Overview

Every now and then it's good to take a look at longer-term charts to help give you perspective for the moves unfolding before your eyes on a daily basis. I have emphasized this in recent weeks and months and I believe it's what's kept us on the right side of the most recent moves and sector rotation which appears to be the source of much consternation from commentators and market participants alike.

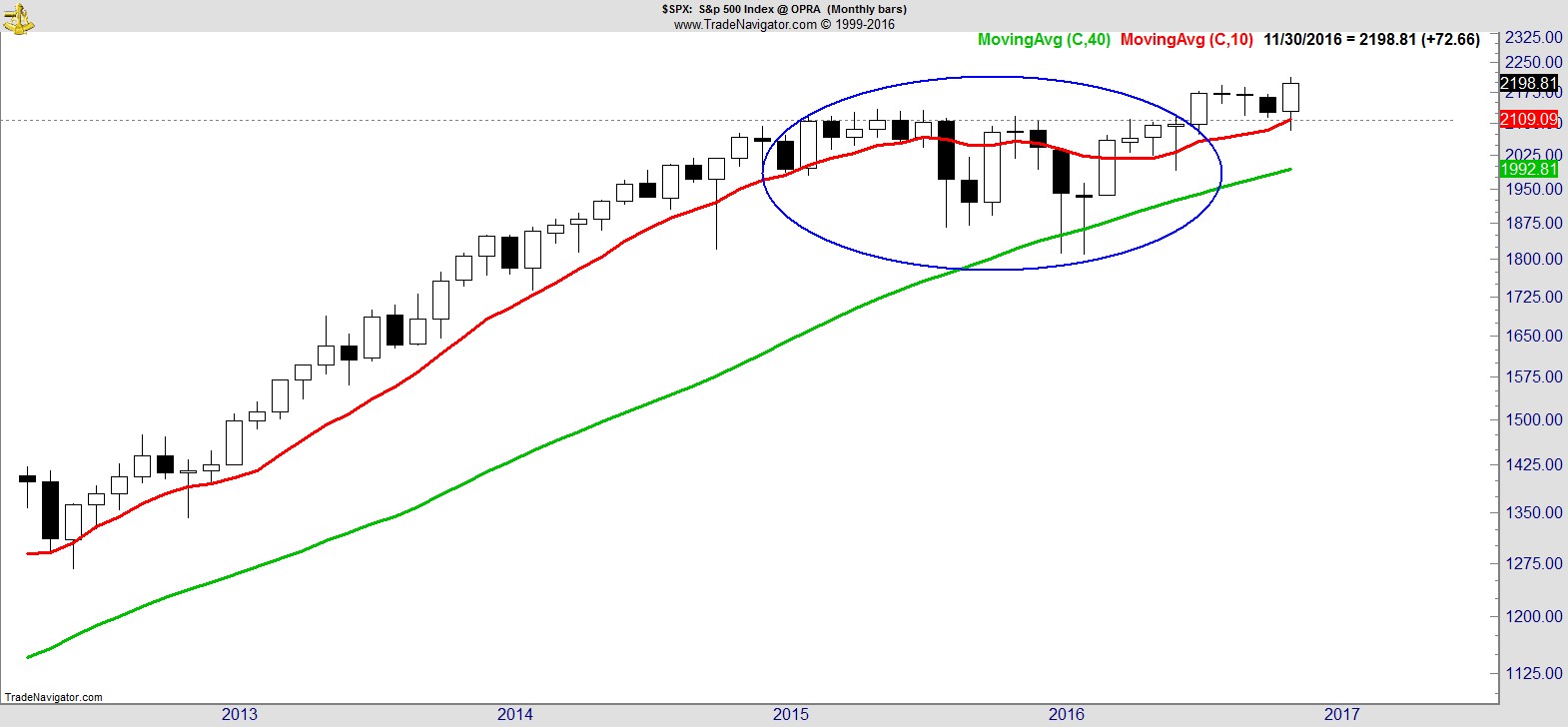

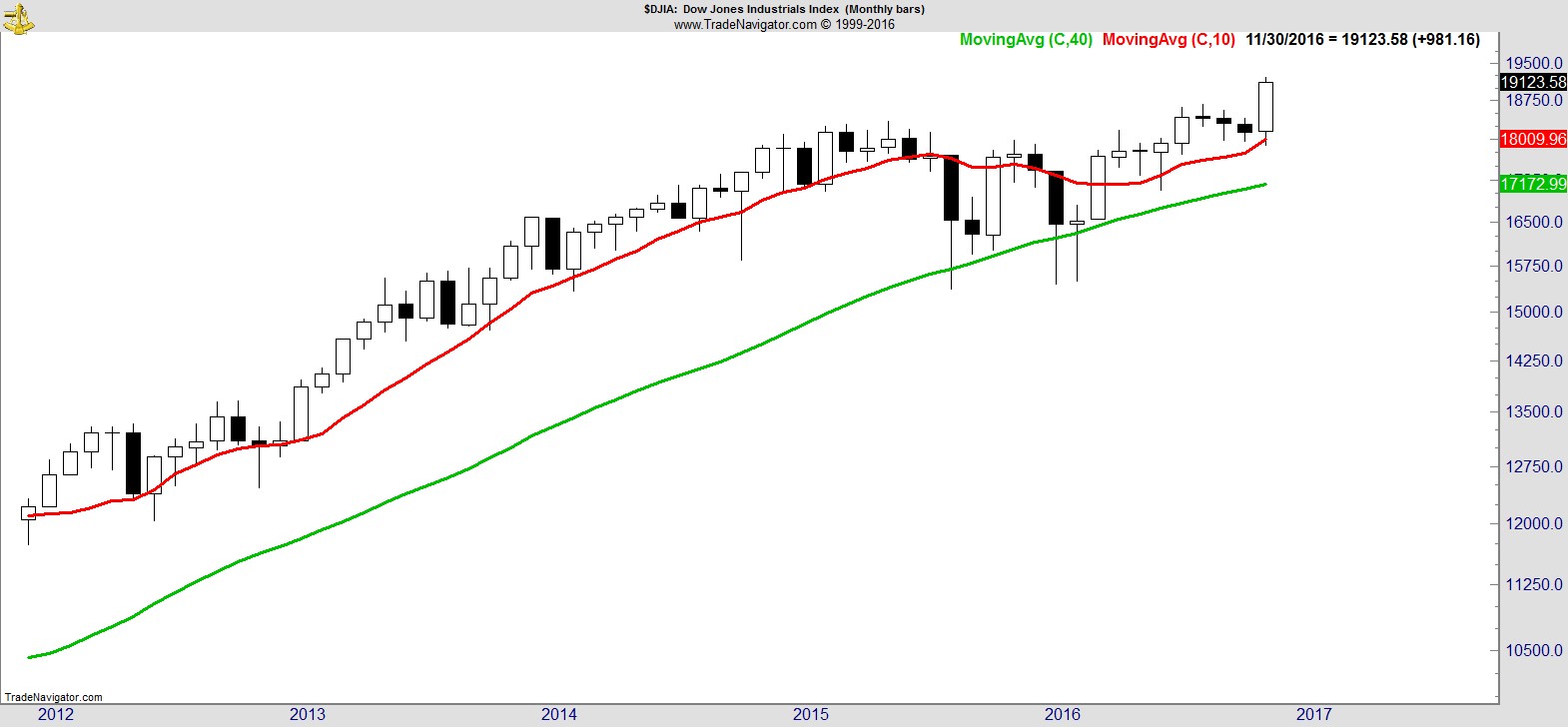

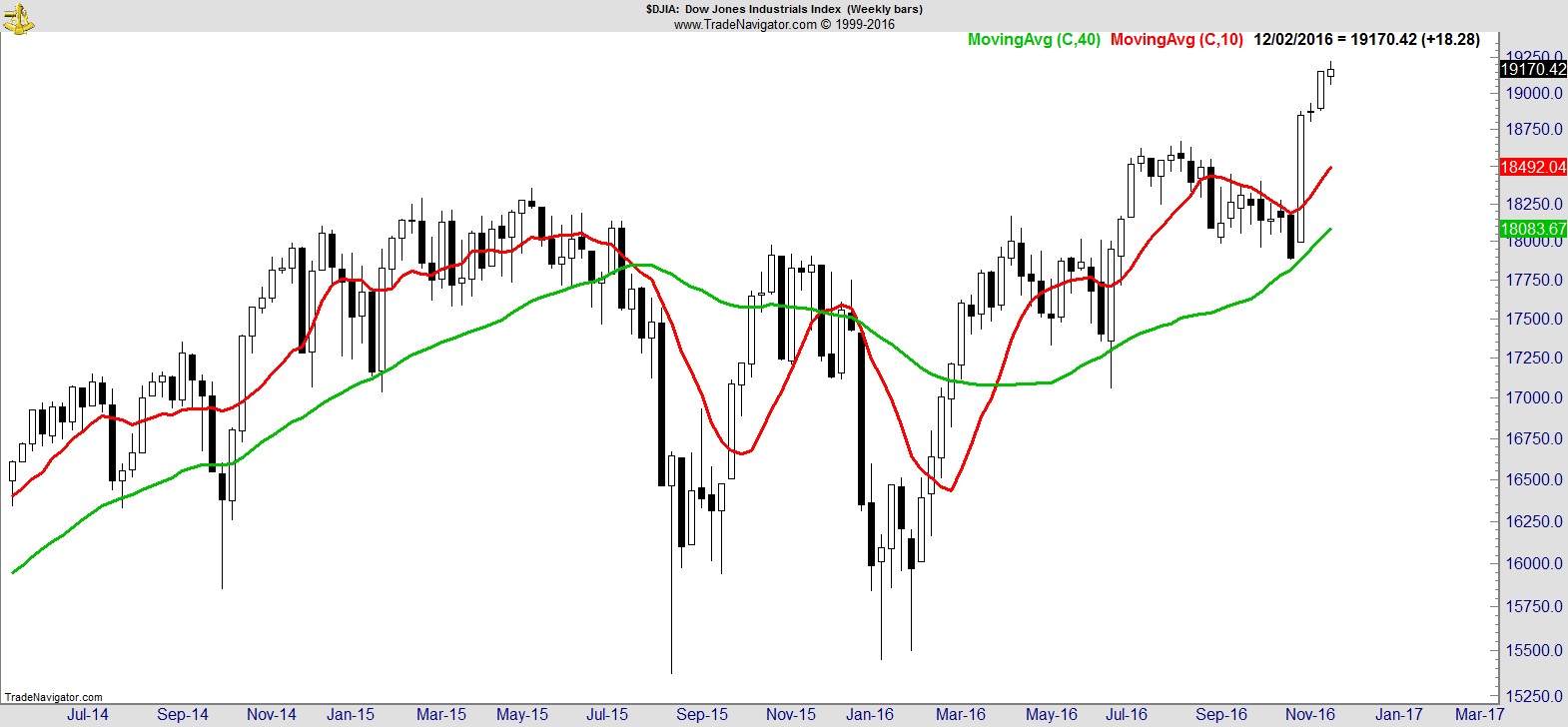

Let's take a look at both the S&P and Dow's monthly charts as at end November:-

Without wishing to get too bogged down in the semantics of labeling and nomenclature, I've maintained the position that the breakout in July marked the end of the bear market of the previous 18 months, and the beginning of a new bull market.

I believe the subsequent price action supports that; a reasonably tight and shallow consolidation and retest of that breakout level, and a resumption higher, and I am telling you no matter what you might want to believe to support your political leanings, politics has absolutely nothing to do with it.

Even if you believe that not to be true, the fact remains you didn't need to have a read on the election in order to identify and follow this trend. A simple study of price action, without bias, is all you needed. With the possible exception of healthcare, the vast majority of the current sector trends were already underway before the election, and no, that doesn't mean the market was pricing in the election result!

I struggle to see how a market at all time highs can be called anything other than a bull market, but there are some people out there that would always rather predict the next move than simply position themselves to follow and benefit from the current one, and that's fine. We can't be too concerned about the motivations of others or let it effect our conviction in our own. Bottom line, it really doesn't matter what you label a market, only that you can be on the right side of it and be ready to change your position when circumstances change and your position is clearly wrong.

