Overview

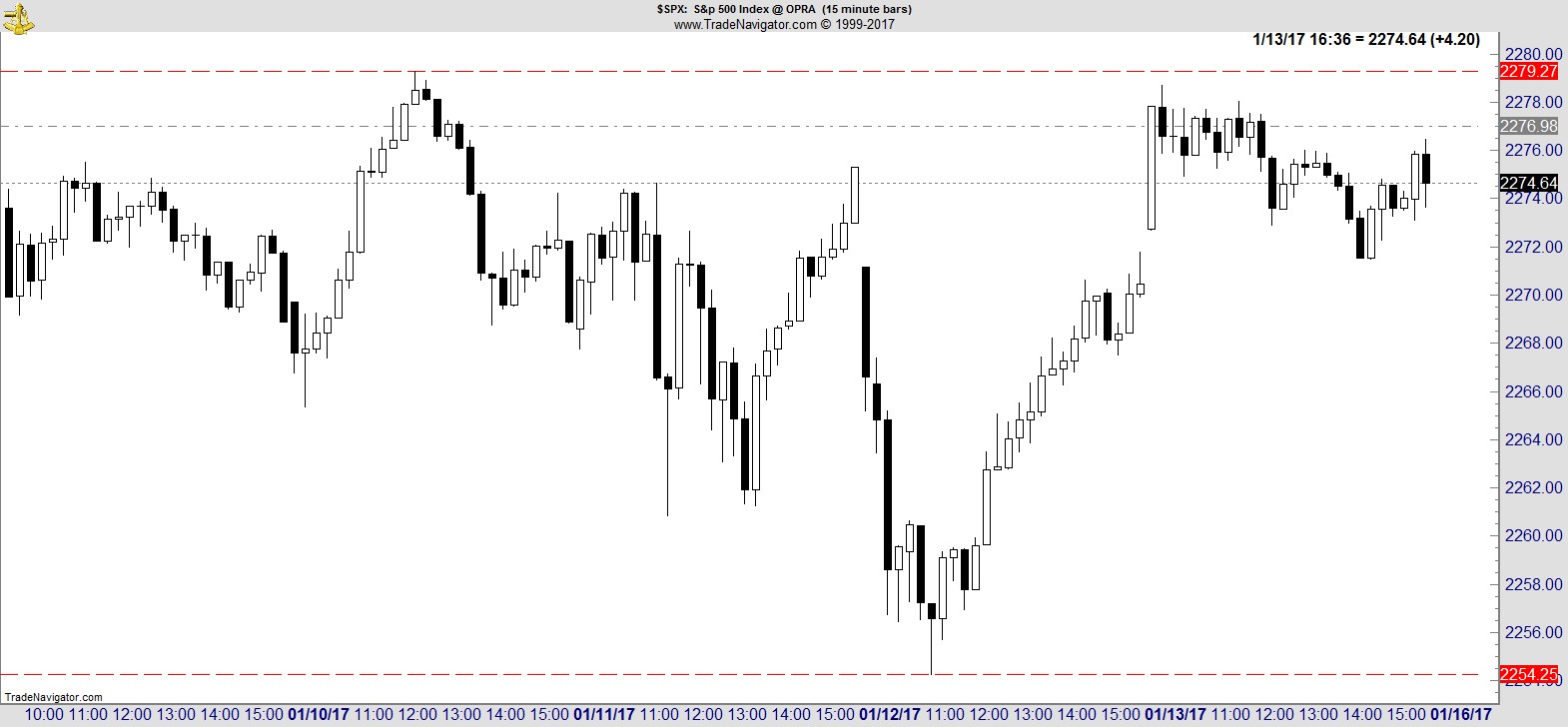

Not much new this week. After a brief period of weakness equity markets recovered off their lows to finish at or near their highs.

The S&P finished near the top of its range of the last 5 days:-

.

And that range itself was at the upper-end of its 10-day range:-

I believe that kind of price action to be fairly typical of consolidations within uptrends, and something that usually results in an eventual resumption higher, but obviously there's nothing to stop it from chopping around here a while longer.

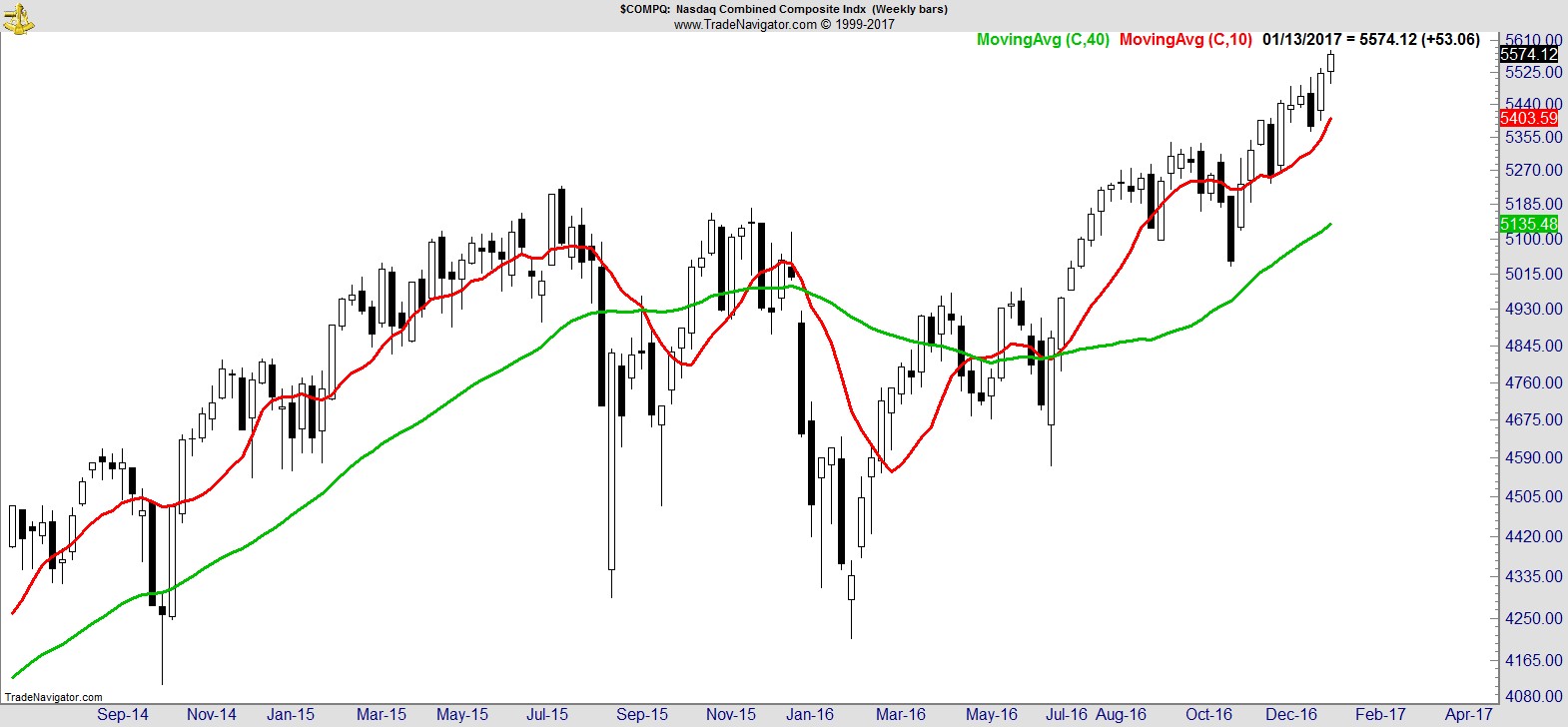

Meanwhile, the NASDAQ moved to a new all time high close on both a daily and weekly close basis. Here's the weekly:-

.

