Overview

Equity indices are probing new highs on multiple timeframes. Breadth is improving. Bullish sentiment is at historical averages.

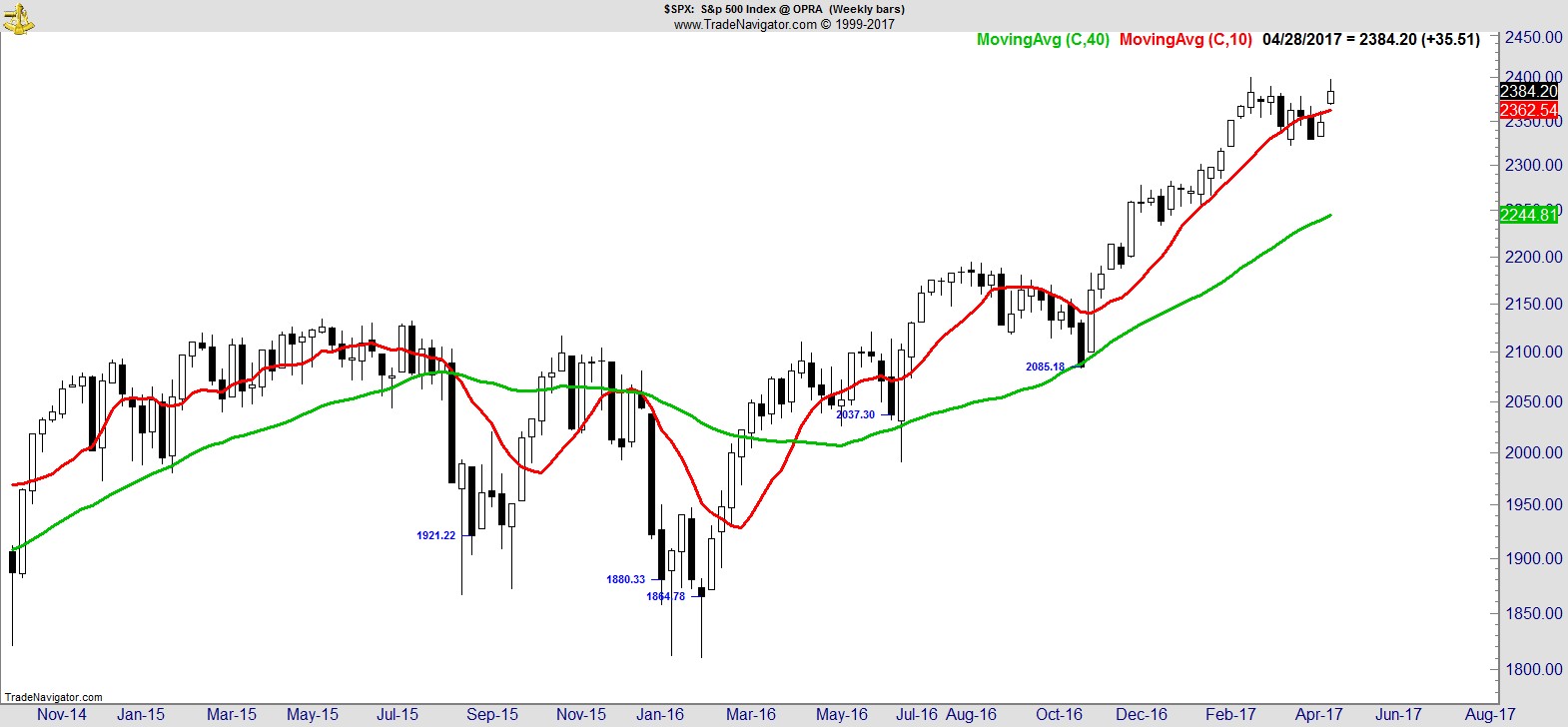

Here's the S&P on a daily, weekly, and monthly:-

.

