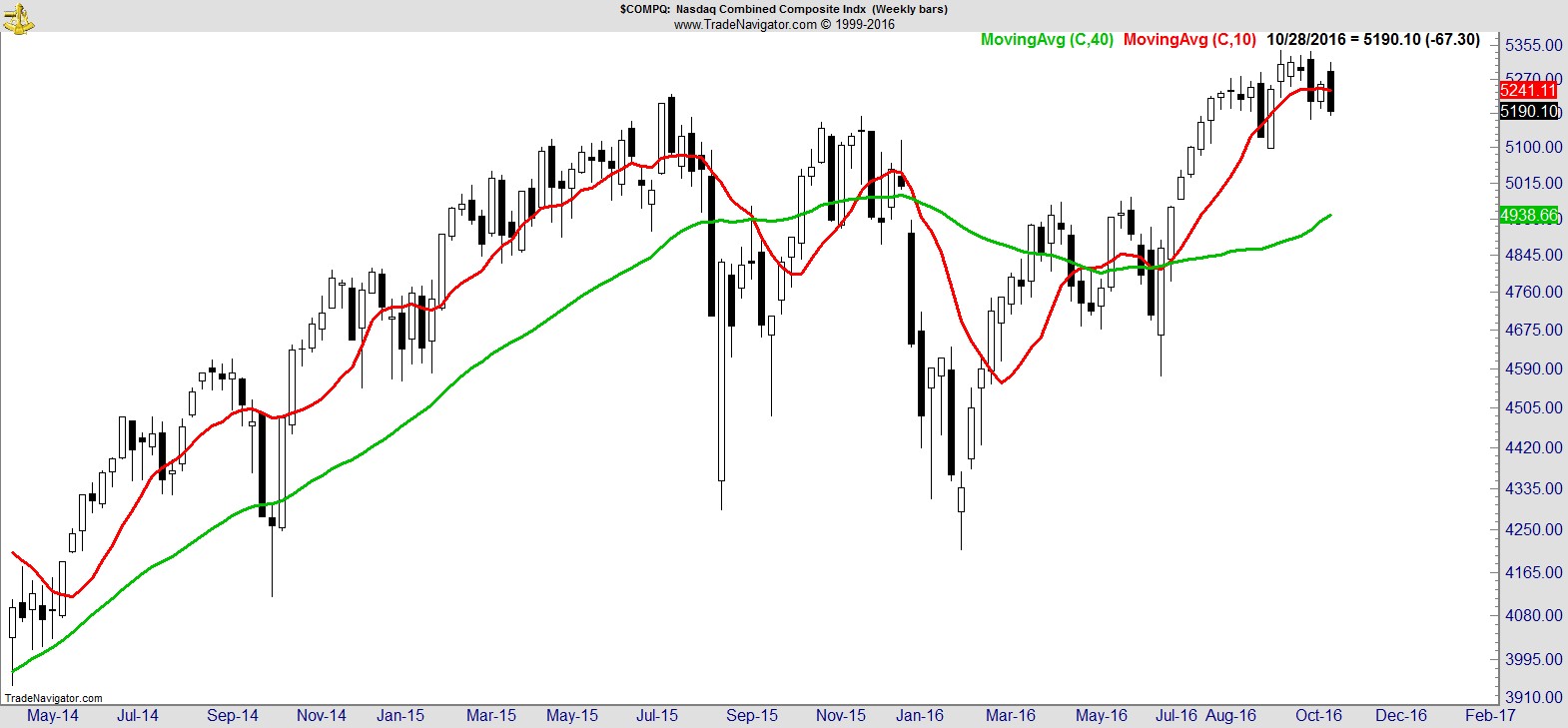

The NASDAQ closed below its 10wk MA at a 7-wk low, but remains within 3% of an all time high.

.

The Transports has traded in a very tight range for four weeks now, just below April's highs.

.

