Overview

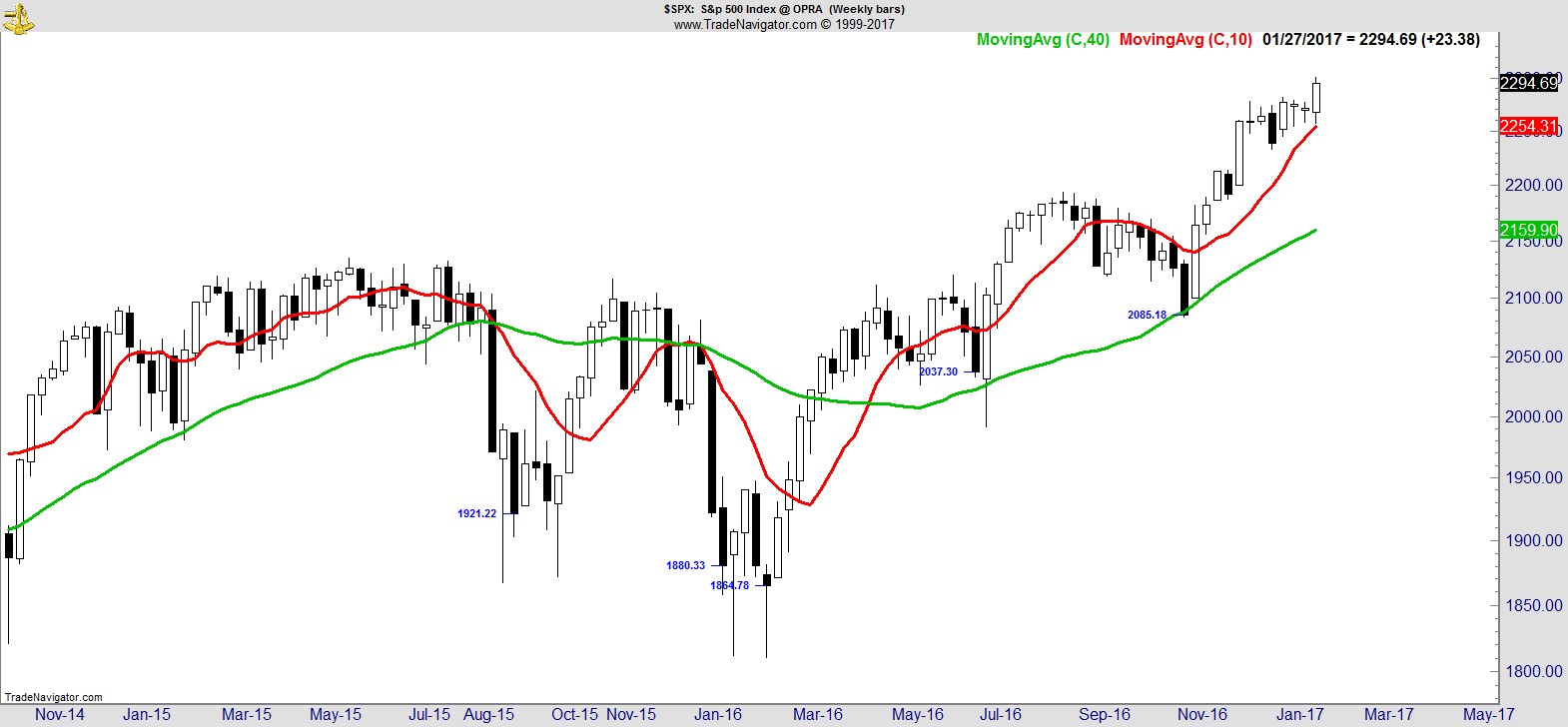

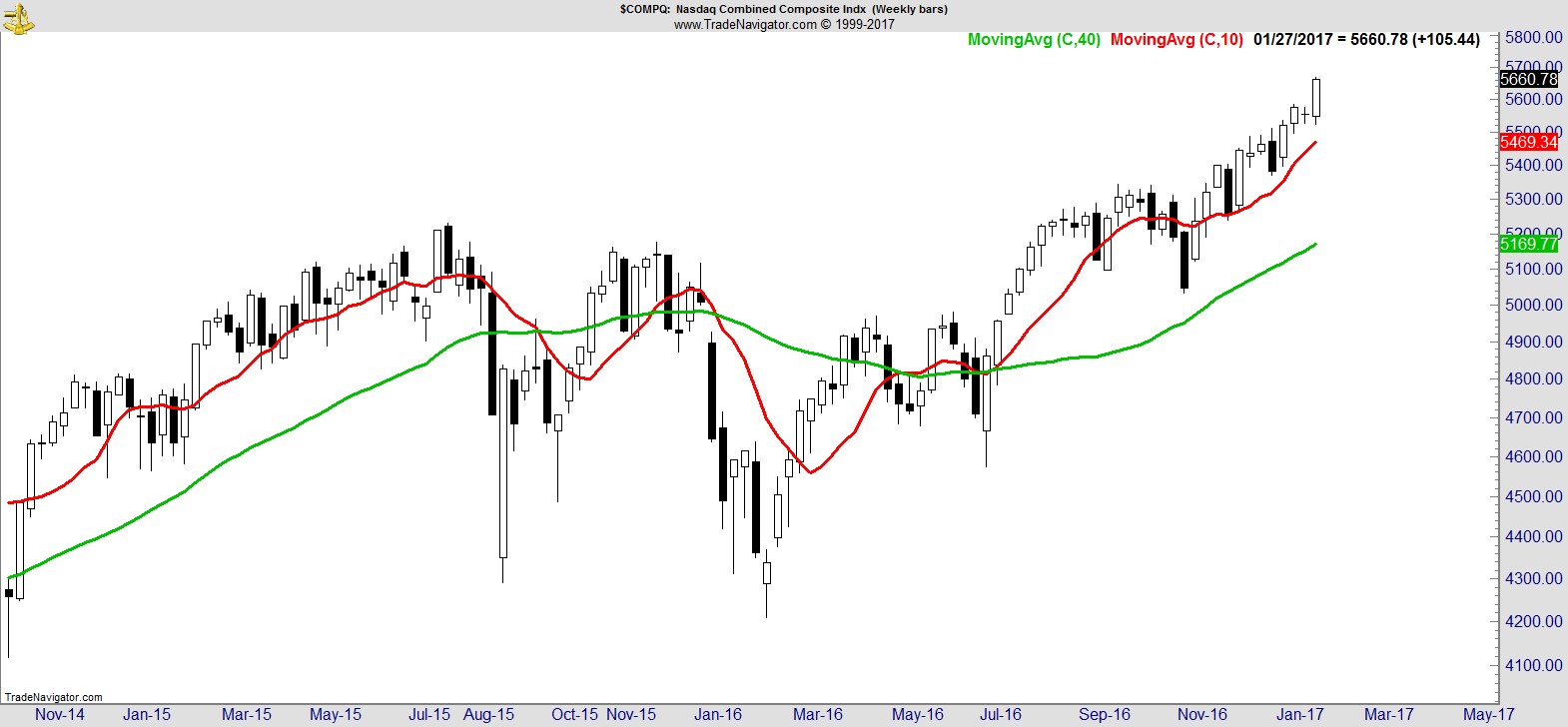

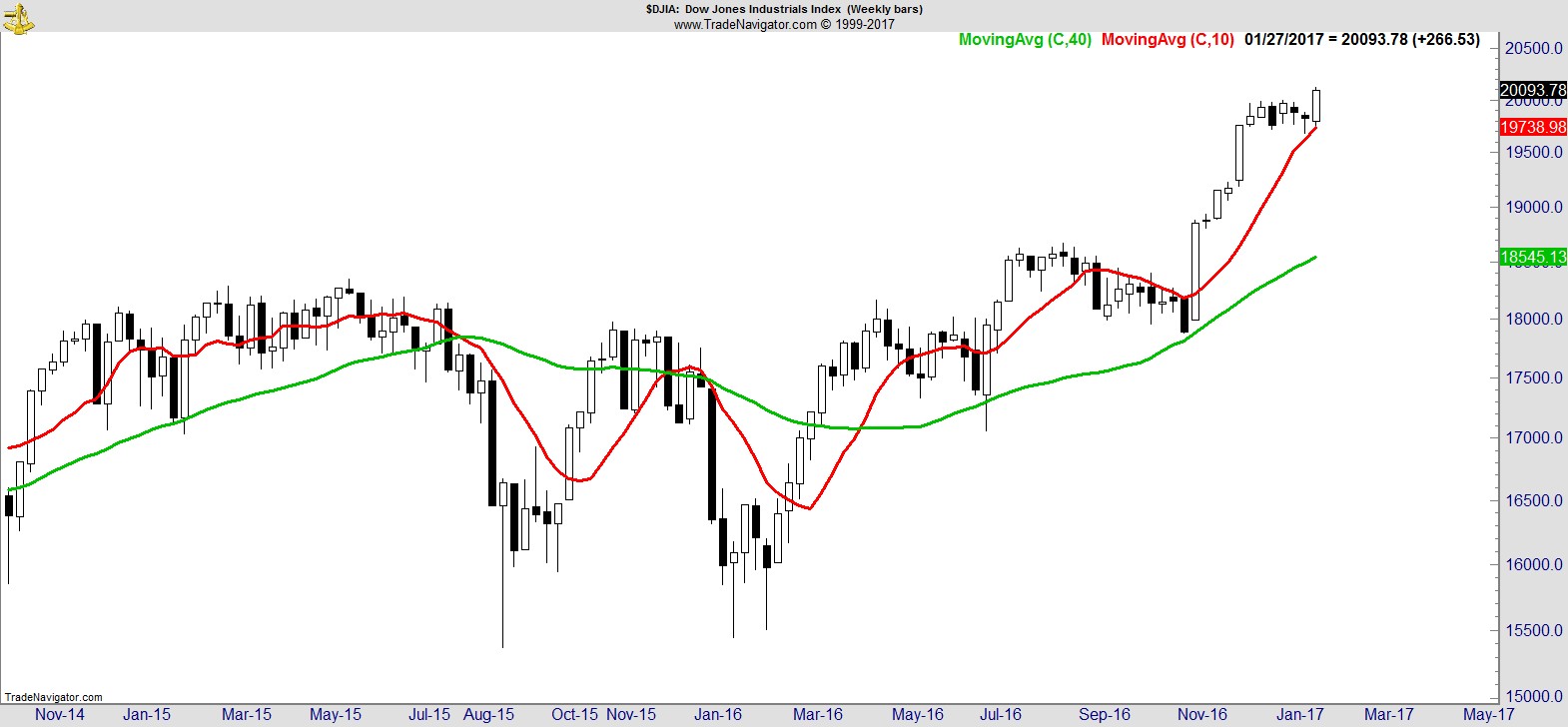

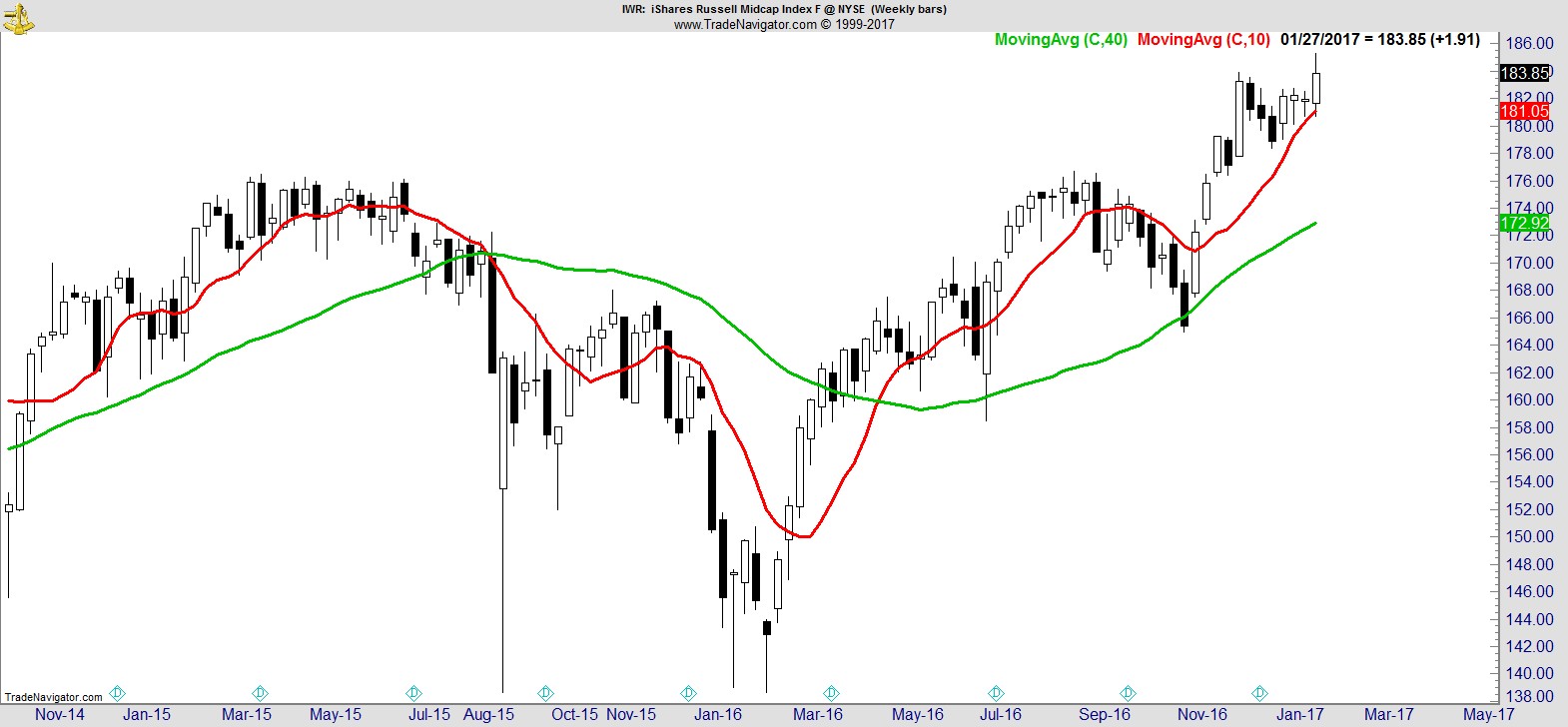

The S&P 500, NASDAQ, Dow Jones Industrials, NYSE Composite, Dow Transports, and Russell MidCap all closed at all time highs on a weekly basis. Breadth remains strong, and bullish sentiment is below its historical average.

.