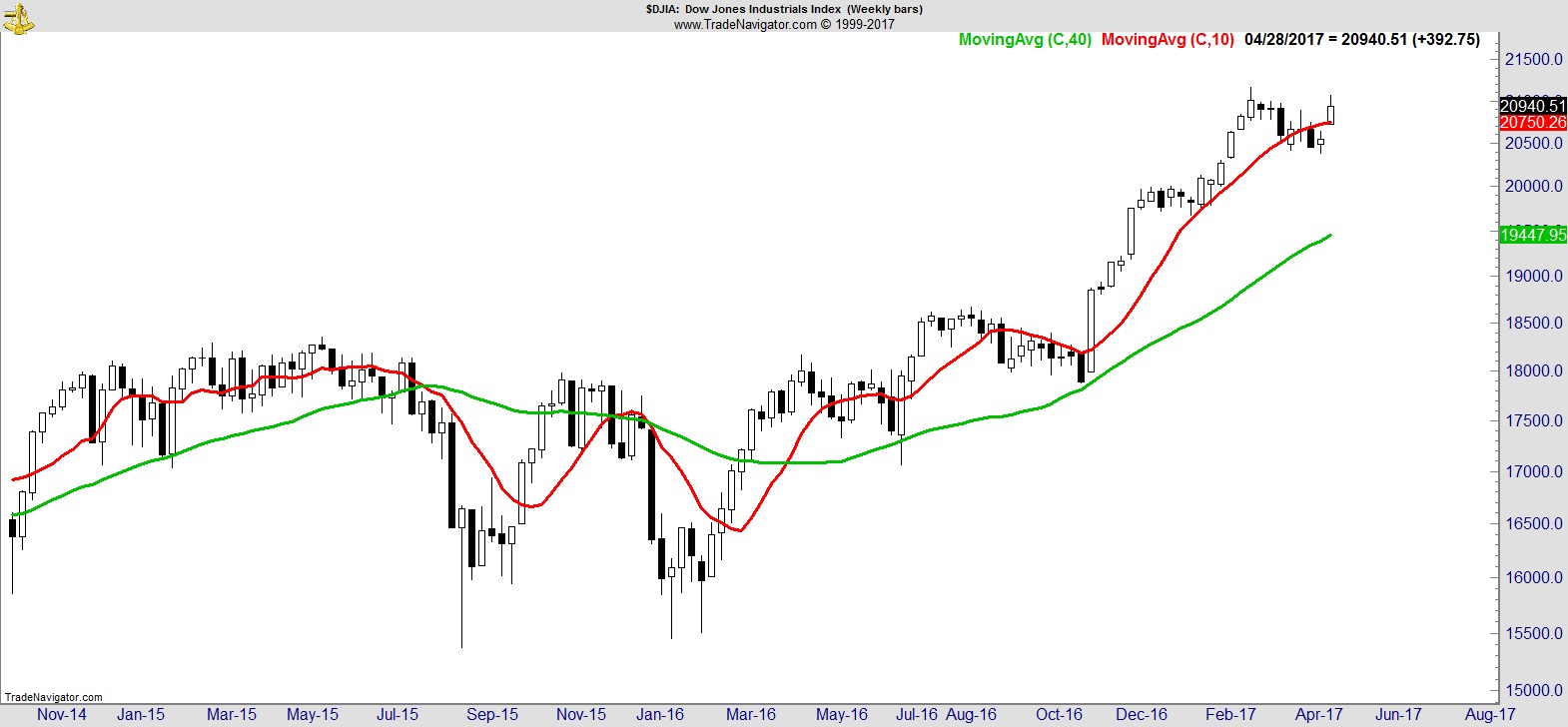

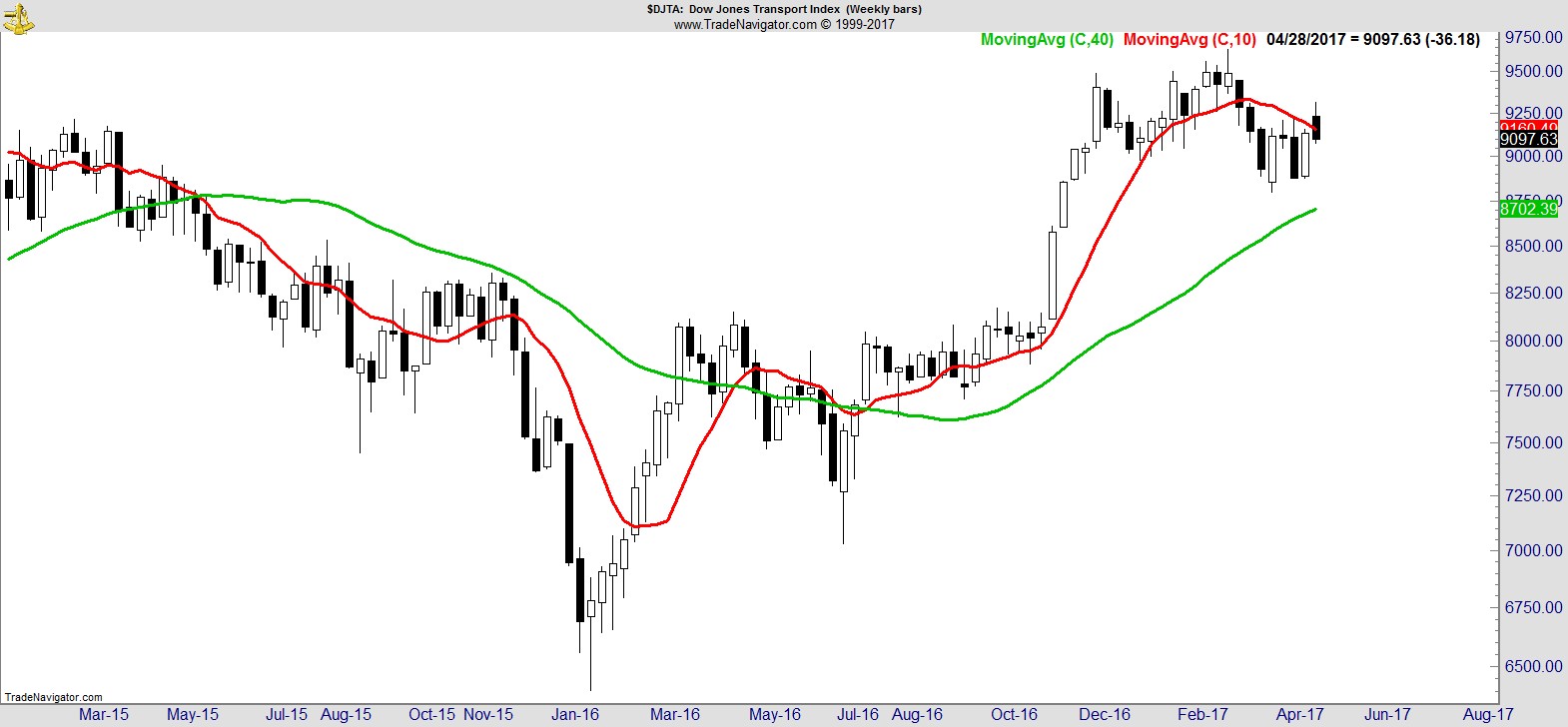