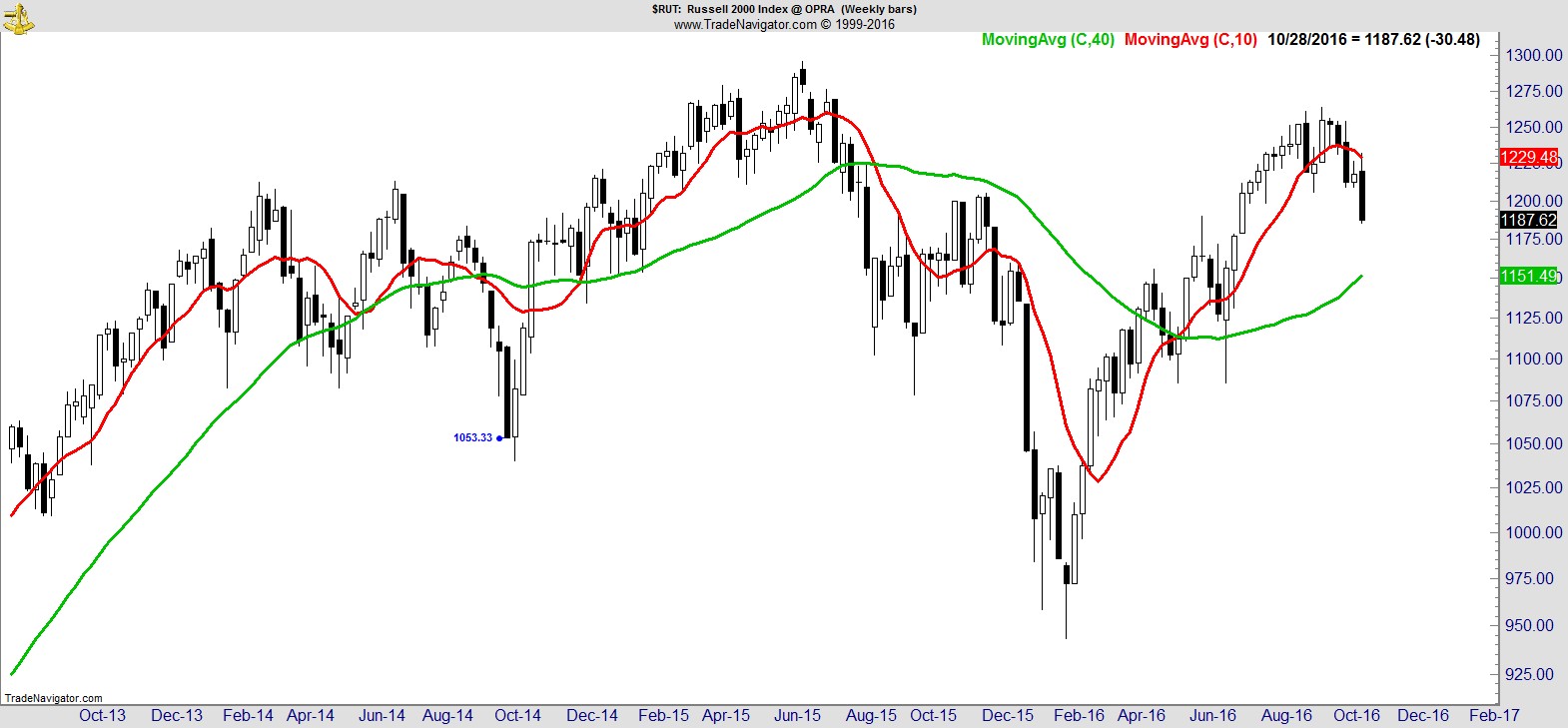

The big move lower was in the Russell ($RUT) which broke to a 16-wk low, and its strong performance relative to the S&P is now coming under pressure.

.

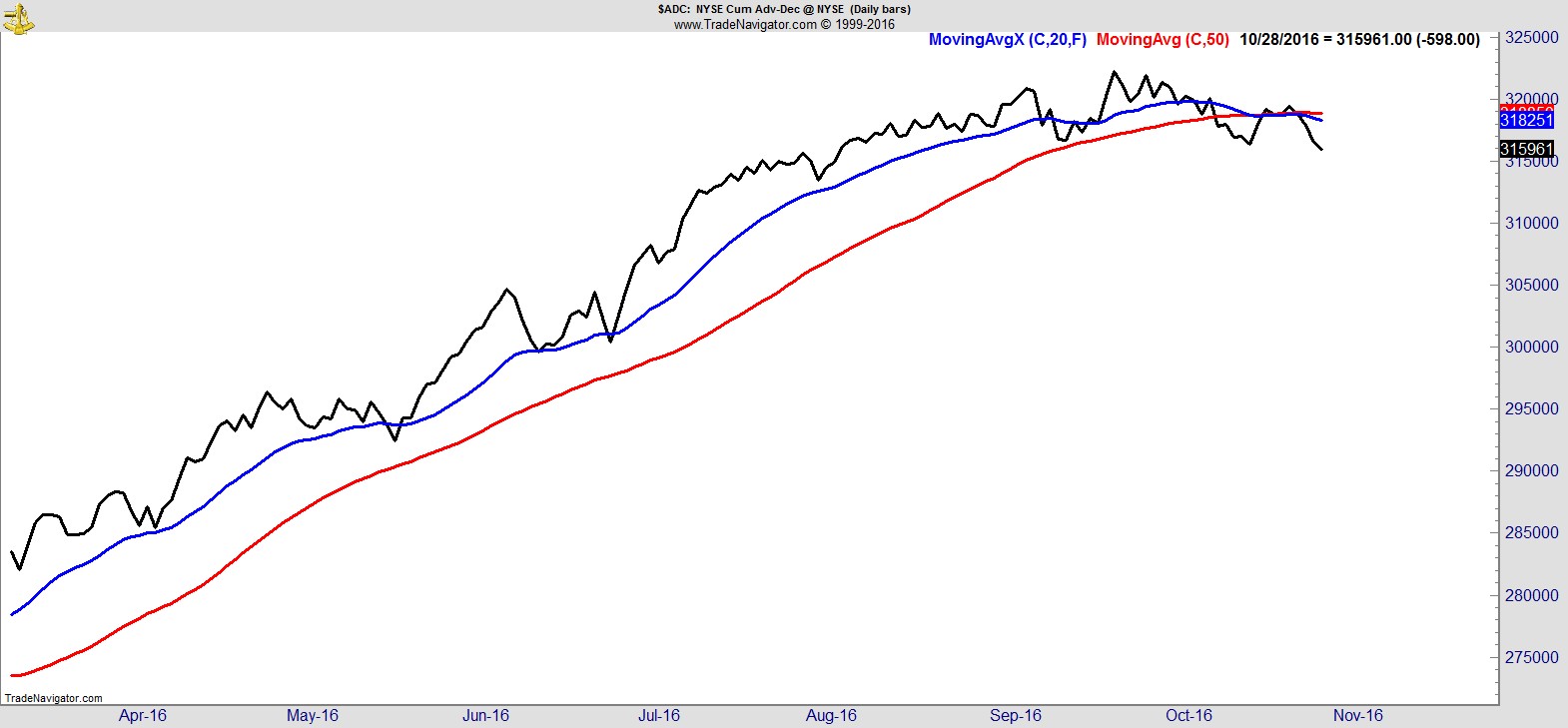

Bullish sentiment remains subdued despite a small rise this week, and breadth shown here via the NYSE Cumulative Advance/Decline, deteriorated further but is still in good shape overall.

.