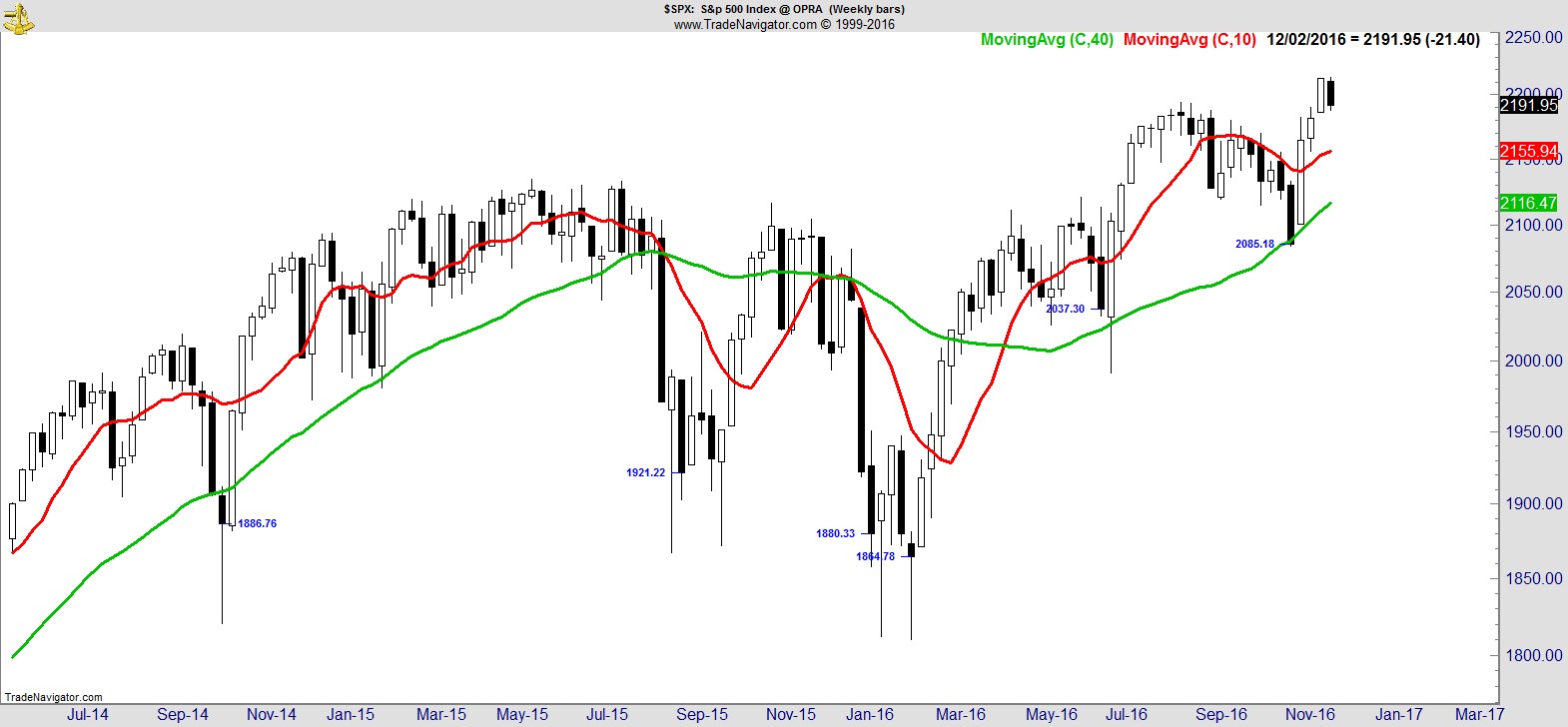

The S&P had its first down week since before the election, but without damaging the intermediate trend.

.

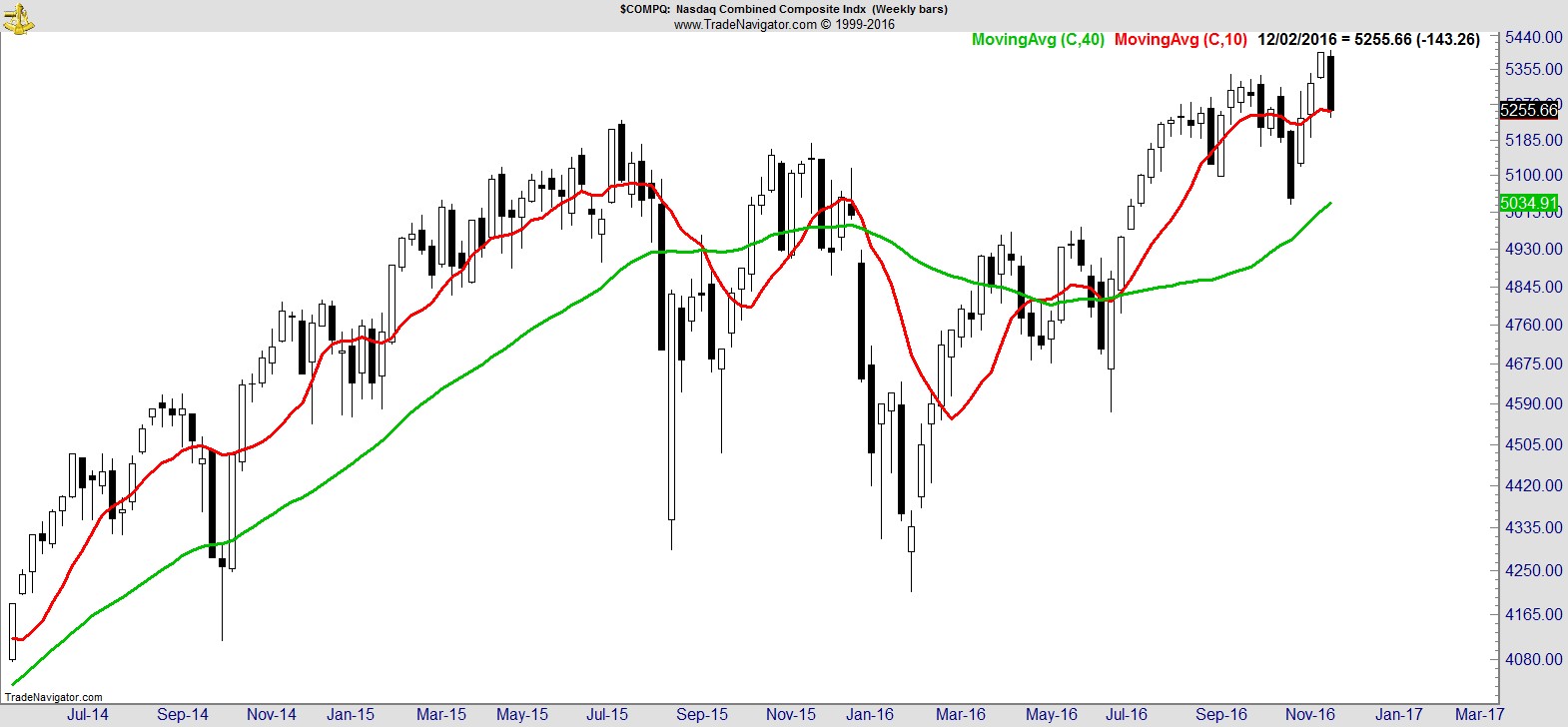

The weakness was more pronounced in the NASDAQ with semis and other tech-related names taking a hit.

.

The Dow and Transports however were higher for a 4th and 5th week respectively:-

.

