Overview

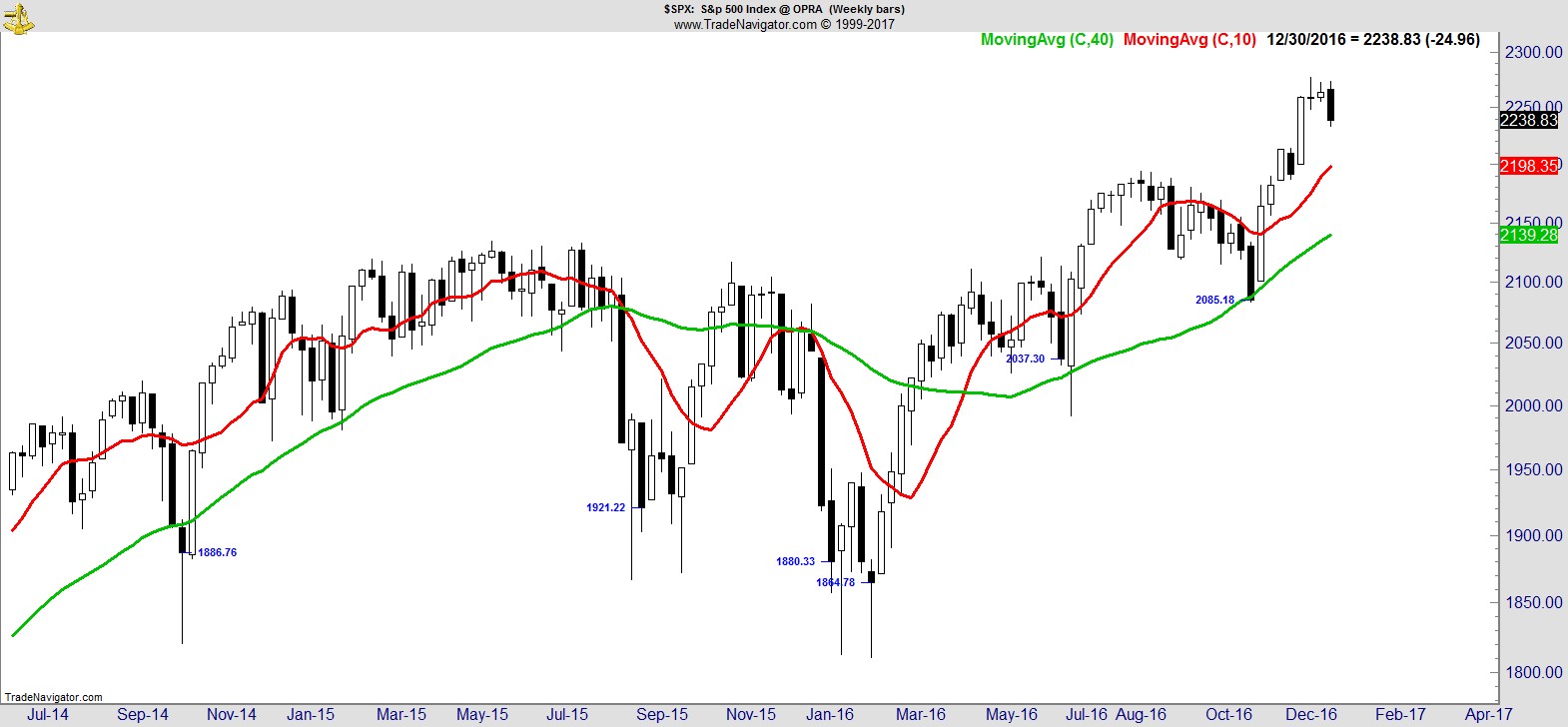

2016 ended with a mild pullback on the week, with the S&P finishing -1.1% but still up a healthy 9.5% on the year. Bigger picture the uptrend is very much intact, and breadth remains supportive.

Here's the S&P on a daily and weekly for context:-

.

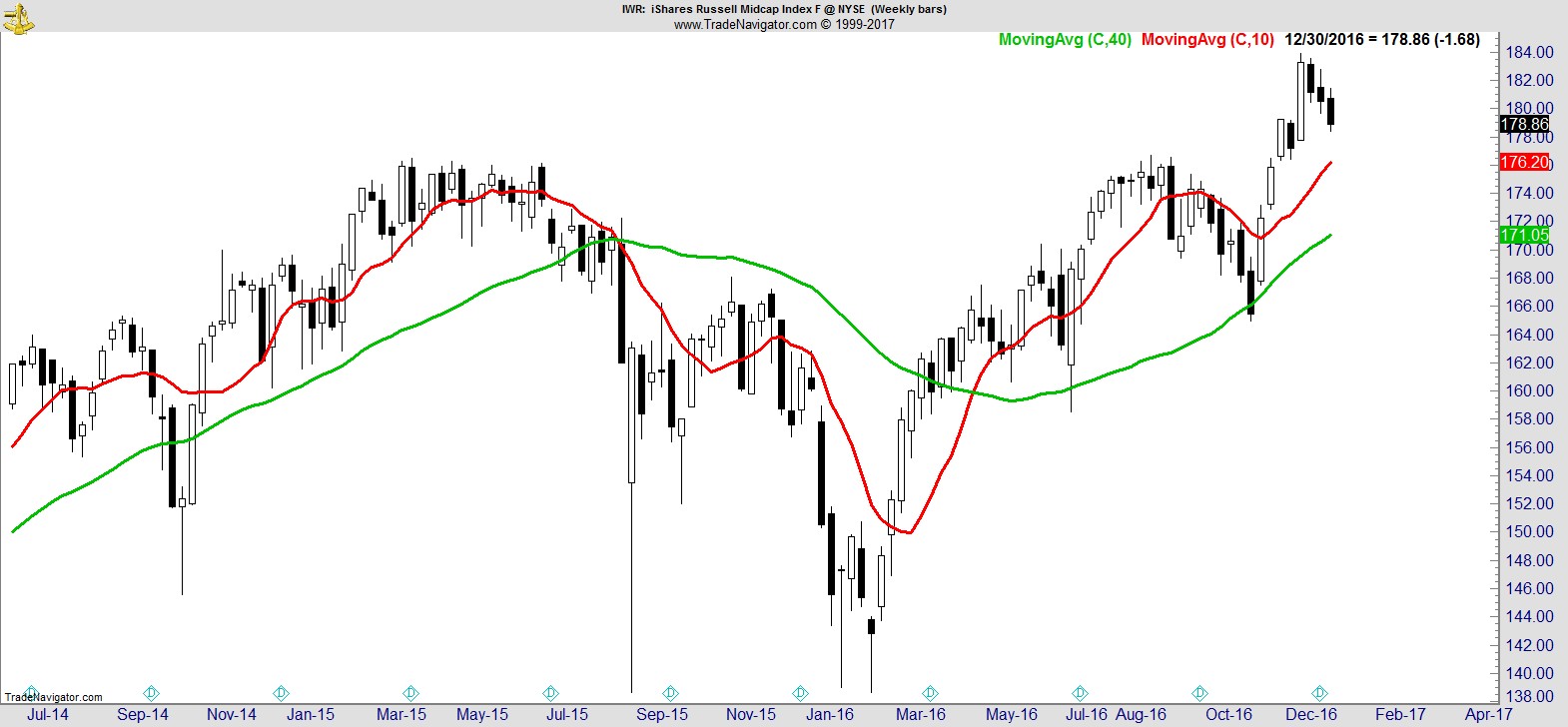

Of the major indices the only one where perhaps the weakness has been slightly more pronounced is in midcaps, which ended lower for a third straight week, but even there it's still a healthy uptrend longer term.

.

