Overview

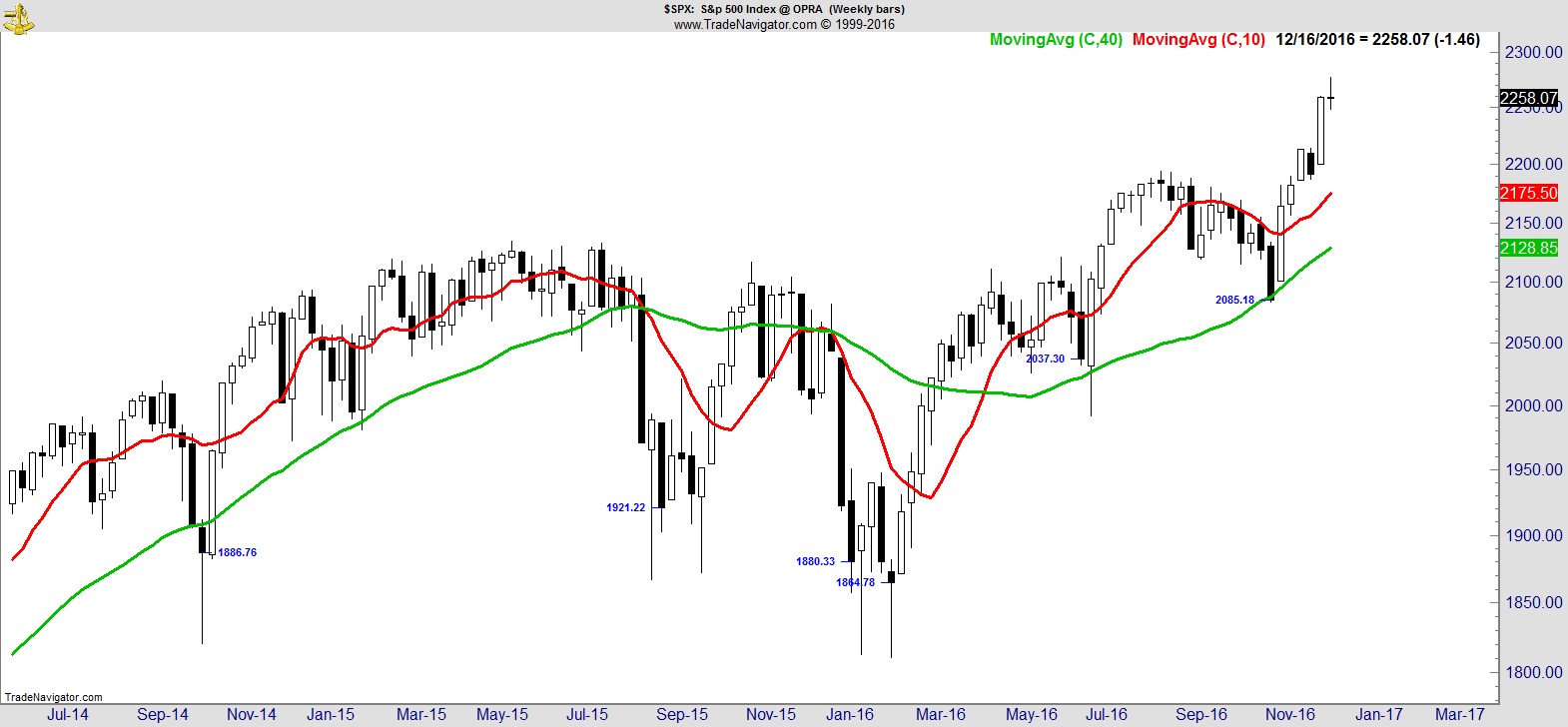

A bit of a nothing week with the major indices little changed. The only significance to the midweek Fed announcement was the amount of noise it generated. Price continues to tell the real story. We're in a new bull market that began in July, and short-term is consolidating near its highs.

The Dow moved higher, the Transports and Russell moved lower, and the S&P and NASDAQ were more or less unchanged. There just isn't anything else of significance with regards to trend, breadth, or sentiment this week. Here's the S&P on a weekly:-

.

Sector Analysis

Financials, Energy, Tech, Materials, Industrials, and Consumer Discretionary are the six leading sectors, all above their 20, 50, 200-day MAs, and all of which are stacked and rising; the 20 above the 50, the 50 above the 200.

Utilities, Staples, and Healthcare have rallied back above their 20 and 50-day MAs, but all remain in downtrends below their 200-day MA. Real Estate gave up most of its recent gains and is now worst of all, below all its MAs.

.

Alpha Capture Portfolio

A quiet week with our model portfolio -0.2% vs -0.1% for the S&P. It's -0.2% YTD having been at its lowest point -10.3% just 6 weeks ago. For what it's worth, my client accounts have seen a similar recovery over the same period from around -5% to +3%, which emphasizes this has been a strong trend on multiple timeframes. Our Alpha Capture portfolio remains 90% long across 15 names. We have an additional 9 active trade ideas, and 26 names on our watchlist.

.