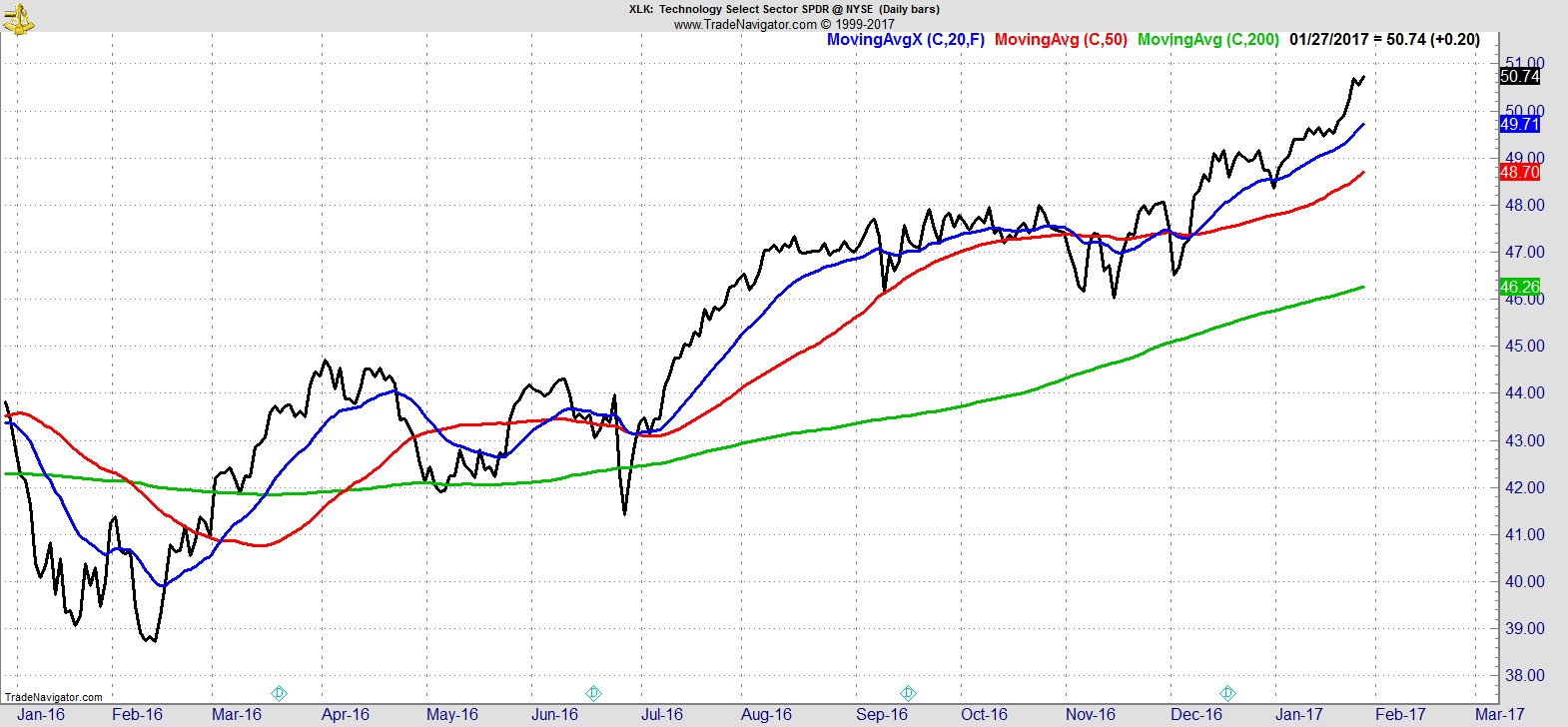

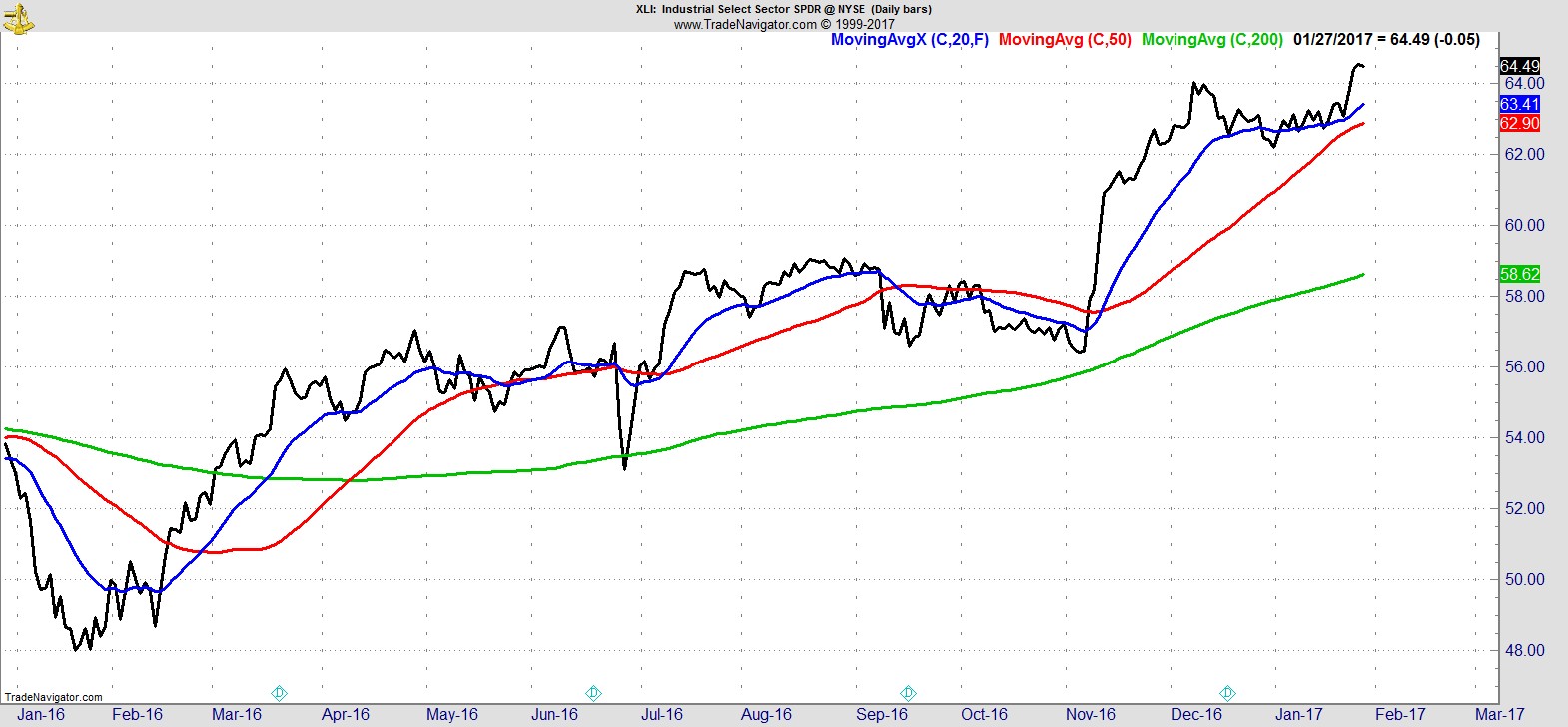

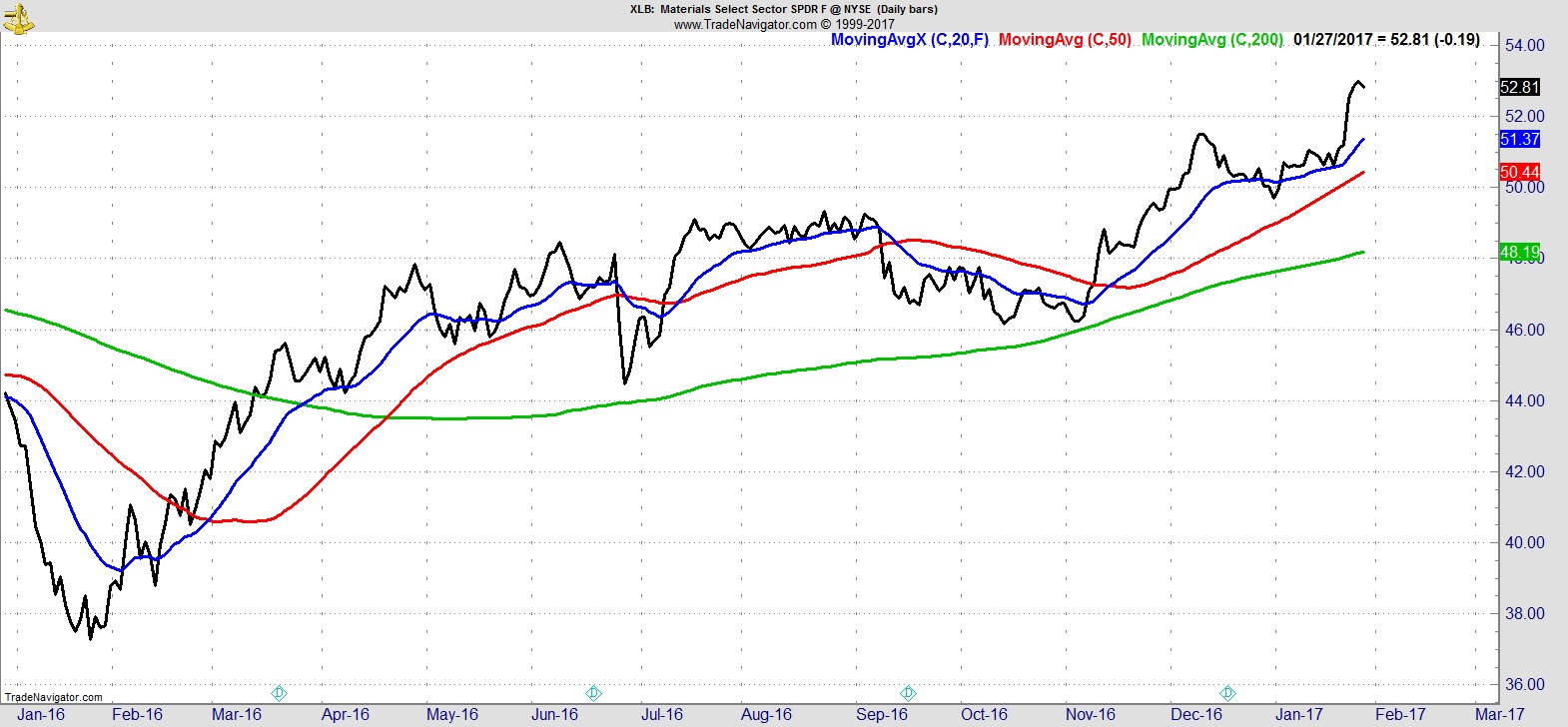

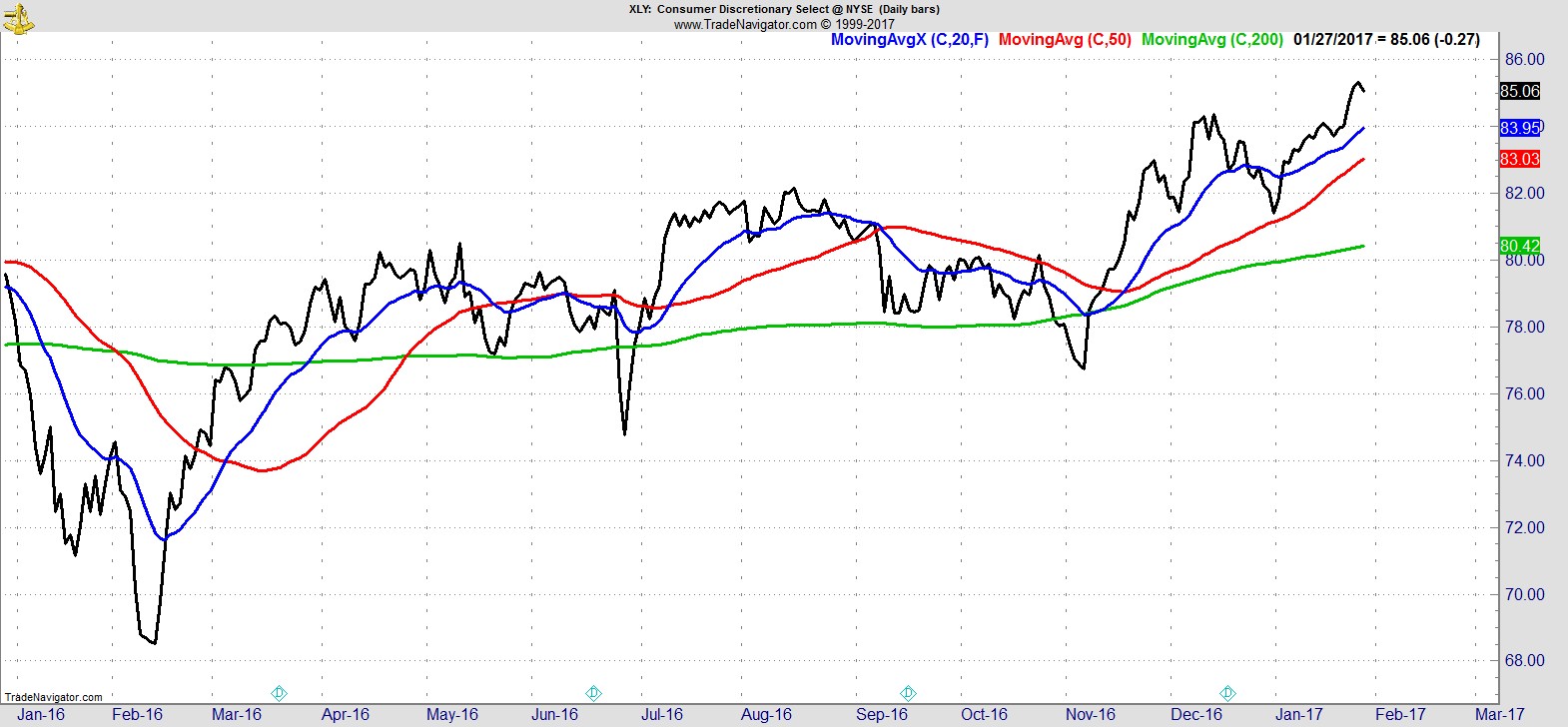

Sector Analysis

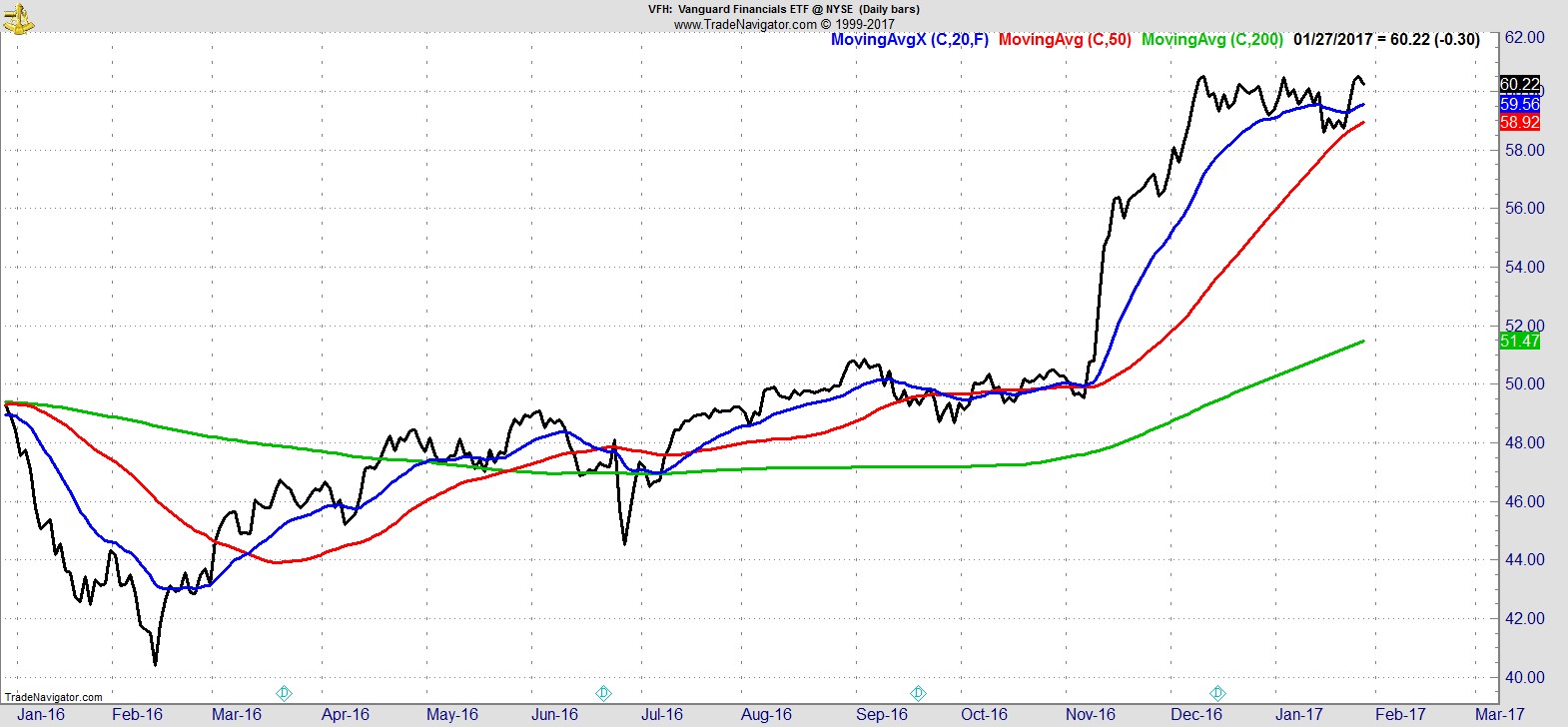

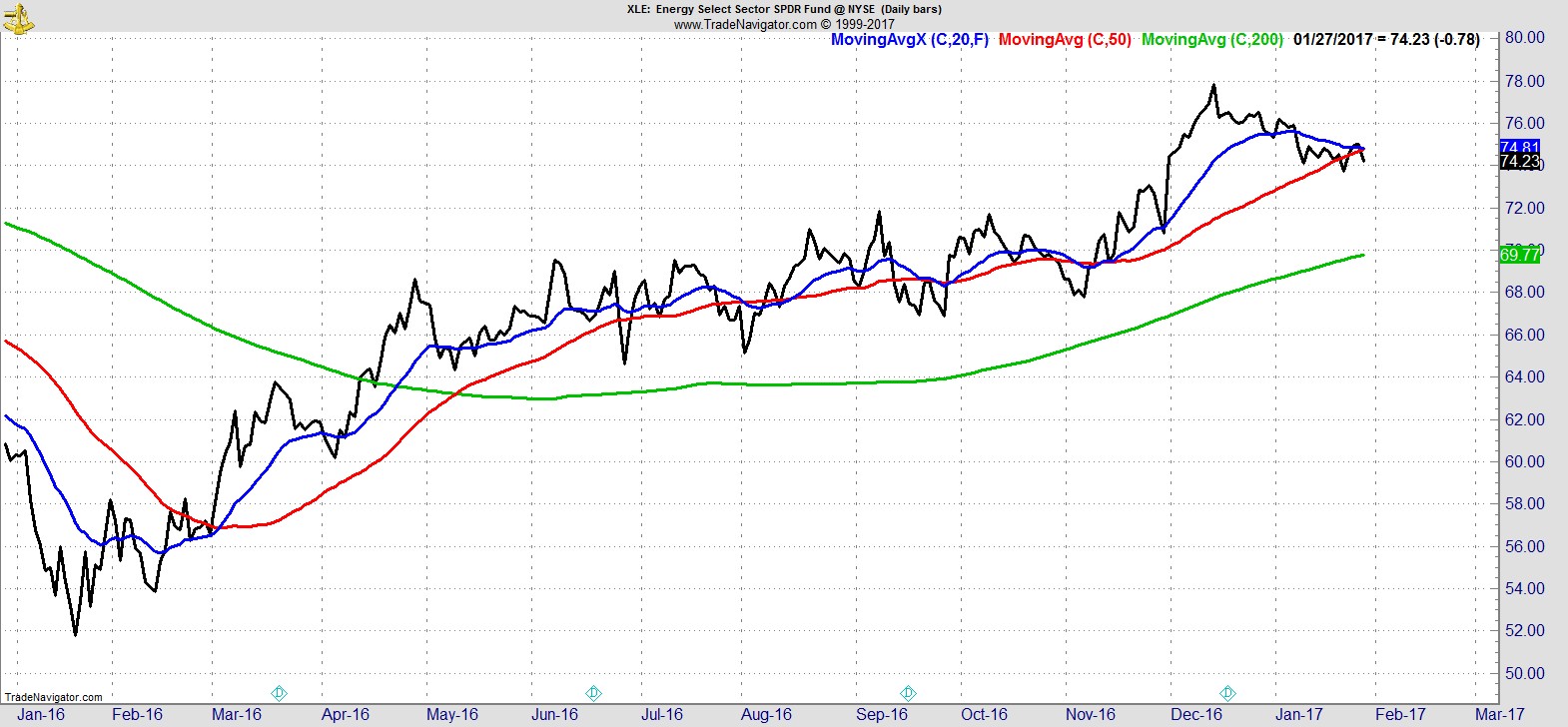

There's not much change at the top. Technology, Industrials, Materials, Consumer Discretionary, and Financials all made new highs this week. They're followed by Energy which remains above its 200-day MA but slipped below its 50-day this week.

.