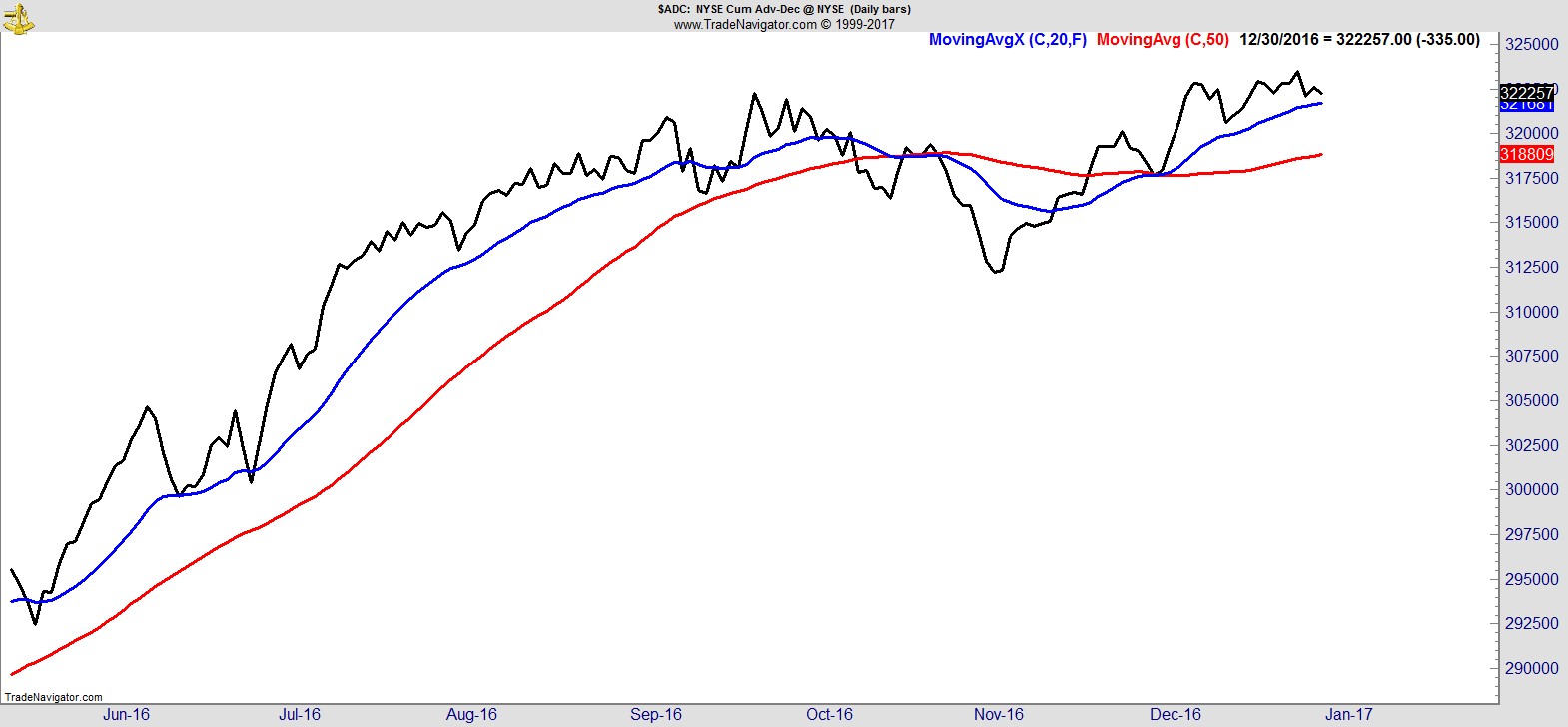

Breadth is also off its highs, via the NYSE cumulative advance/decline, but as we'll see with the sector analysis, leading stocks can still be found in a broad range of areas.

.

Sector Analysis

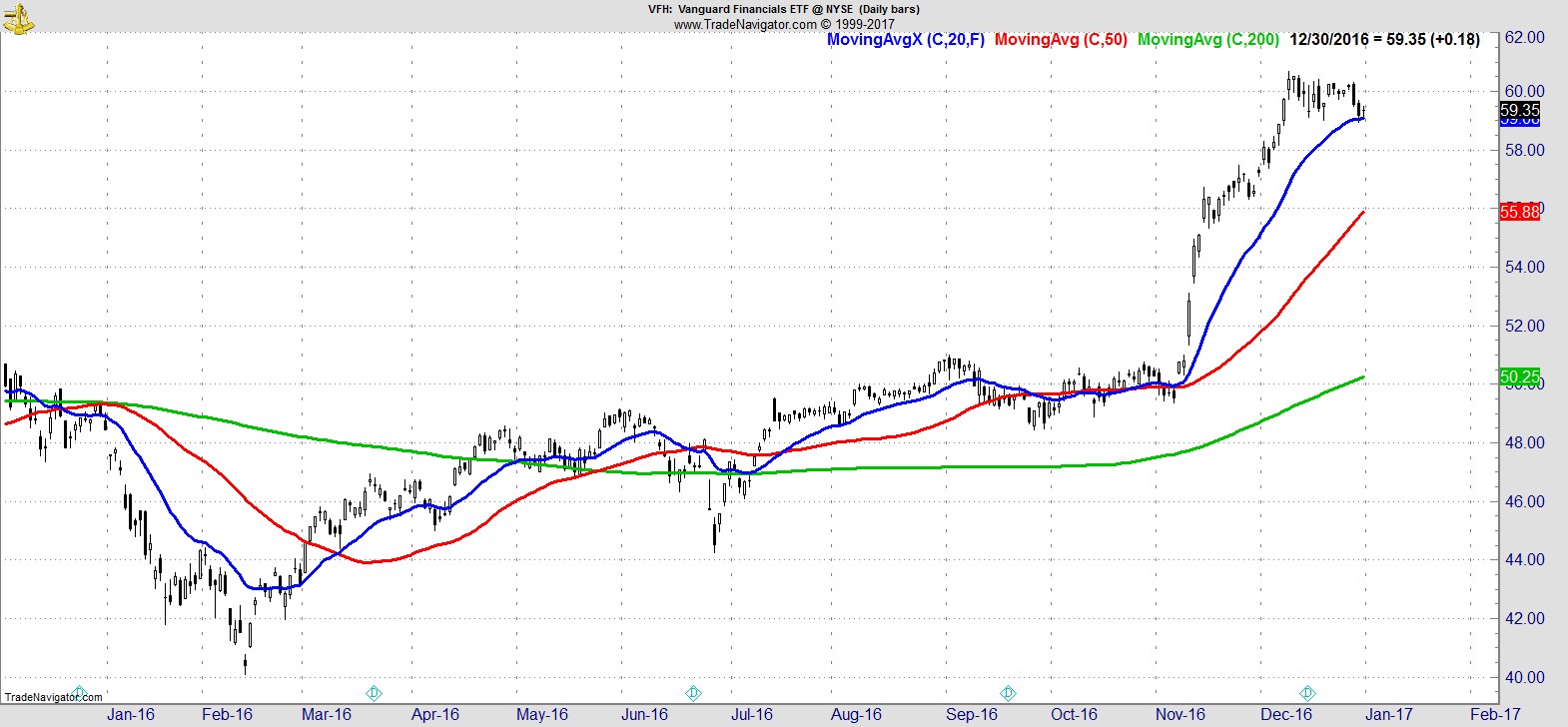

Financials, shown here via $VFH, is the outright leader, just below its highs but still above its 20 EMA.

.