Watchlist

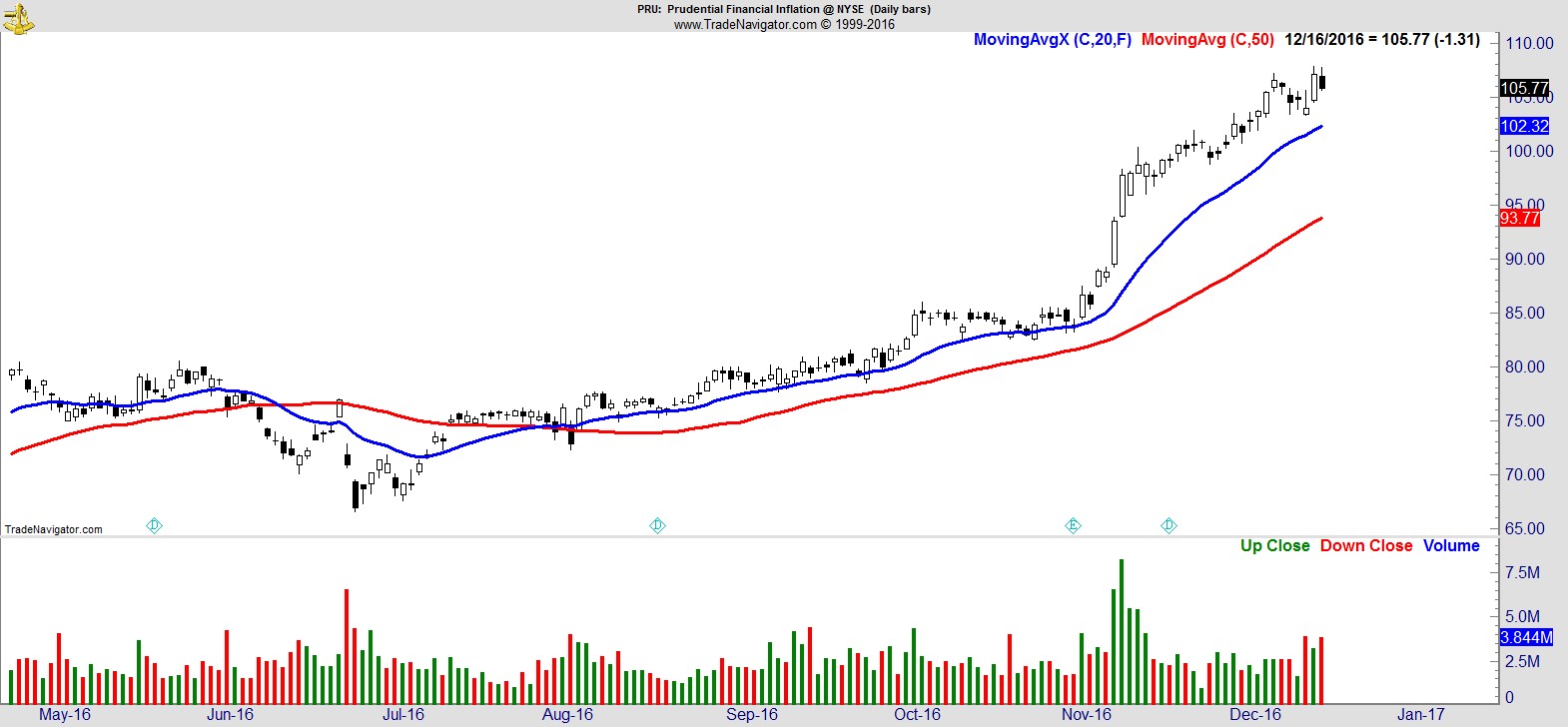

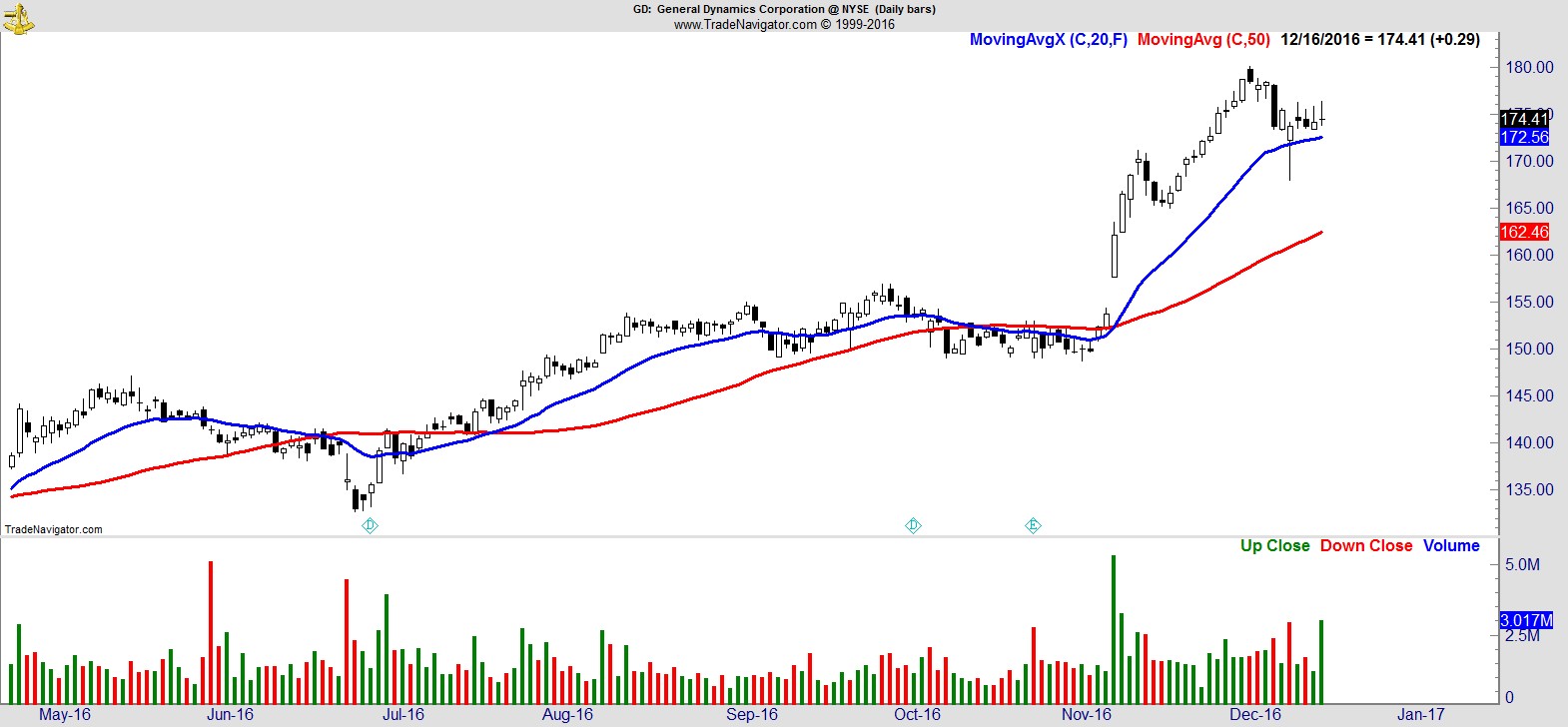

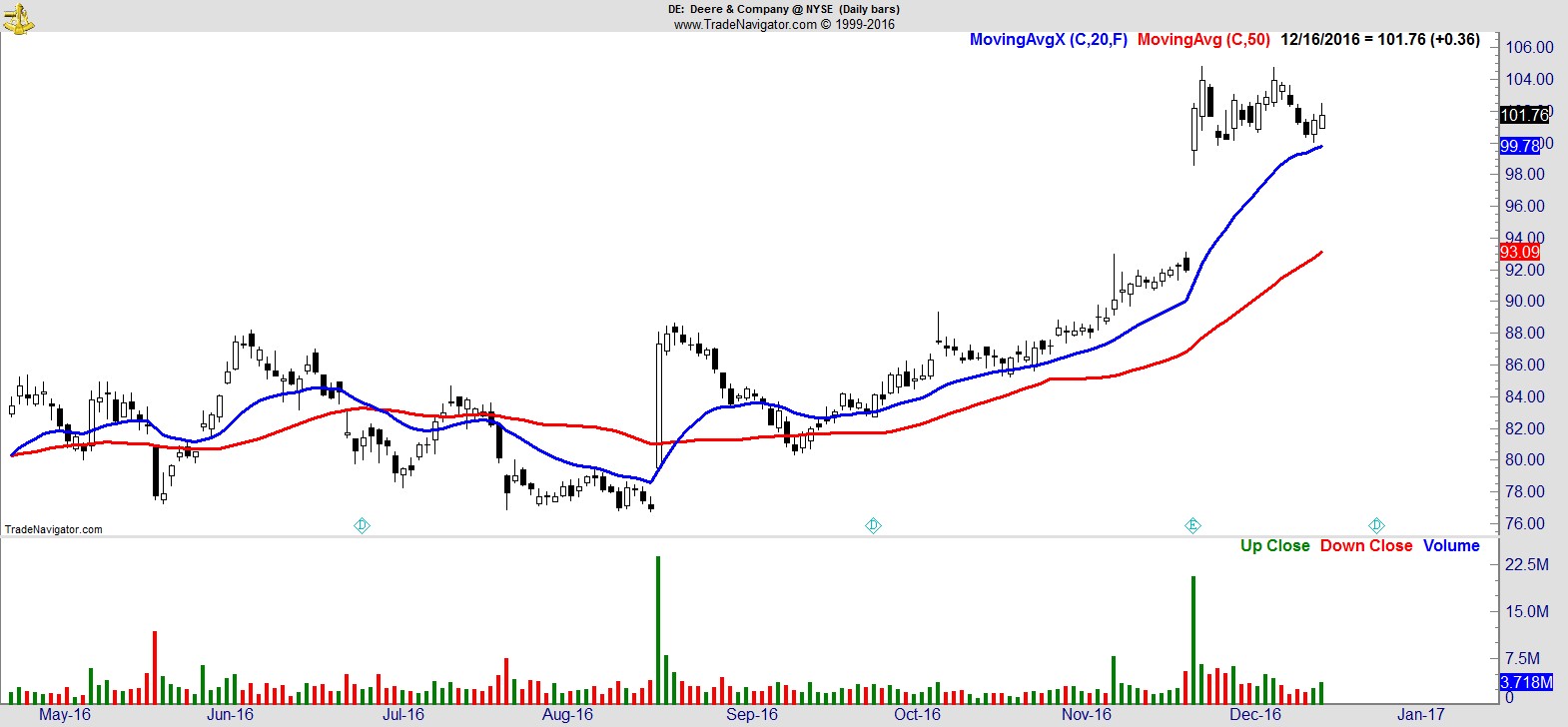

Our watchlist has good representation across all the leading sectors:- Financials, Industrials, Materials, Energy, Technology, and Consumer Discretionary. There's little reason to look beyond those strong trends.