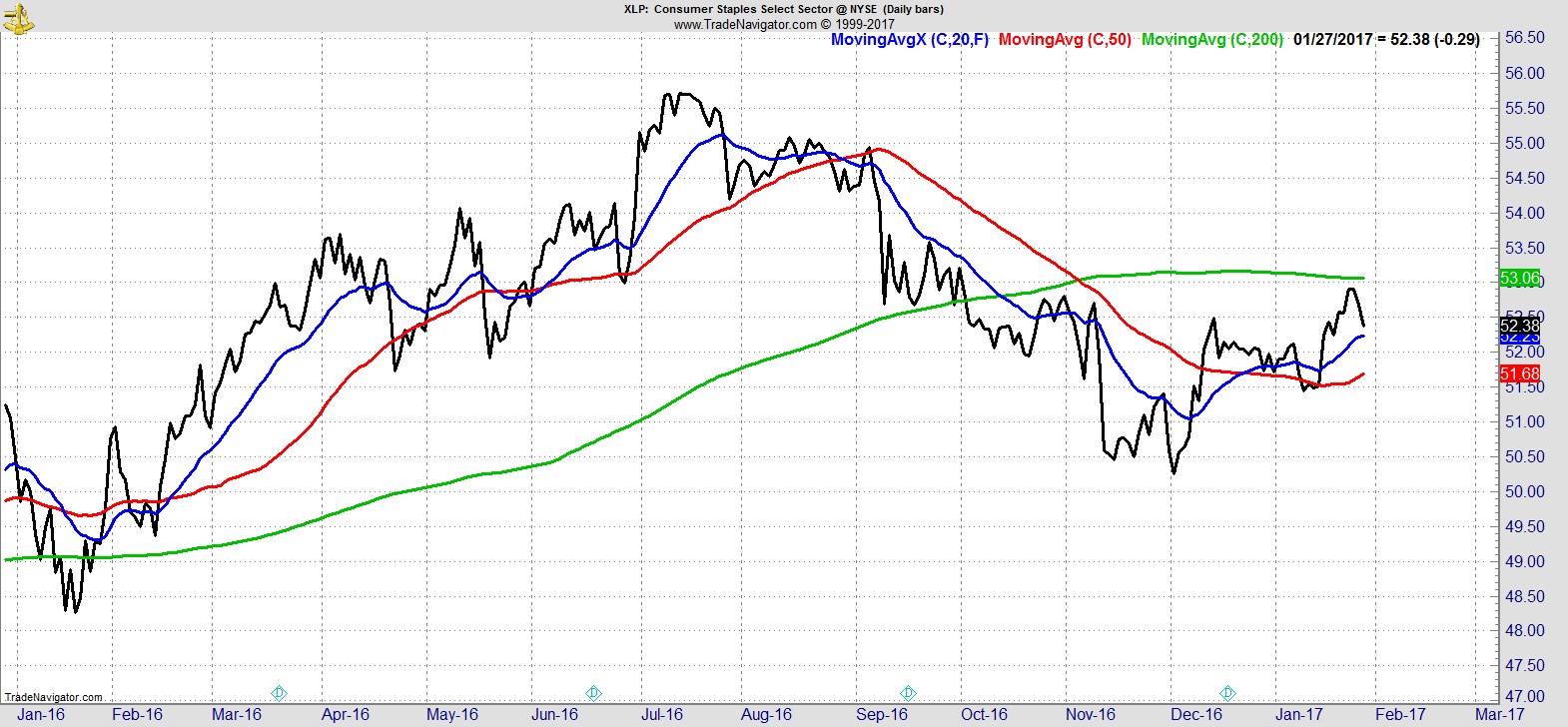

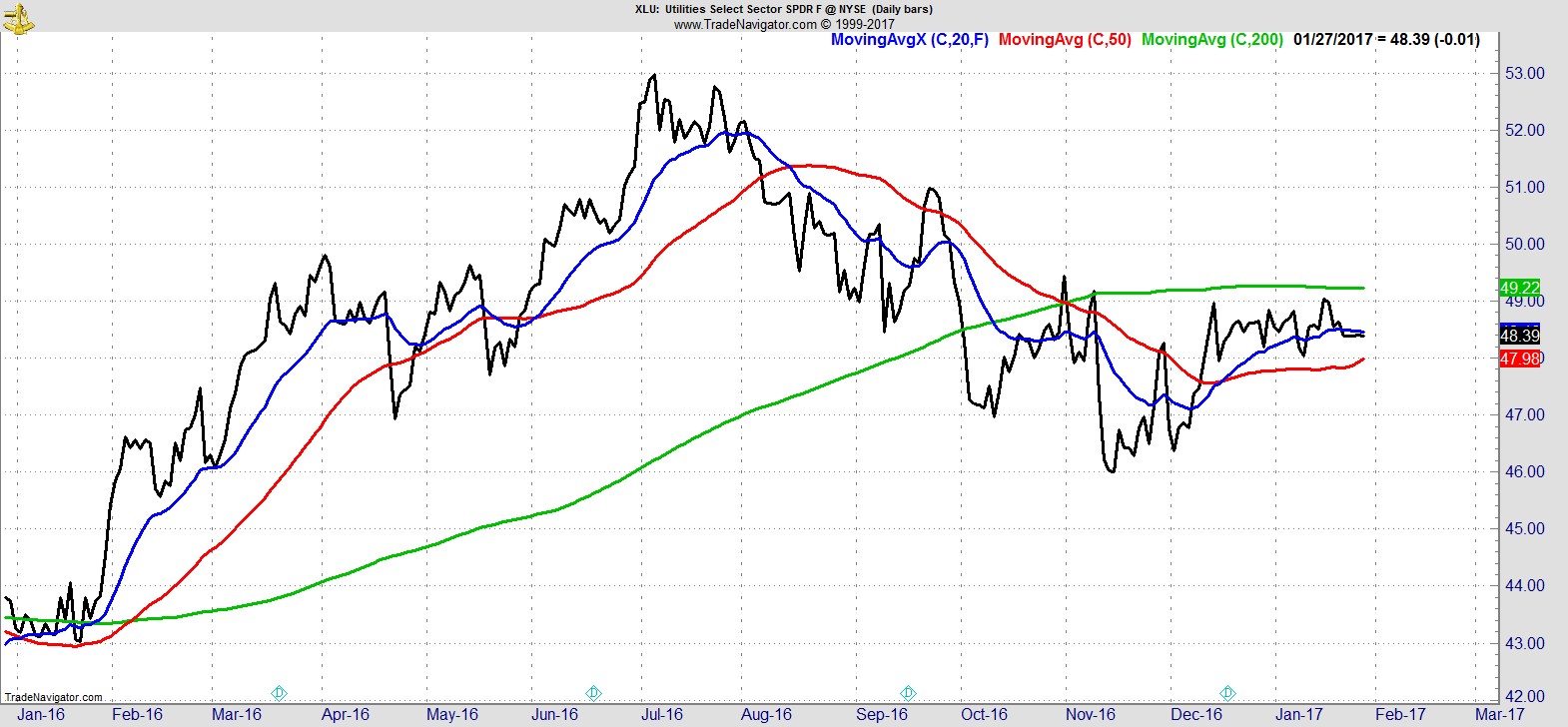

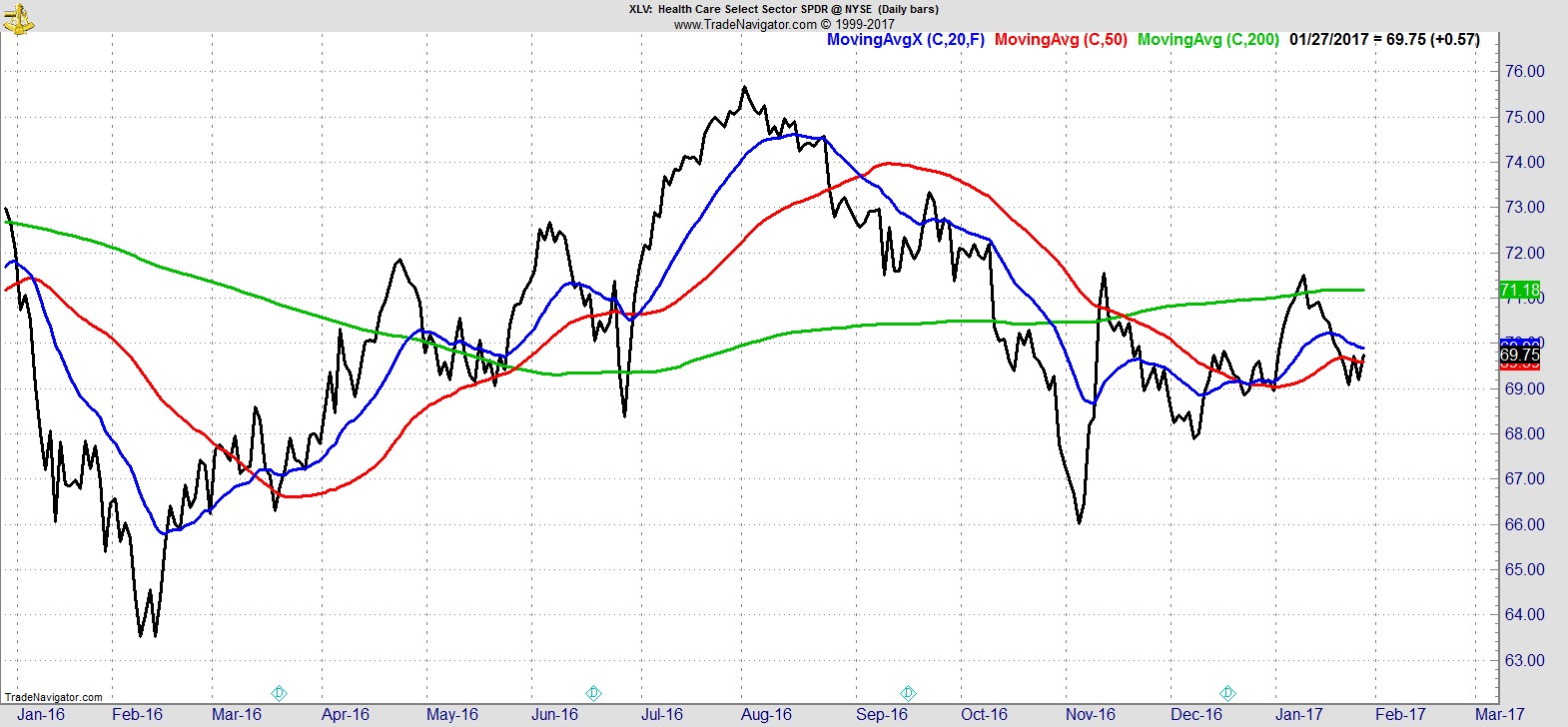

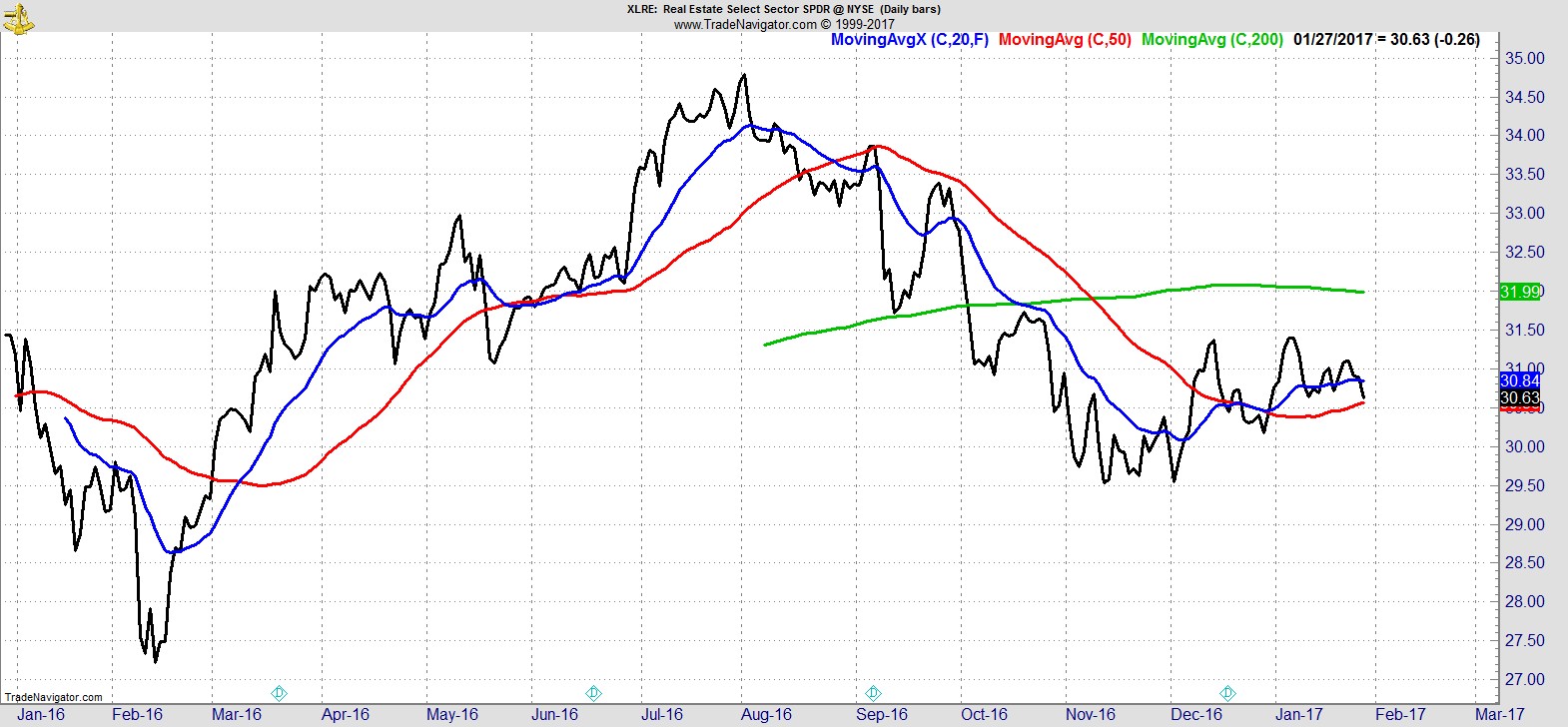

At the other end Staples, Utilities, Healthcare, and Real Estate all remain below their 200-day and in intermediate downtrends.