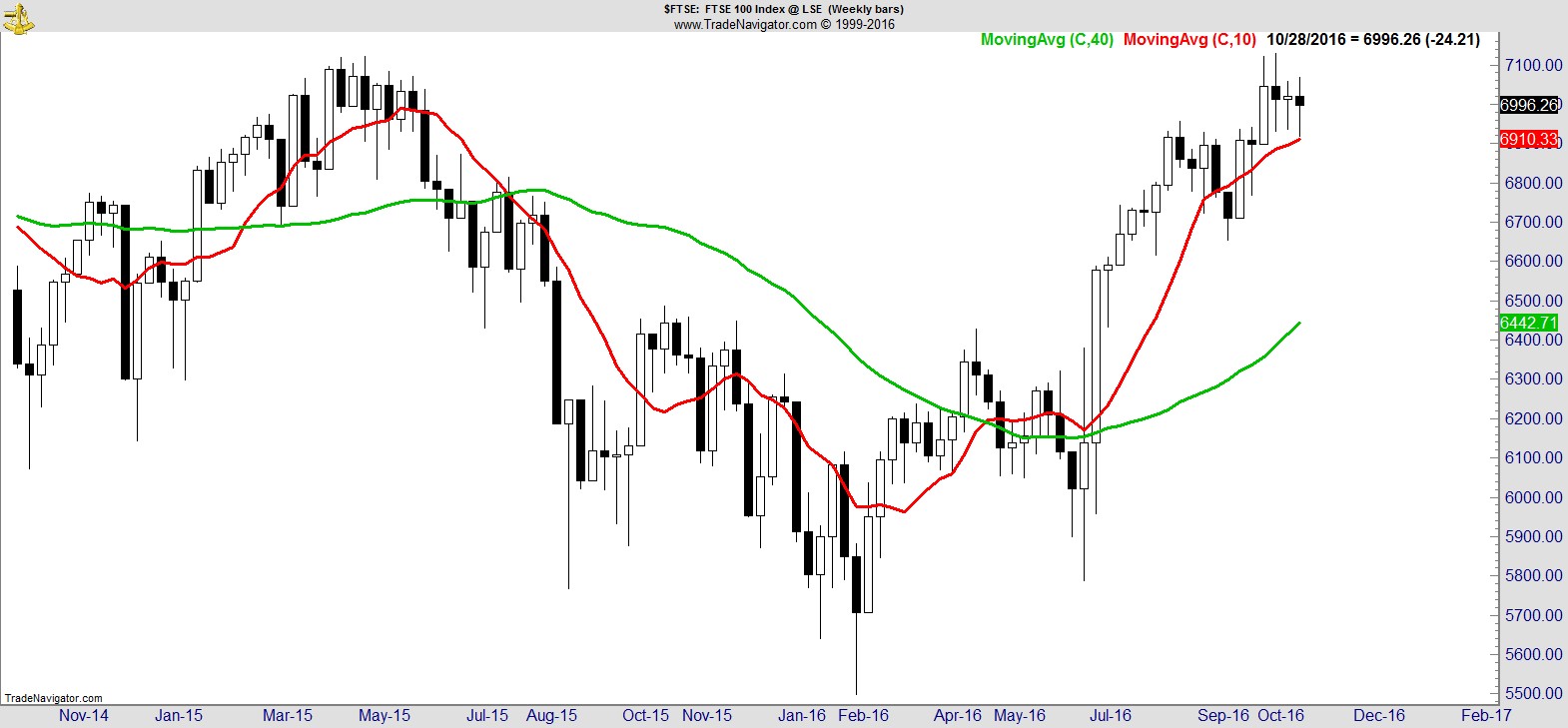

Although I focus primarily on US markets, it's interesting to note the rest of the world's major markets continue to improve, like Germany, China, Japan, UK. Generally speaking it suggests the recent weakness in the US is more likely to be just a consolidation, rather than the beginning of the next global meltdown as so many commentators would have you believe.

.