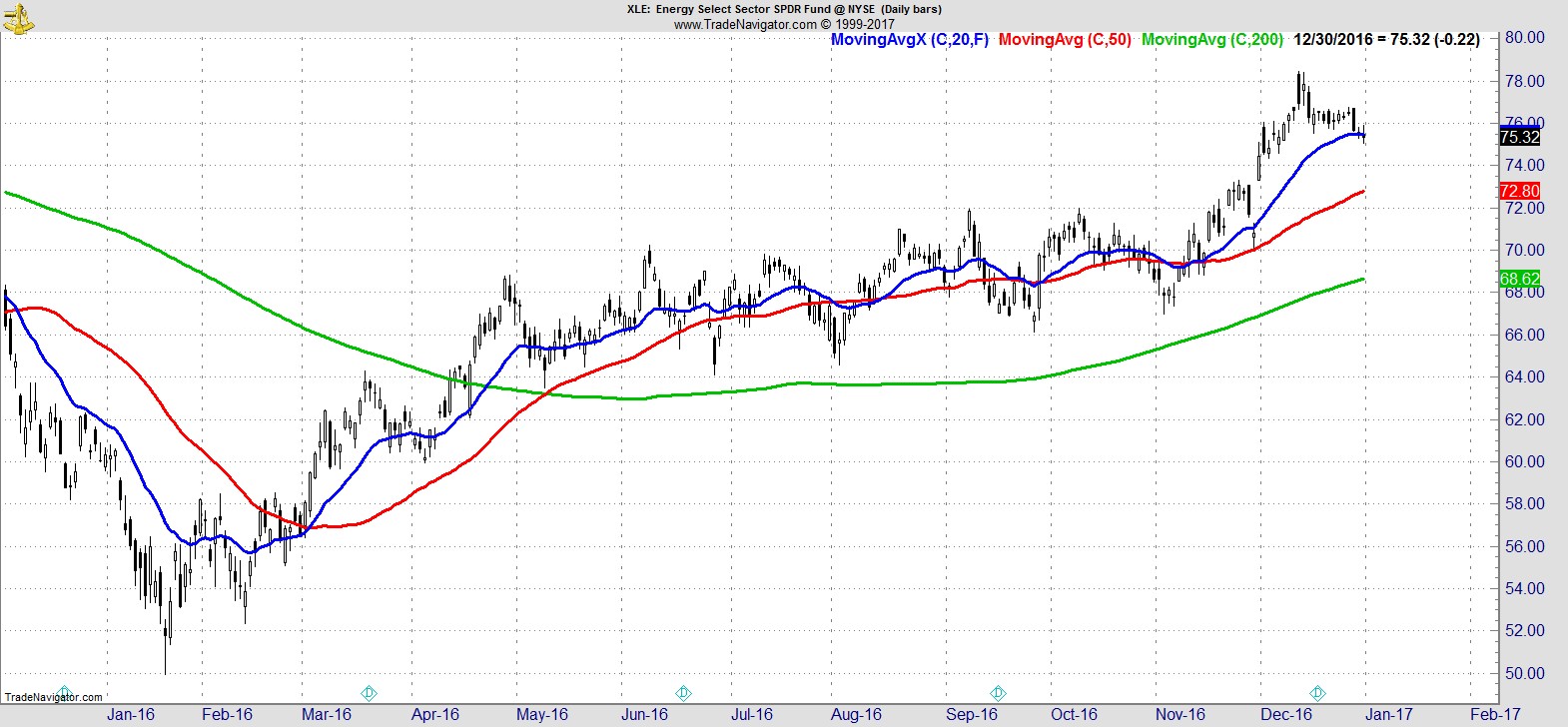

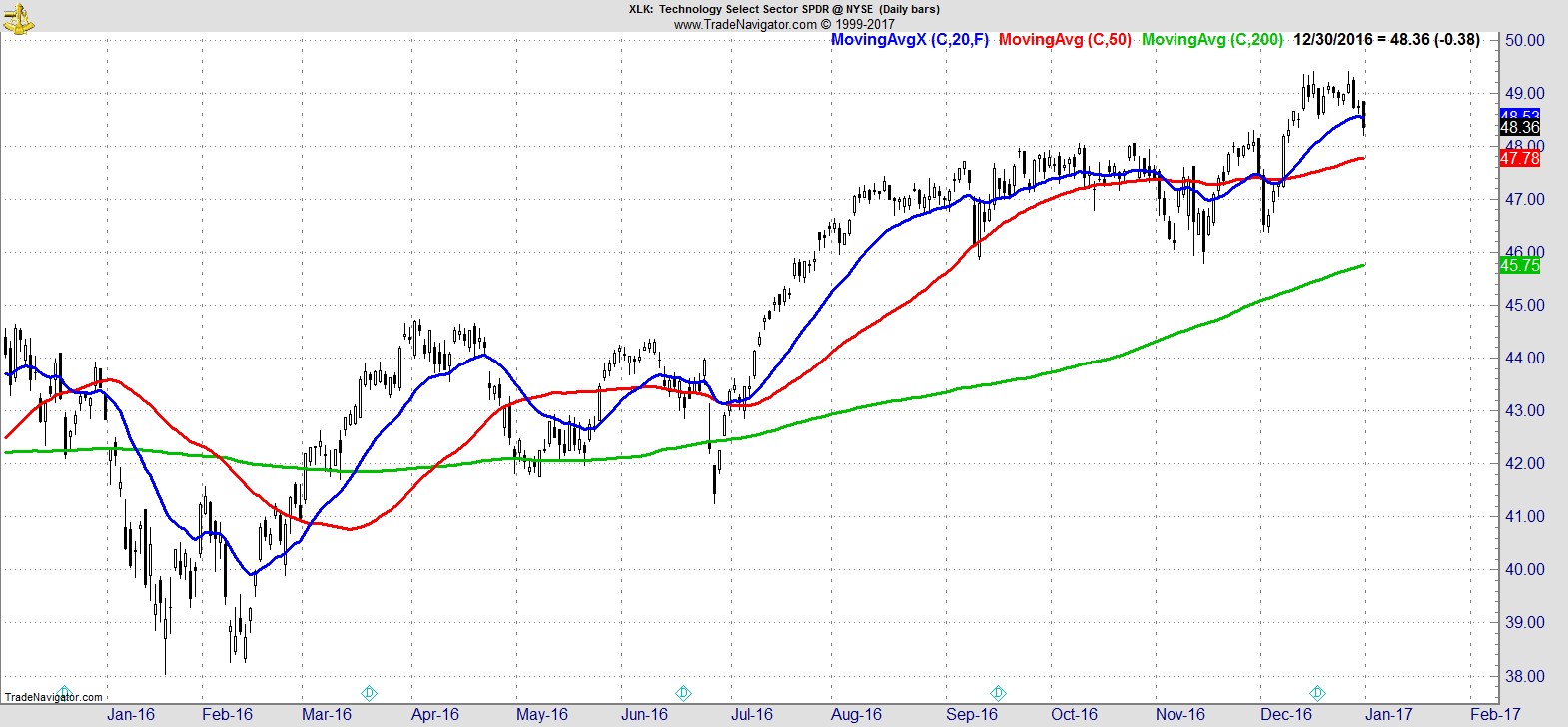

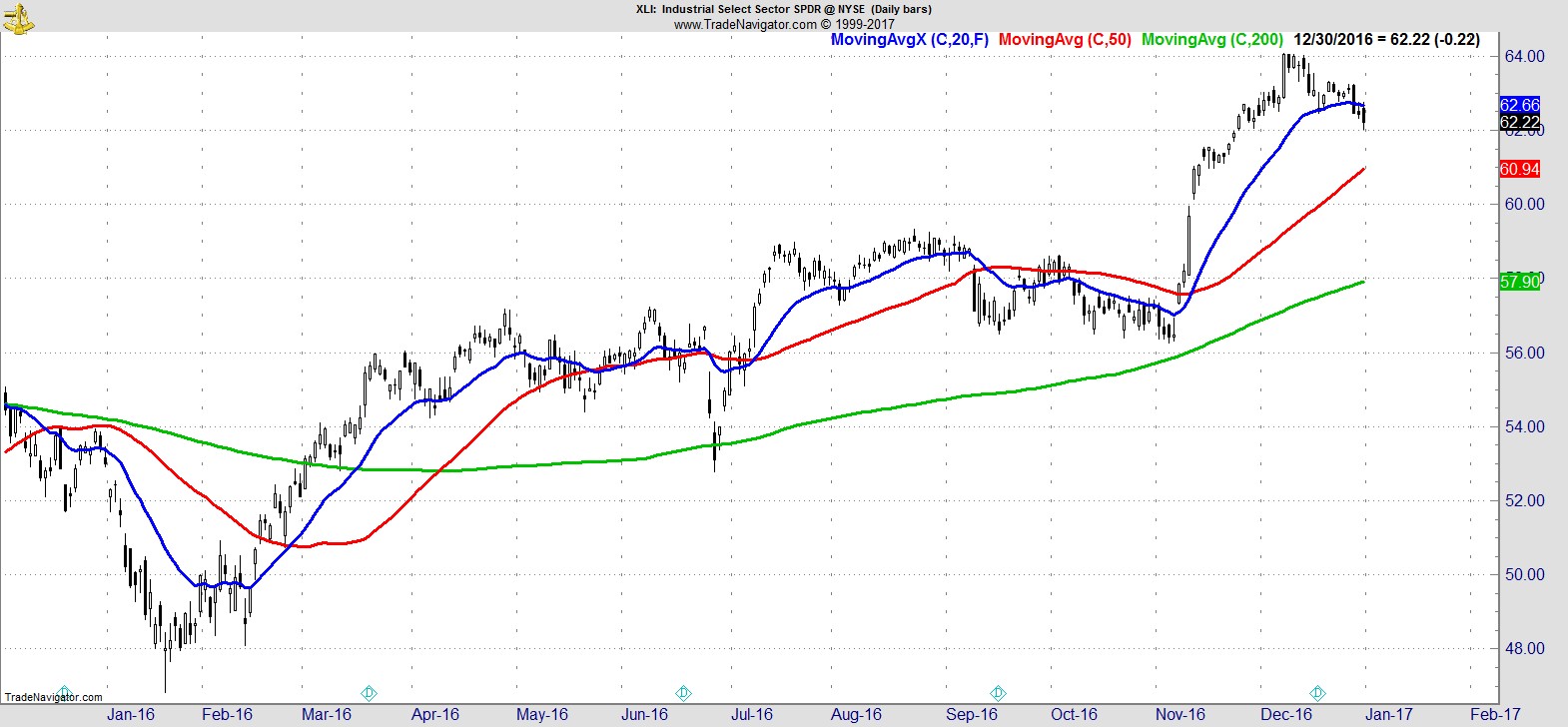

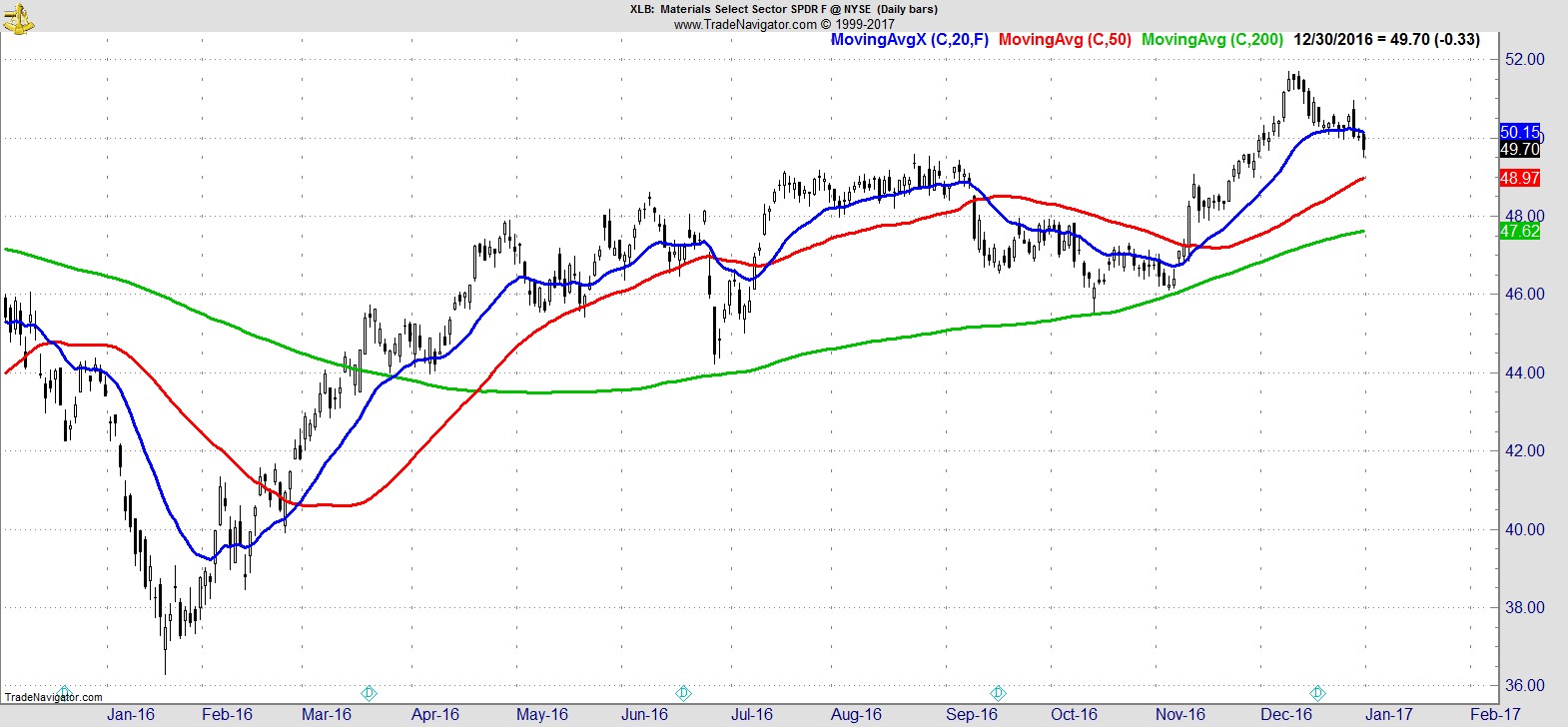

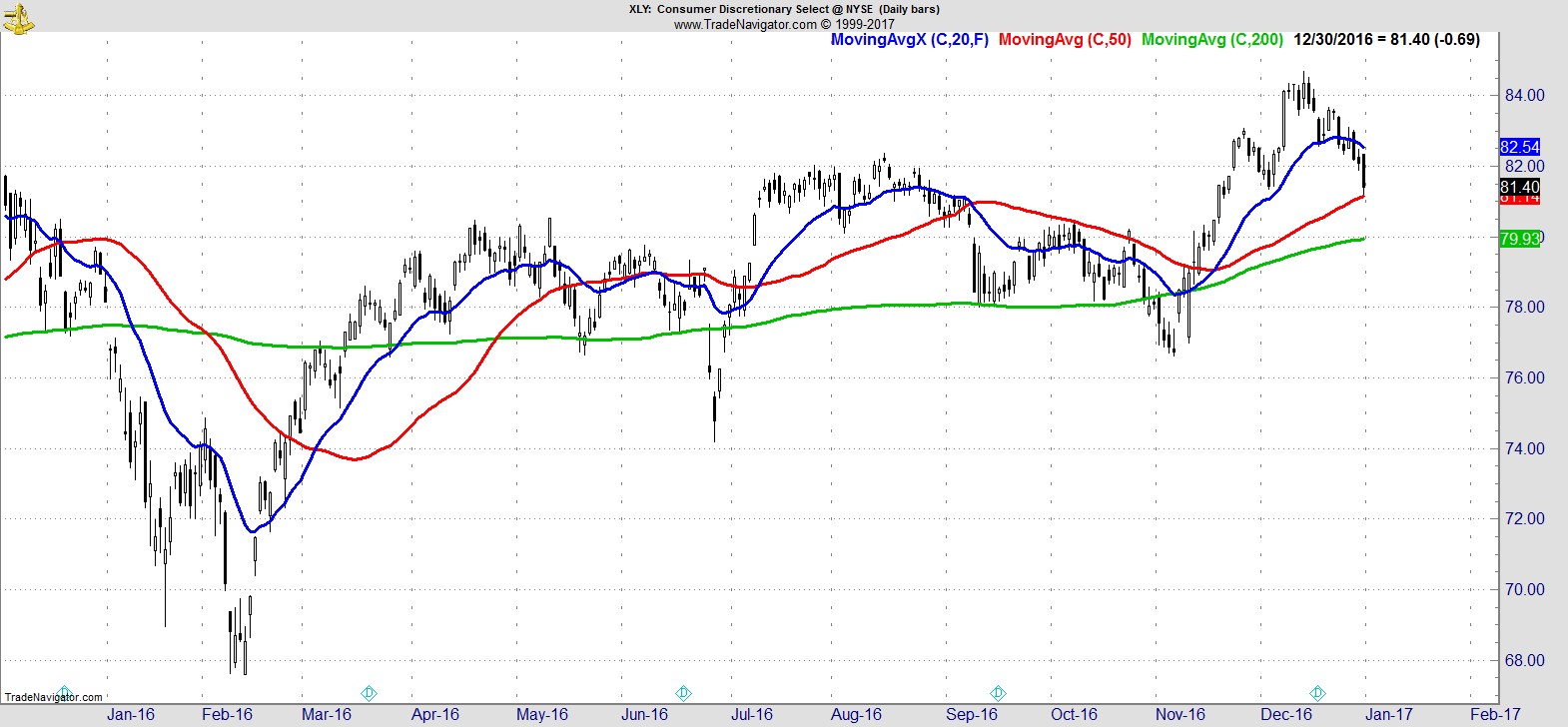

Next I have Energy, Technology, Industrials, Materials, and Consumer Discretionary, which are just below their 20 EMA but above their 50-day. Together with Financials, these have been the leading sectors for several weeks now and have fueled much of the market advance of the last 2 months.

.

