In yesterday's weekly indicator review, I noted that the colors were starting to change on some of our longer-term, big-picture market models. To be clear, this is NOT a reason to panic, don the helmet, or head for the hills. However, it is a reason to sit up, take notice, and pay attention because all may not be as it seems at this juncture.

I have said many times that you can often get the "message" from the indicator boards simply by glancing at the colors of the boxes. So, you don't need to be a technical geek and/or plow through 50 model readings in order to get something out of my weekly update. A lot of green is good, yellow means caution, and red, well, you get the idea.

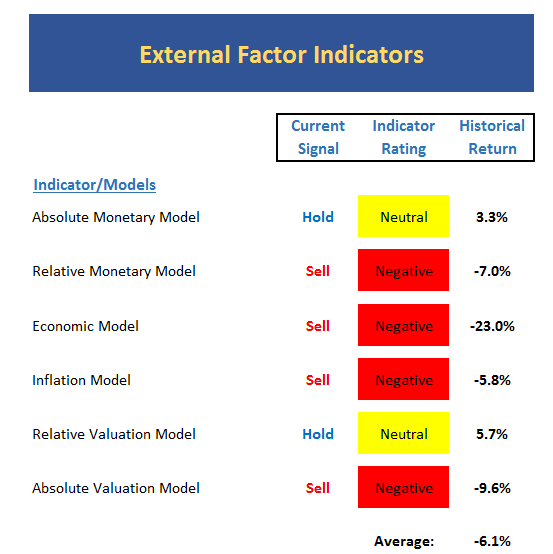

Here's the gist of yesterday's report in two indicator boards. The first covers the "external factors" of the market. This is big-picture, non-trend stuff like interest rates, economic conditions, inflation and valuations. This board doesn't change much and for quite some time, it has sported a decent shade of green. In short, this told us that the odds favored the bulls.

However, check out this week's board:

That's a lot of red, right? And it is worth noting that there is nary a single green box on the board. Uh oh!

But let's remember that these types of models are designed to give us a feel for the state of the environment - and NOT when to buy or sell. Another way to look at this board is it tells us what type of winds investors are experiencing on their journey. A lot of green on this board means investors can expect a nice tailwind and a shorter-than normal flight while red suggests a stiff headwind, which usually means your flight is going to take a bit longer than normal.

My view on the message from this board is: rates are rising, inflation is heating up, and valuations are stretched. Which, when you say it out loud, doesn't sound so good.

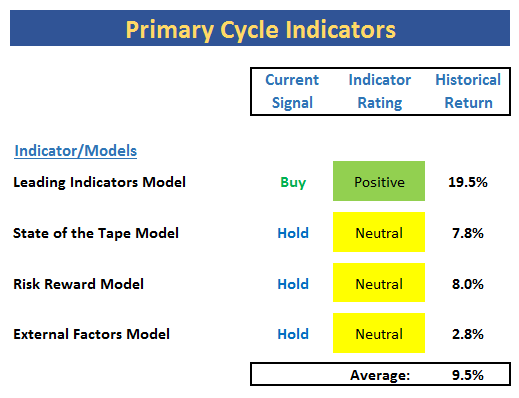

Then there is the Primary Cycle board, which is basically a group of my favorite longer-term models. In short, I use this combo to remind me which team is likely to remain in control of the game. But again, none of these models are particularly good at "timing" when to take action. No, the goal here is to determine the big-picture environment, so that one can attempt to play the game accordingly.

Looking objectively at these two boards, it is hard to be overly optimistic about stocks. One board is a sea of red and the other sports an abundance of yellow.

However, this is when understanding the components of the models can be of helpful. And in my humble opinion, things aren't as bad as they may look.

You see, the External Factors board is basically waving one big sign that reads, "Beware - Interest Rates Are Rising!" And then another that says, "Inflation is Heating Up."

The problem is that when looking back at history, stocks don't tend to fare well when rates are rising, inflation is heating up and valuations are high.

Yea, But...

It is said that in the investing game, the quickest way to financial ruin is to rely on the words, "But this time it's different." The idea here can be summed up by yet another well-known cliché. "Those who ignore history are doomed to repeat it."

However, it is important to recognize that while interest rates are indeed rising, they are (a) moving up from all-time lows and (b) rising for the right reason!

As such, it can be argued that unlike prior rising rate cycles, this time rates are not likely to "bite." It is also worth noting that this time around, the Fed is most definitely not trying to fight inflation or slow the economy. No, Janet Yellen's merry band of central bankers is merely trying to return rates to more normalized levels.

Put another way, the patient (the U.S. Economy) no longer requires life support (the extreme measures taken by the Fed to keep the economy out of a deflationary cycle). And from a medical perspective, this is usally a good thing!

Next, let's remember that inflation is currently the GOAL - and NOT the problem it has been in the past. Lest we forget, the central bankers of the world have been trying everything they can think of to INCREASE inflation - not fight it.

Again, with inflation being the goal, it very well could that our inflation model itself is confused. You see, this time is quite a bit different from the cycles that the model has been designed to warn against.

So, will this time be different? We can't know for sure. But I can say that I am not quaking in my boots over the negative readings seen in the inflation and monetary models. In fact, I could argue that because of the way these models were built, the fact that they have now turned red, is actually a good thing during this cycle. Fingers crossed!

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies

2. The State of the U.S. Economy

3. The State of Global Central Bank Policies

4. The State of Bond Yields

Thought For The Day:

"Comparison is the thief of joy" - Theodore Roosevelt

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member