Sector Rankings

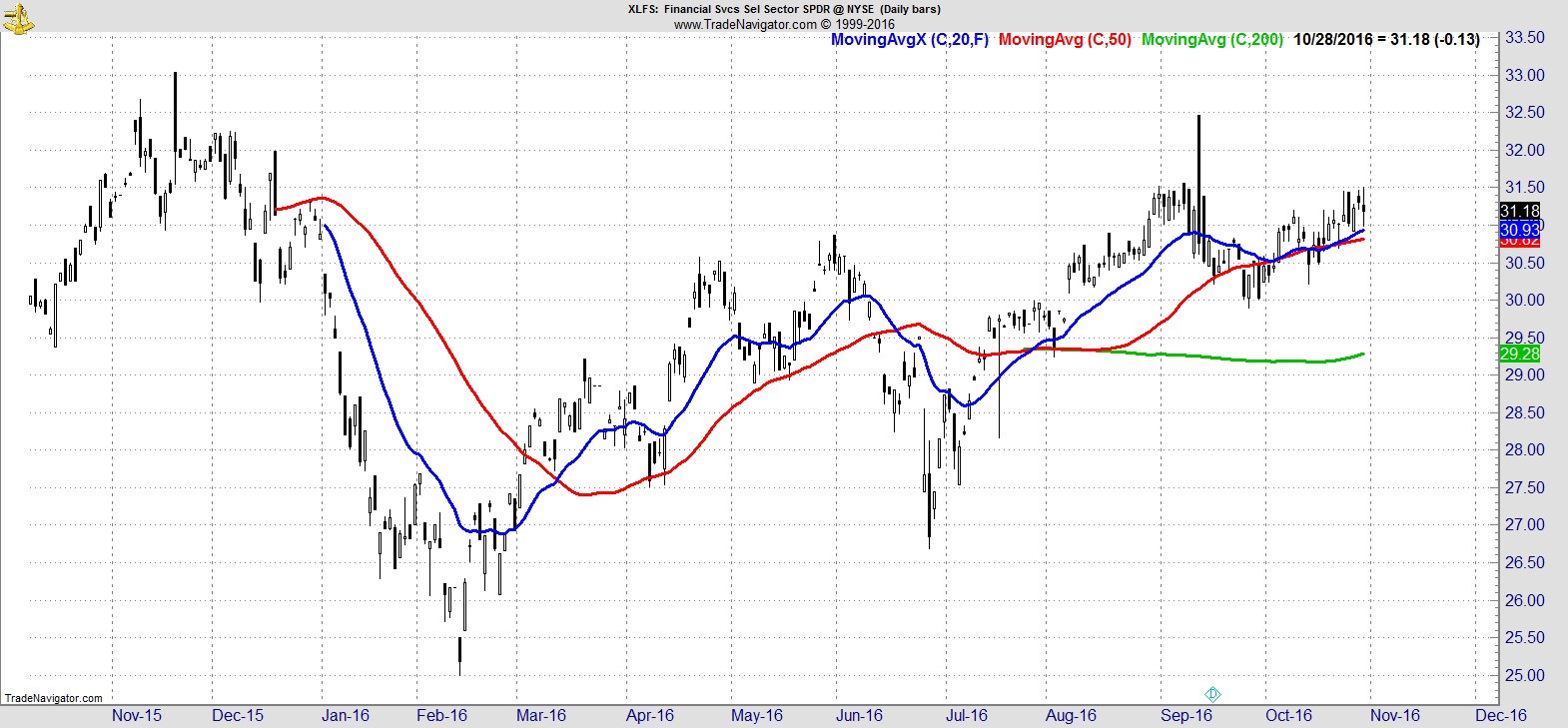

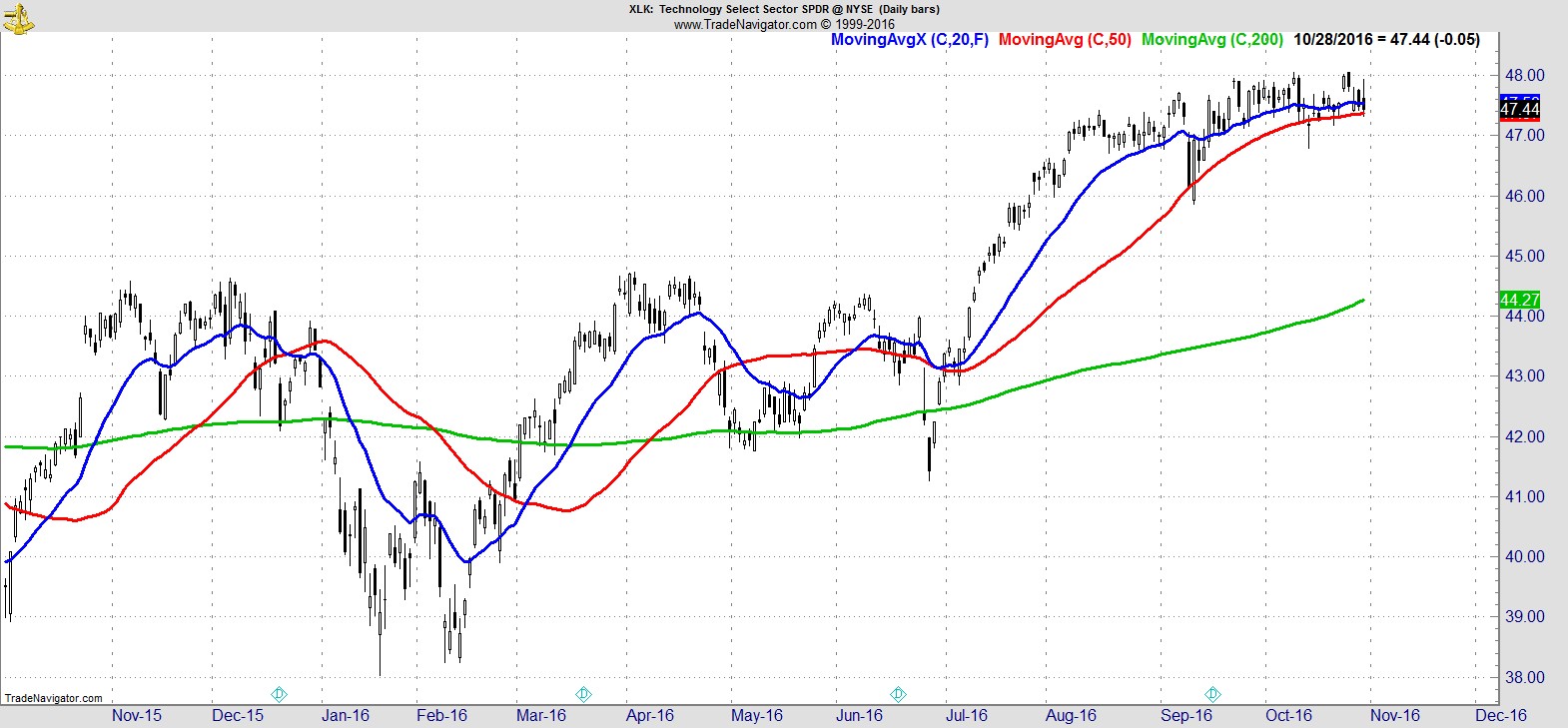

There's not much between the two, but I'm going to put Financials, or more specifically Financial Services ($XLFS) at the top this week, ahead of Technology ($XLK).

.

