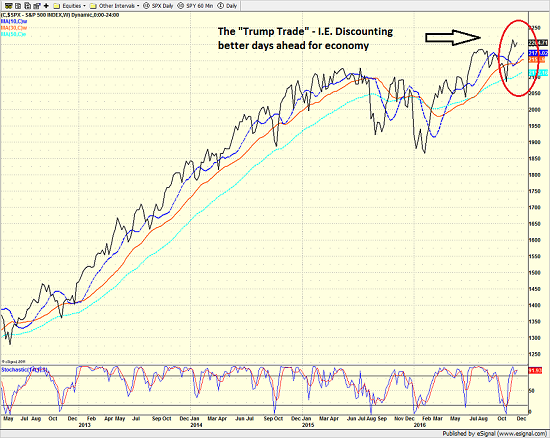

To be sure, the impetus for the stock market's most recent joyride to the upside, (a move that pushed the S&P 500 up by 6.2% in less than 3 weeks after the surprise election outcome) has been the so-called "Trump Trade." From my seat, one of the major components of this trade has been the expectation for better days ahead in the U.S. economy.

If this rationale for higher stock prices sounds like a bunch of hooey (I've heard this sentiment expressed a time or two lately from my friends in the bear camp), keep in mind that the stock market tends to be a discounting mechanism for future expectations. Especially in the area of earnings, which, of course, tend to be led - at least to a certain degree - by the state of the economy. So... expectations for stronger economic growth naturally lead to expectations for improved earnings - which, of course, can lead to higher stock prices.

S&P 500 - Weekly

View Larger Image

However, expectations for the future can only take stock prices so far. At some point, those expectations need to turn into reality. Otherwise, the gains based on a greener pastures view can be quickly erased when the green shoots turn out to be nothing but weeds.

This has been one of the reasons that stocks have been stuck in a trading range since late 2014. Generally speaking, each year, investors expected the economy to reach "escape velocity." The thinking was that growth would pick up in the second half of each year and then would continue into the next year. But, each year those with this upbeat view of the macroeconomic world have been disappointed. And with stock valuations at elevated levels, well, a trading range has resulted. A long, frustrating, sideways trading range.

Is It Finally Over?

But now it appears that the bulls have rediscovered their mojo and stocks have "broken out" to the upside. The bulls tell us that this is the start of a new cyclical bull run. And since the average cyclical bull market that occurs within a secular bull trend is something on the order of 106% (source: Ned Davis Research), the thinking is that investors should put away their fears and just enjoy the ride on the bull train.

The fly in the ointment here though is that "economic reality" needs to show up at some point.

The good news is that recent reports have been consistently better than expected. Consumer Sentiment. GDP growth. Job creation. The unemployment rate. ISM Manufacturing. ISM Non-Manufacturing. All of these reports came in surprisingly strong and much better than expectations. Now couple this with the fact that the real estate market has officially recovered from the crisis, and well... I'm just saying.

Heck, even Europe is getting into the act here as Germany's report on factory orders came in much better than expected this morning.

So, while lots of folks have made a living "calling the tops" in the stock market since late 2014, if the current trend of economic data continues - AND the new administration starts to use fiscal policy as a stimulus tool - the bottom line is it will become harder and harder to maintain a negative view on the longer-term outlook for stocks.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the "Trump Trade"

2. The State of Global Central Bank Policies

3. The State of Global Economies

Thought For The Day:

"Watch your thoughts; they become words. Watch your words; they become actions. Watch your actions; they become habits. Watch your habits; they become character. Watch your character; it becomes your destiny." - Lao Tze

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member