Here's a sample from our full list of 26 names:-

$PRU

.

$GD

.

$DE

.

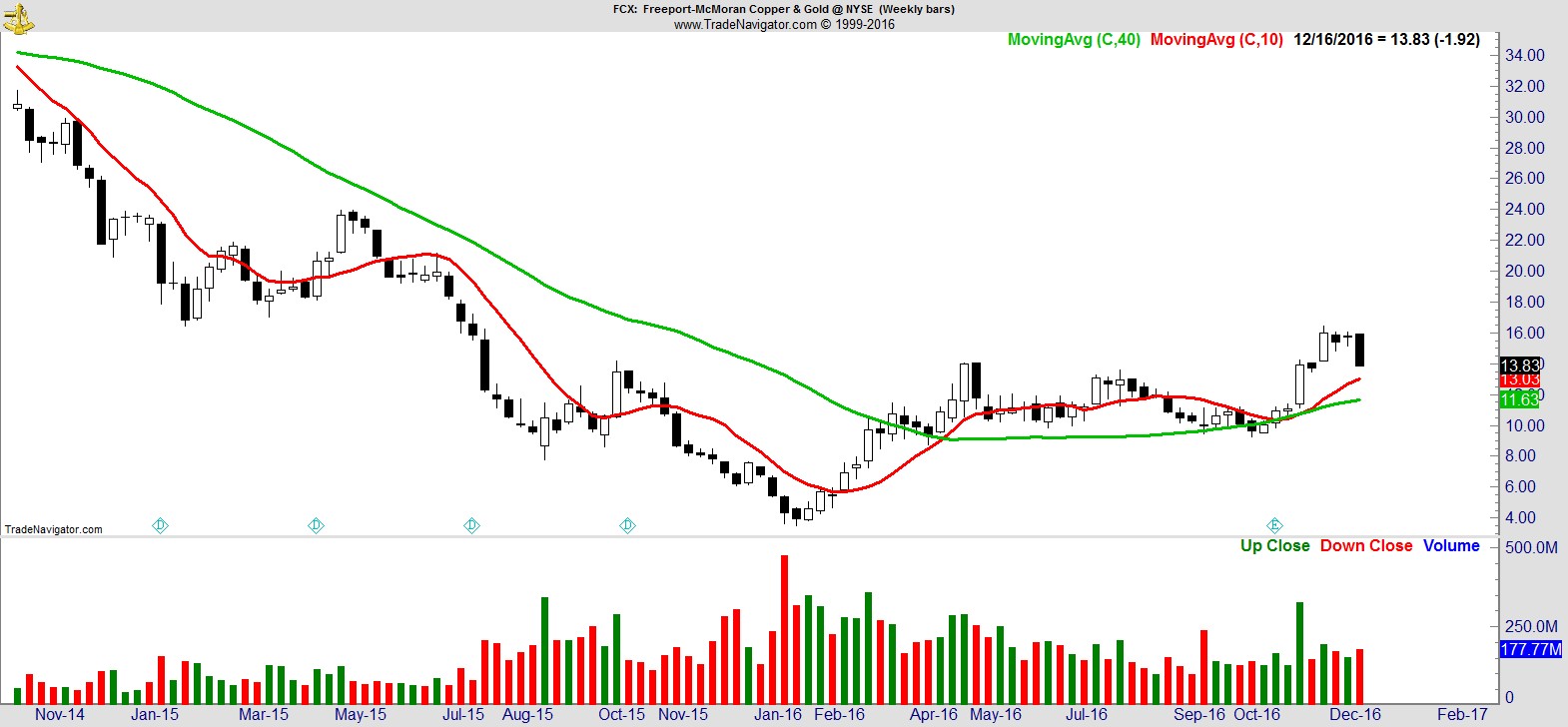

$FCX

.