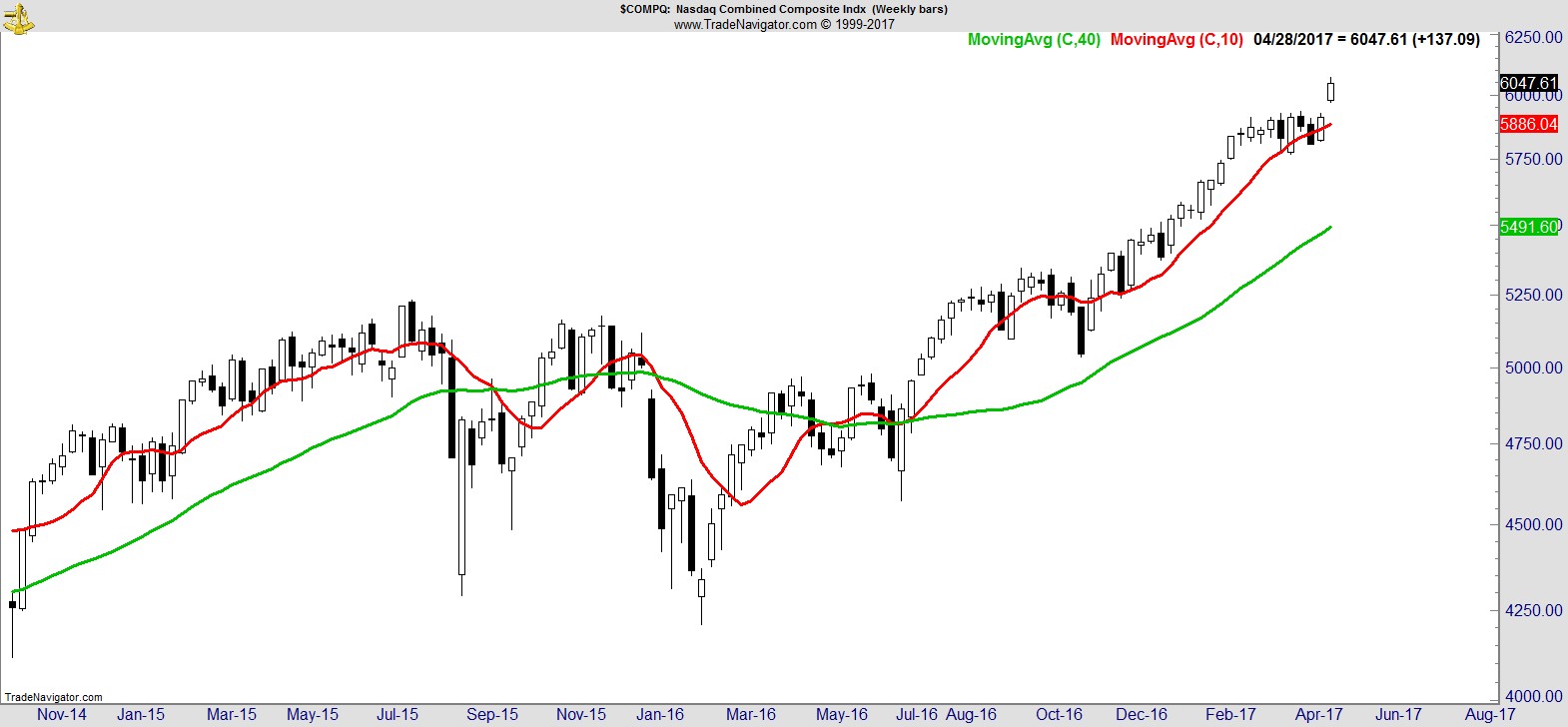

Here's the weekly charts of the Dow, Transports, NASDAQ, and Russell 2000:-

.