They're followed by Energy ($XLE), Industrials ($XLI), and Materials ($XLB), all of which are between their 50-day and 200-day MAs. Consumer Staples ($XLP) and Utilities ($XLU) remain below their 200-day, and were joined this week by Consumer Discretionary ($XLY), with a strong assist from Amazon which is its largest component.

.

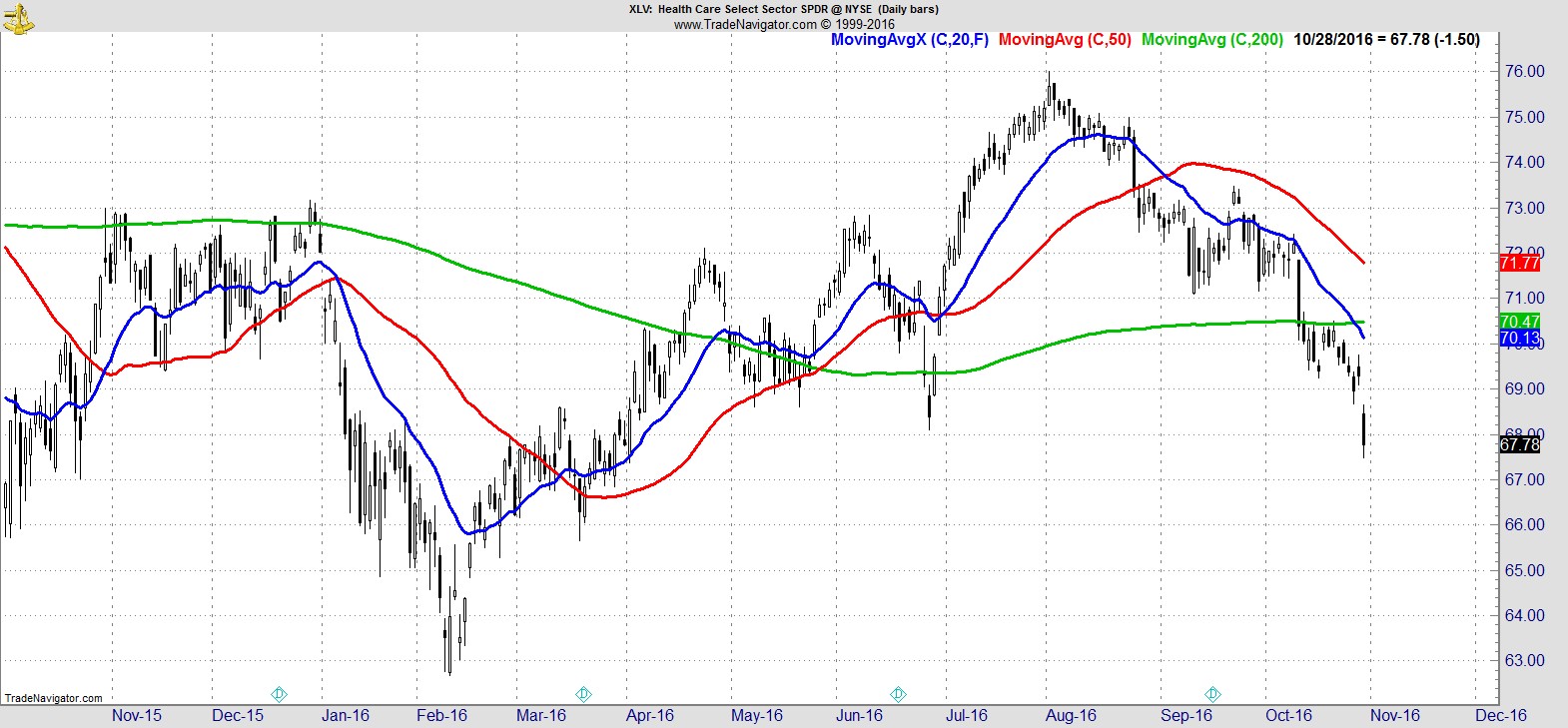

Lastly, pass the sick bag for Real Estate ($XLRE), and Healthcare ($XLV) which is in desperate need of its own services.

.

Alpha Capture Portfolio

Our model portfolio was -0.55% on the week vs -0.7% for the S&P, and remains down heavily on the year -8.96%. It's taken some big hits in recent weeks with the likes of ILMN, ISRG, AMZN and others taking chunks out of it. We had some big moves this week in both directions with wild round-trips in RTN and GIMO in particular. This weekend we have another exit and two new entries. Those changes will leave us with 9 names, about 4% total open risk, and around 24% in cash.

.

Watchlist

Our watchlist is fairly evenly split this week between Financials, Tech, Energy/Materials, and Consumer names.