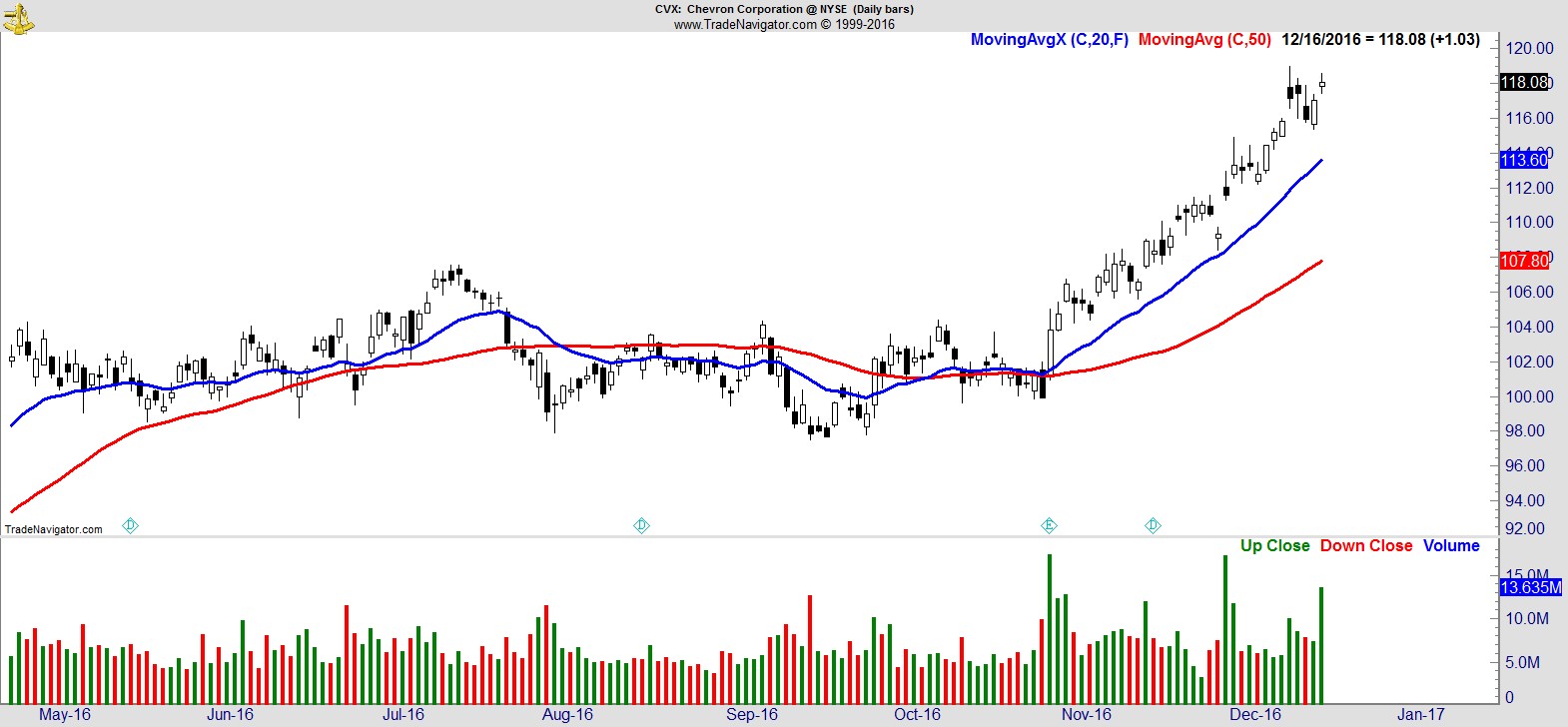

$CVX

.