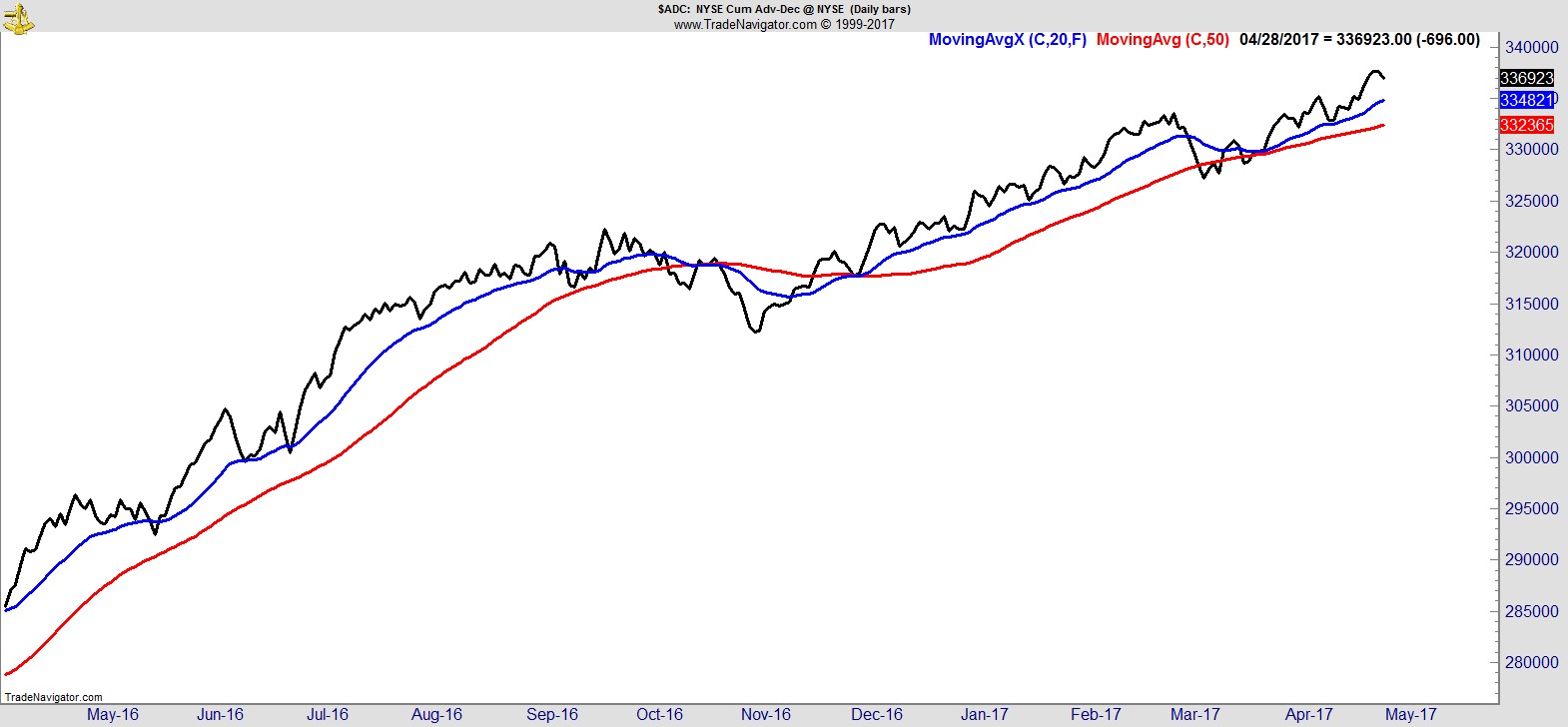

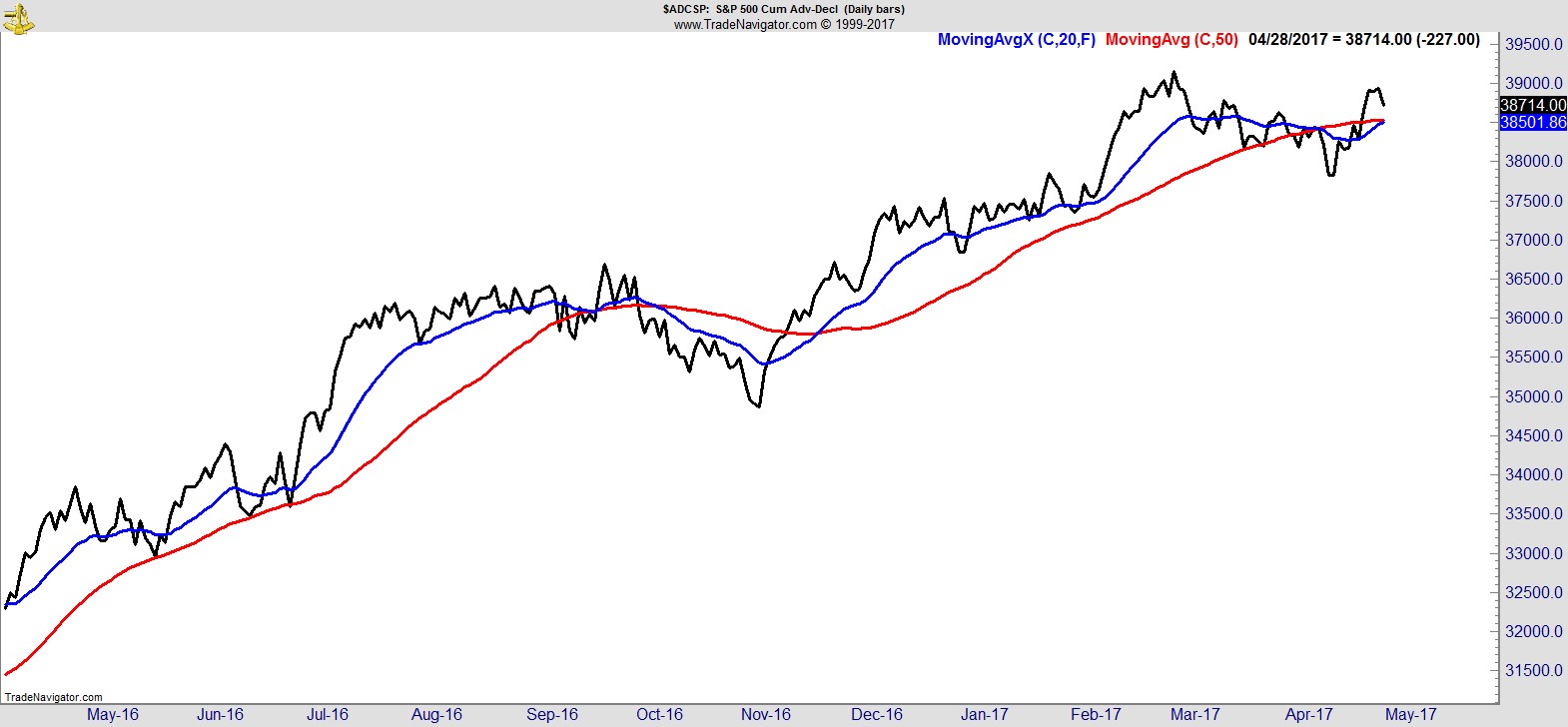

Breadth via the Cumulative Advance/Decline for the NYSE and S&P 500:-

.