Here's a small sample from the full list of 20 names:-

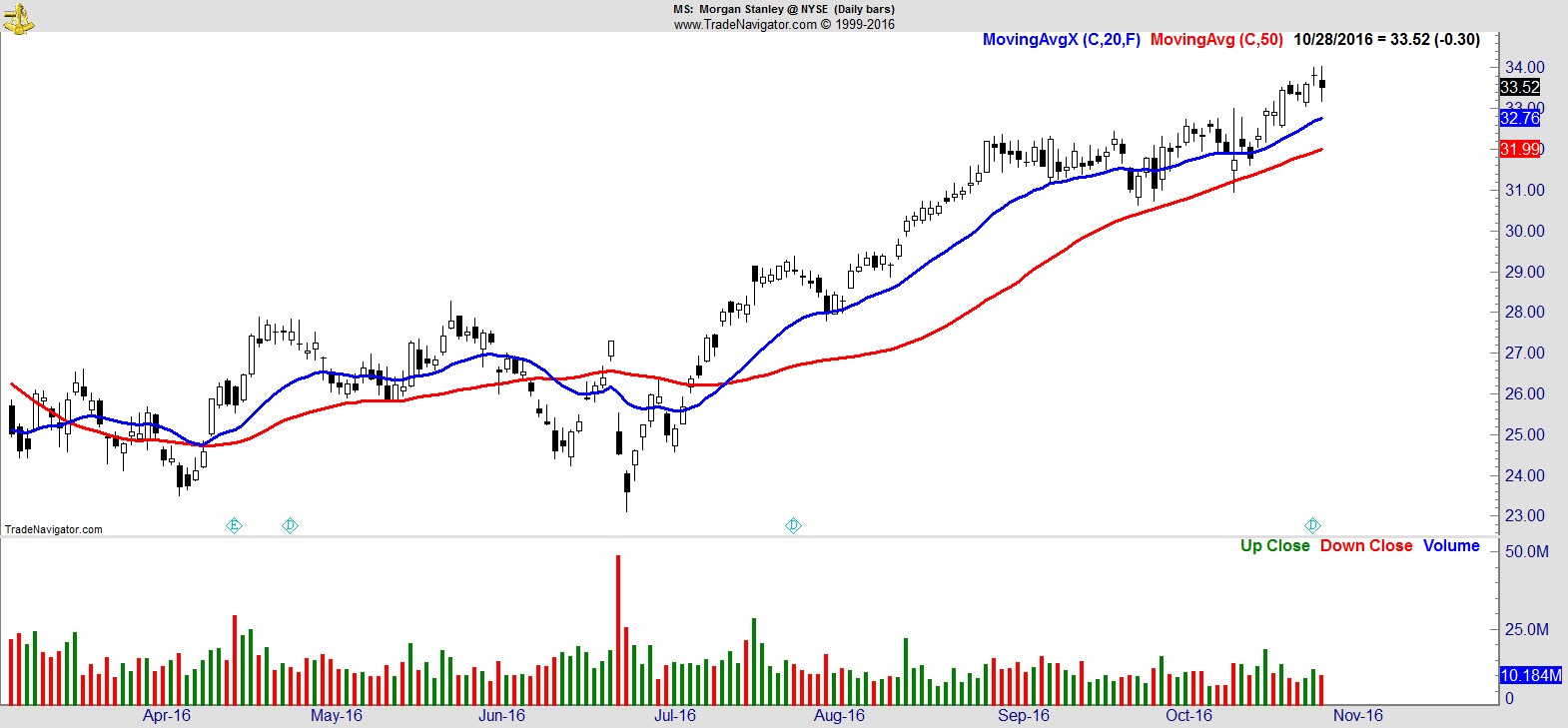

$MS

.

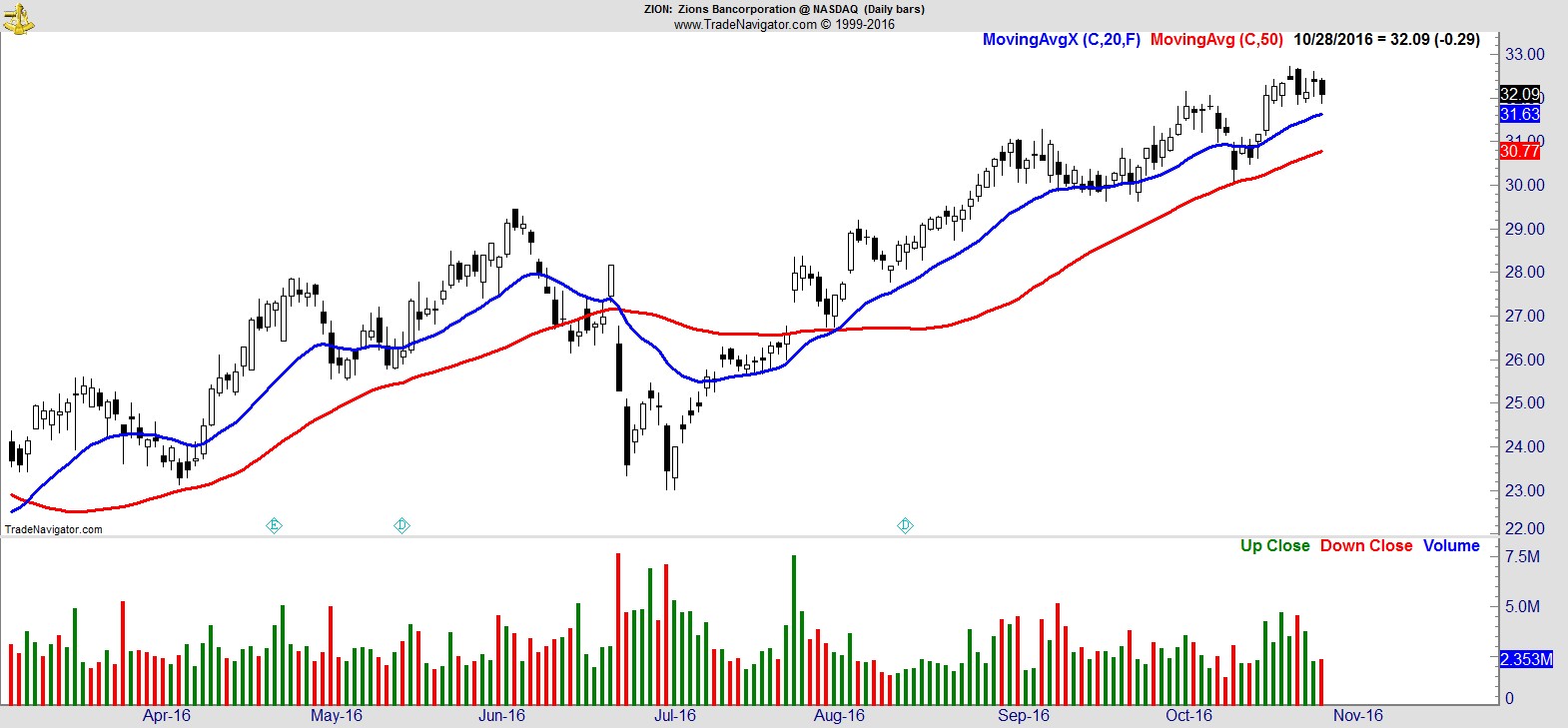

$ZION

.