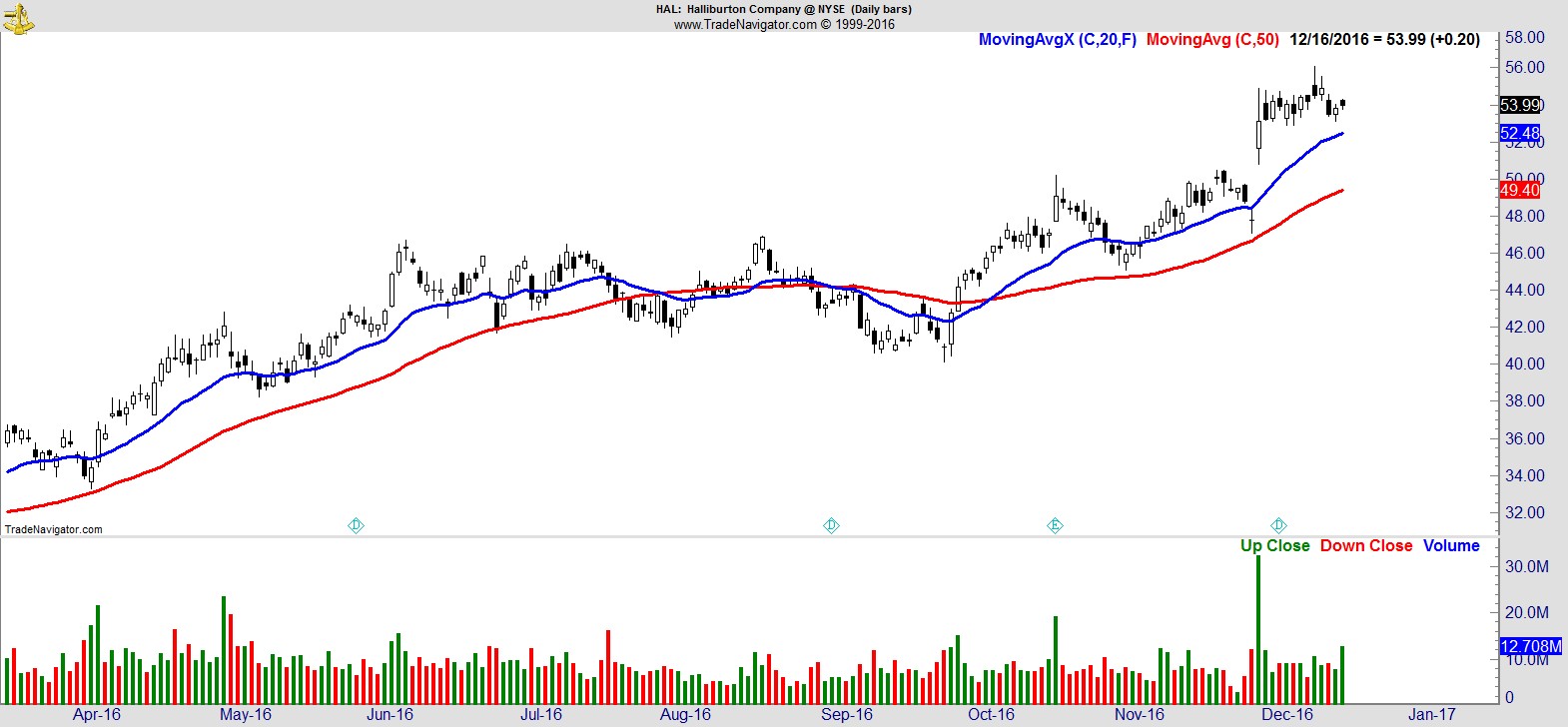

$HAL

.

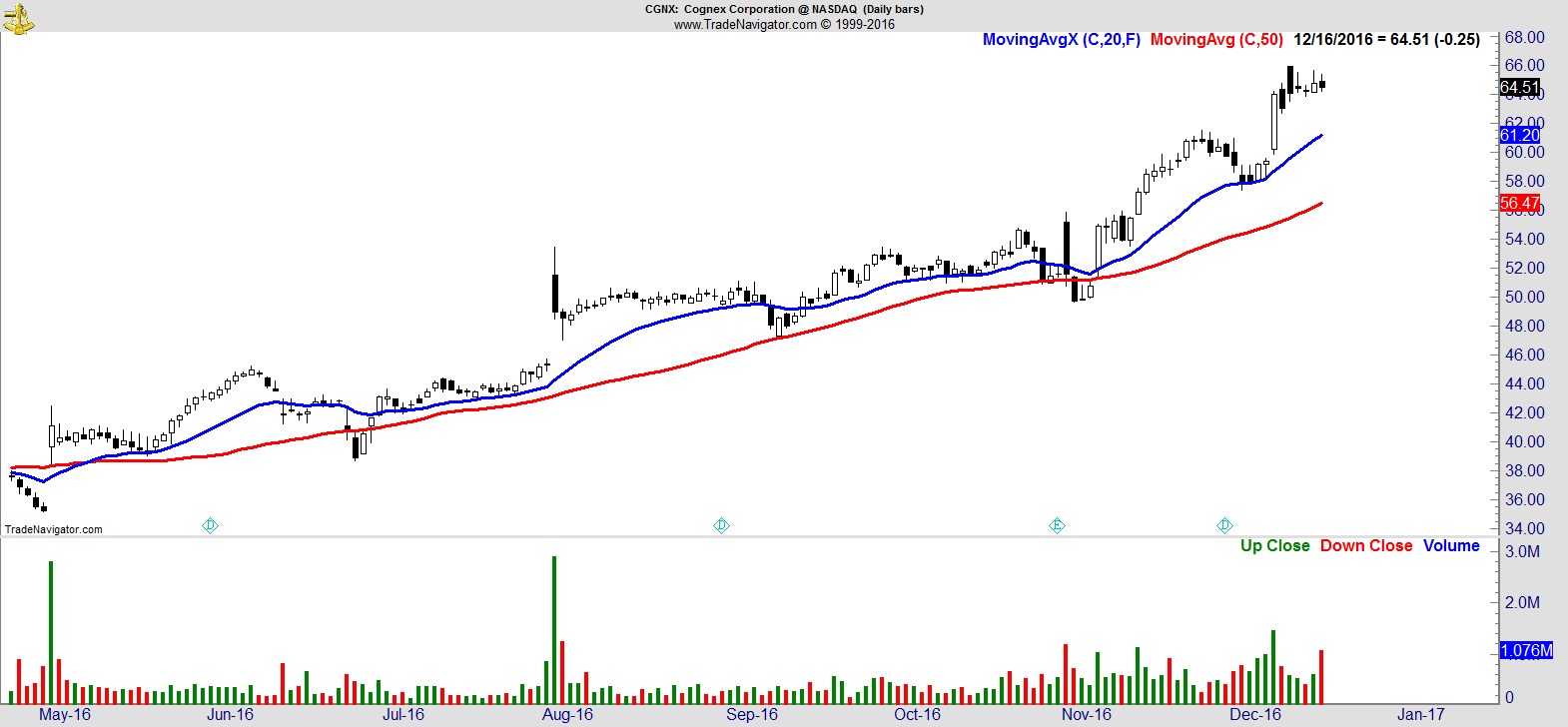

$CGNX

.