Sector Analysis

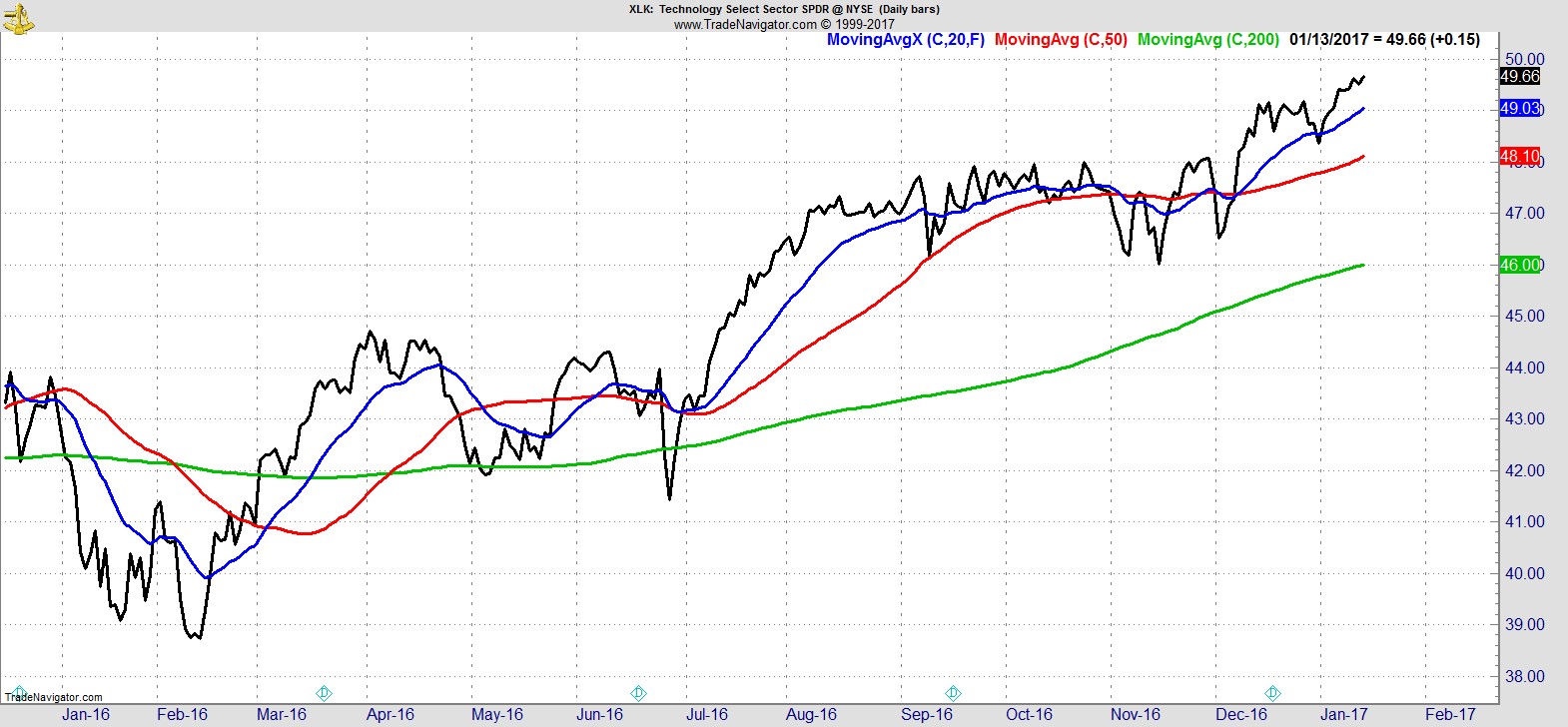

Tech is the clear leader, at new highs, and in turn leading the NASDAQ to its fresh highs this week.

.