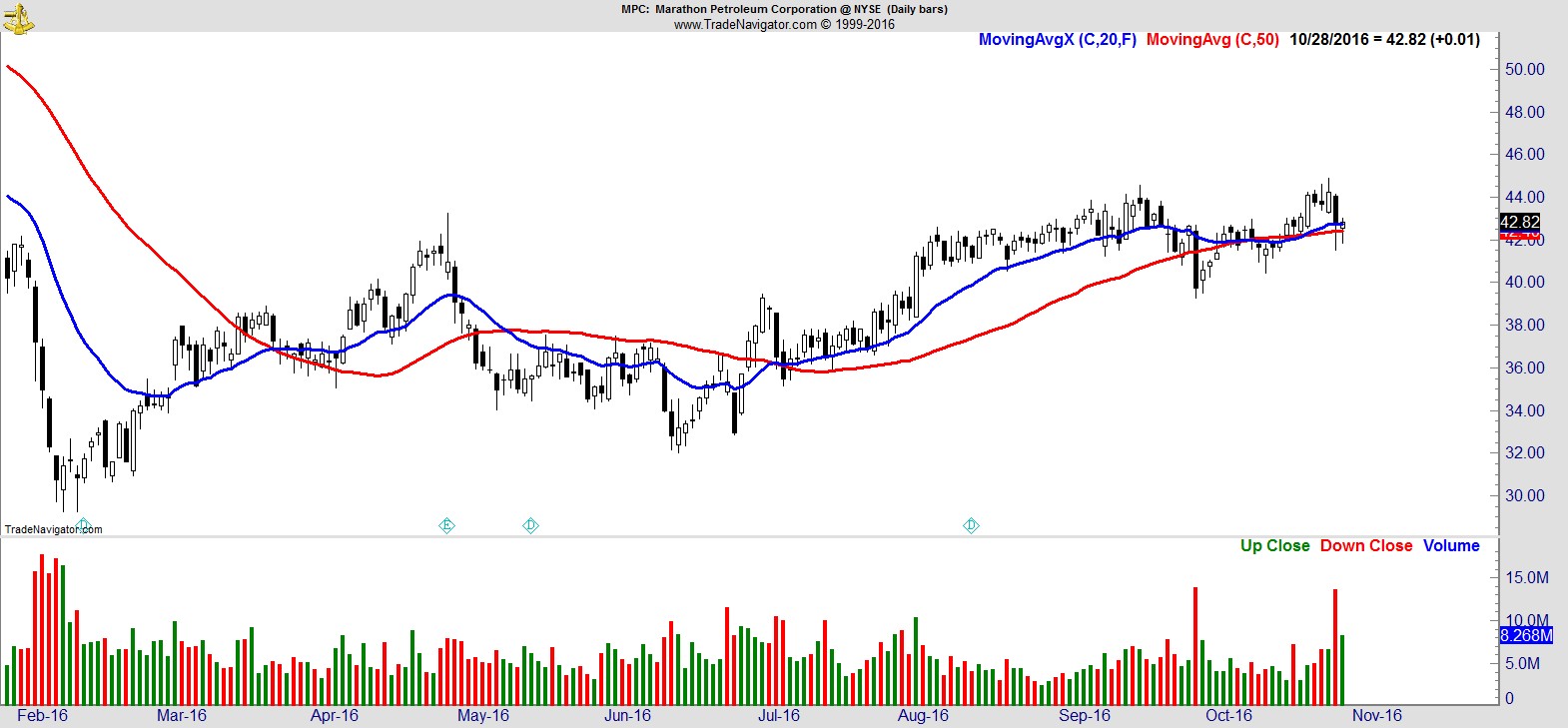

$MPC

.