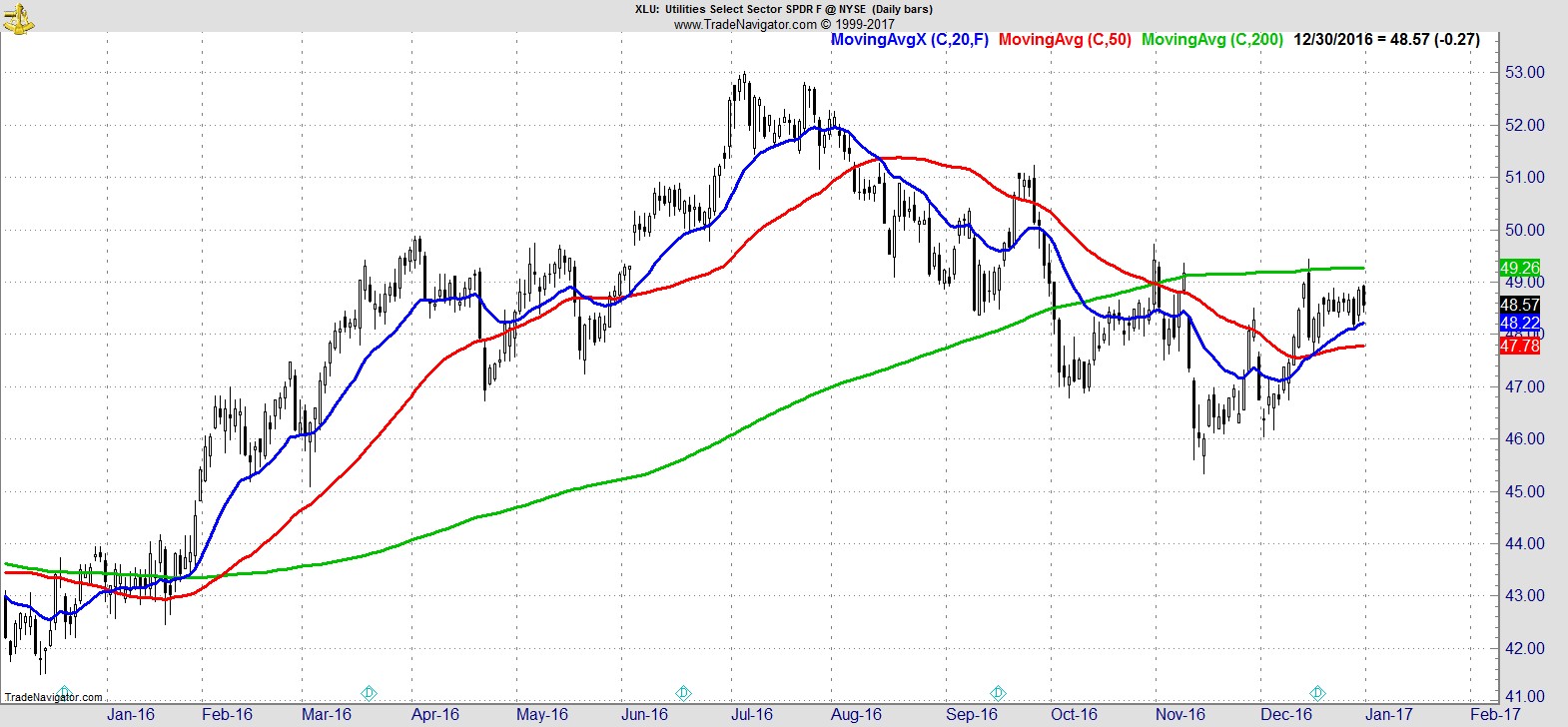

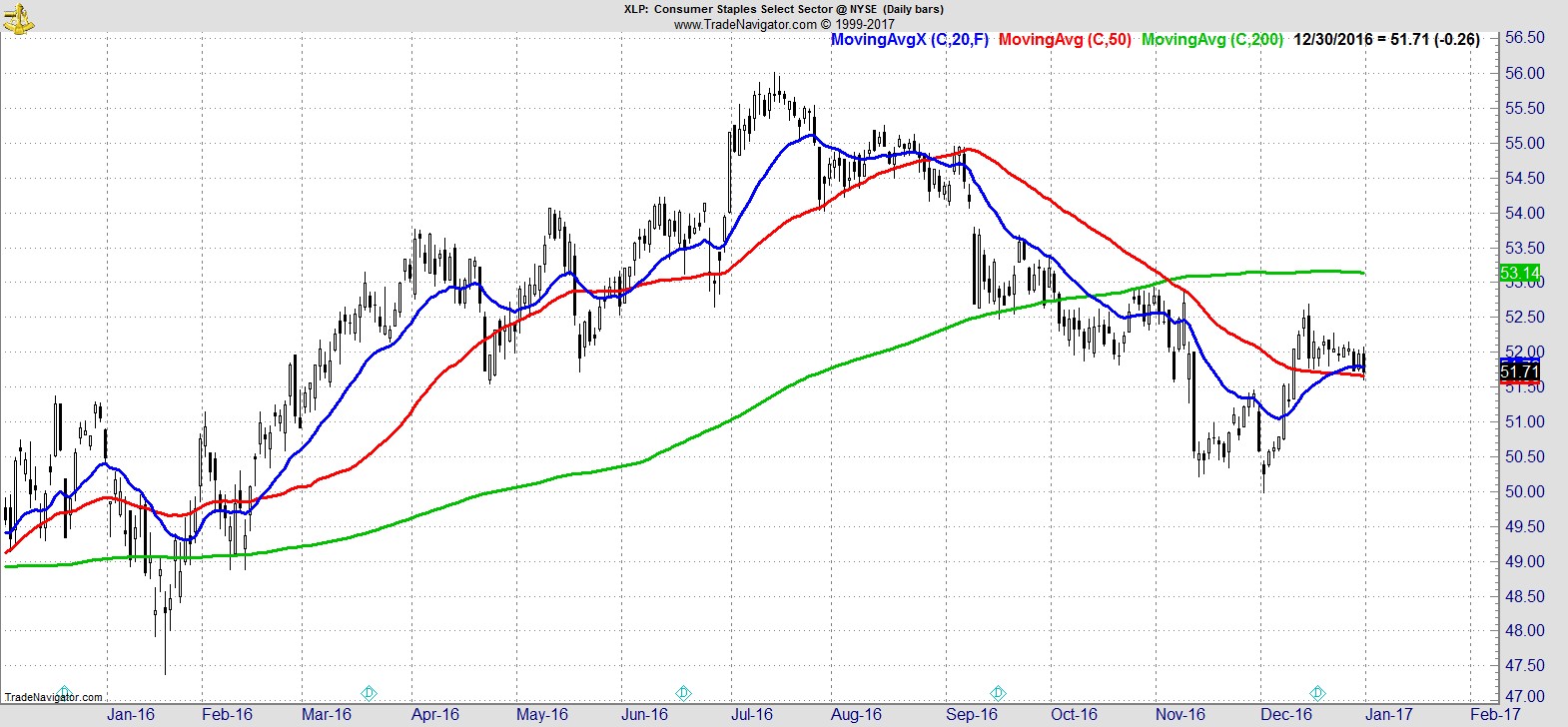

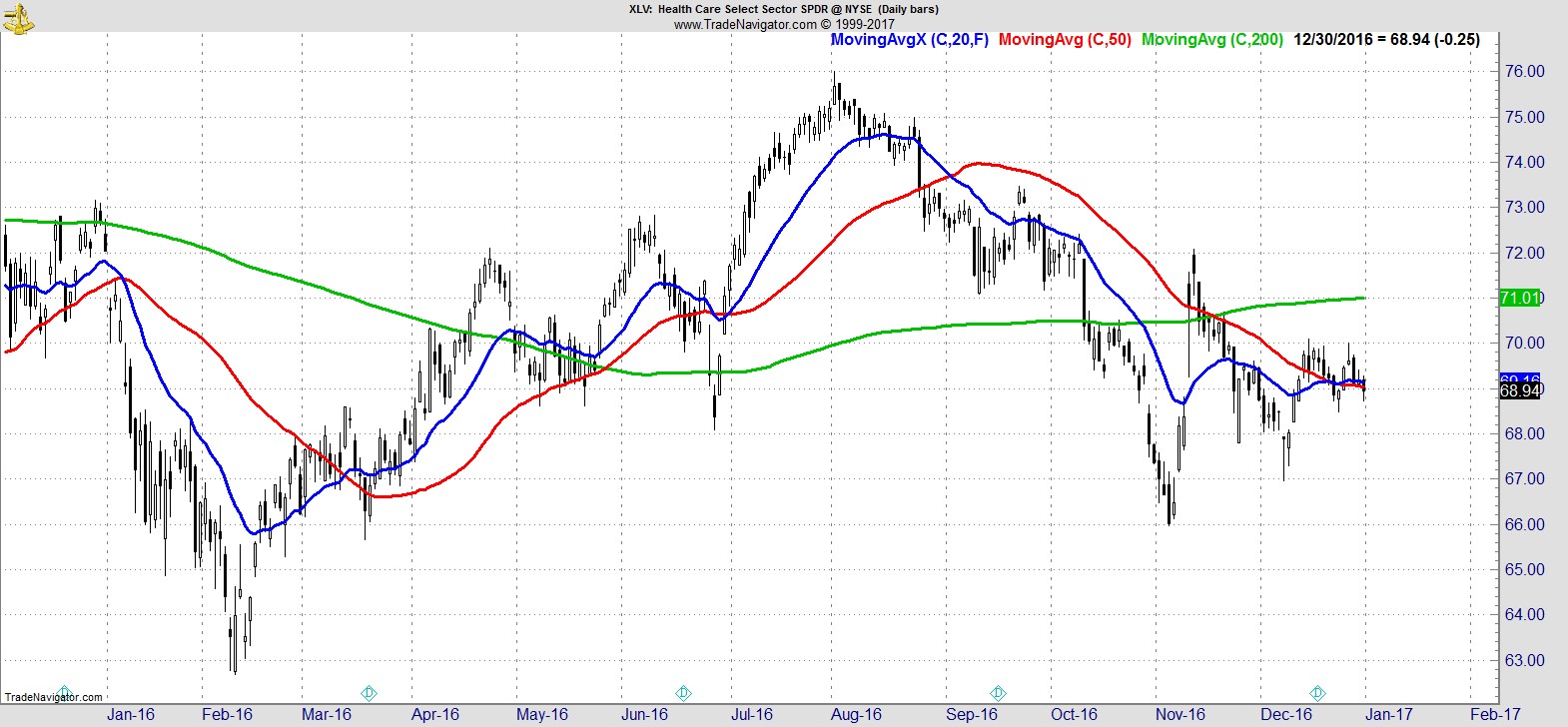

Next comes Utilities, Real Estate, and Consumer Staples which are all below their 200-day, while Healthcare remains at the bottom, below its 20, 50, and 200-day MA.

.

Alpha Capture Portfolio

Our model portfolio finished the week -0.7% vs -1.1% for the S&P, having outperformed the index for 9 of the last 11 weeks. It ended with a small gain on the year +0.5%, well shy of the index, but also well off its lows of -10.3% just 8 weeks ago.

Despite the underperformance on the year, the good news is it managed to capture all the recent upside and the rangebound market that lasted over 18 months finally appears to be behind us with the summer breakout to new highs and the subsequent post-election resumption higher.

It may be a new month and a new year, but our process doesn't change or start over, it's never-ending. We stick to our rules and methods like normal, regardless of any narratives or themes that may be popular for this time of year, and no matter how persuasive the arguments.

Our portfolio remains 90% long, with exposure to financials, energy, tech, industrials, materials, and consumer discretionary, across 15 names.

.

Watchlist

Overall the leading sectors remain much the same as they have for many weeks now, but this week we have fewer industrials and materials names, and a few more tech and energy showing through.