Sector Analysis

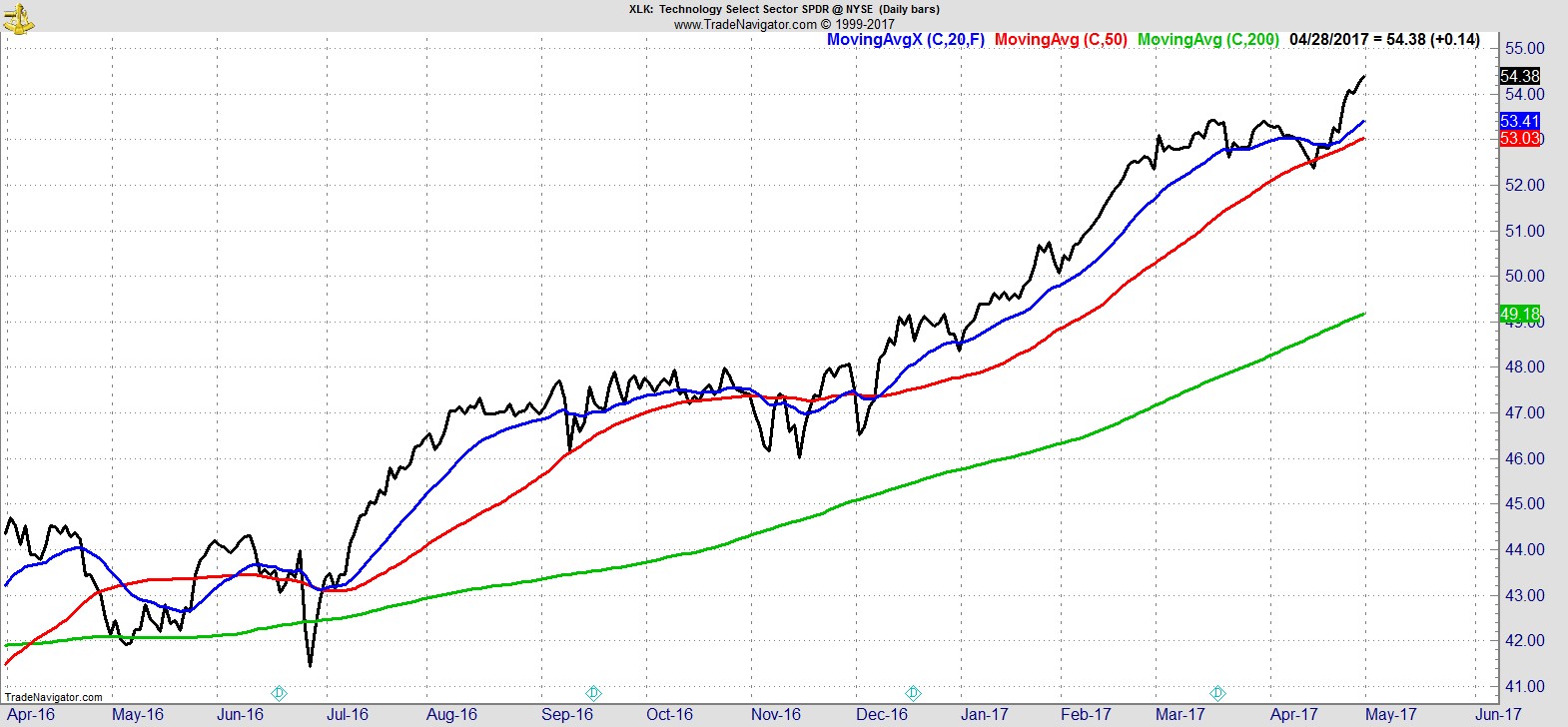

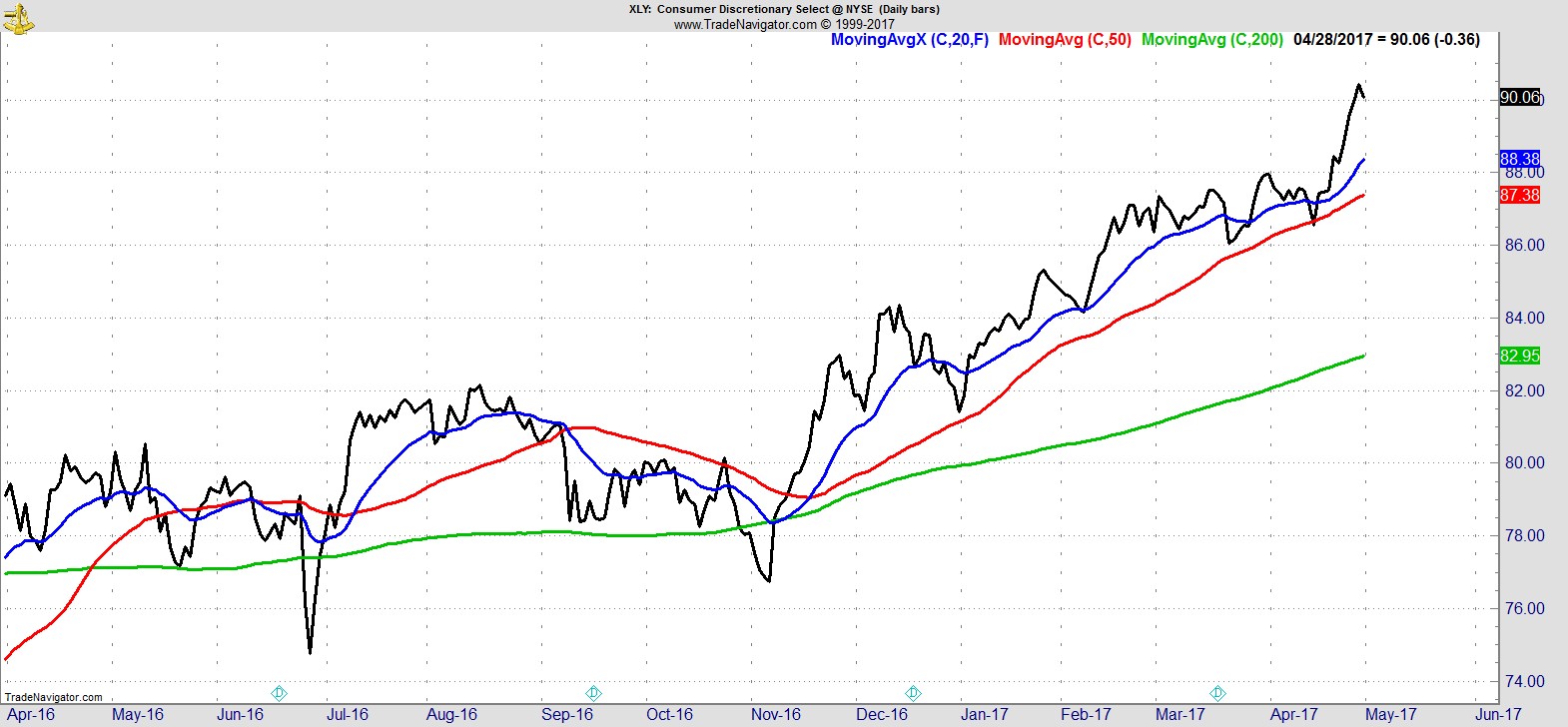

Technology and Consumer Discretionary are the leading pair.

.