Sector Analysis

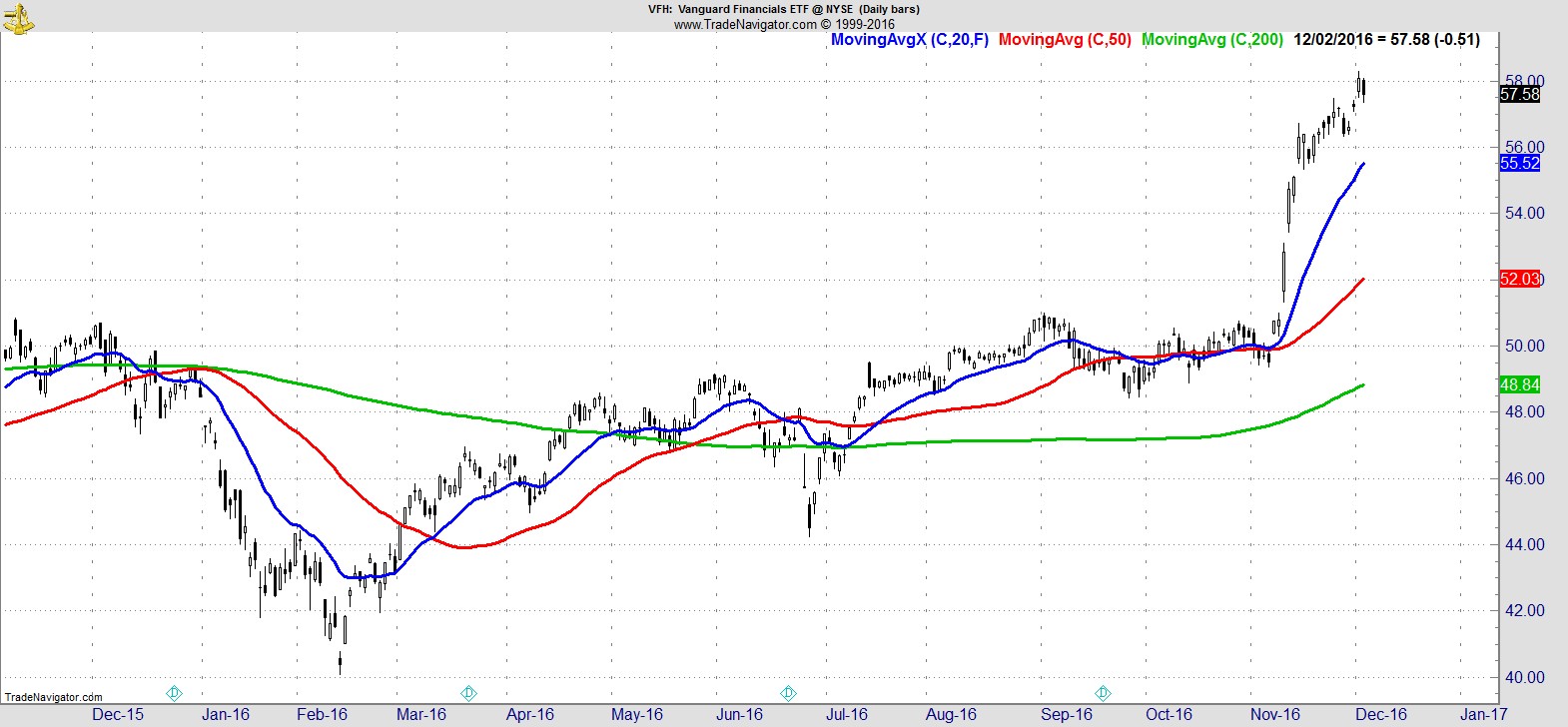

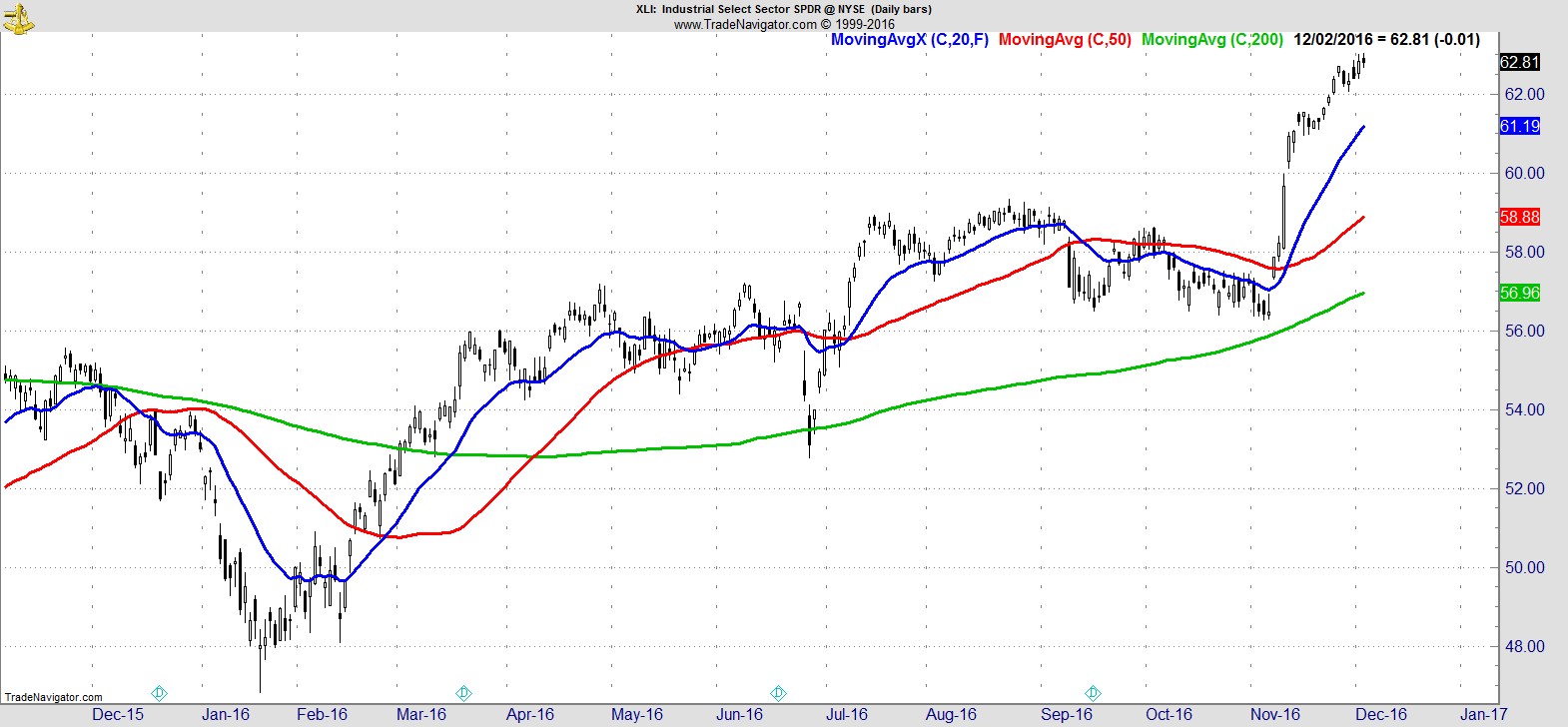

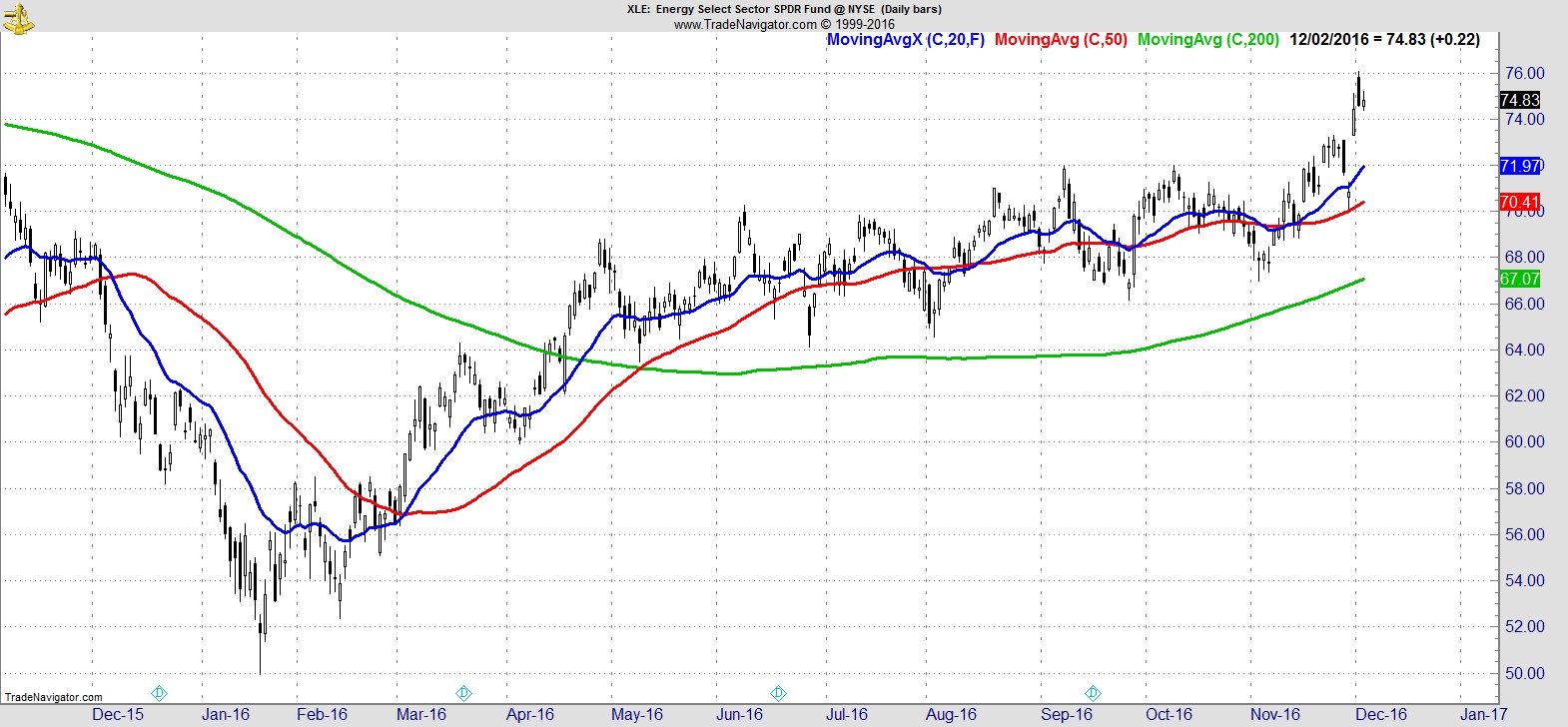

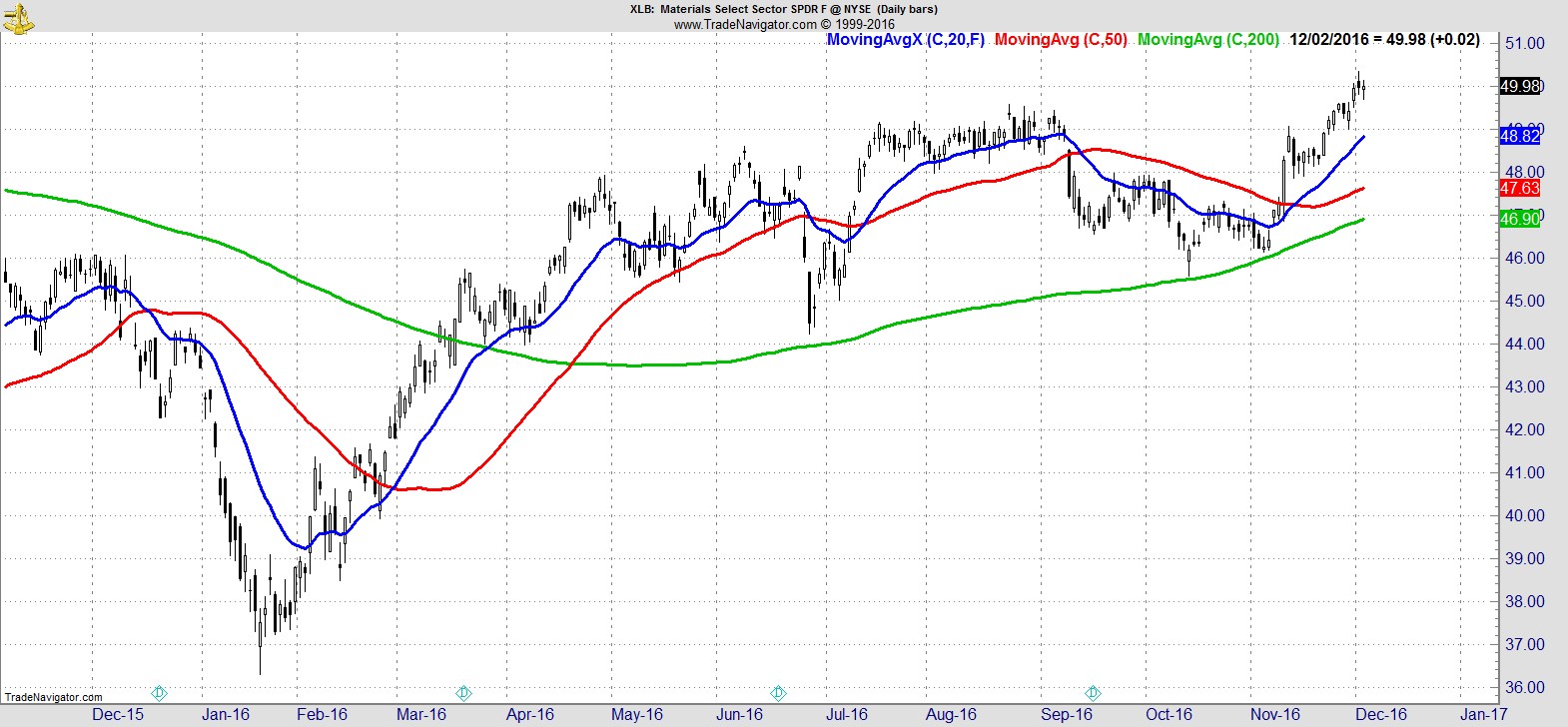

The clear sector leaders at the moment are Financials, Industrials, Energy, and Materials:-

.