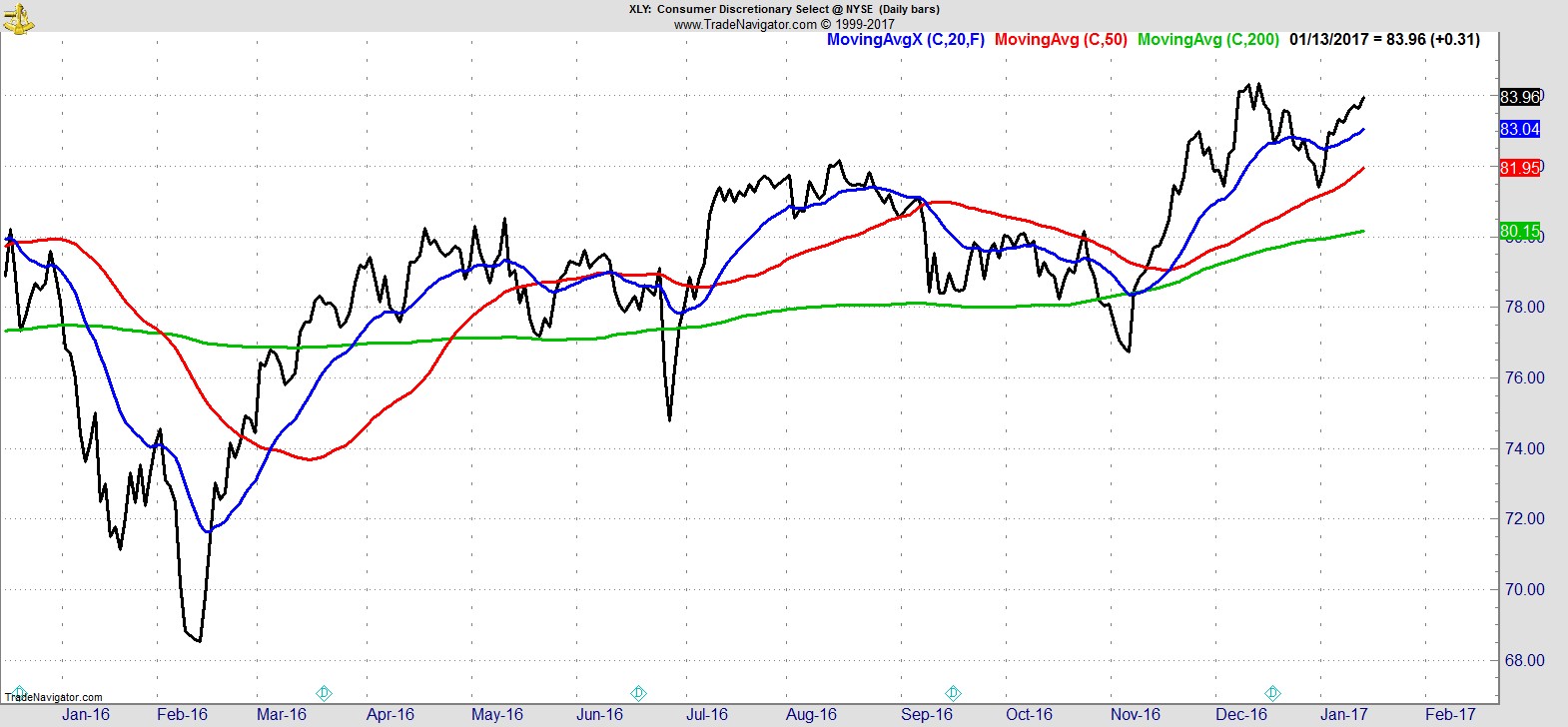

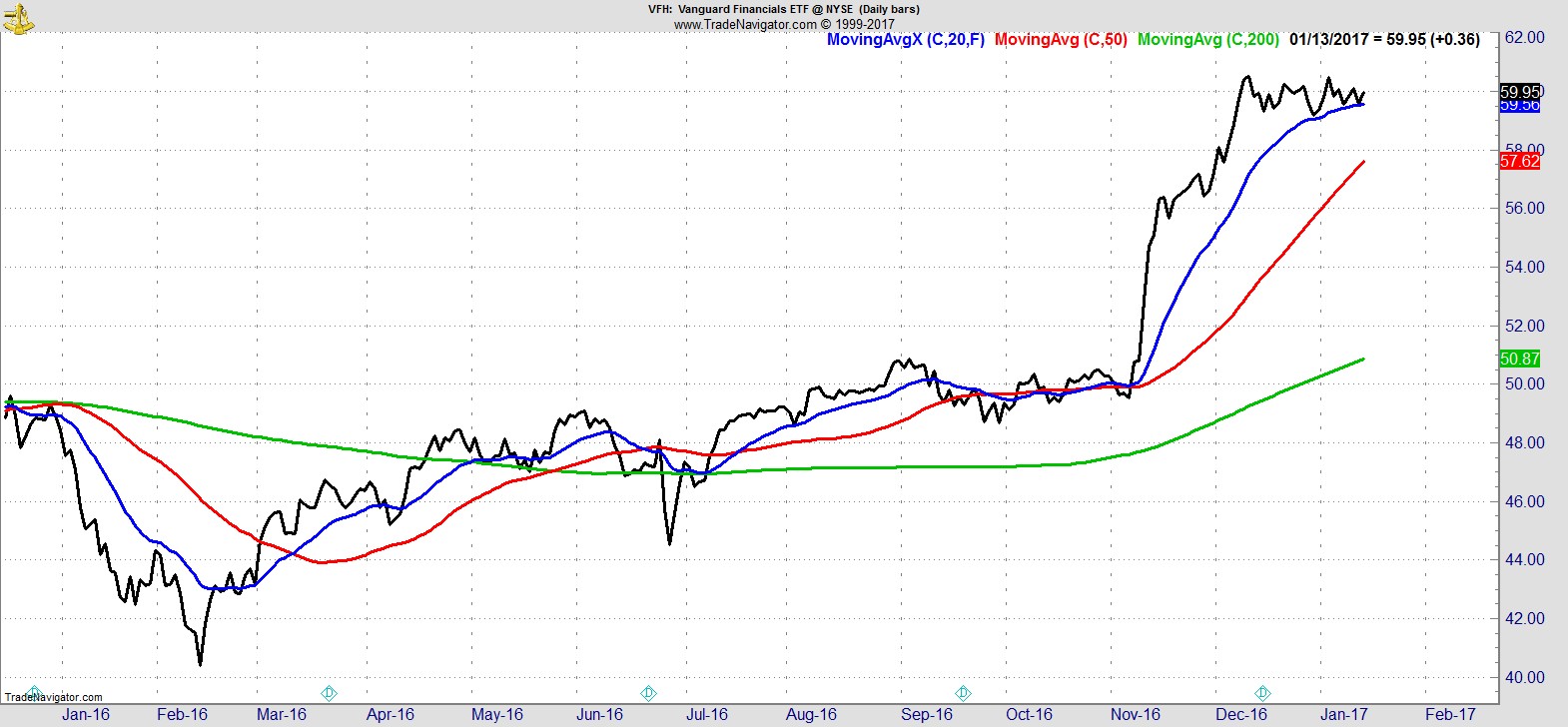

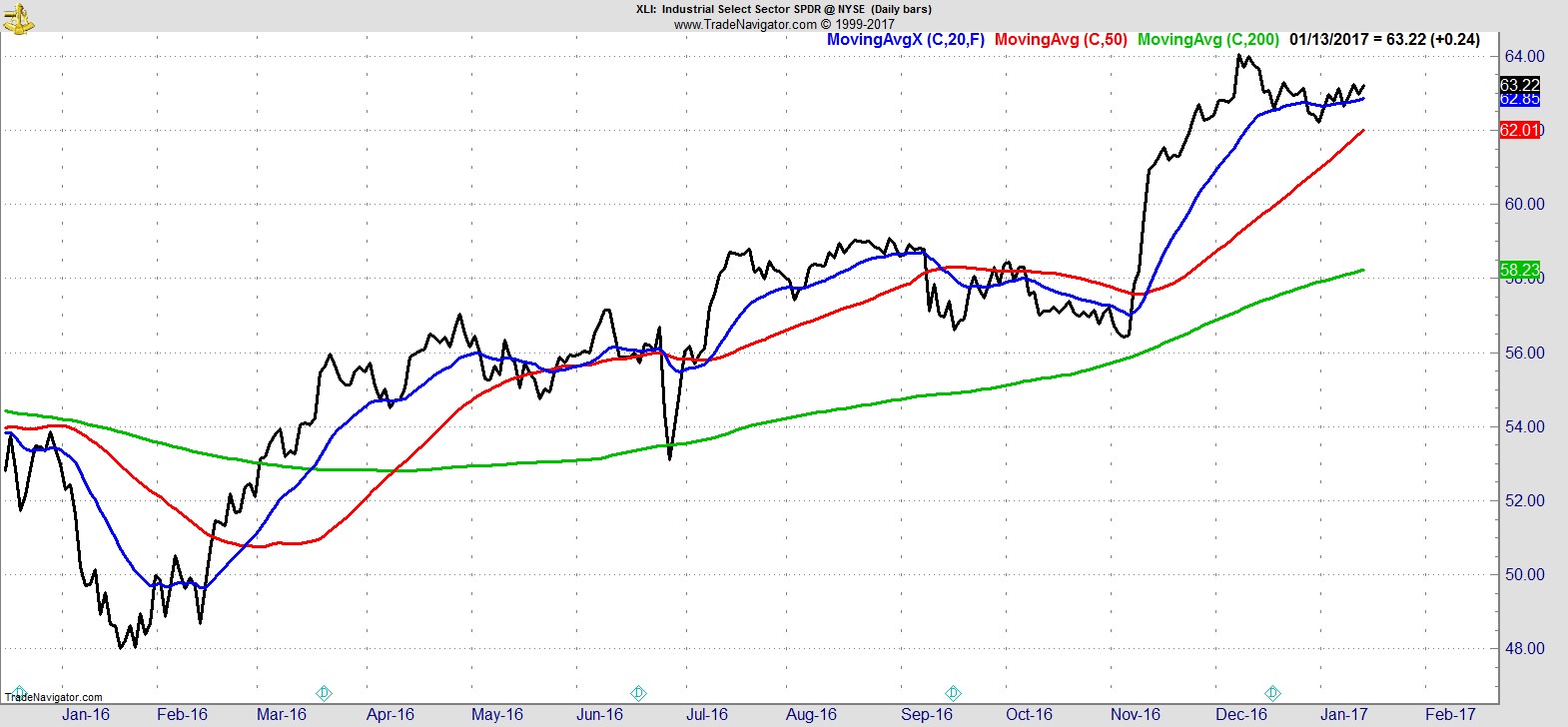

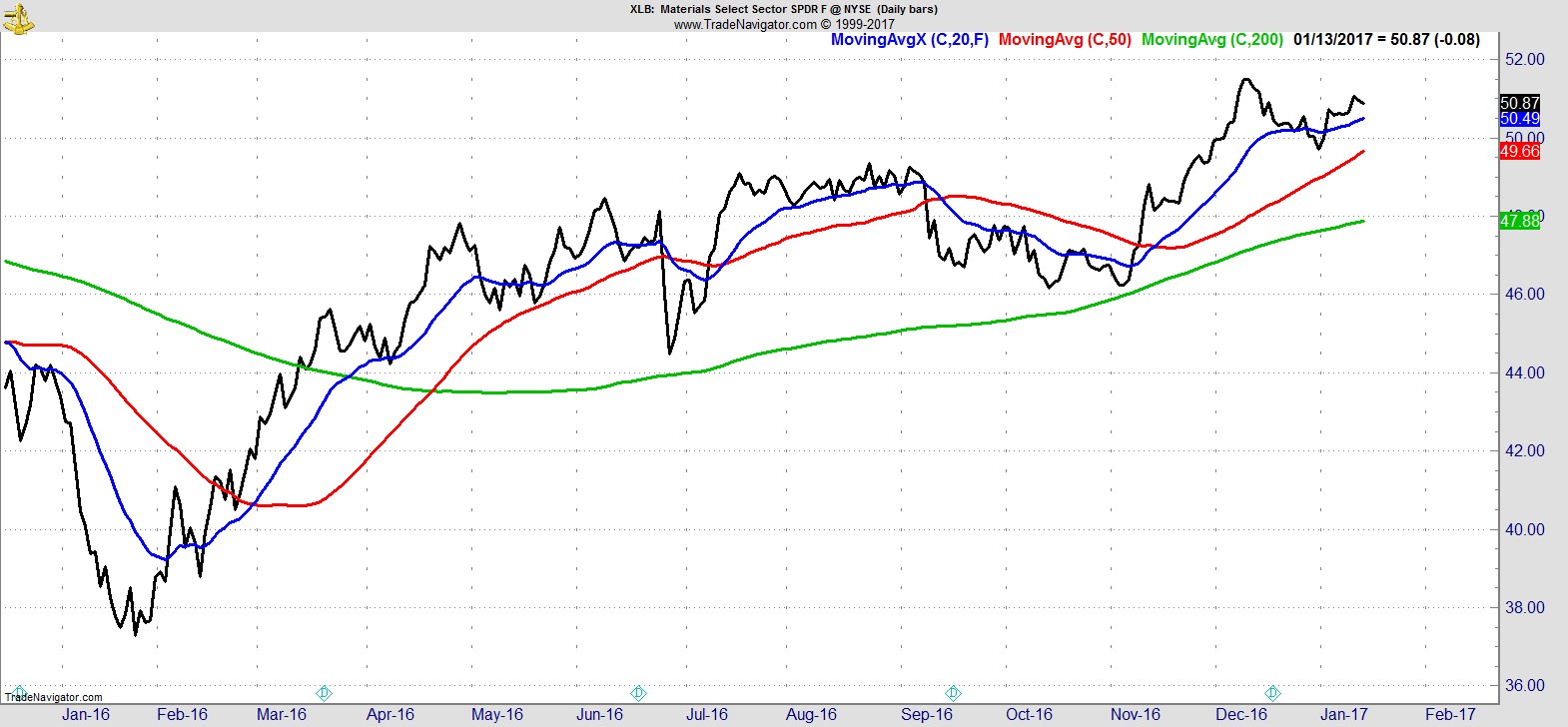

That's followed by a resurgent Consumer Discretionary sector, and the former leaders of Financials, Industrials, and Materials which continue to consolidate just below their highs. All are above their 20, 50, 200-day MAs.

.