Here's a sample from the full list of 25 names:-

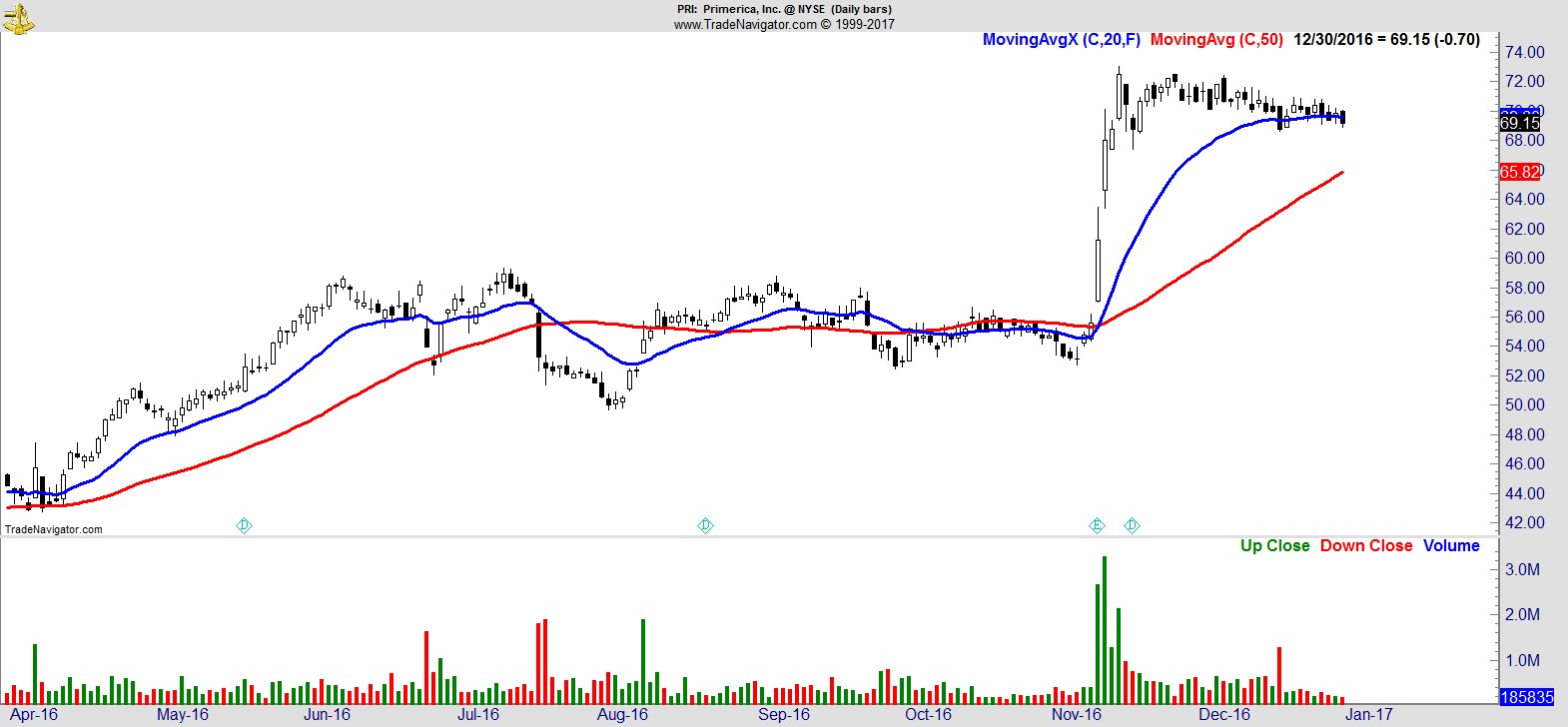

$PRI

.

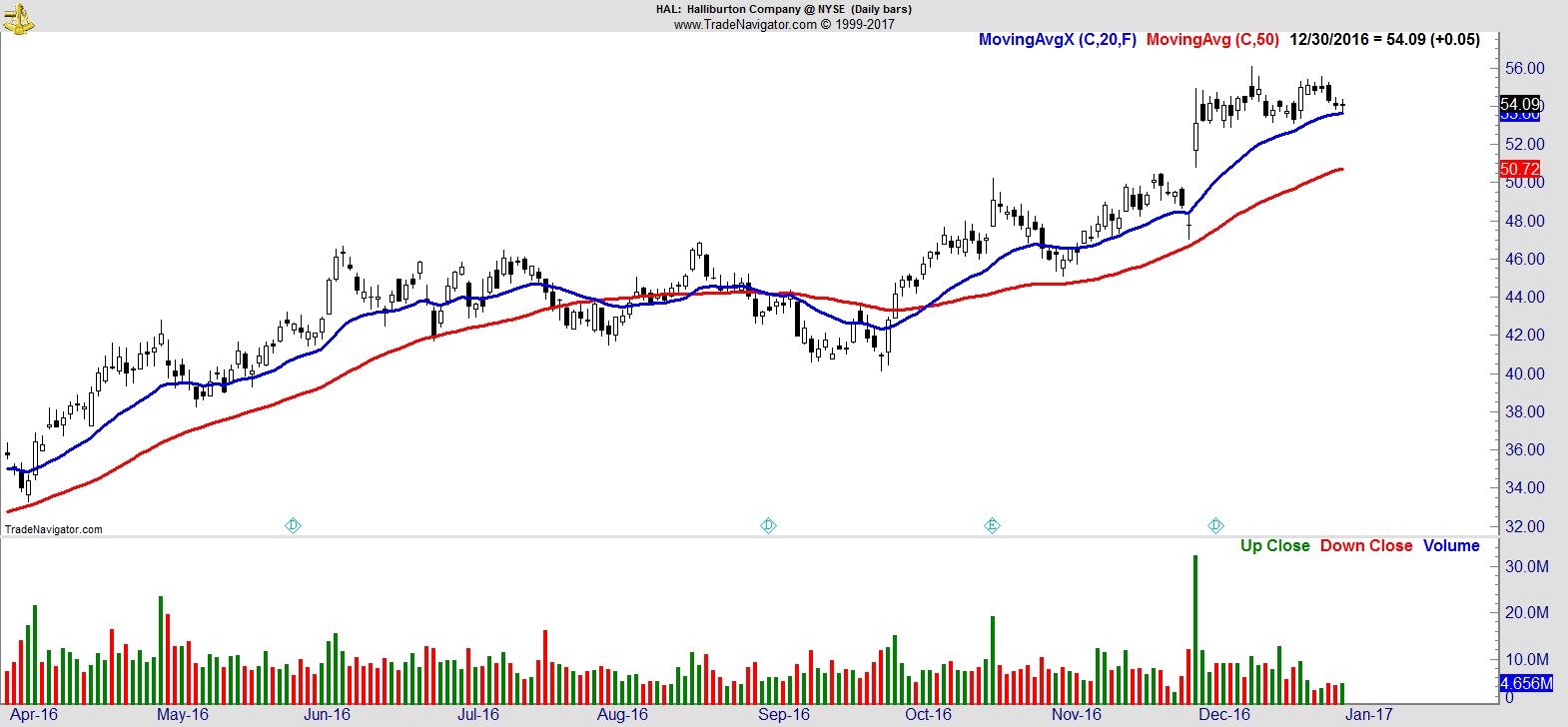

$HAL

.

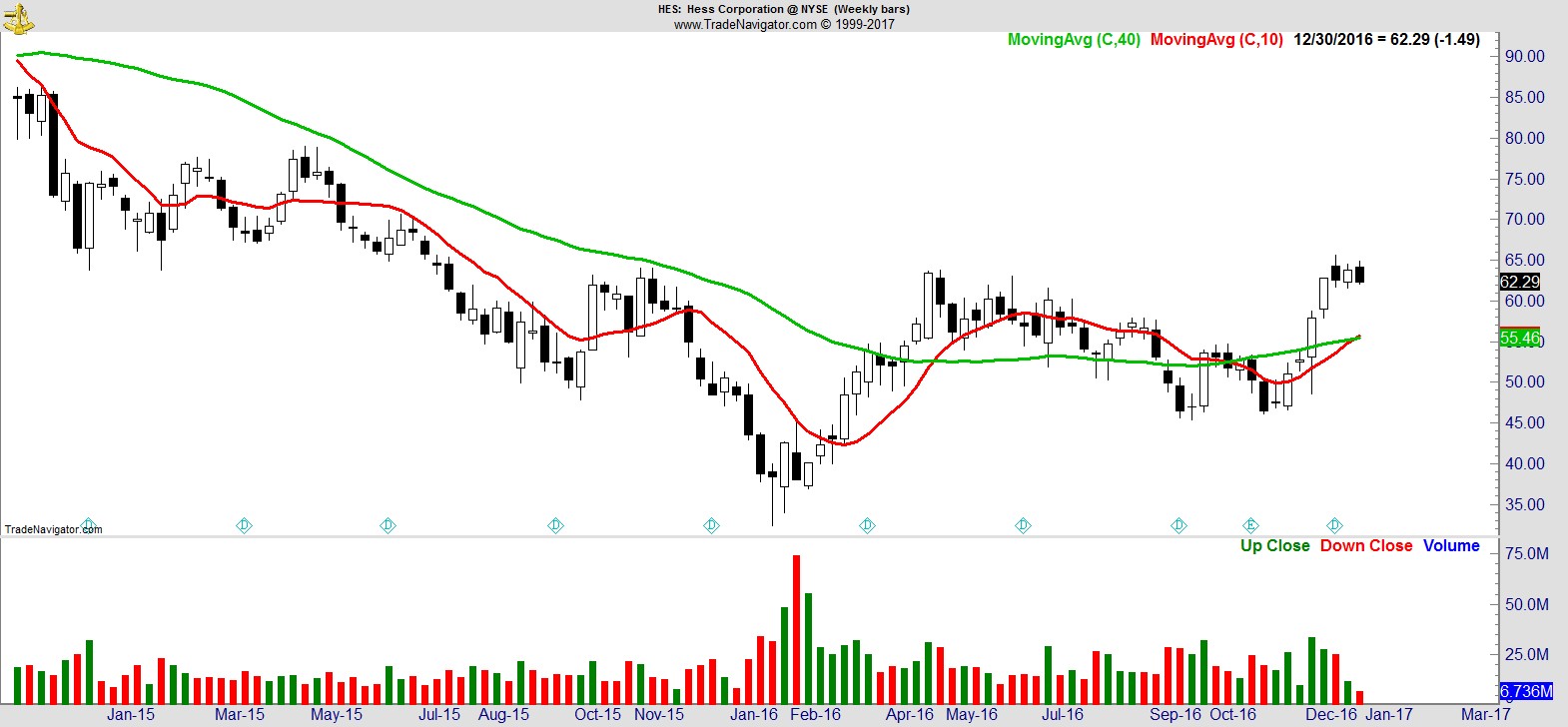

$HES

.