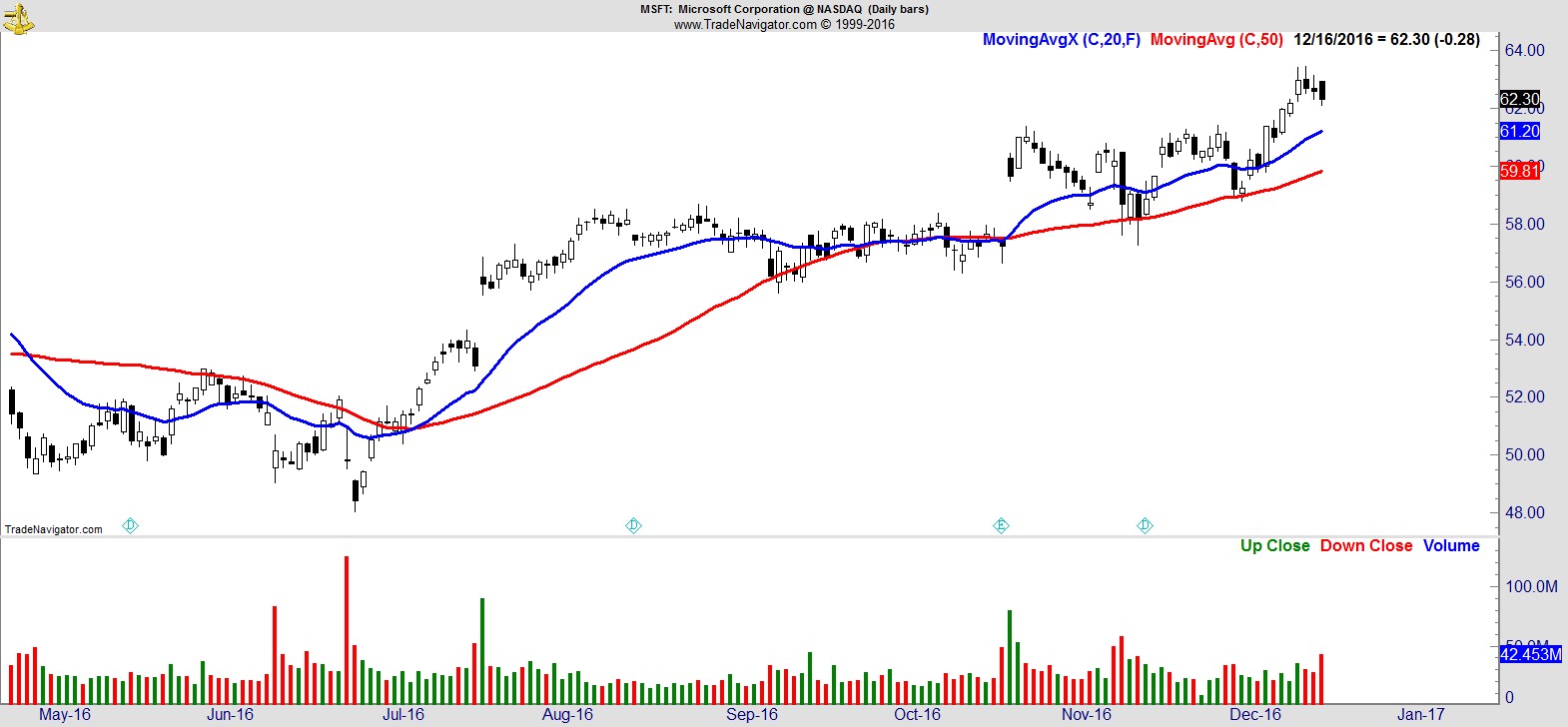

$MSFT

.