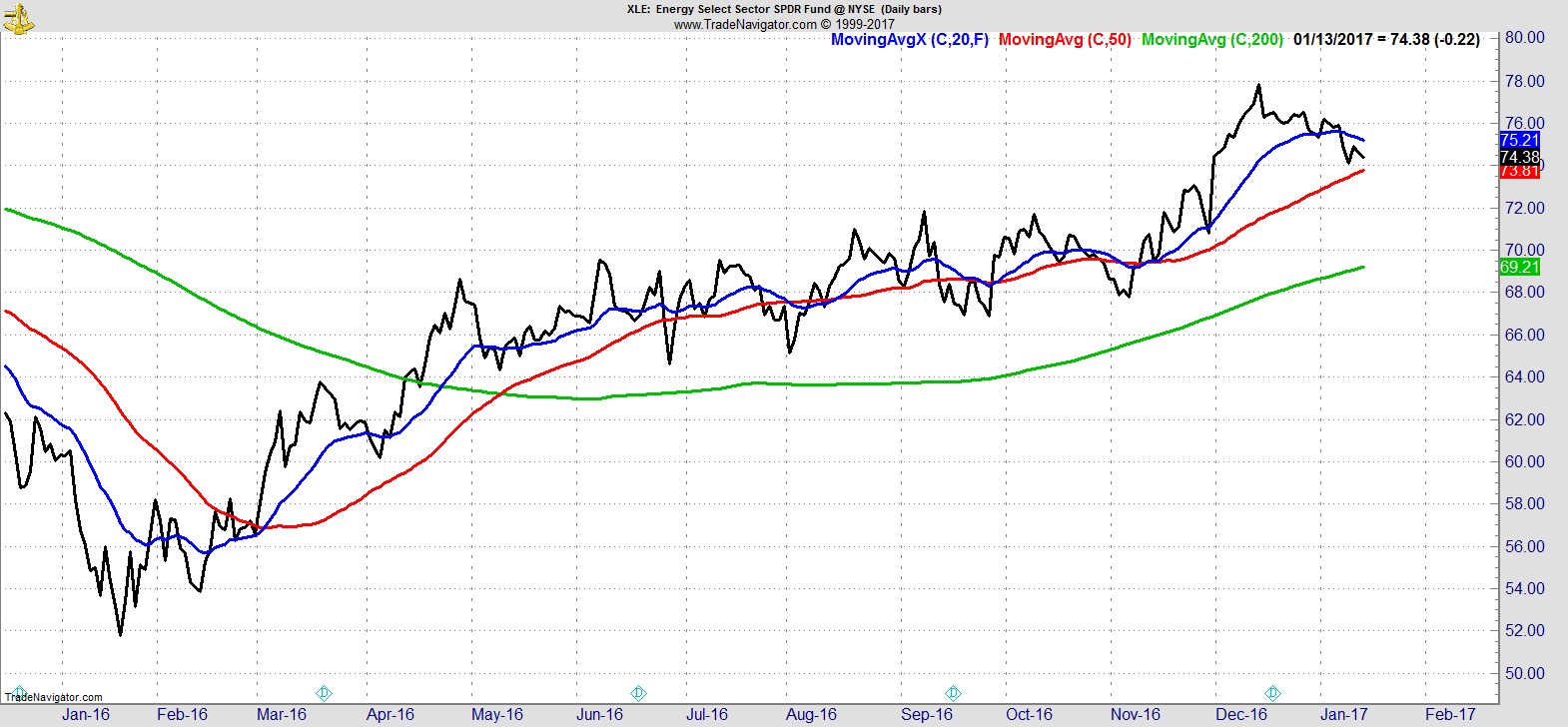

Next comes Energy which has continued its retracement to just above its 50-day MA, but remains in a strong uptrend longer-term.

.