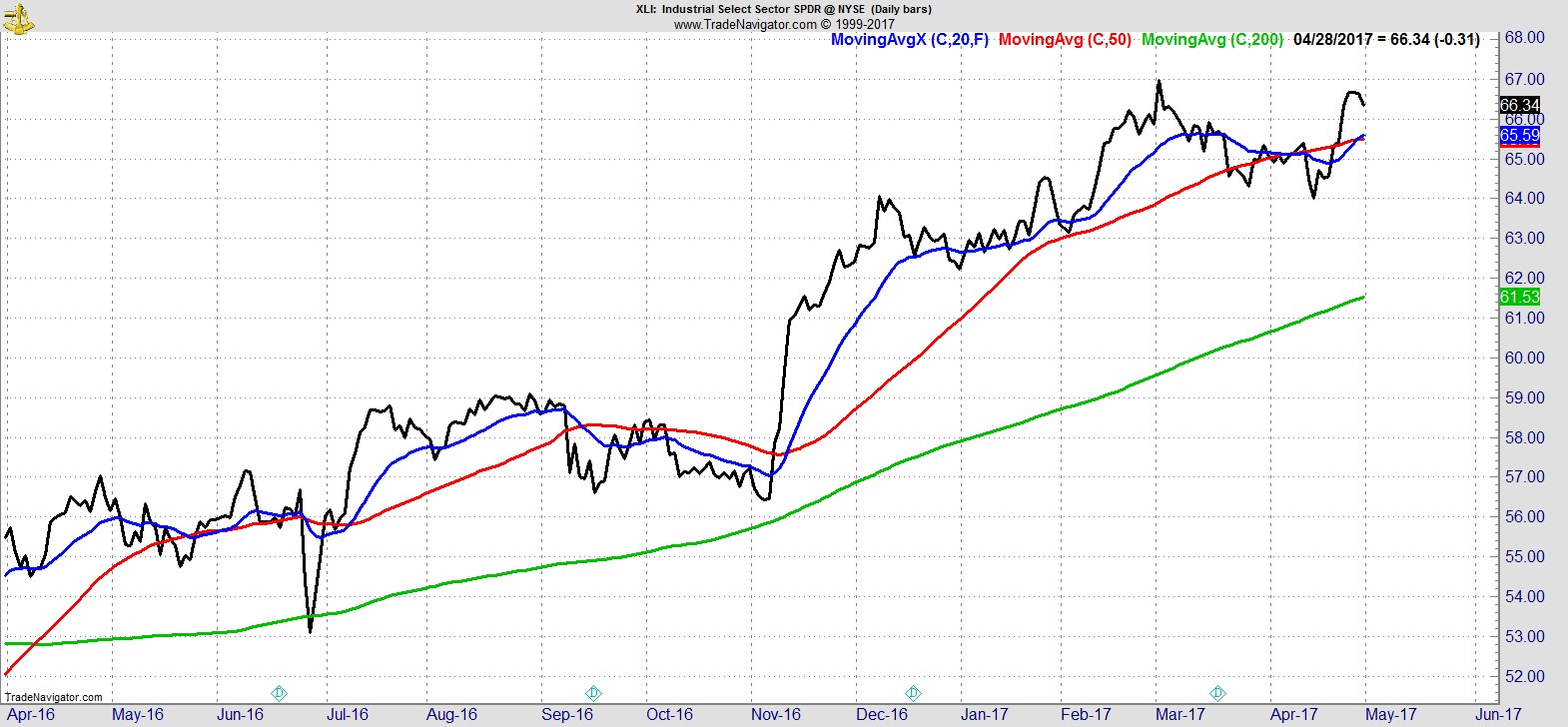

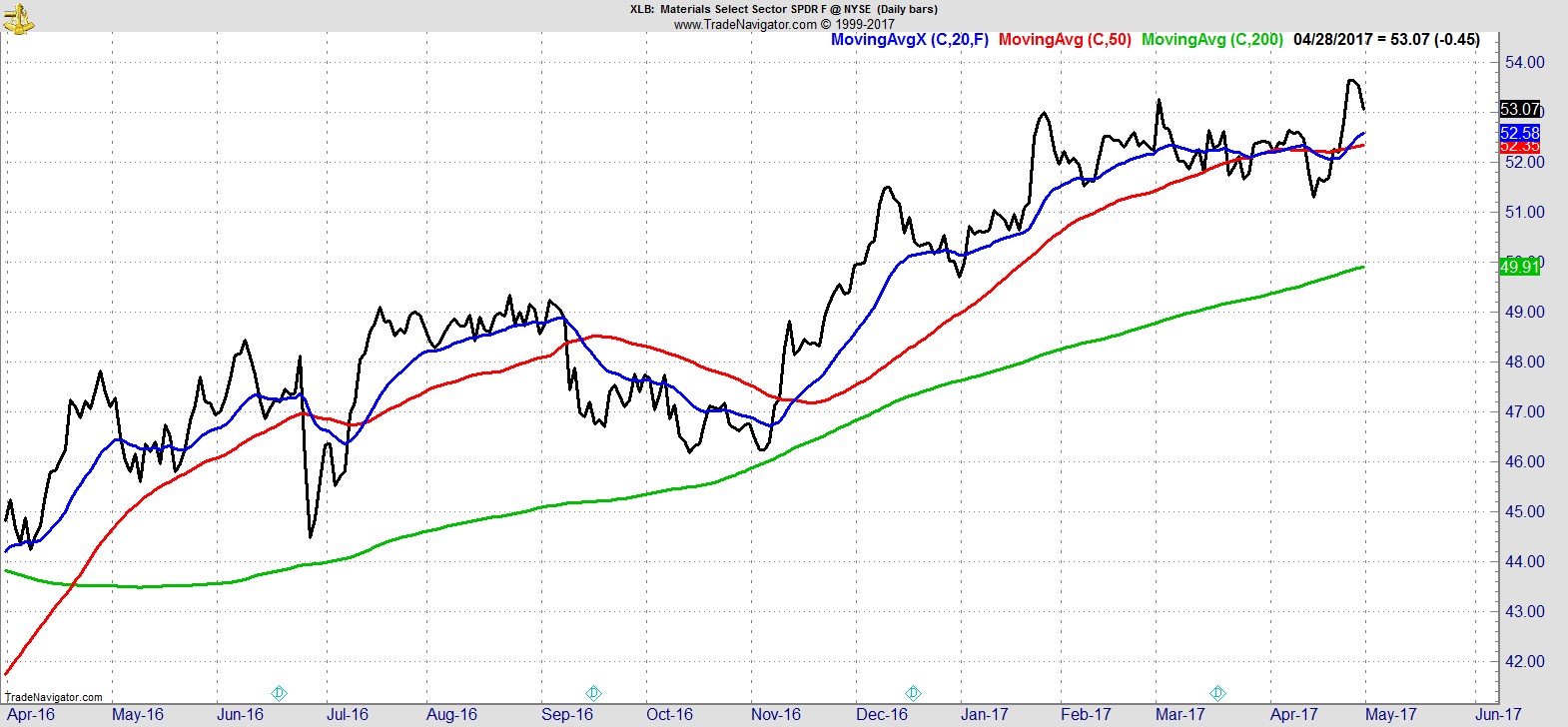

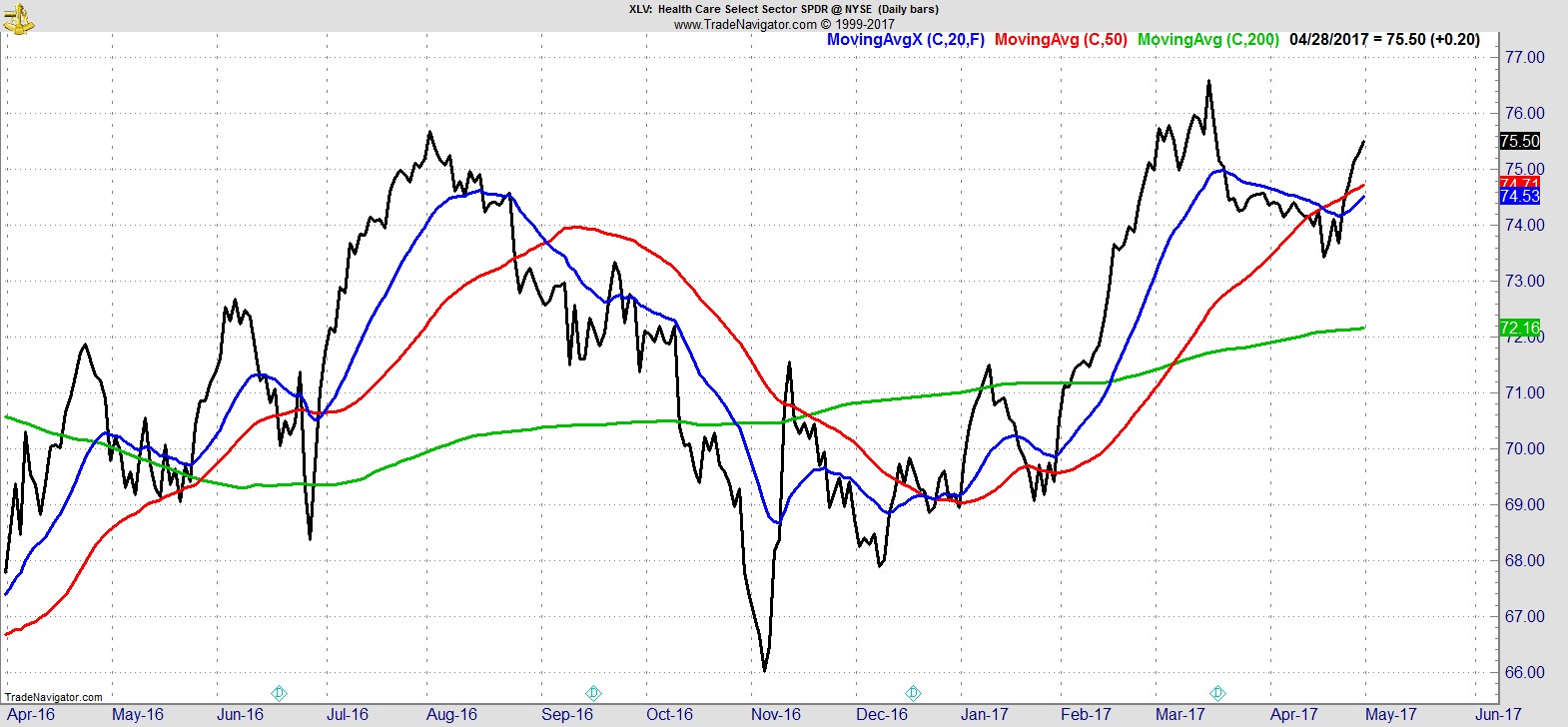

They're followed by Industrials, Materials, and Healthcare which all improved.

.