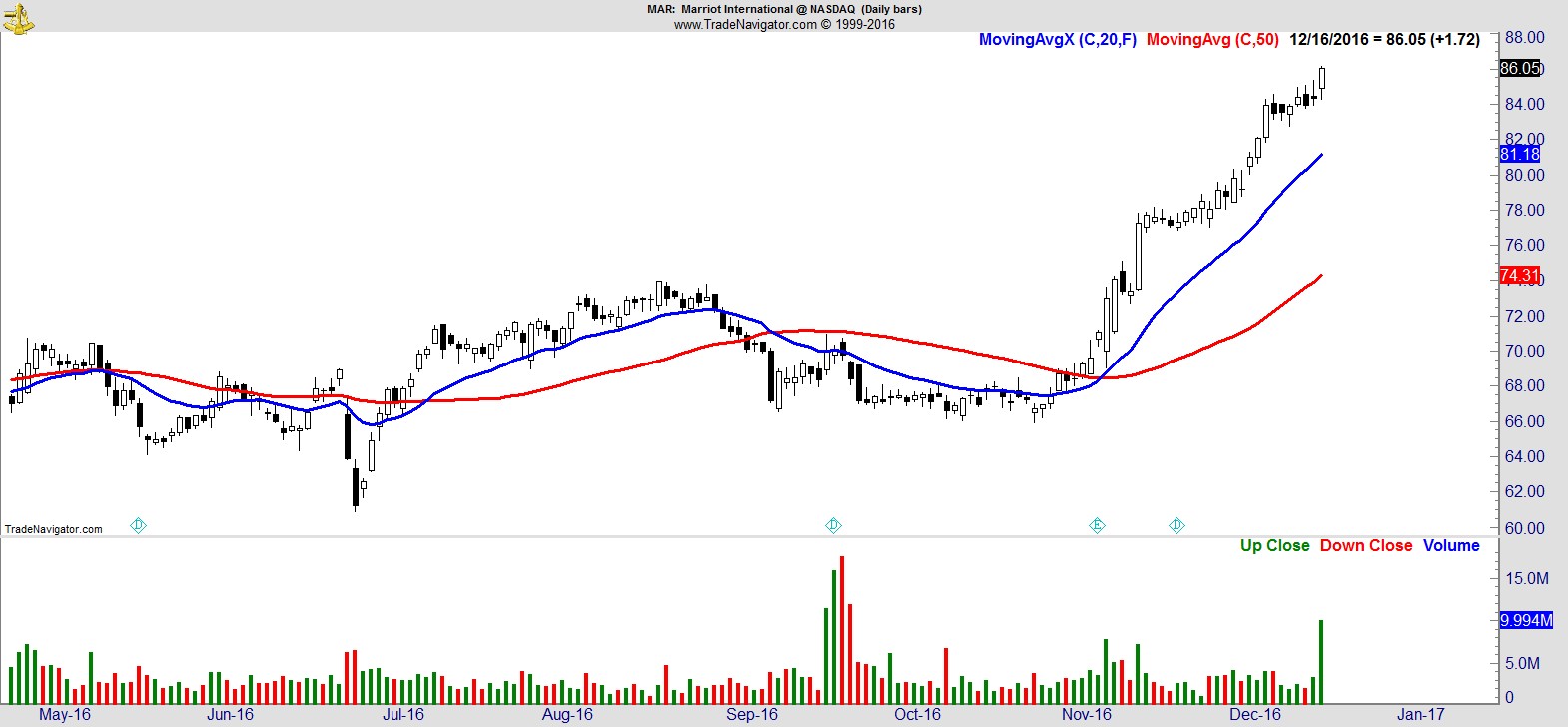

$MAR

.

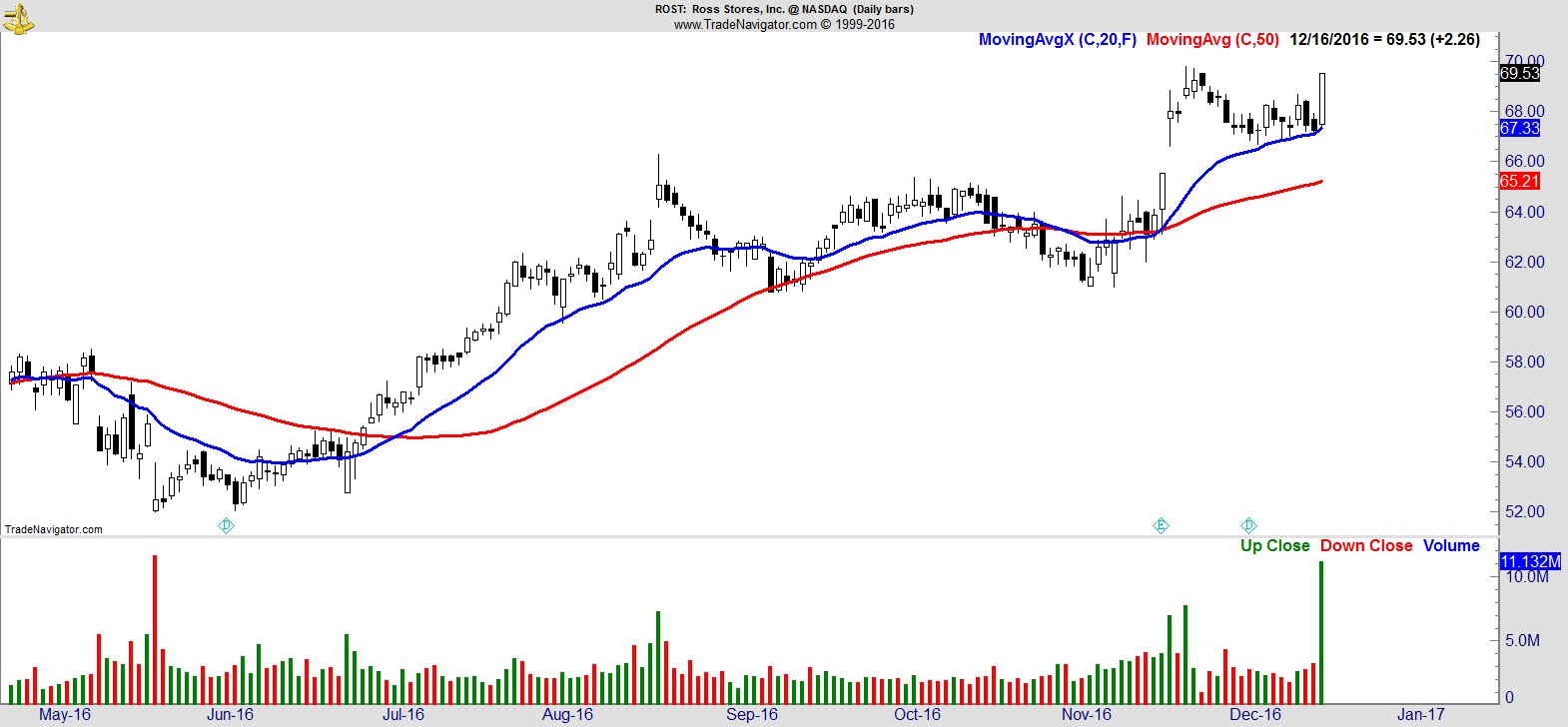

$ROST

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17