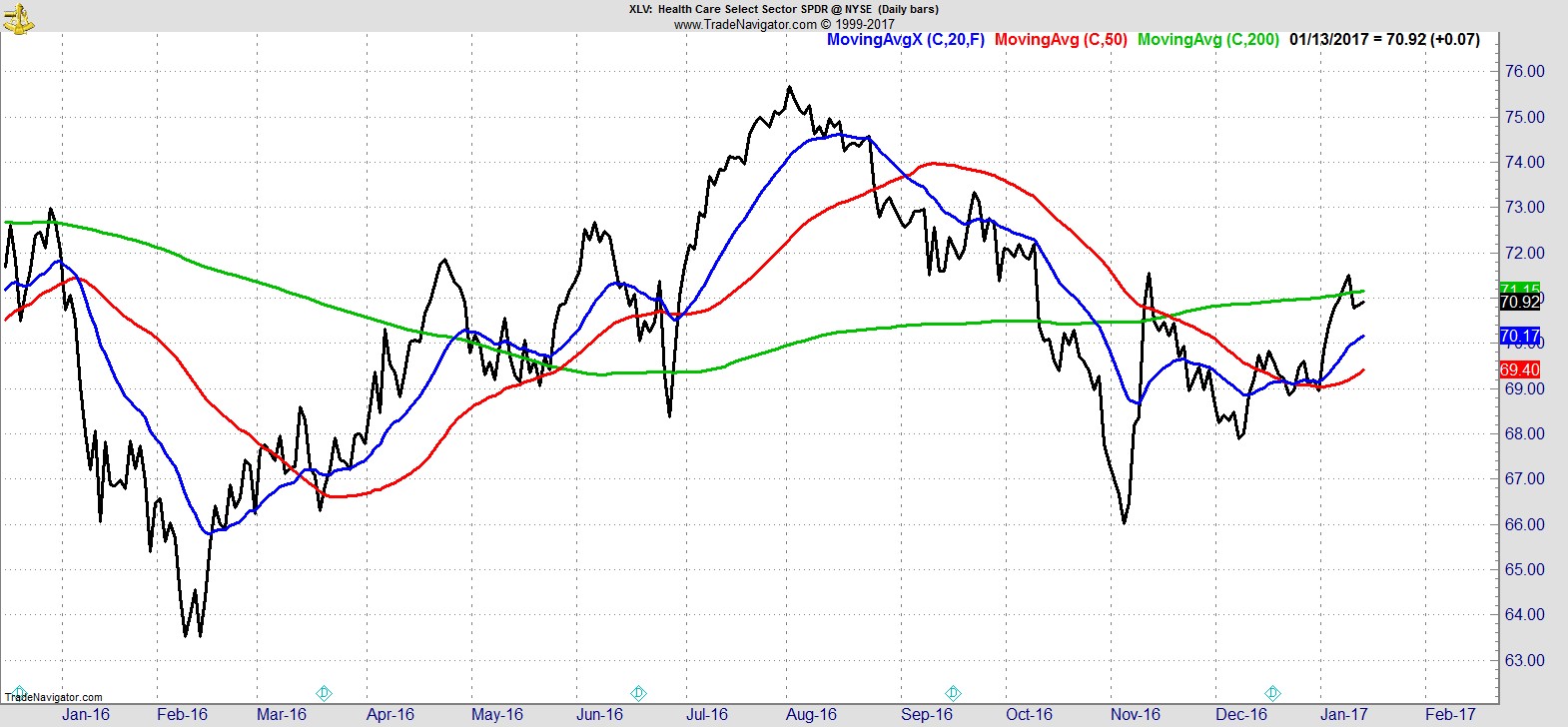

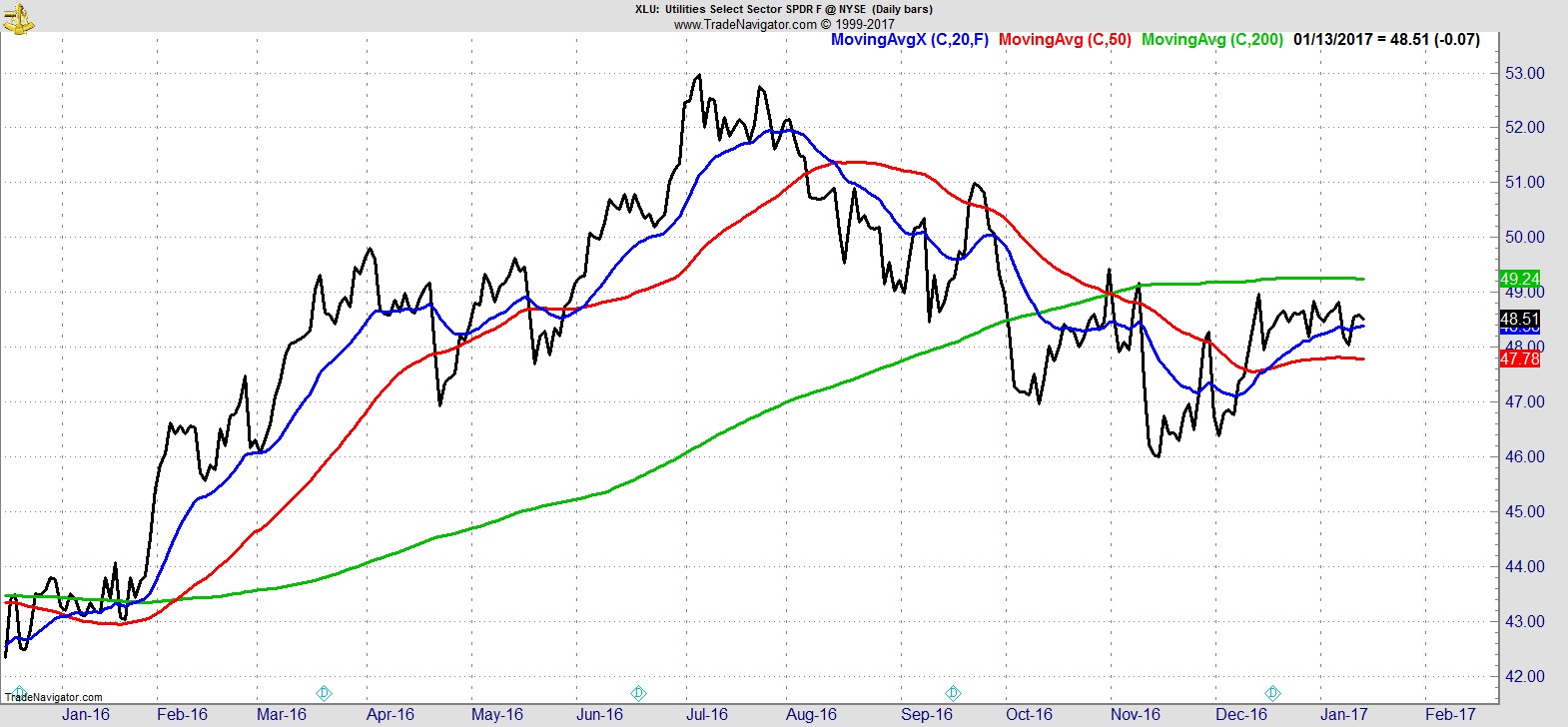

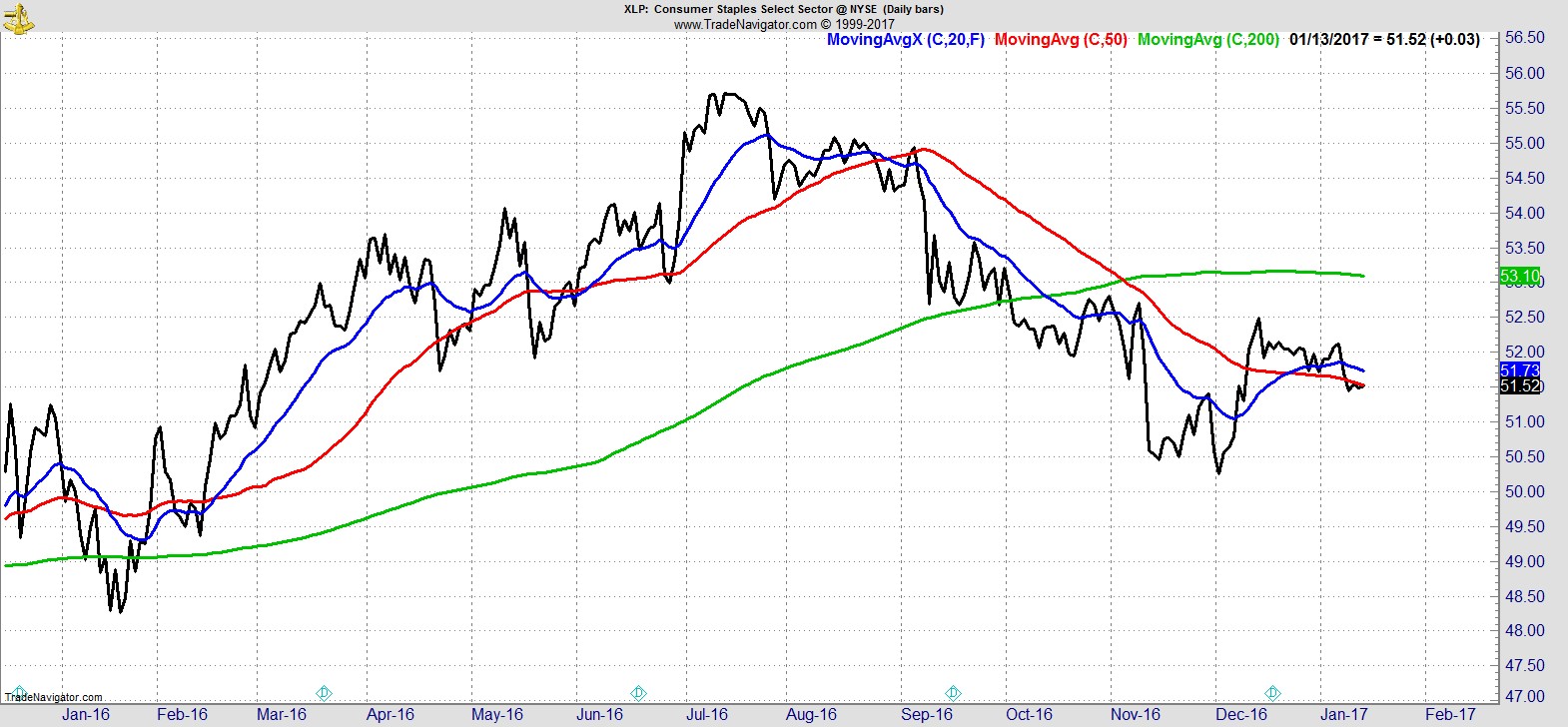

Bring up the rear are Healthcare, Utilities, Real Estate, and Staples which are all below their 200-day MA, and appear to be rangebound or worse on an intermediate-term basis.

.

Alpha Capture Portfolio

Our model portfolio edged higher +0.2% on the week vs -0.1% for the S&P. That takes it to +1.3% YTD. Heading into next week there will be 12 open positions, around 20% cash, and open risk of just under 9%.

.

Watchlist

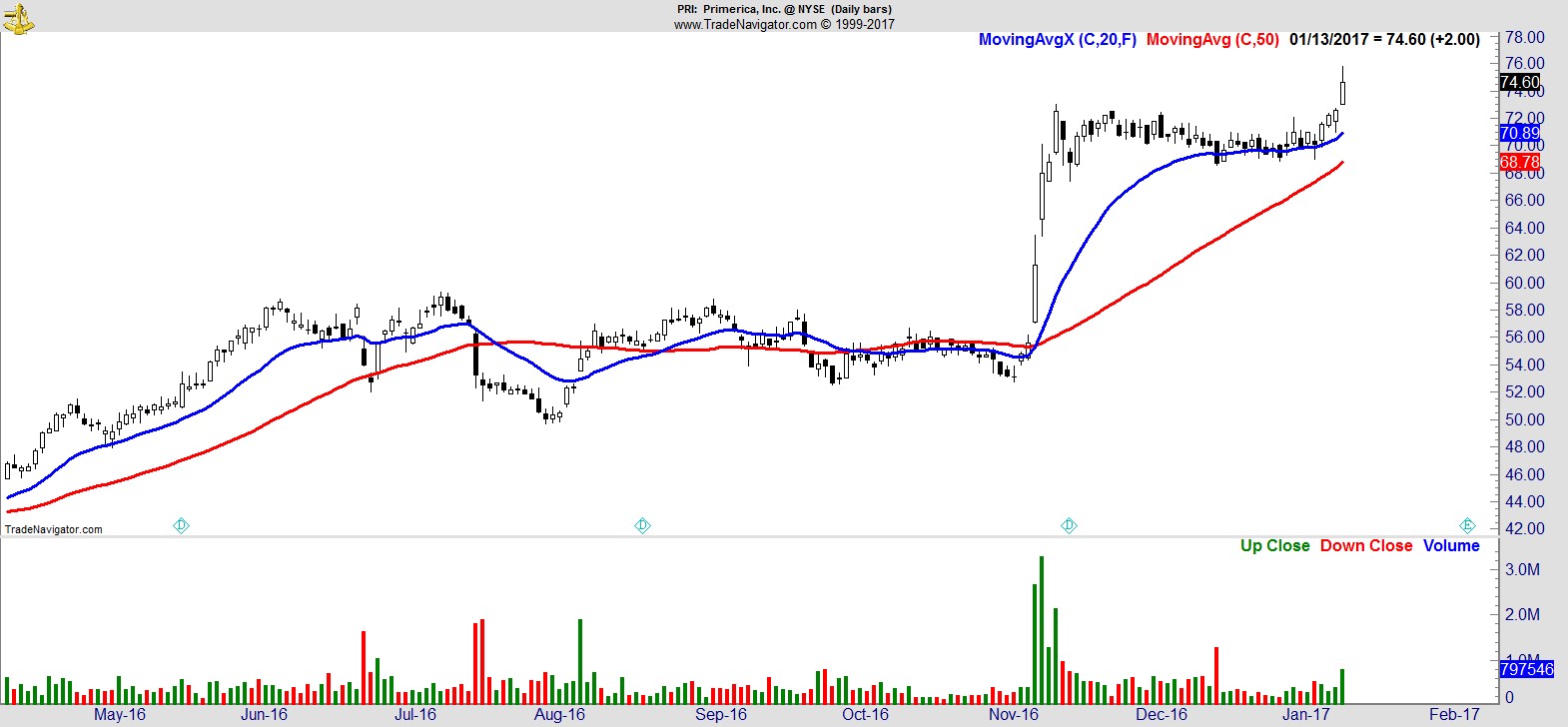

Once again our list reflects the strongest areas of the market for our timeframe, with representation from tech, consumer discretionary, financials, industrials, materials, and energy. That's been the case for many weeks now.