.

Alpha Capture Portfolio

Our model portfolio had a great week climbing +2.7% vs +1.0% for S&P 500. That takes it to +3.6% YTD.

This weekend we have a number of stops to trail higher, and one exit signal which will leave us with 12 names and around 20% in cash. Our open risk is back down to a more reasonable 6.3%, well below the double-digit levels it has seen in the last few months.

.

Watchlist

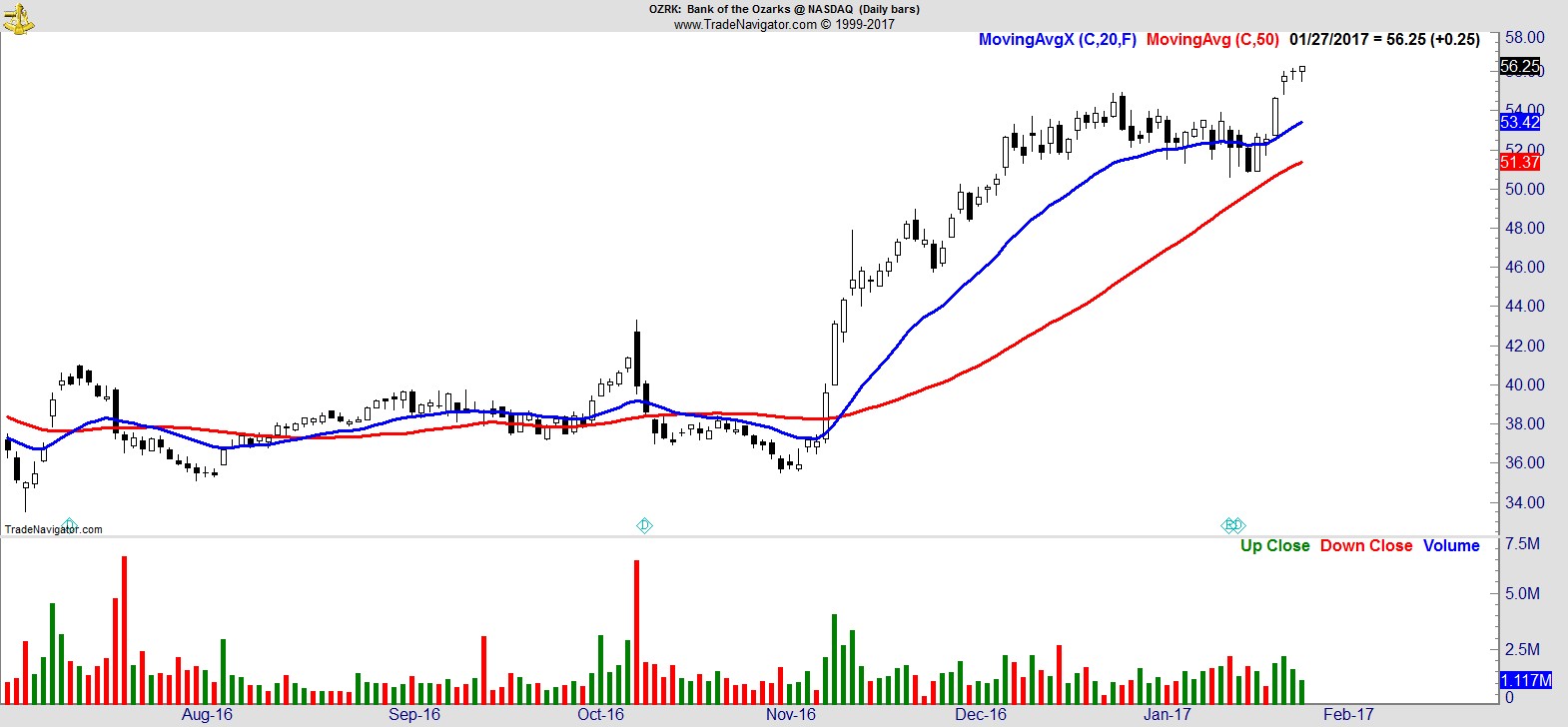

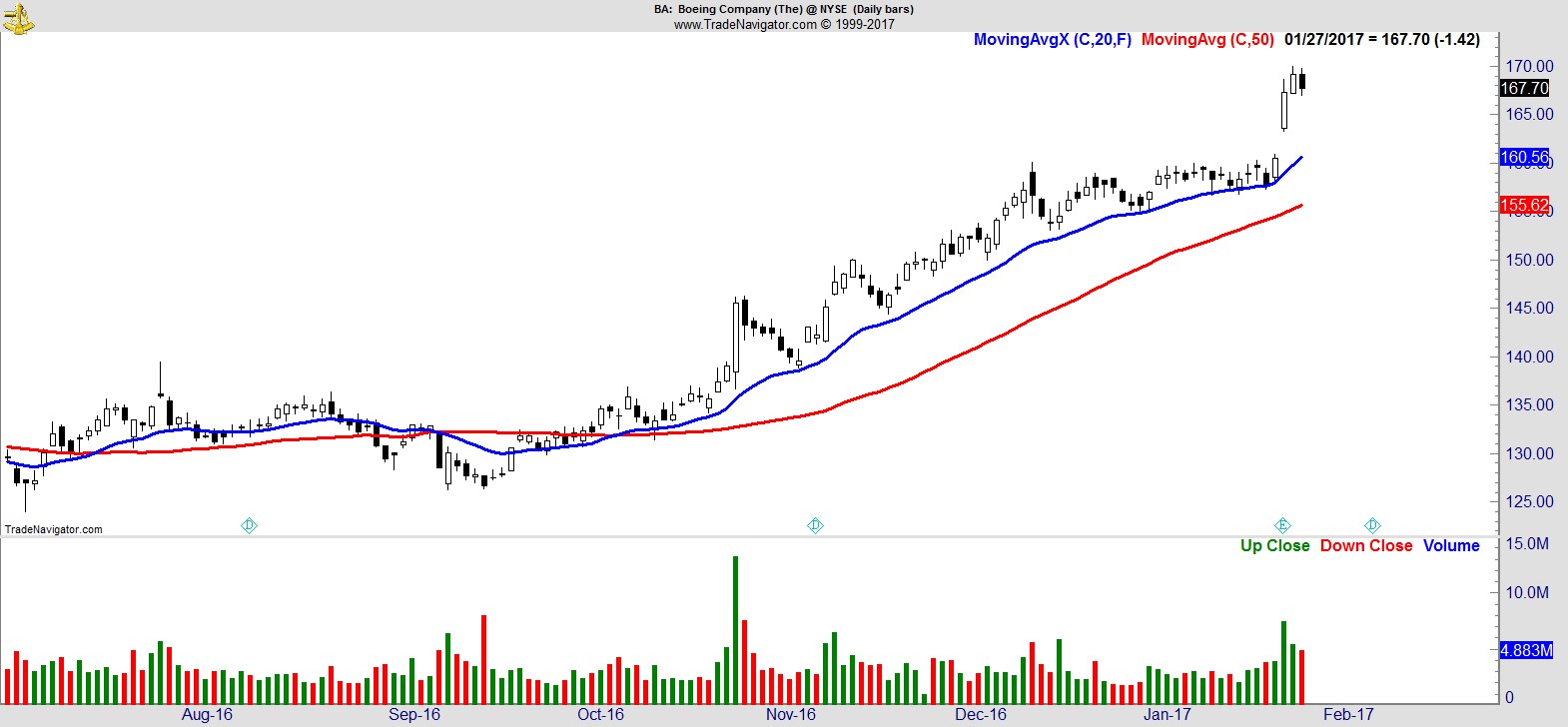

Once again our list is mostly made up of the major sectors leading this market; Technology, Industrials, Financials, Consumer Discretionary, and Energy/Materials.

Here's a sample from the full list of 30 names:-

$OZRK

.

$BA

.