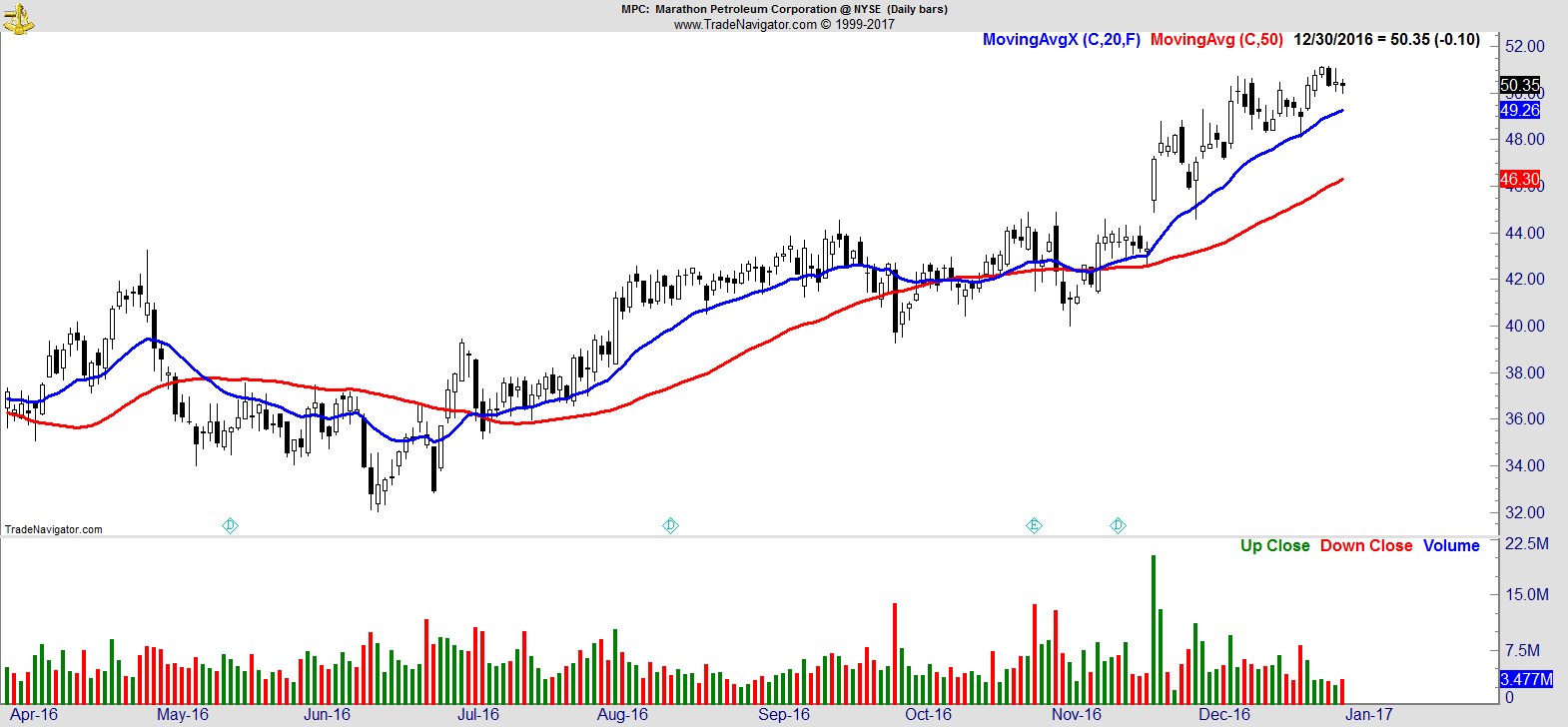

$MPC

.

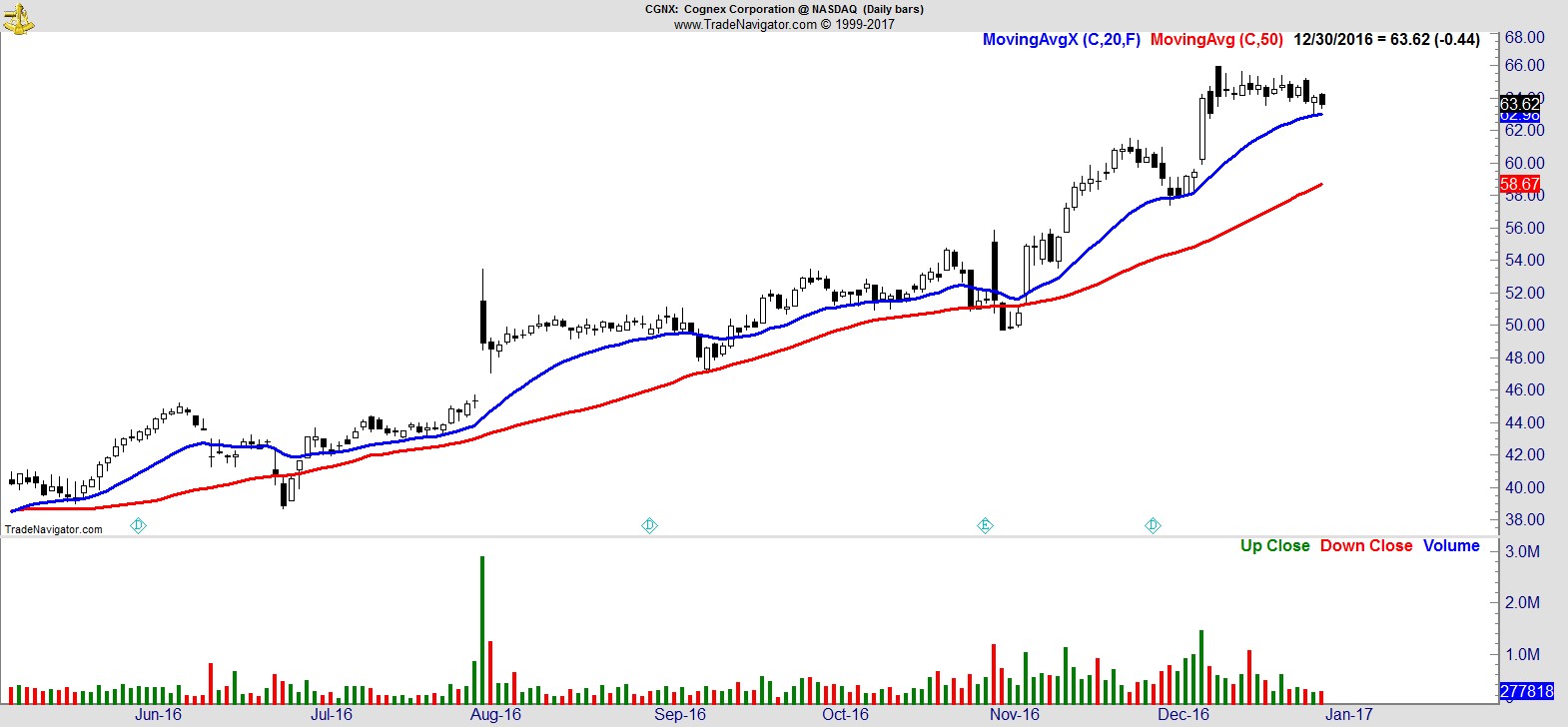

$CGNX

.