Despite the laggard sectors being off their lows, there's still very little coming through for us. It may require them to reclaim ground above their 200-day before we start seeing a reasonable showing.

Here's a sample from the full list of 30 names:-

$PRI

.

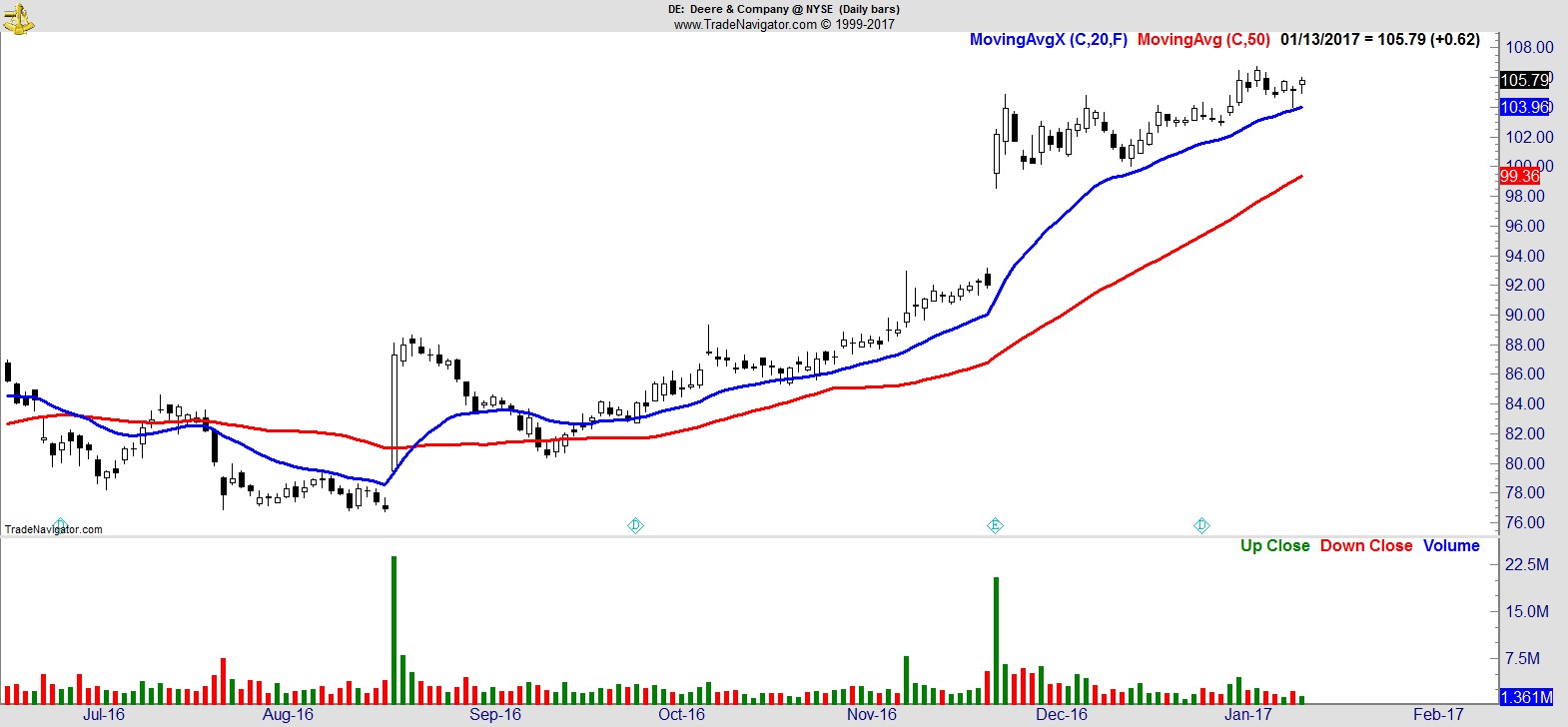

$DE

.

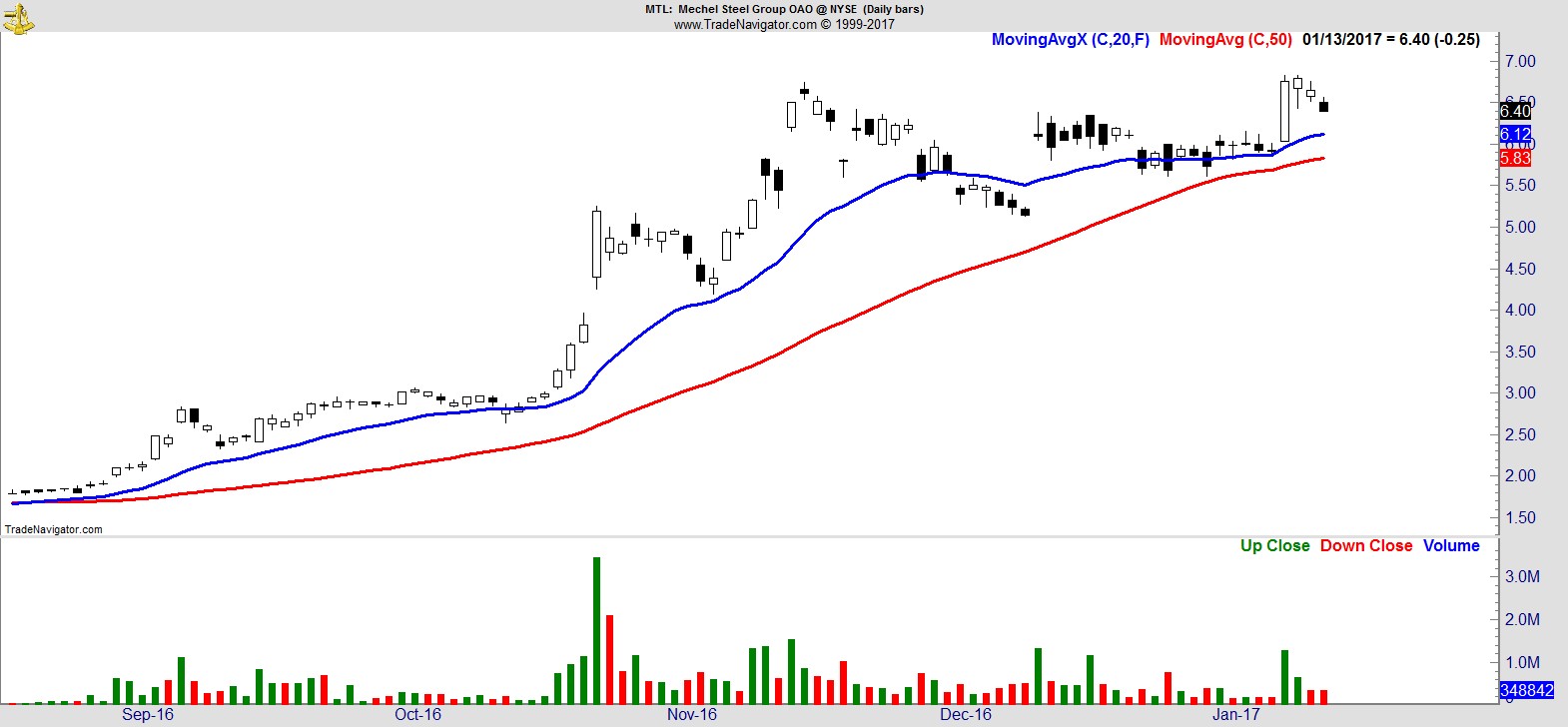

$MTL

.