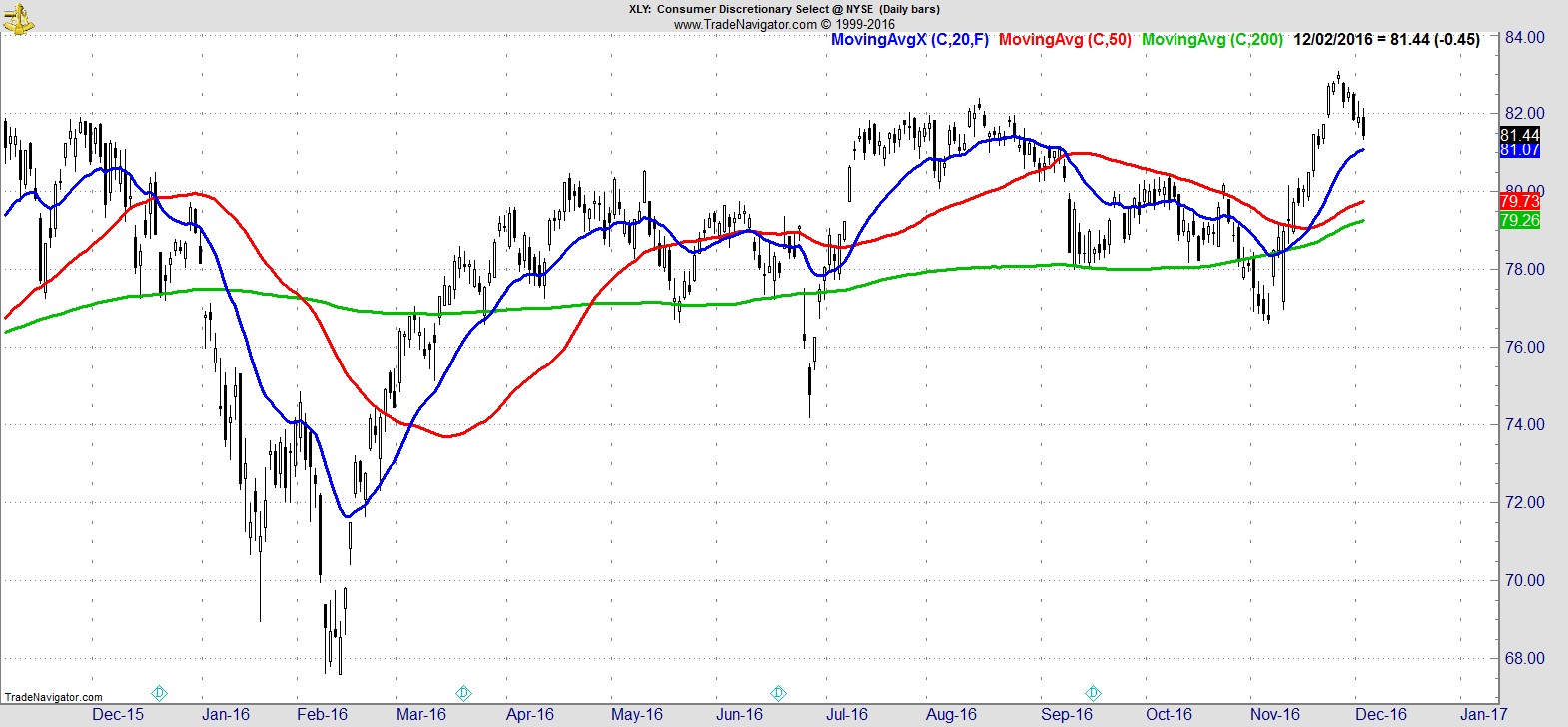

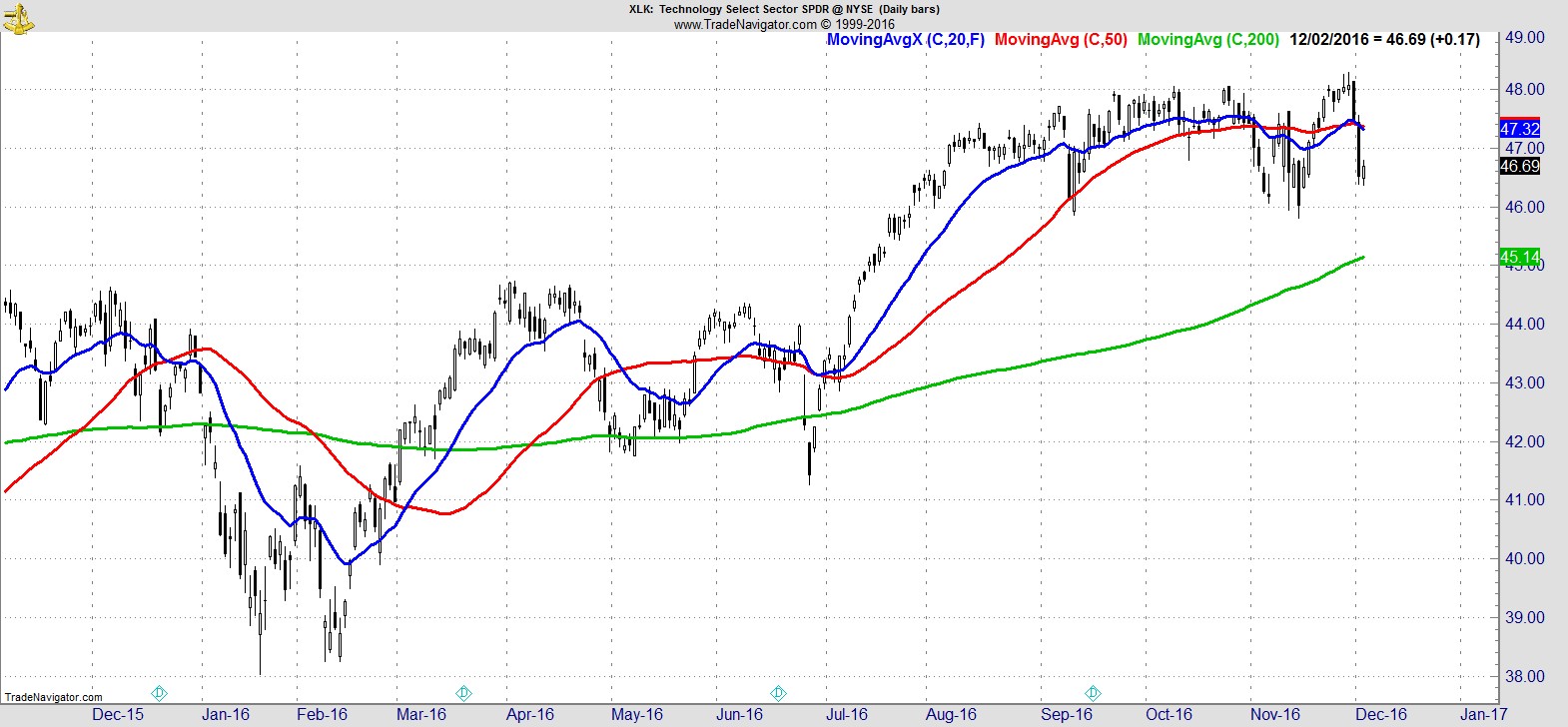

They're followed by Consumer Discretionary which pulled back near to its 20 EMA, and Technology which sank below its 50-day MA:-

.