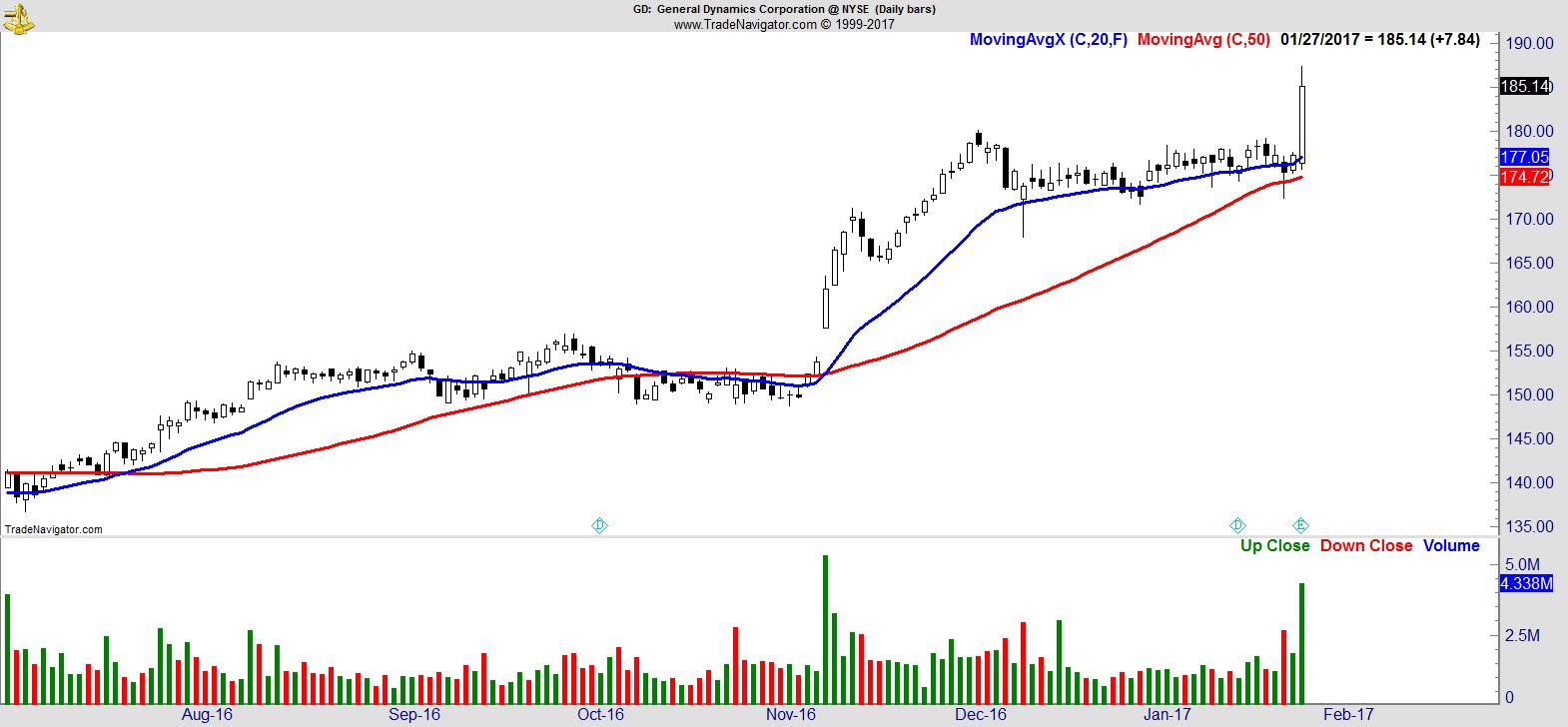

$GD

.

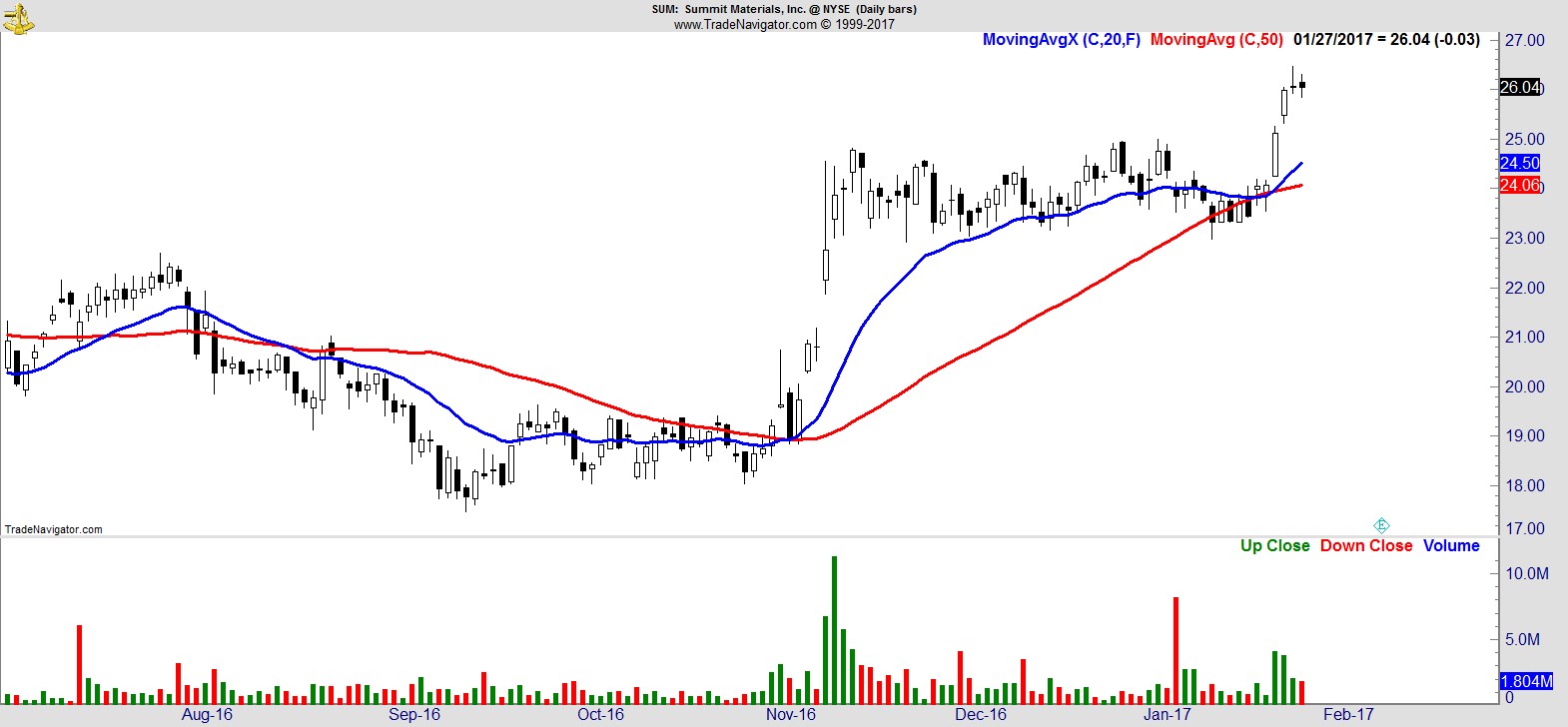

$SUM

.

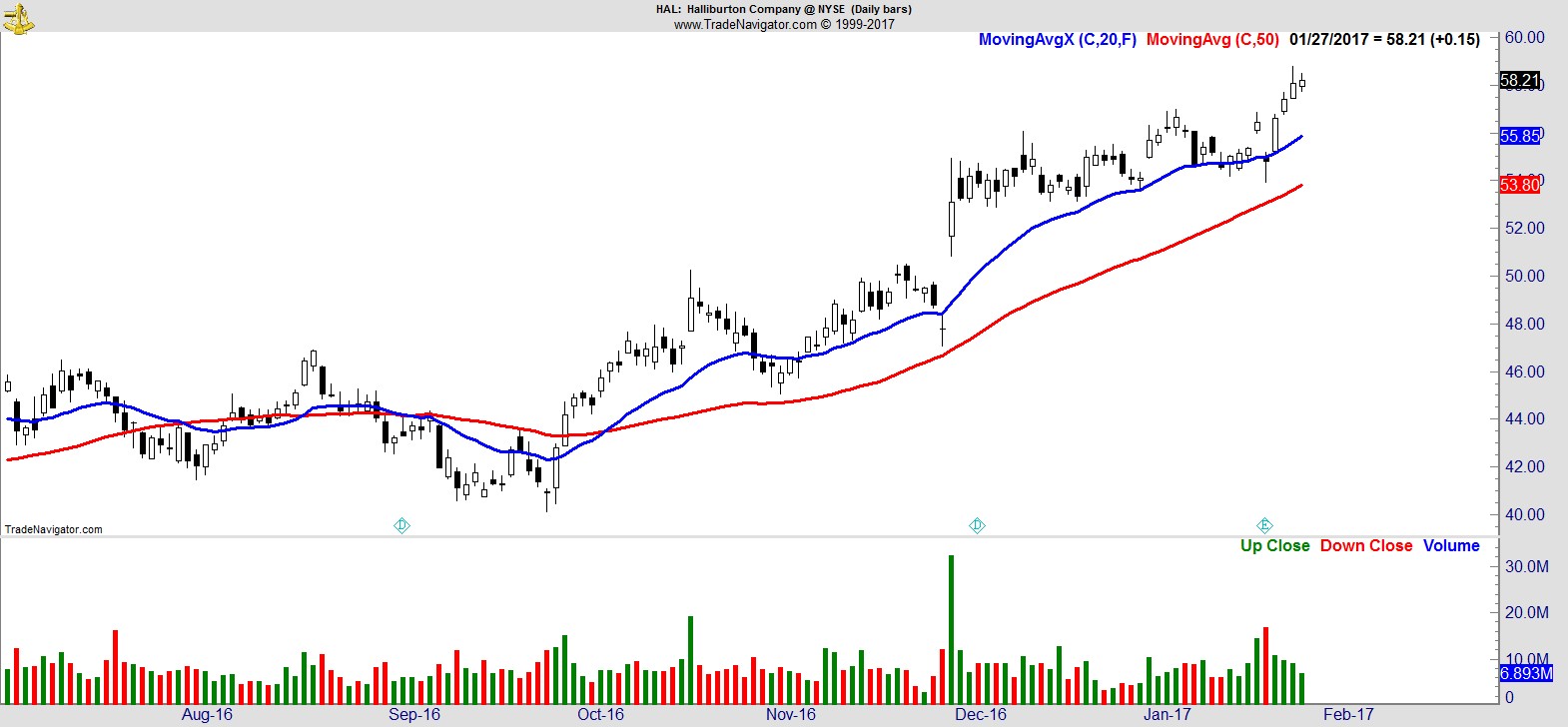

$HAL

.