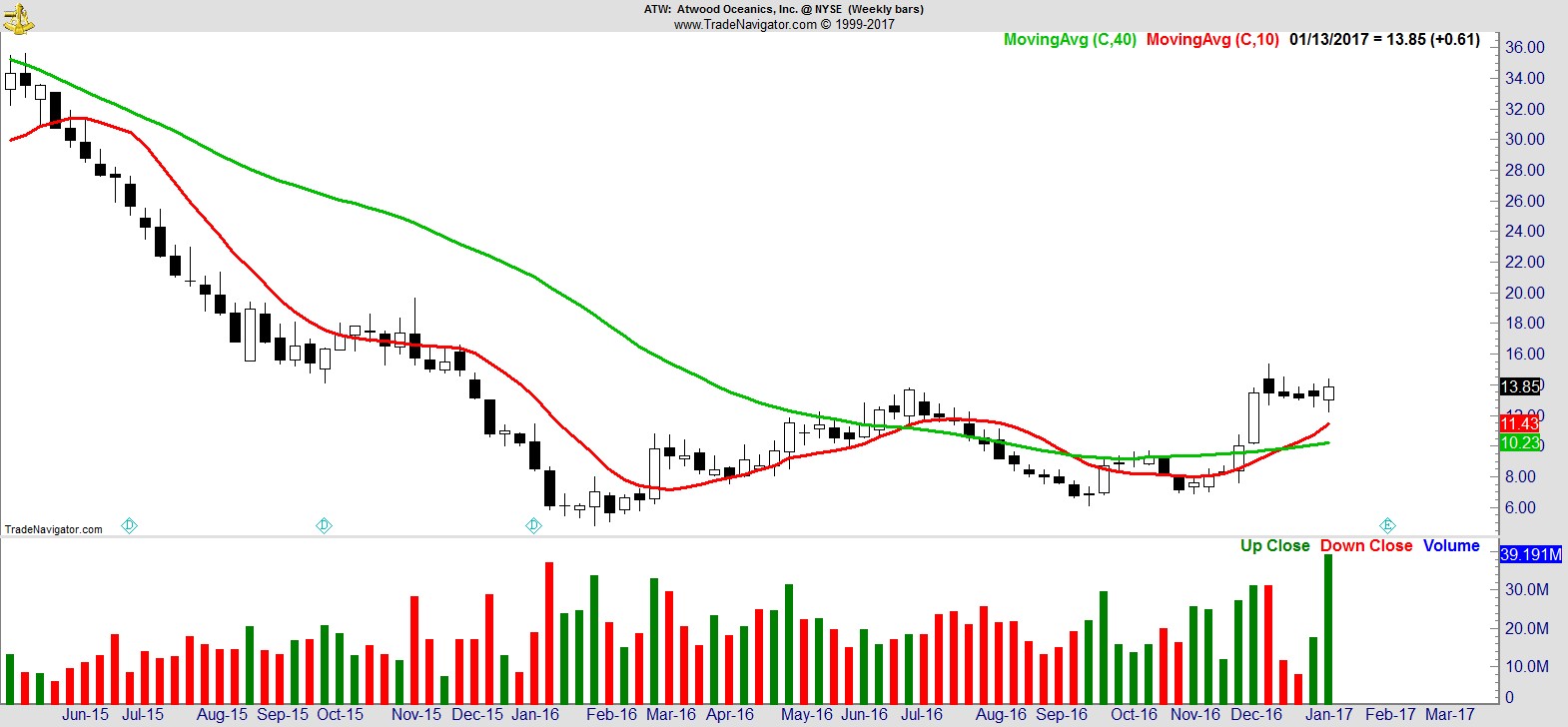

$ATW

.

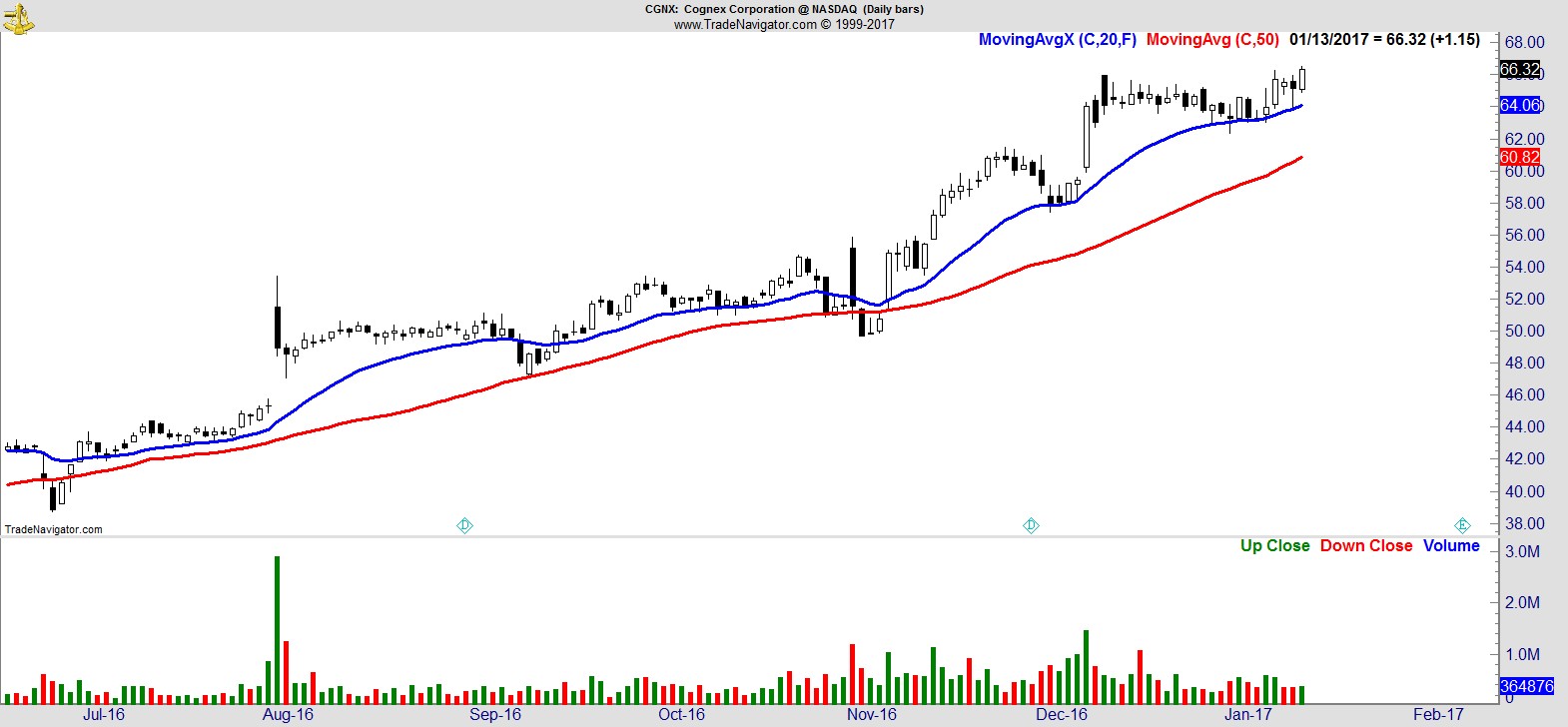

$CGNX

.