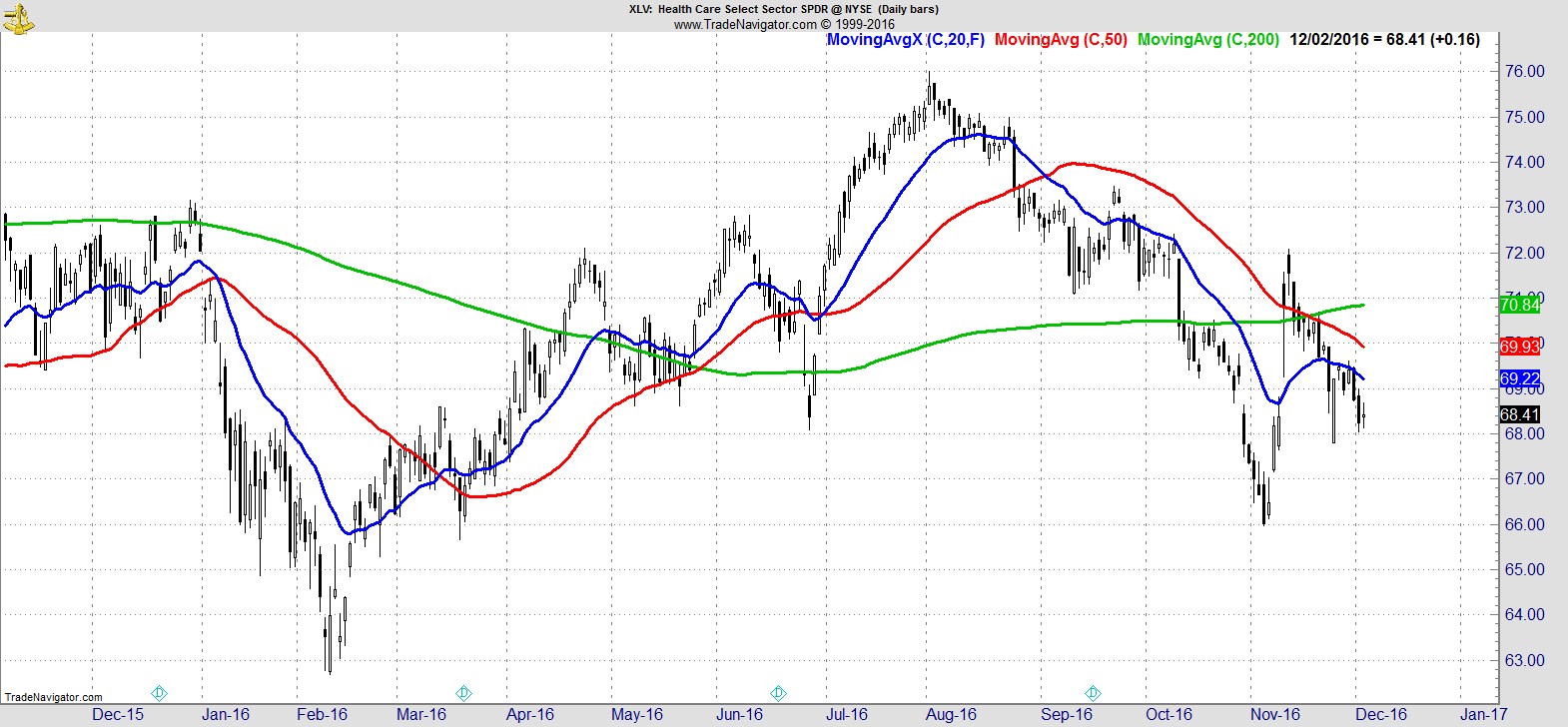

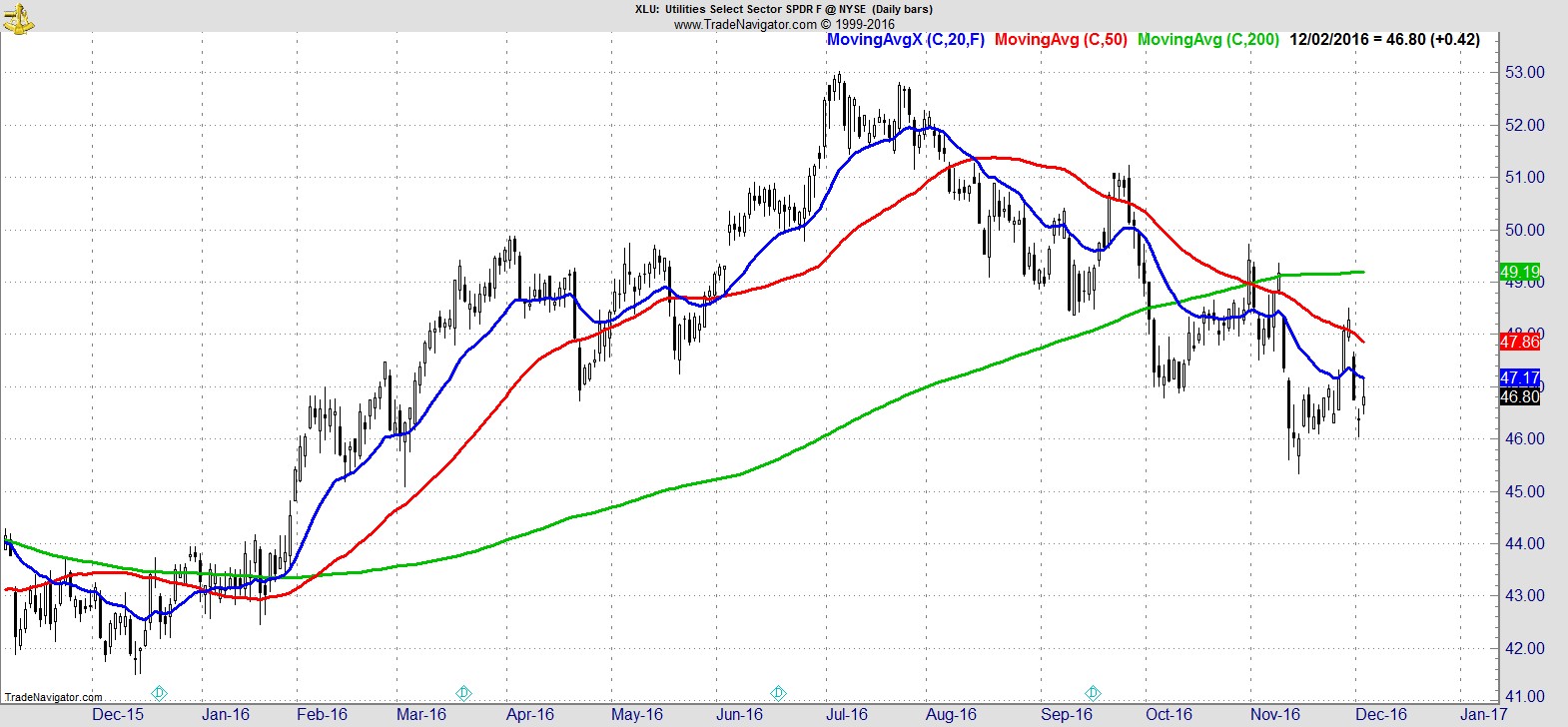

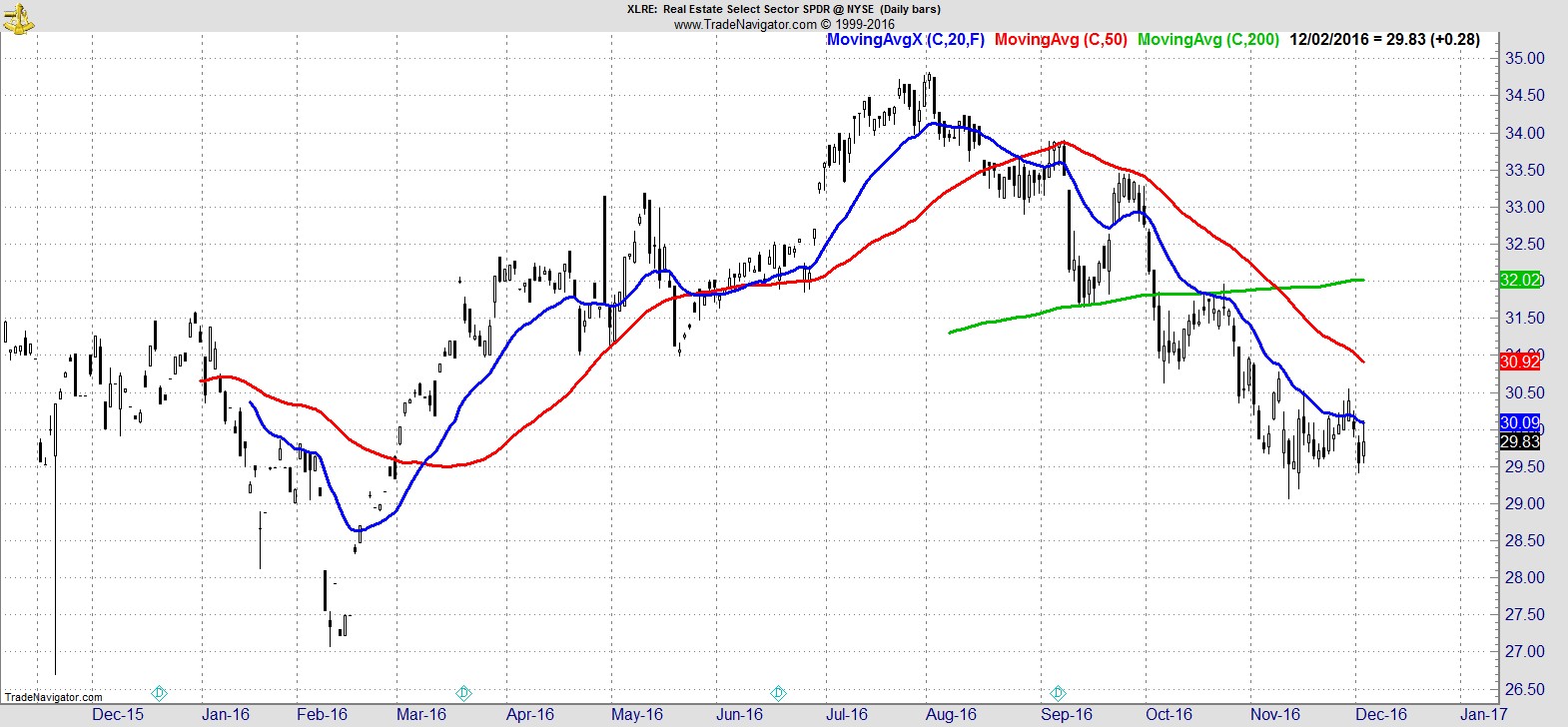

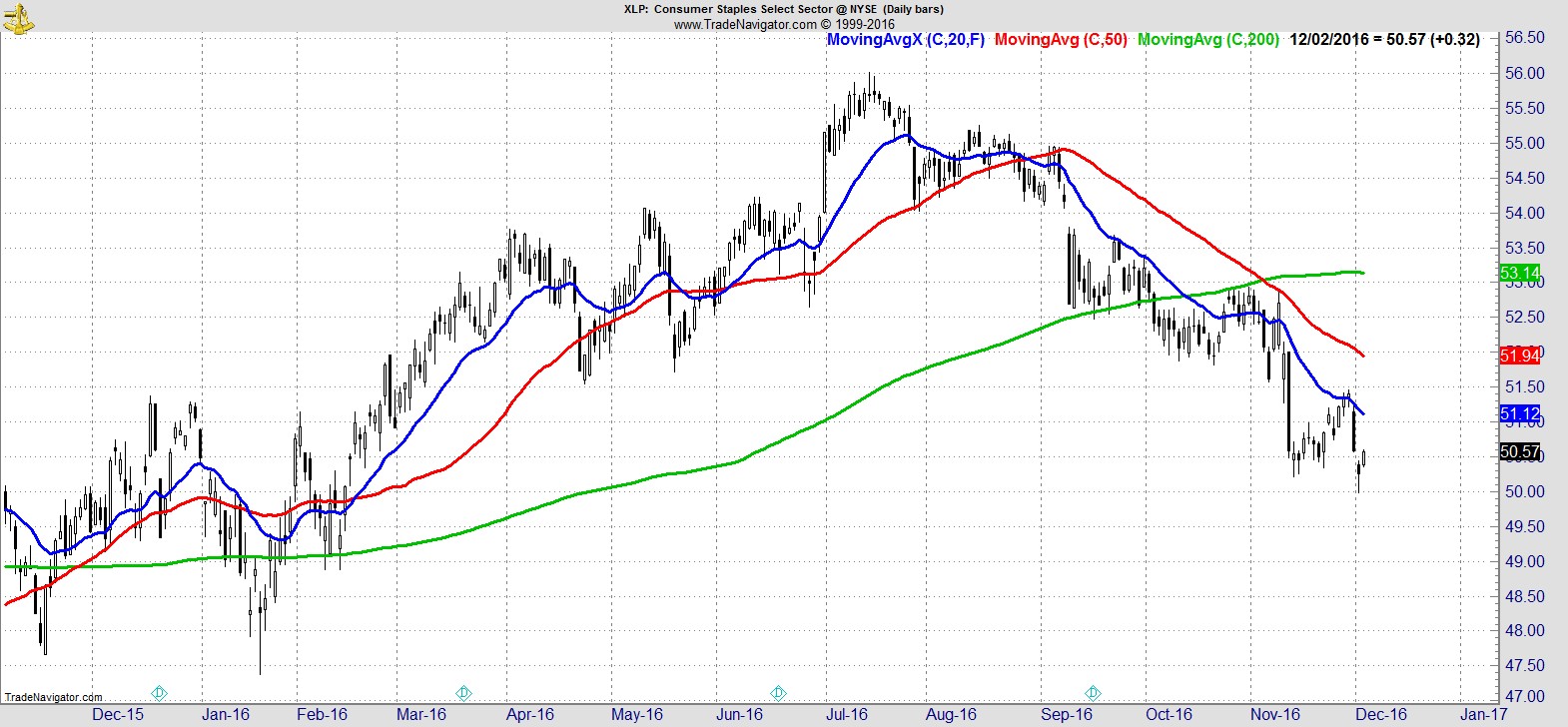

The bottom four are Healthcare, Utilities, Real Estate, and Consumer Staples, which are all in downtrends and remain below their 20, 50, and 200-day MAs:-

.

Alpha Capture Portfolio

After three straight weeks of solid gains and five straight weeks of outperformance, our model portfolio lost some ground this week finishing -1.7% vs -1.0% for the S&P.

We remain fully allocated with 16 names, the most we've ever had, which is a function of many positions having wide stops at entry, resulting in less capital being necessary for the same amount of risk. Our biggest exposure is to financials, materials, and tech.

.

Watchlist

As per last week, we're using many of the names here to gauge continued strength in sectors where we already have considerable exposure, rather than as potential setups for additional signals. Financials continue to lead but the biggest change this week was several tech names coming off the list, and a few more energy and materials names showing up.

Here's a sample from the full list of 30 names:-

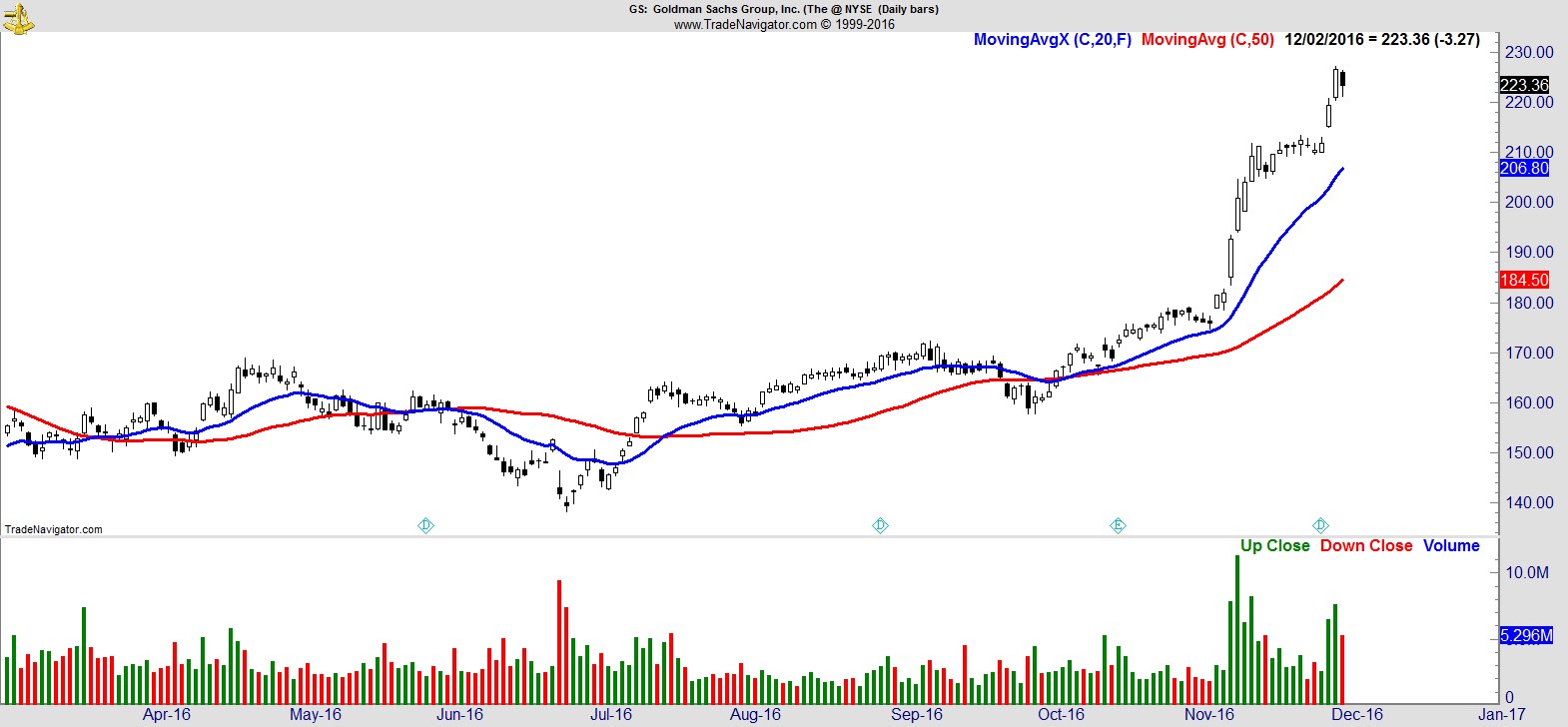

$GS

.

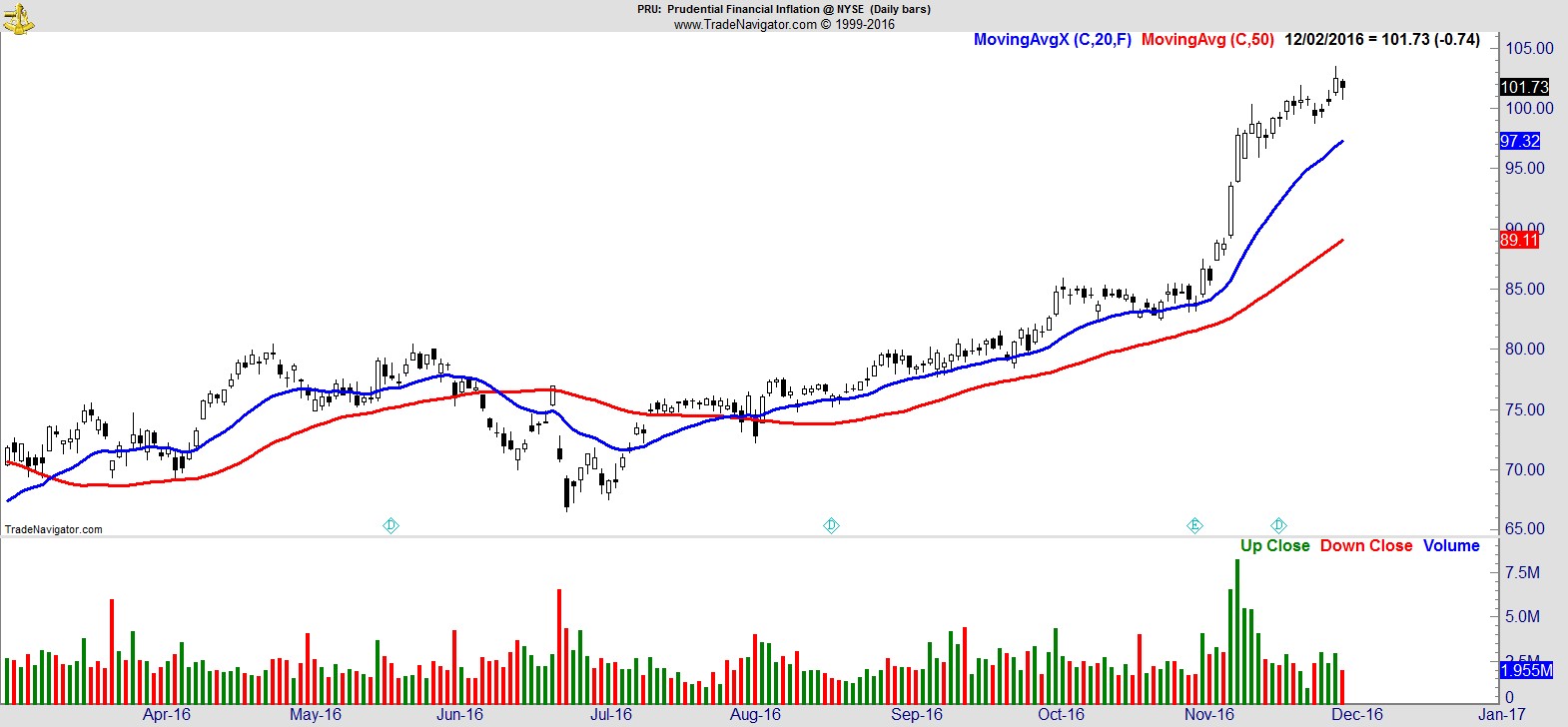

$PRU

.

