Good Monday morning and welcome back to the land of blinking screens. My guess is that after the big game - and what a game it was - the last thing anyone is thinking about is a bunch of market models and indicators. But this is what discipline is all about. So, let's buckle down and run through a review of my favorite models and indicators.

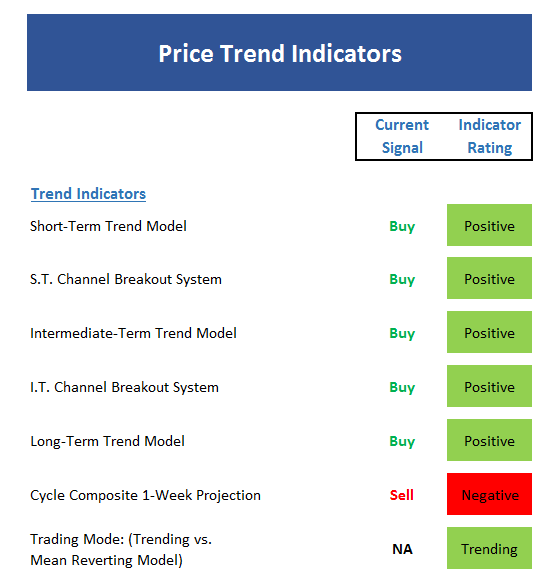

The State of the Trend

We start each week with a look at the "state of the trend" from our objective indicator panel. These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

Executive Summary:

- With the major indices flirting at all-time highs, it is not surprising to see a lot of green on the trend board.

- However, the question of the day is if the bulls can break on through to the other side

- The negative on the board is the Cycle Composite, which projects slightly lower prices by the end of the week

- It is worth noting that the "trading mode" models are not unanimous at this point and as such, the strength of the current trend is a question mark

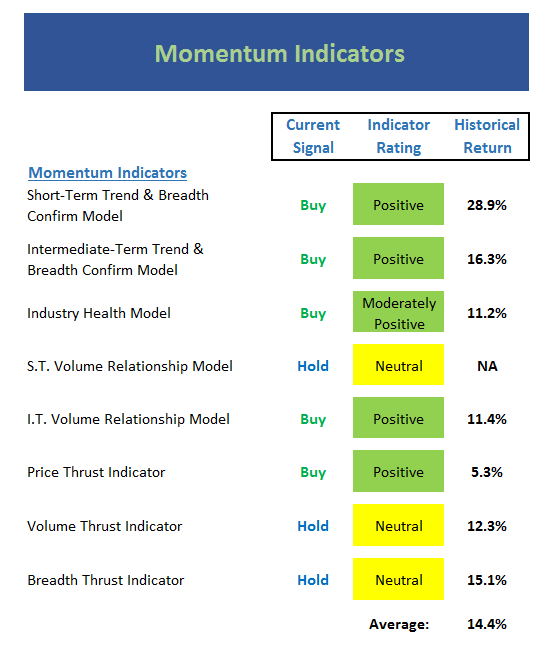

The State of Internal Momentum

Now we turn to the momentum indicators...

Executive Summary:

- Overall, the momentum board is clearly positive

- However, the ST Volume, Volume Thrust, and Breadth Thrust indicators are all neutral, which suggests there isn't a lot of "oomph" behind the current move (well, so far, at least)

- The Price Thrust indicator is also barely in the green zone

- In sum, the board's historical return is pretty strong and suggests siding with the bulls for the time being

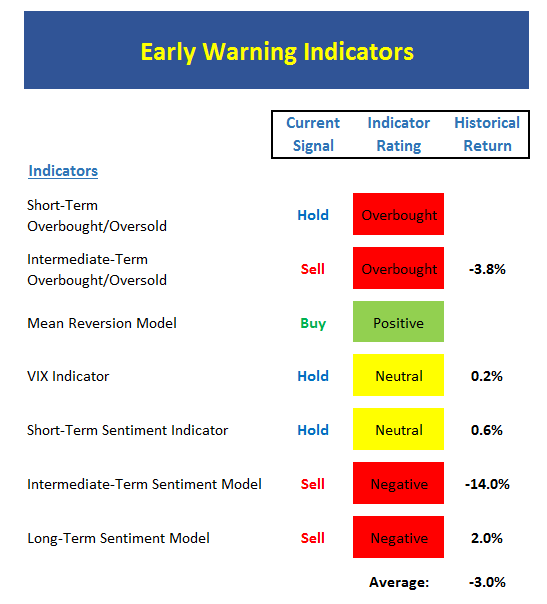

The State of the "Trade"

Next up is the "early warning" board, which is designed to indicate when traders may start to "go the other way" -- for a trade.