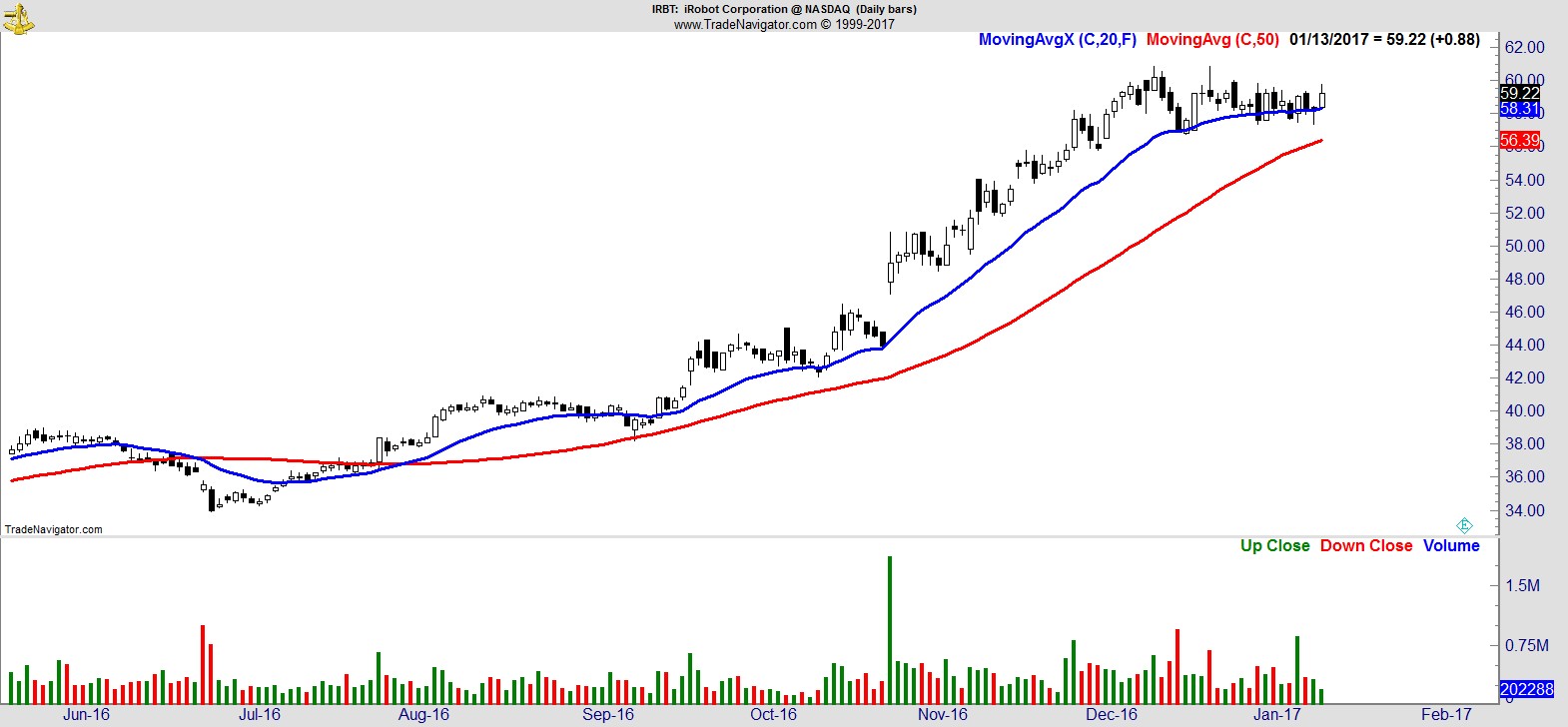

$IRBT

.

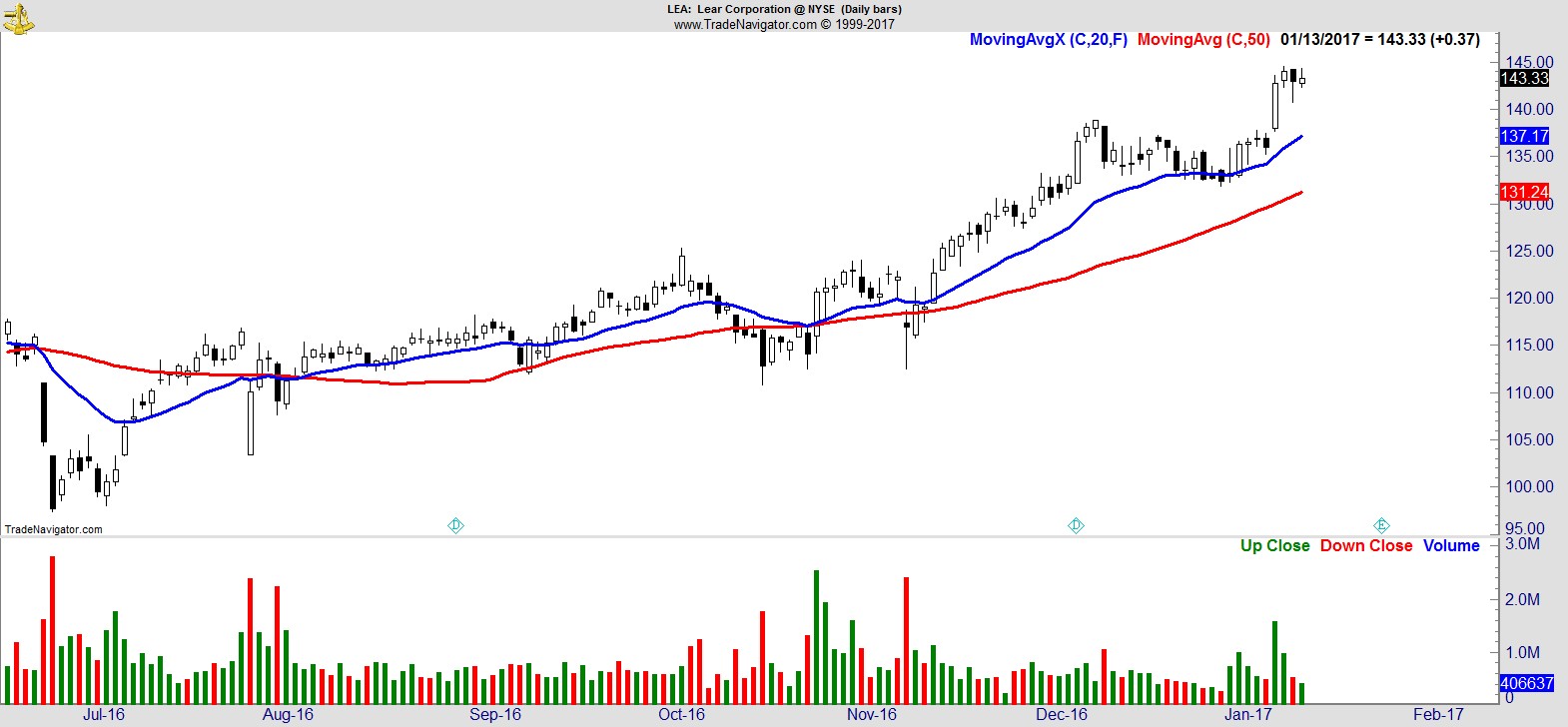

$LEA

.

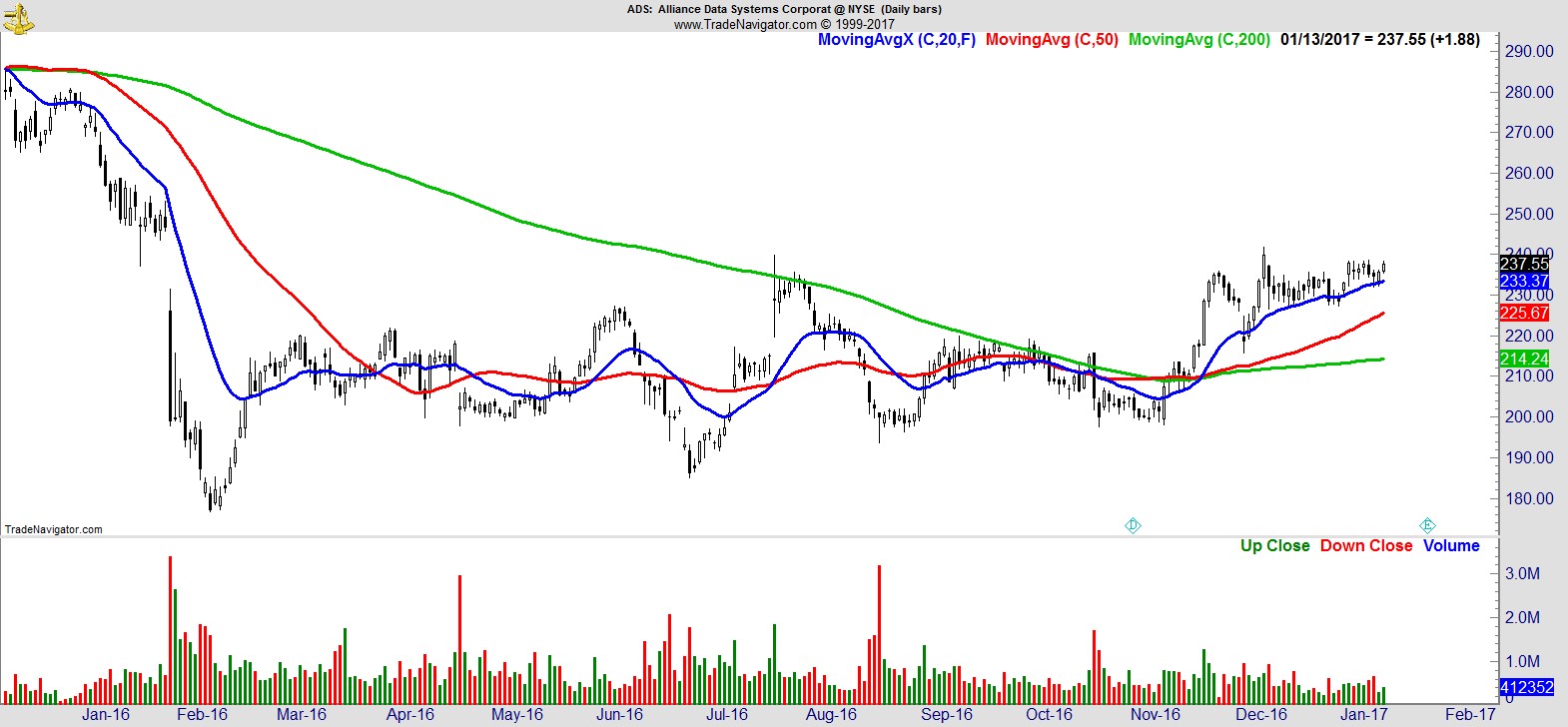

$ADS

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17