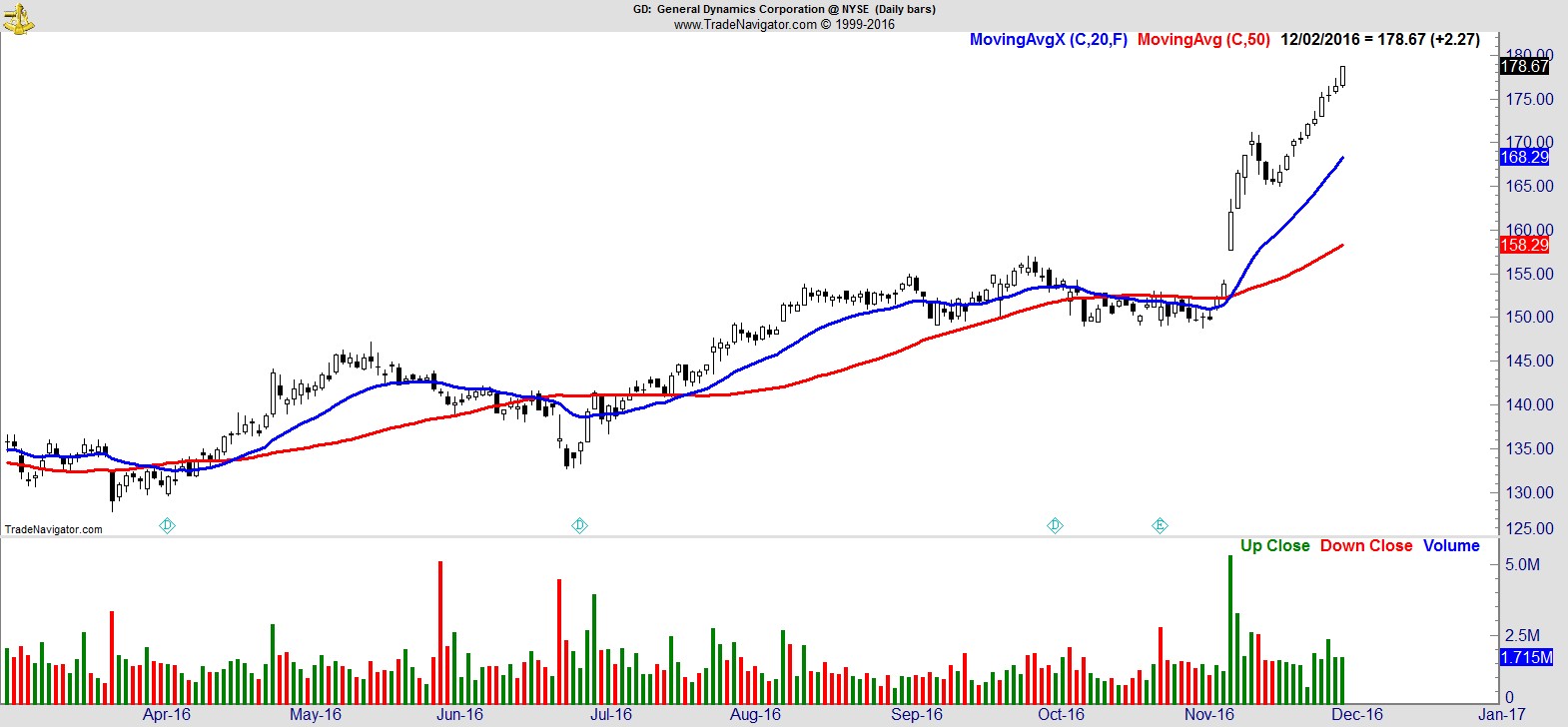

$GD

.

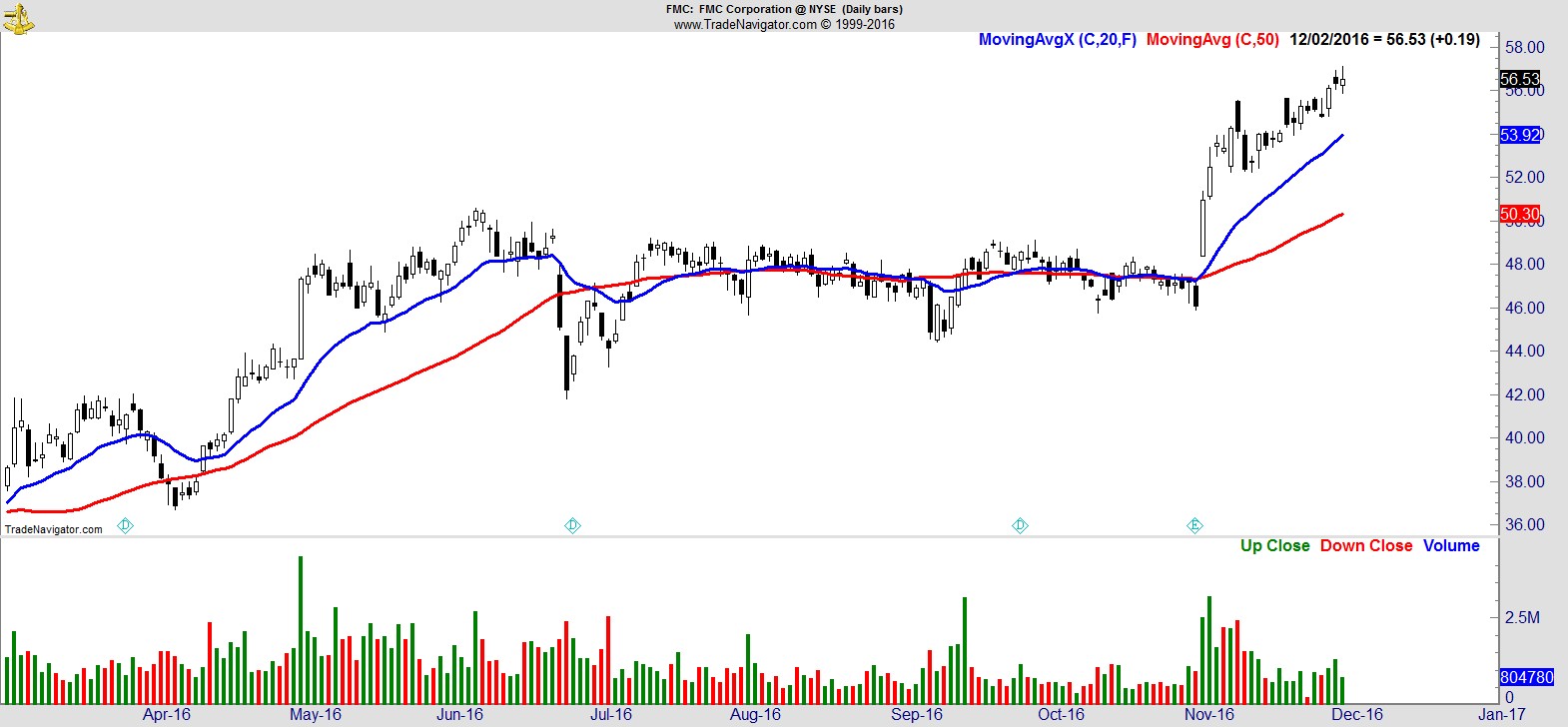

$FMC

.

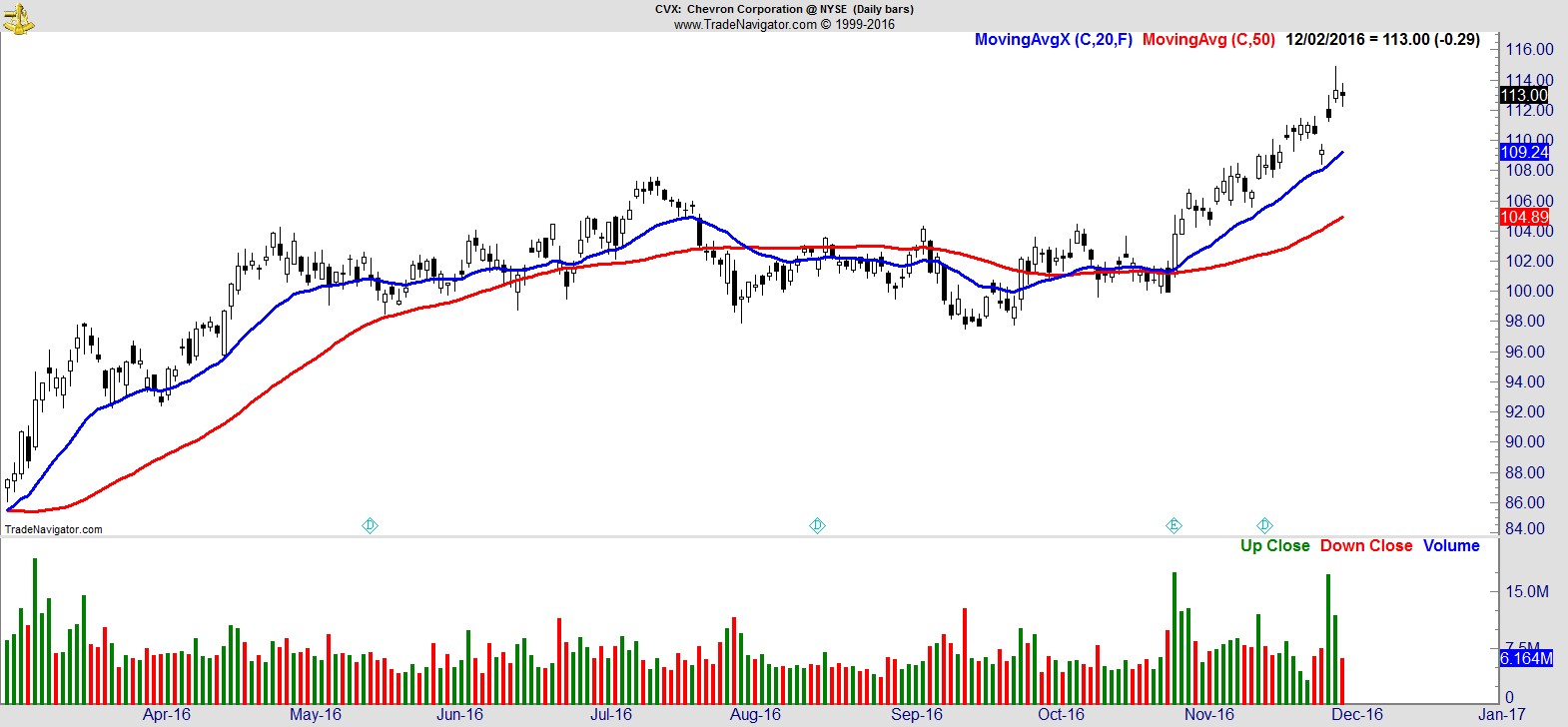

$CVX

.