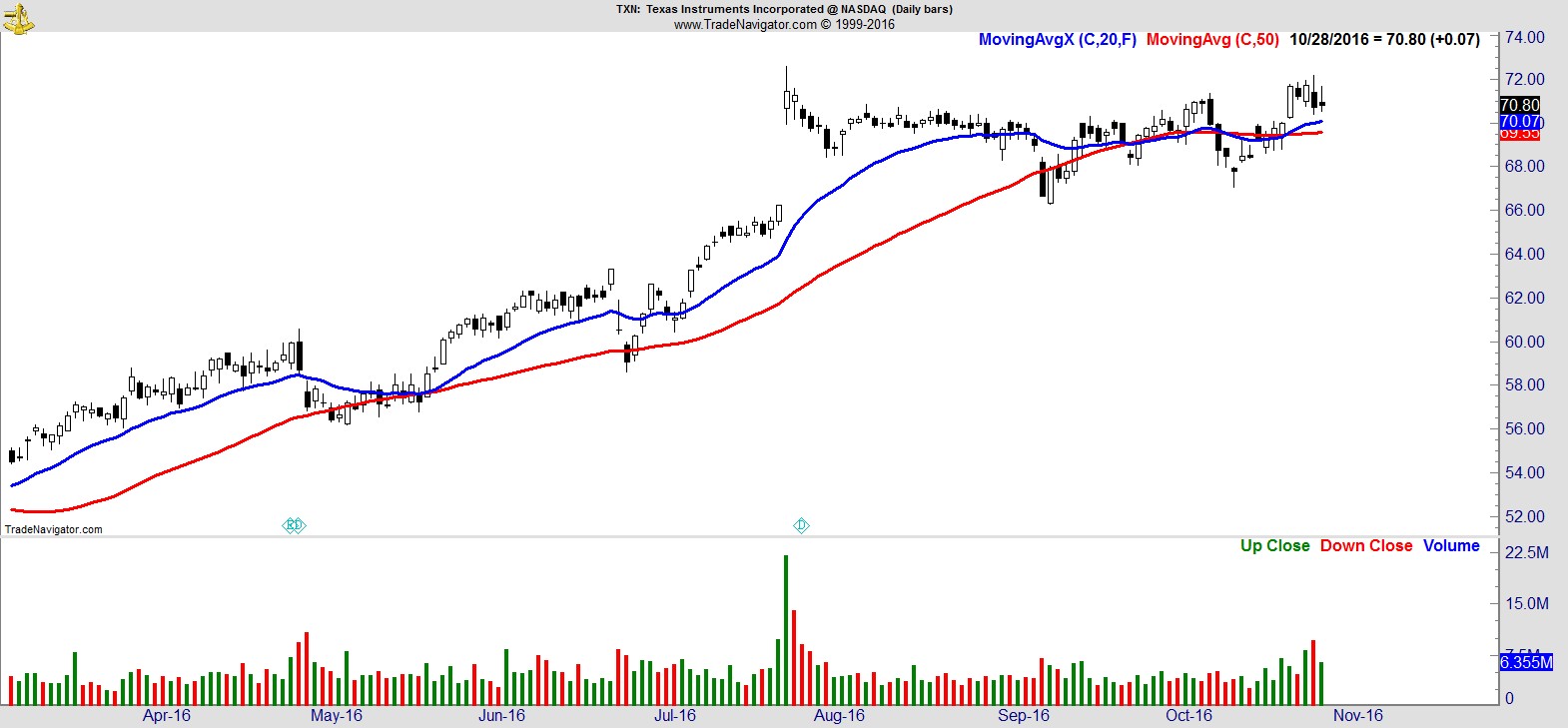

$TXN

.

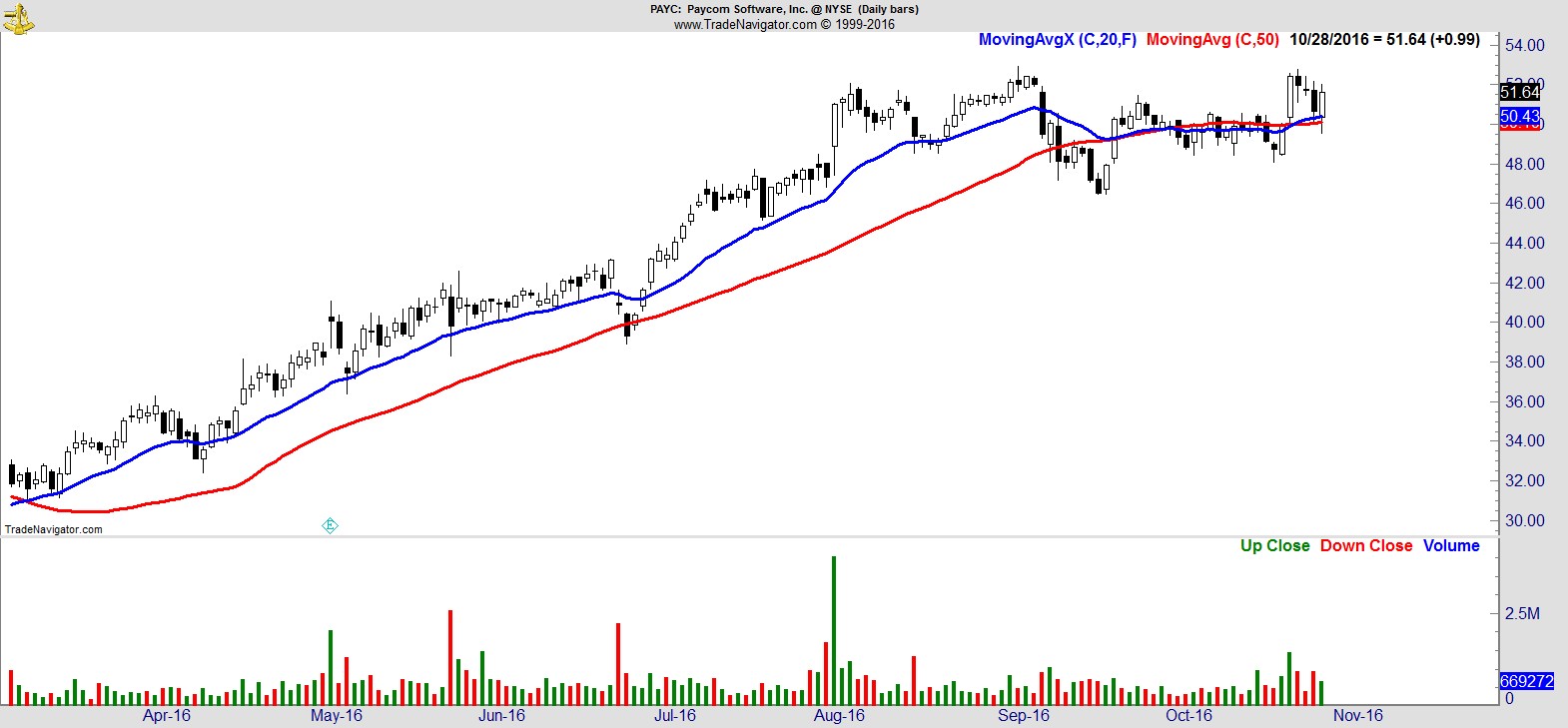

$PAYC

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17