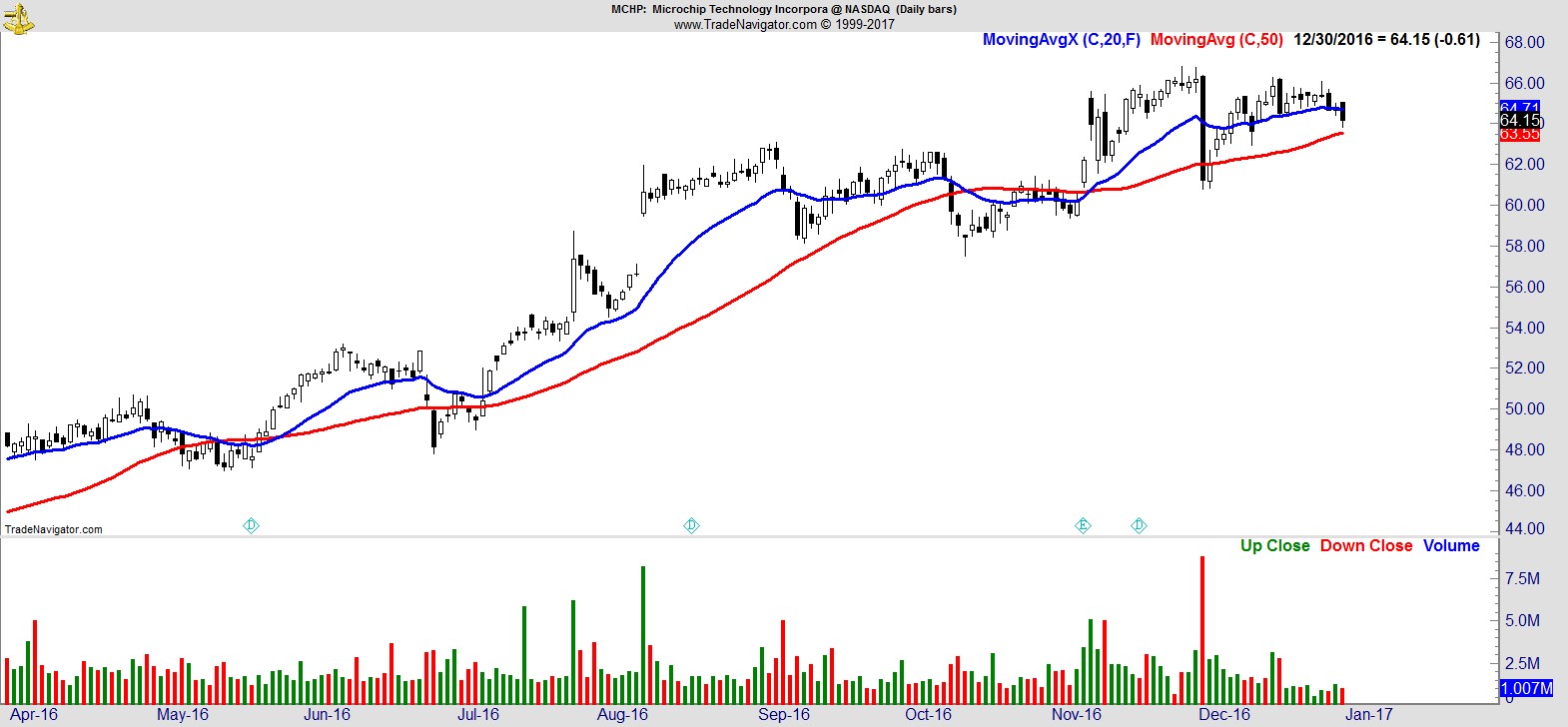

$MCHP

.

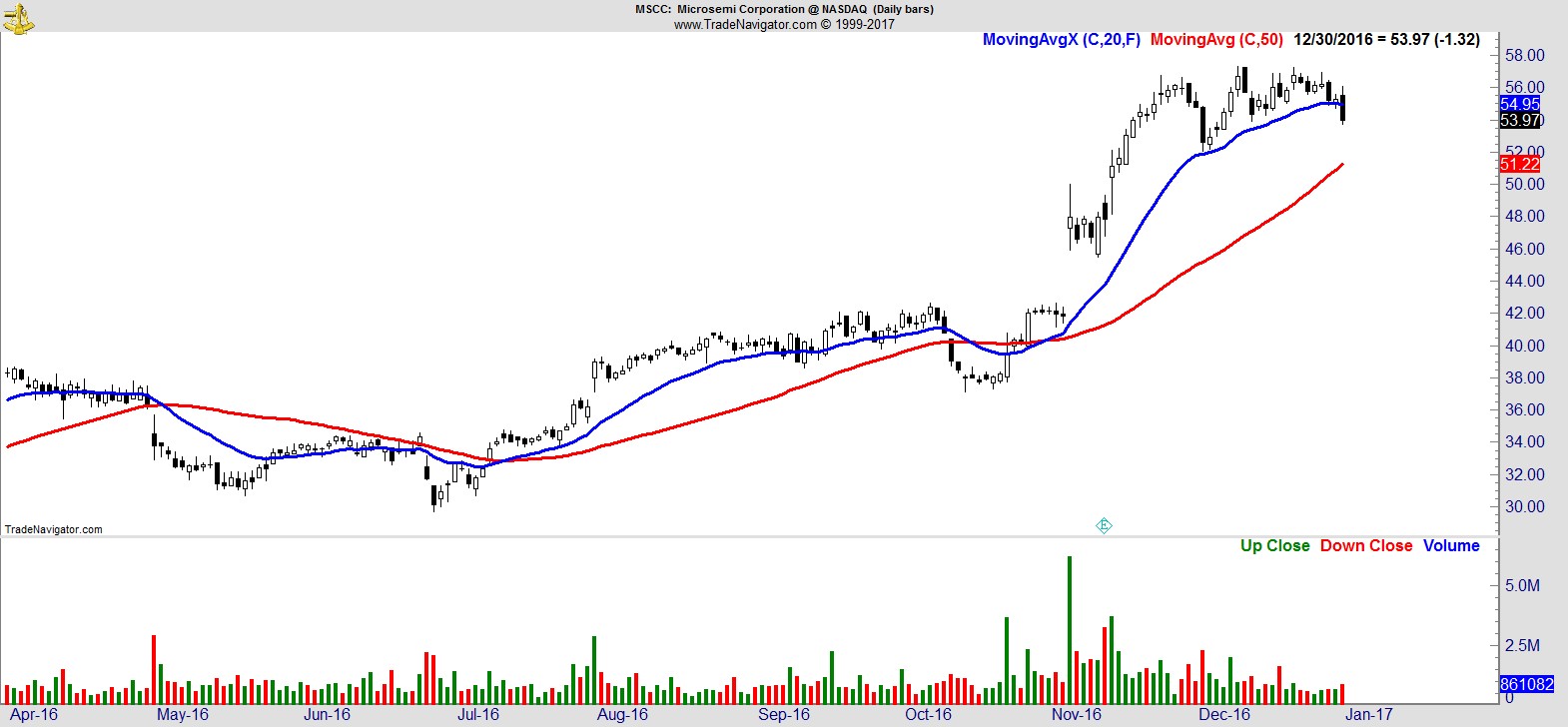

$MSCC

.

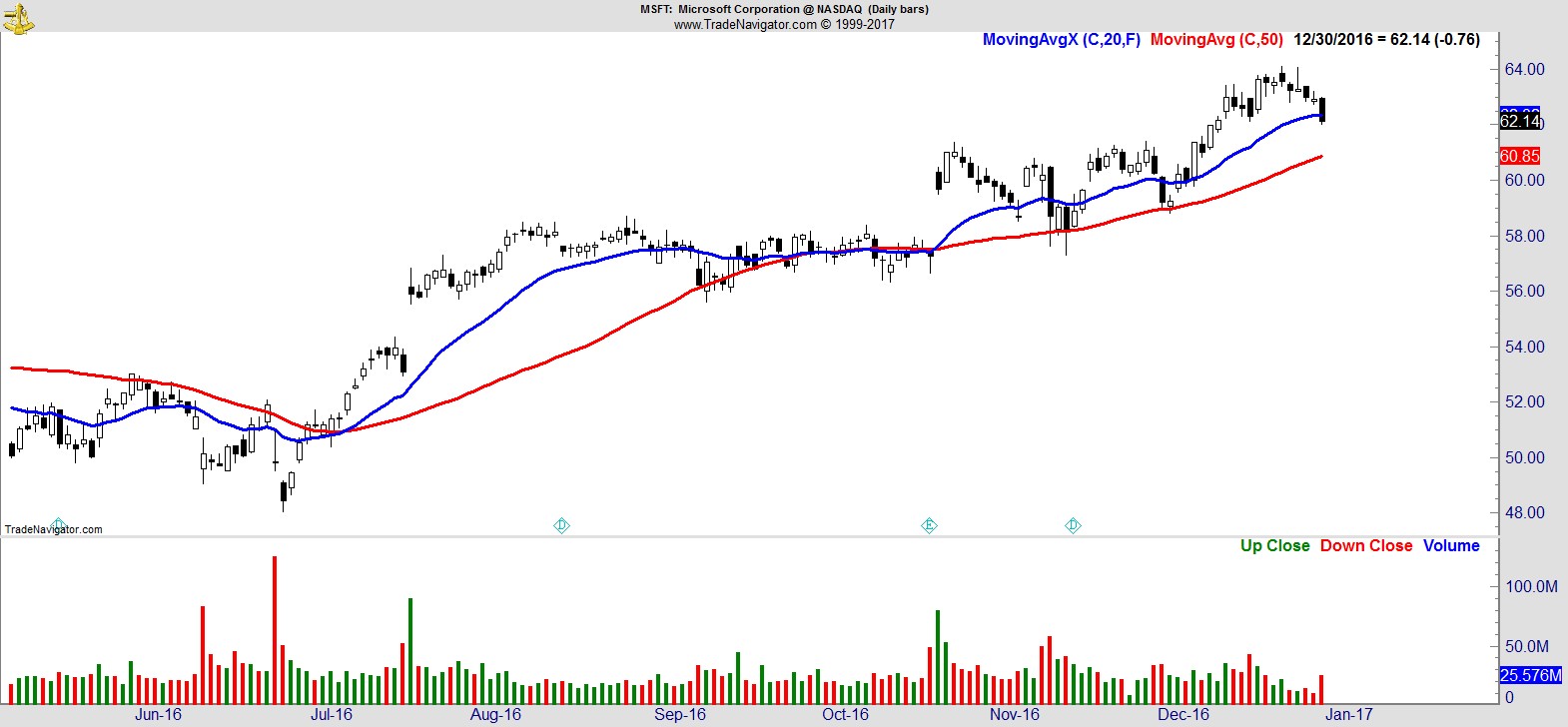

$MSFT

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17