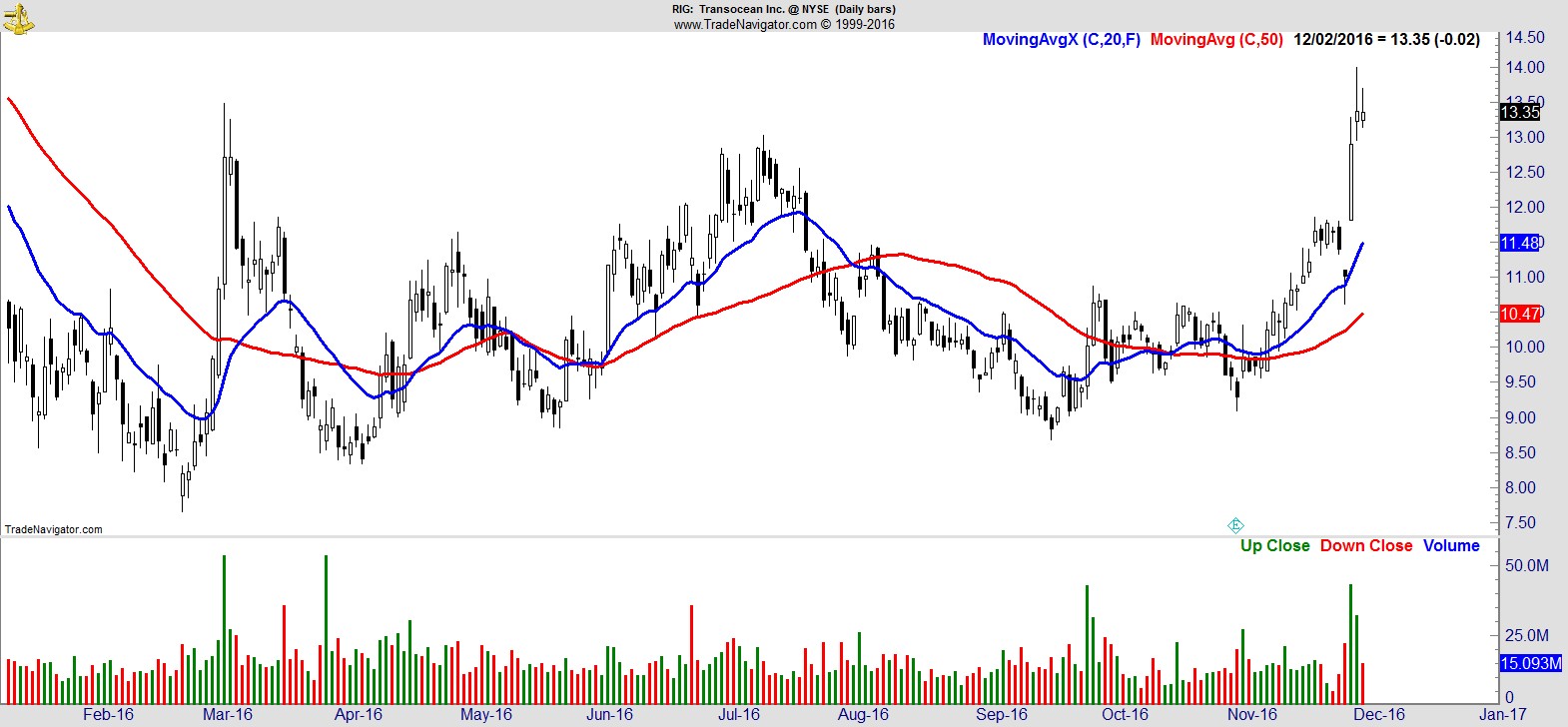

$RIG

.

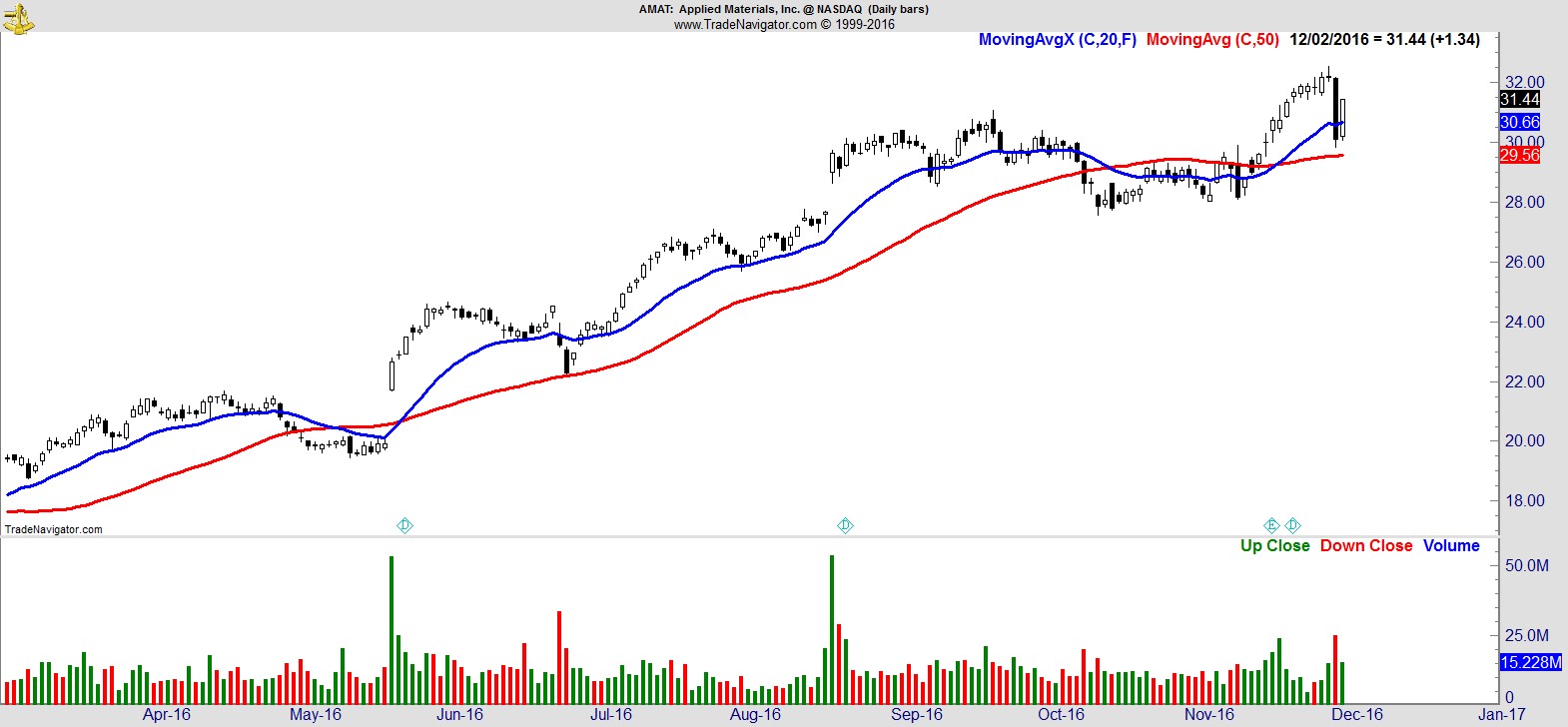

$AMAT

.

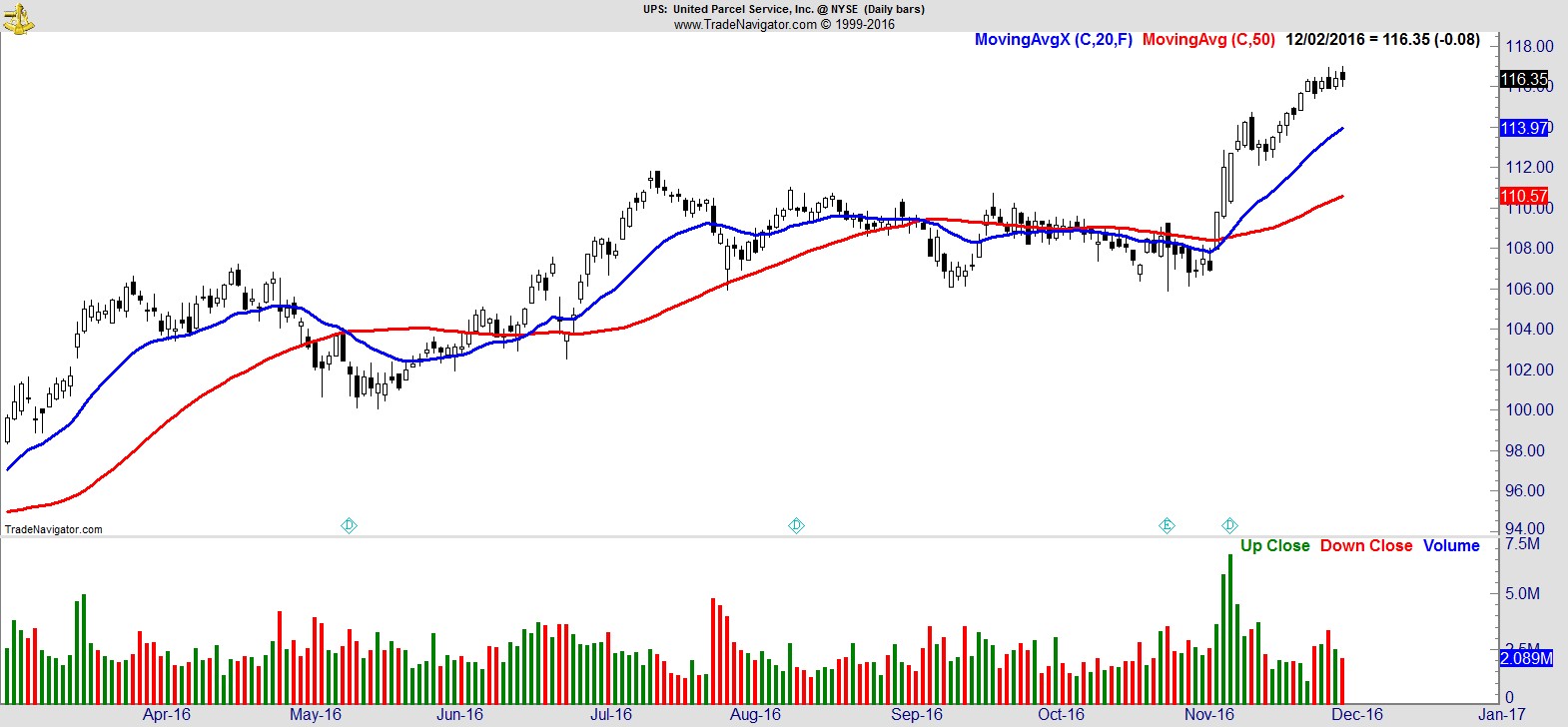

$UPS

.

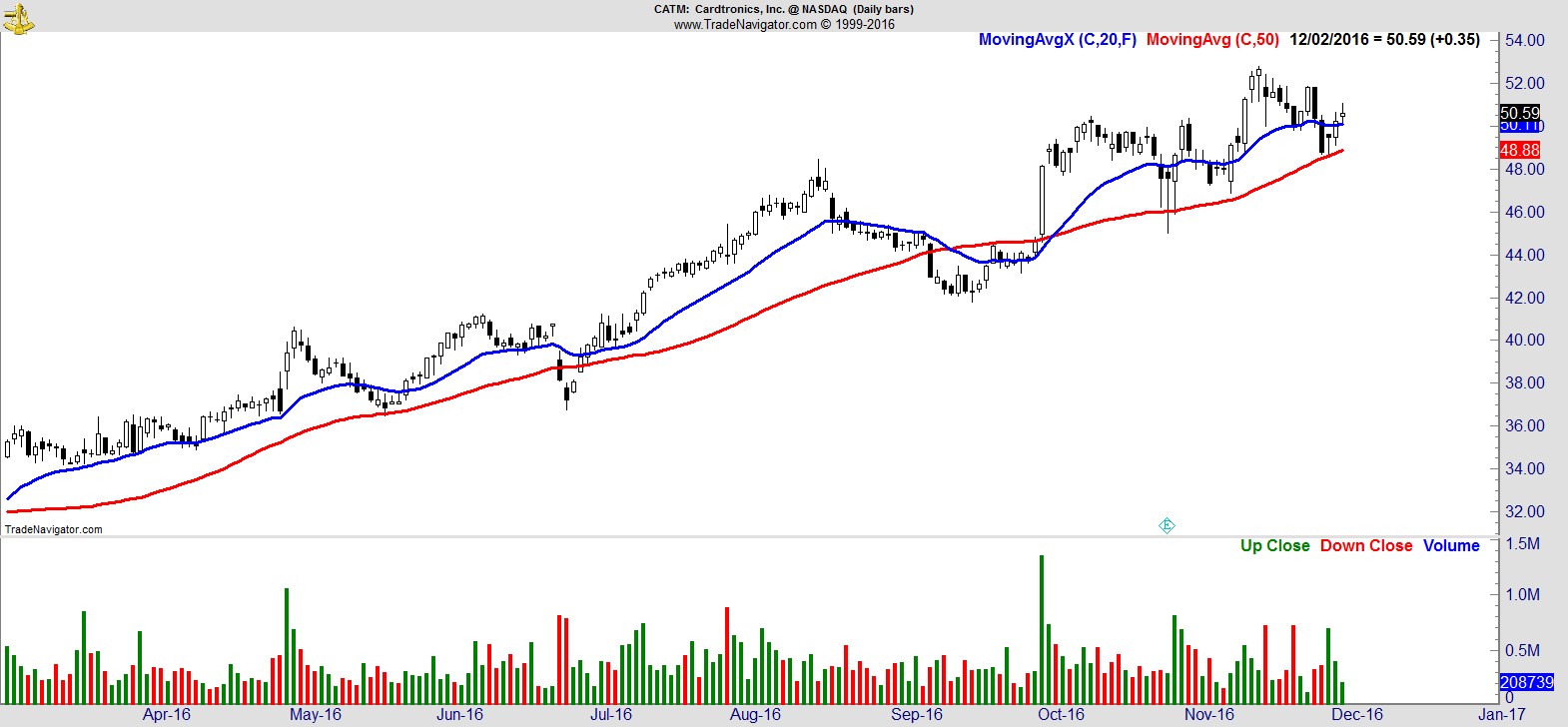

$CATM

.