Executive Summary:

- Last week, I talked about this being a "good" overbought condition. Unless the bears can get something meaningful going sometime soon, this will continue to be the case.

- The S&P 500 is overbought from short-, intermediate-, and long-term perspective

- Sentiment remains overly optimistic, which results in a negative reading

- Our Mean Reversion model appears to be confused, as it is giving a buy signal at the close on Monday. Not exactly the normal set-up for this type of signal.

- The intermediate-term VIX signal remains in never-never land as the VIX has not moved far enough to trigger a signal from this indicator

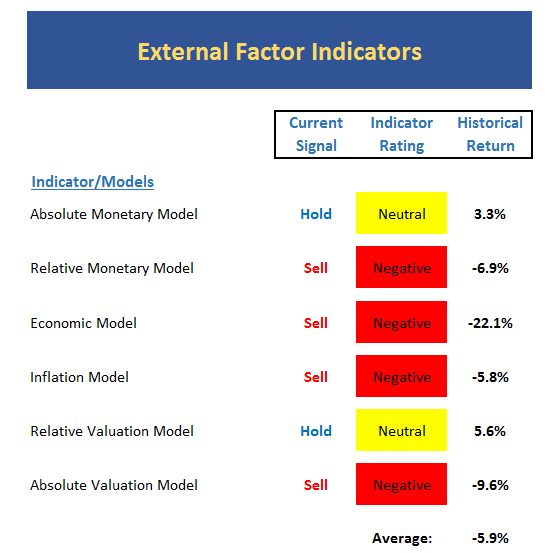

The State of the Macro Picture

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

Executive Summary:

- The surprising amount of red on this board still makes me sit up and take notice

- In fact, there isn't a single positive external indicator here, which is pretty amazing given the proximity to new highs.

- In reality though, there are 4 models here: Monetary, Economic, Inflation, and Valuation.

- In short, the board tells me this is NOT a low-risk, no-brainer environment

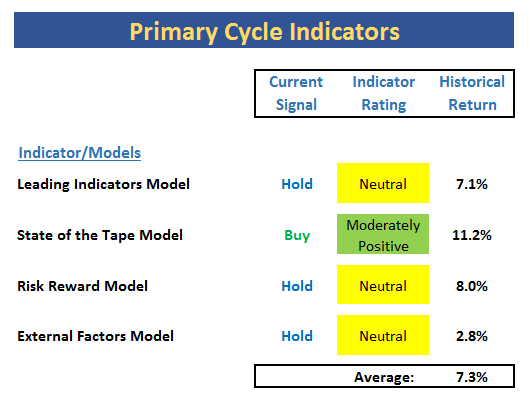

The State of the Big-Picture Market Models

Finally, let's review our favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

Executive Summary:

- This board also suggests this is not the time to employ the turbo chargers

- The historical average is below the market's long-term average

- The Leading Indicators model is at the high end of neutral and not close to issuing a warning

- I remain concerned from a big-picture standpoint that the State of the Tape model has been unable to move into purely positive territory

The Takeaway...

While the major indices are flirting with all-time highs, many of my favorite indicators - especially some of the longer-term, big-picture stuff - are telling me this is not a low-risk environment. However, if my 30+ years of money management has taught me anything it is that bull markets can last much longer than you (or your indicators) might think. Therefore, I see this as an ongoing bull market that is starting to see some wear and tear.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies

2. The State of the U.S. Economy

3. The State of Global Central Bank Policies

4. The State of Bond Yields

Thought For The Day:

"Economists were invented to make weathermen look good" - Anonymous

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio Management? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member