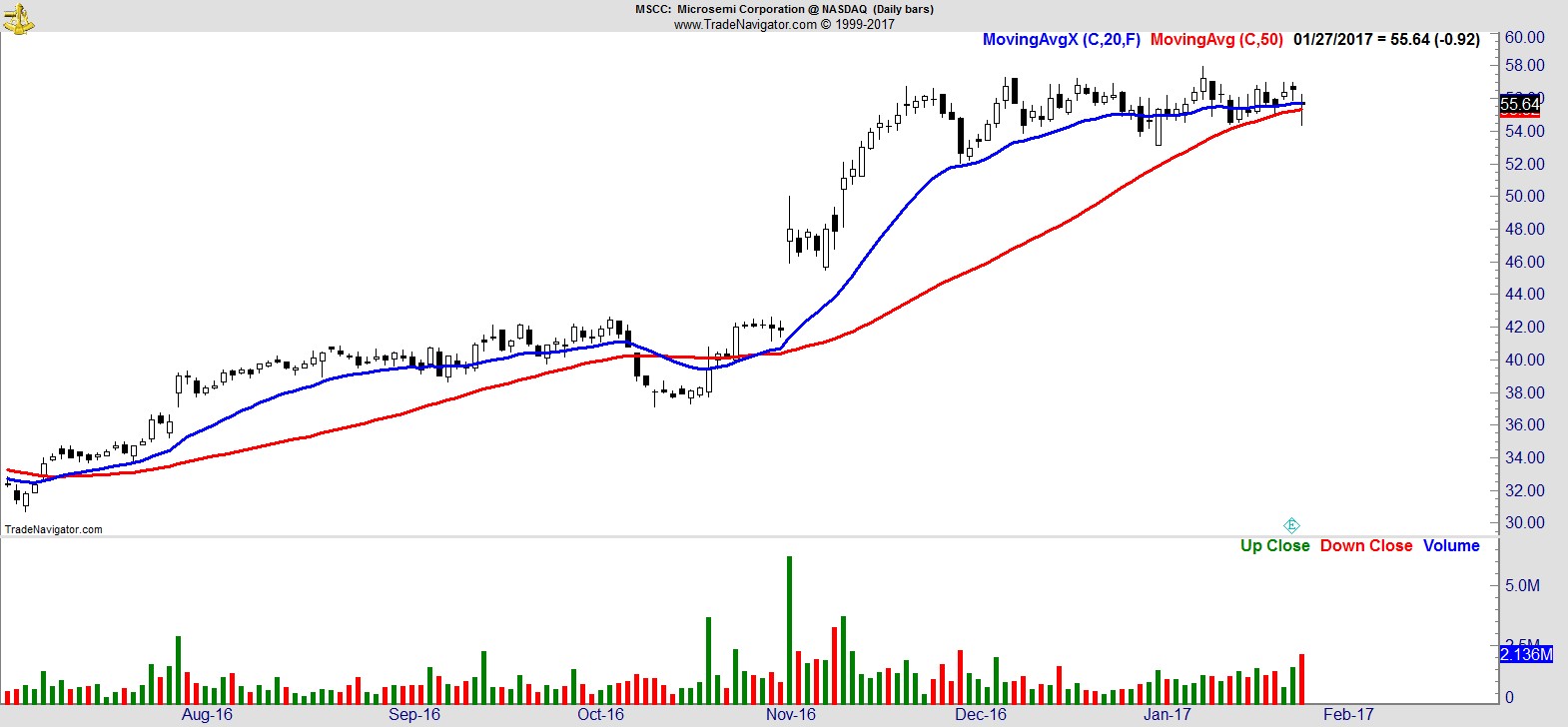

$MSCC

.

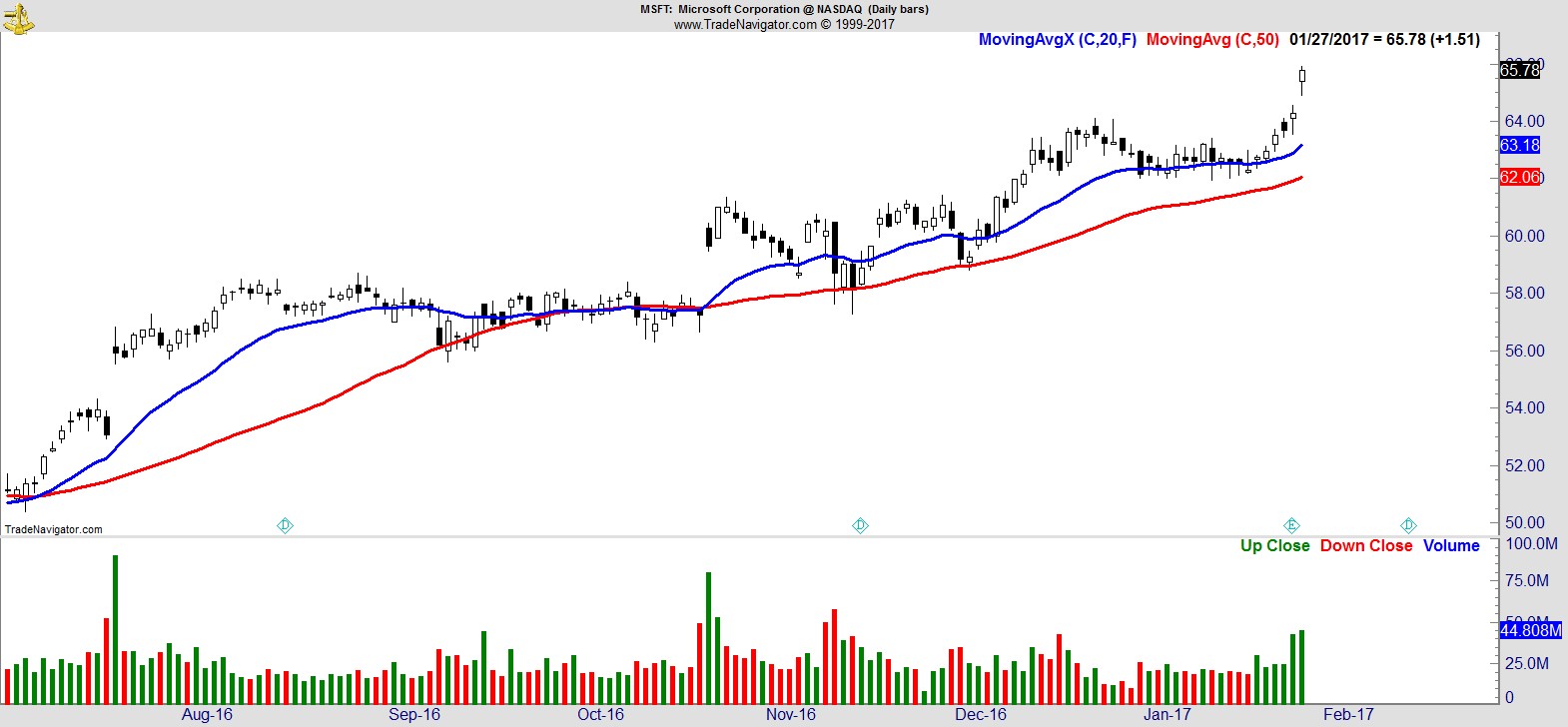

$MSFT

.

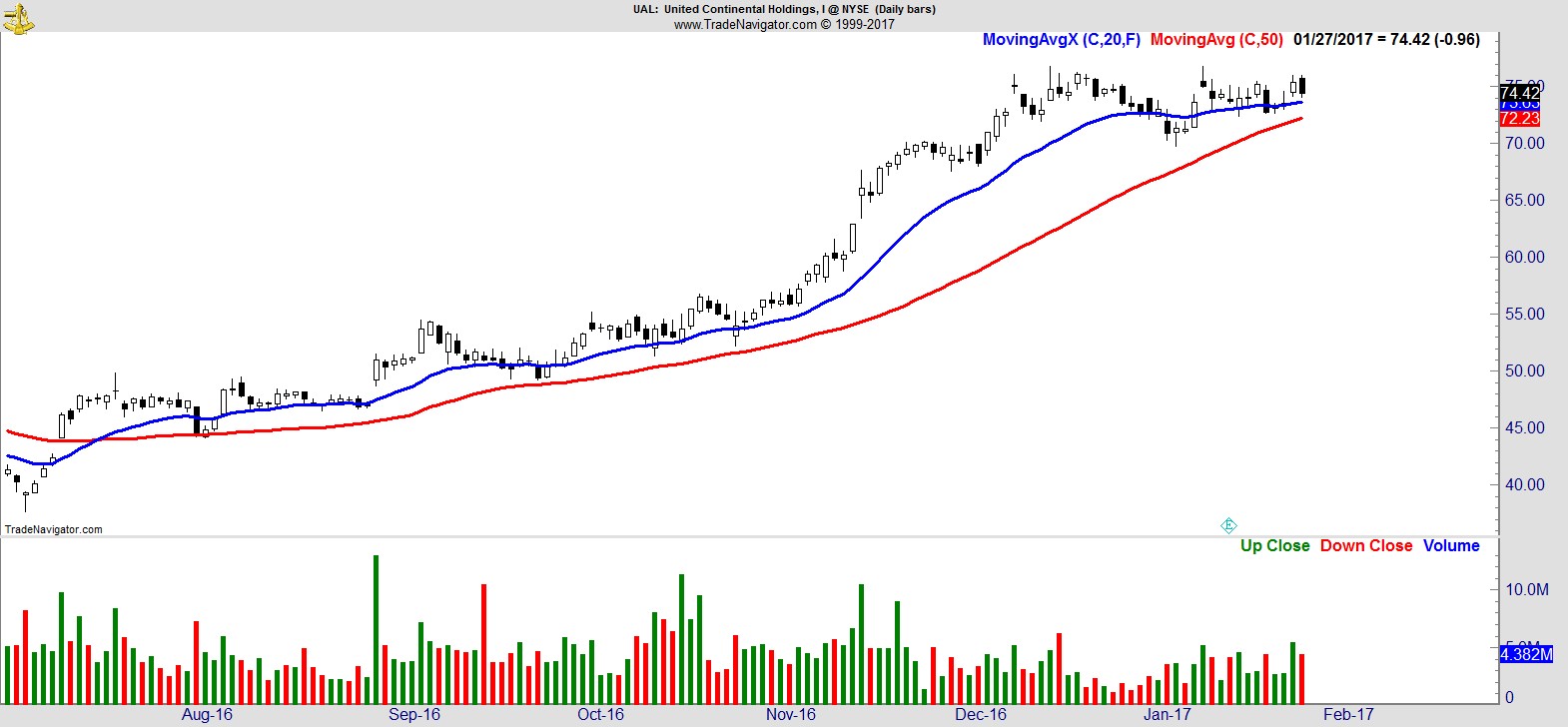

$UAL

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17