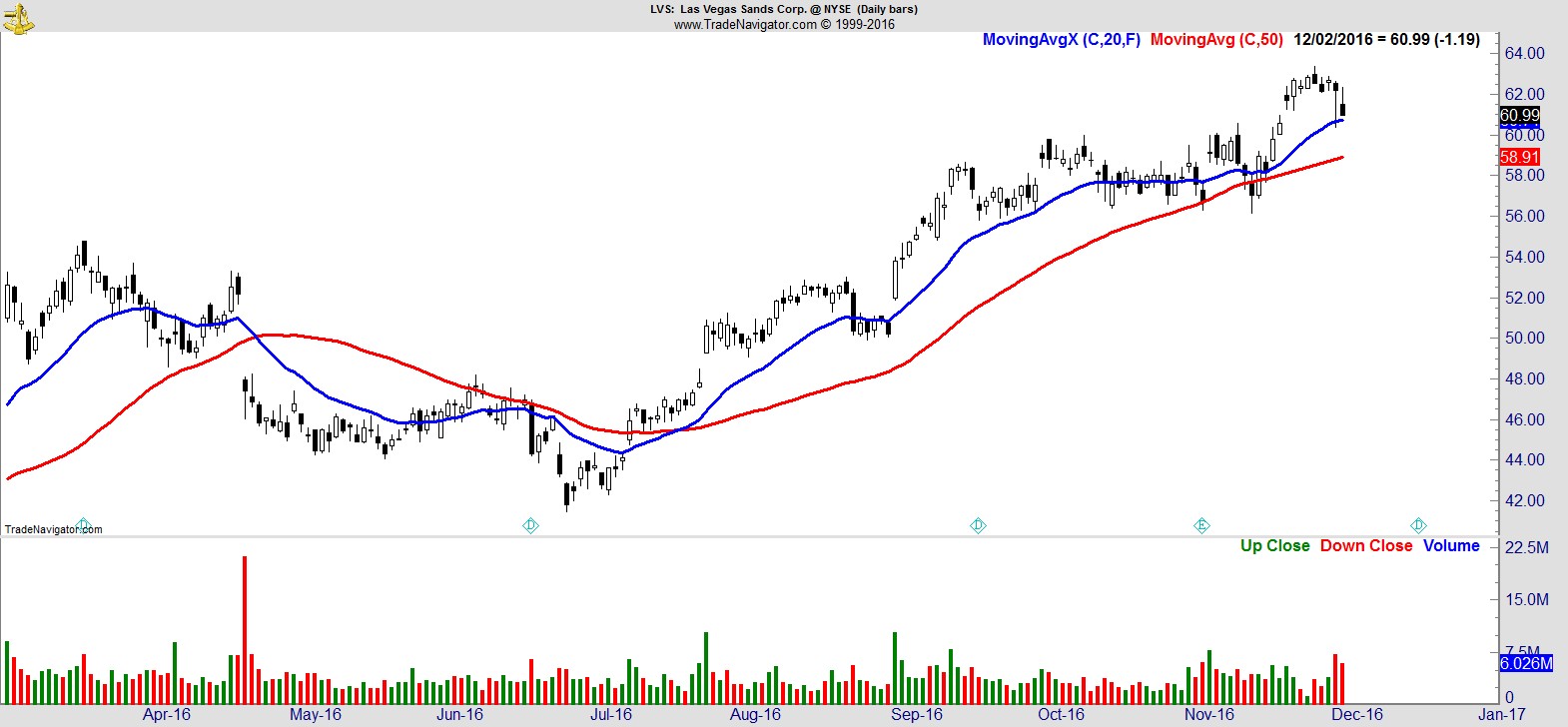

$LVS

.

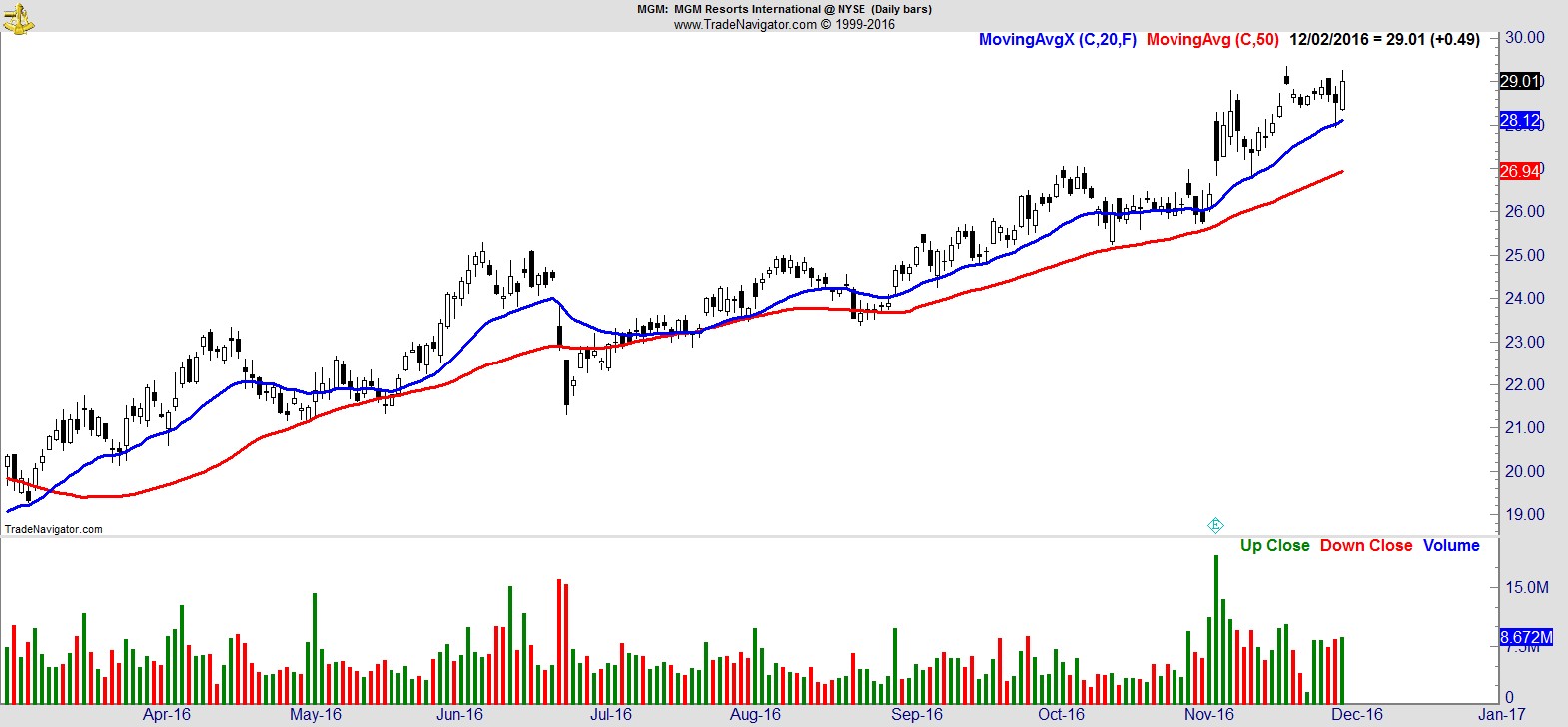

$MGM

.

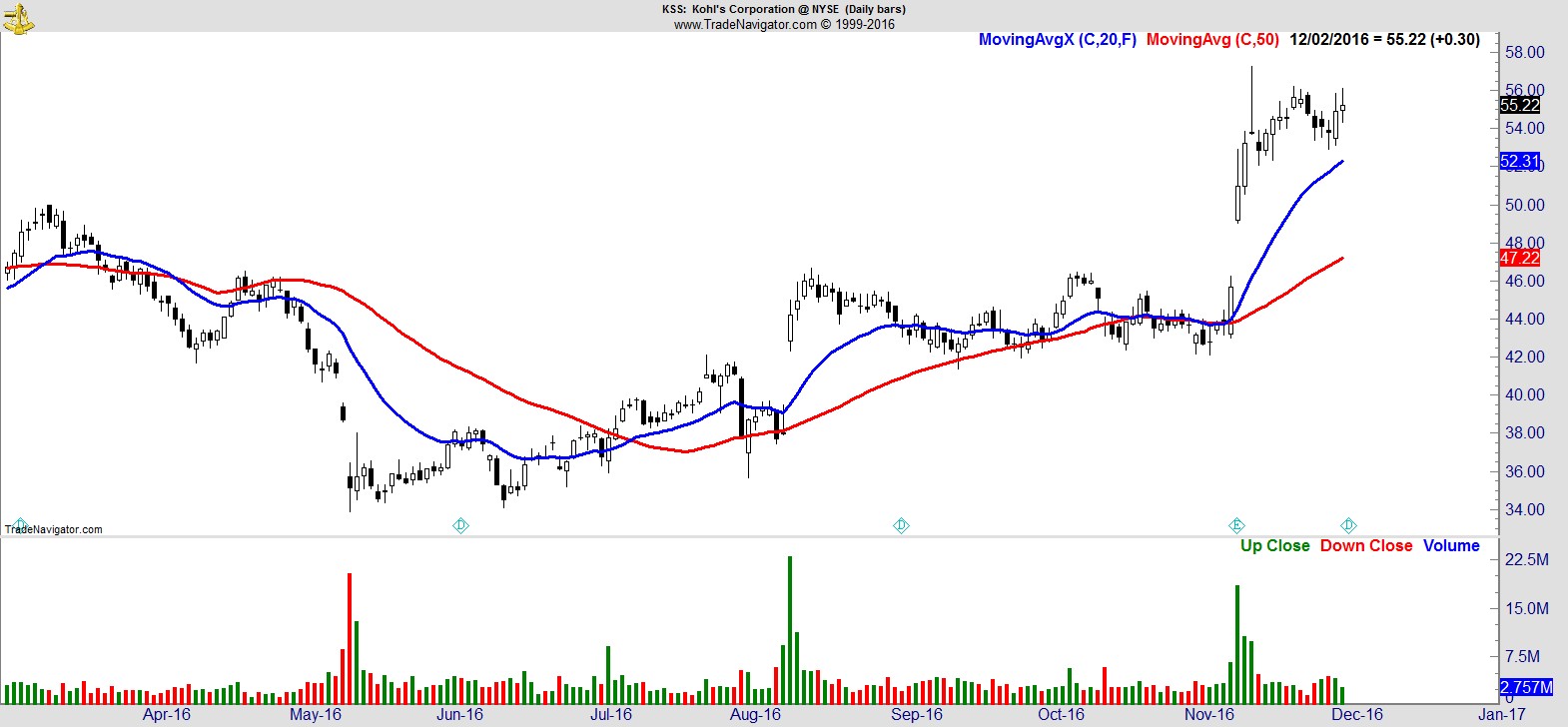

$KSS

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17