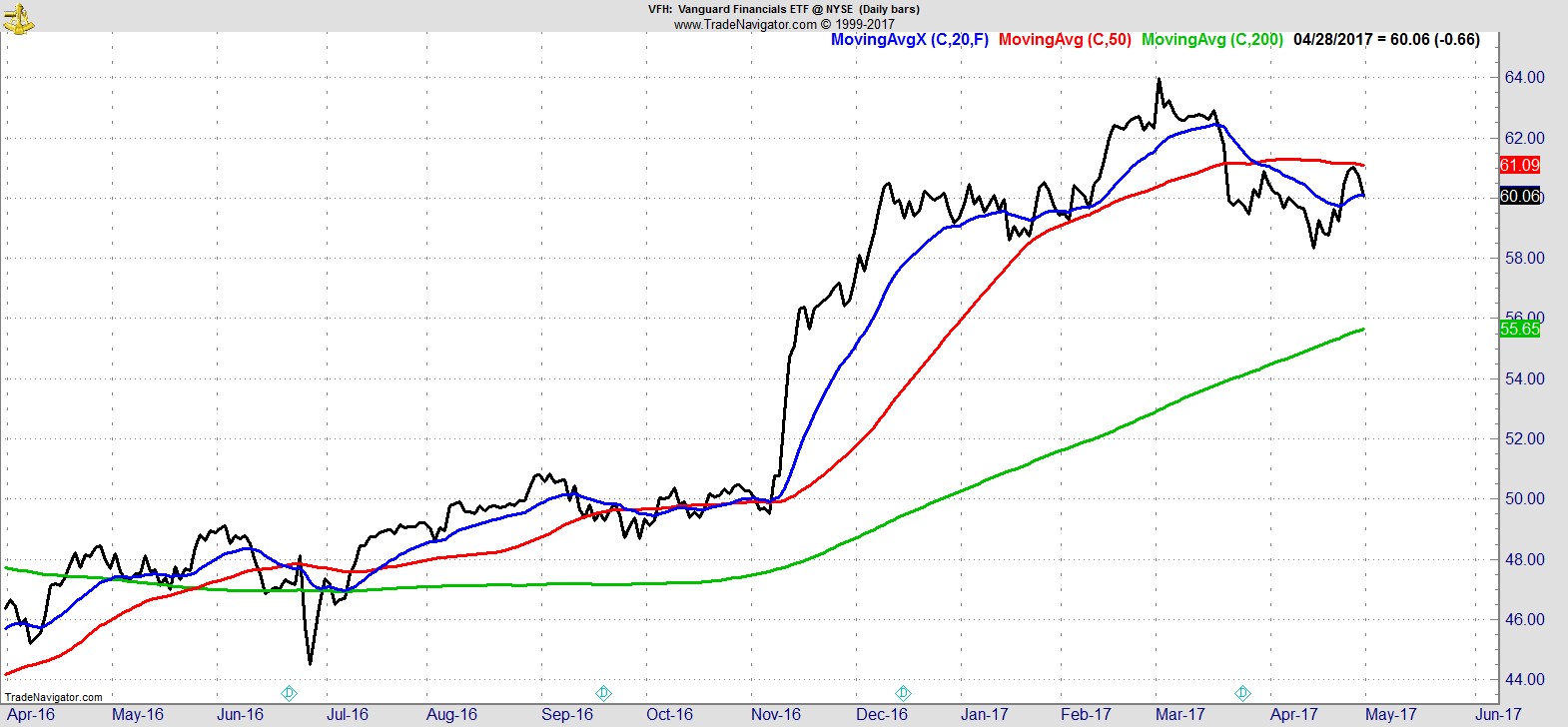

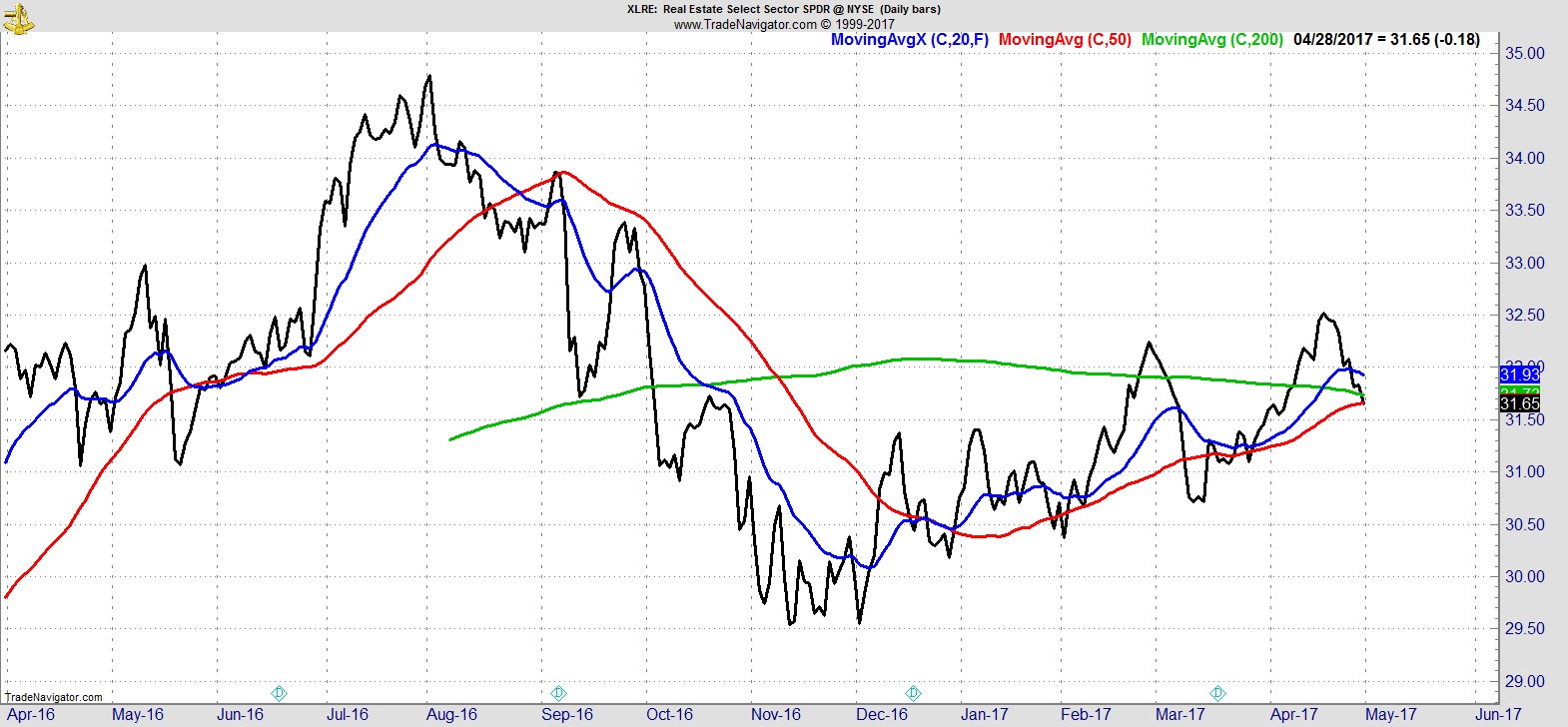

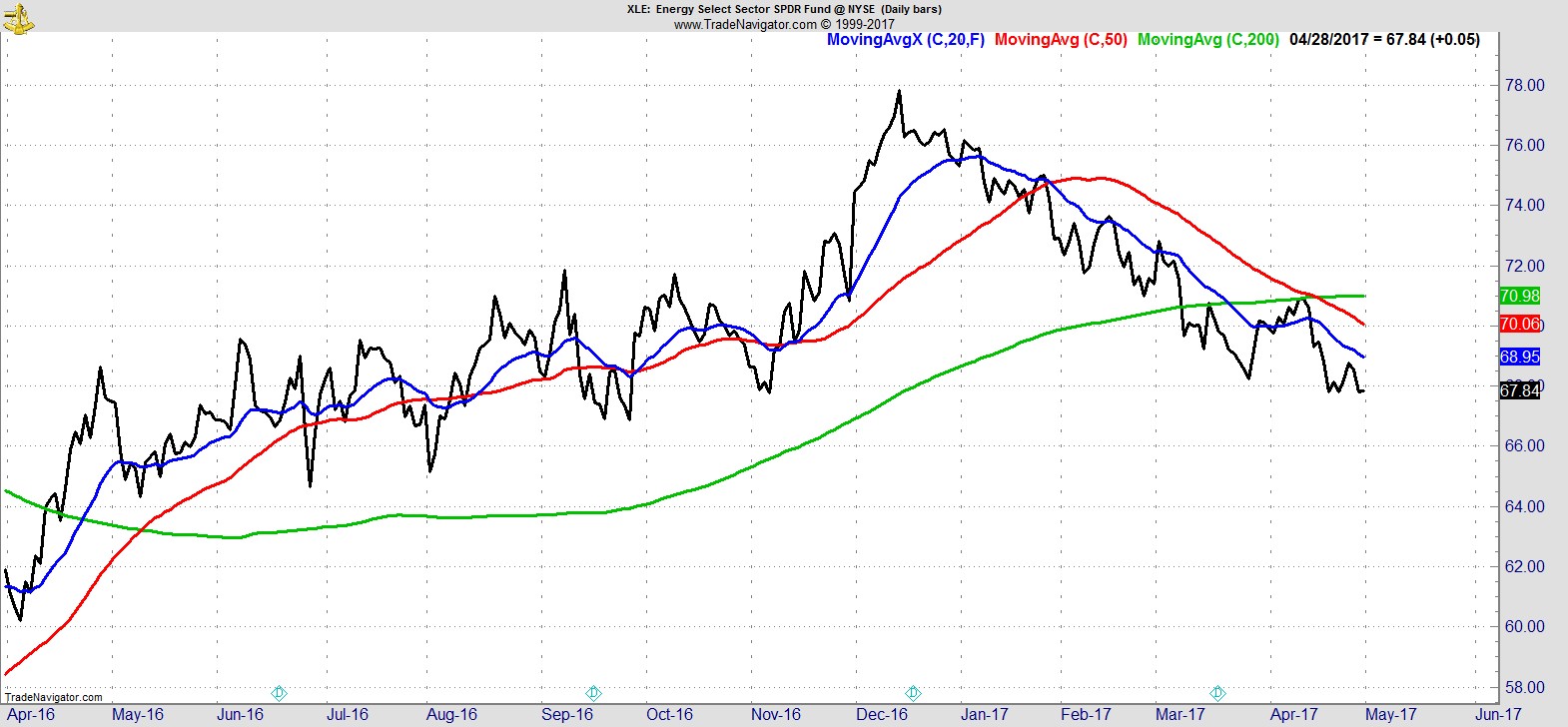

Utilities and Staples are weakening but remain above their MAs. The bottom three are Financials, Real Estate, and Energy:-

.

Alpha Capture Portfolio

Our model portfolio enjoyed another good week, climbing +3.3% vs +1.5% for the S&P. It's fully allocated across 12 names with total open risk of 8.7%. Our cash is down to just 7% having added to an existing position during the week.

.

Watchlist

Not many changes to our list this weekend, which continues to be dominated by technology and consumer discretionary.

Here's a sample from the full list of 30 names:-

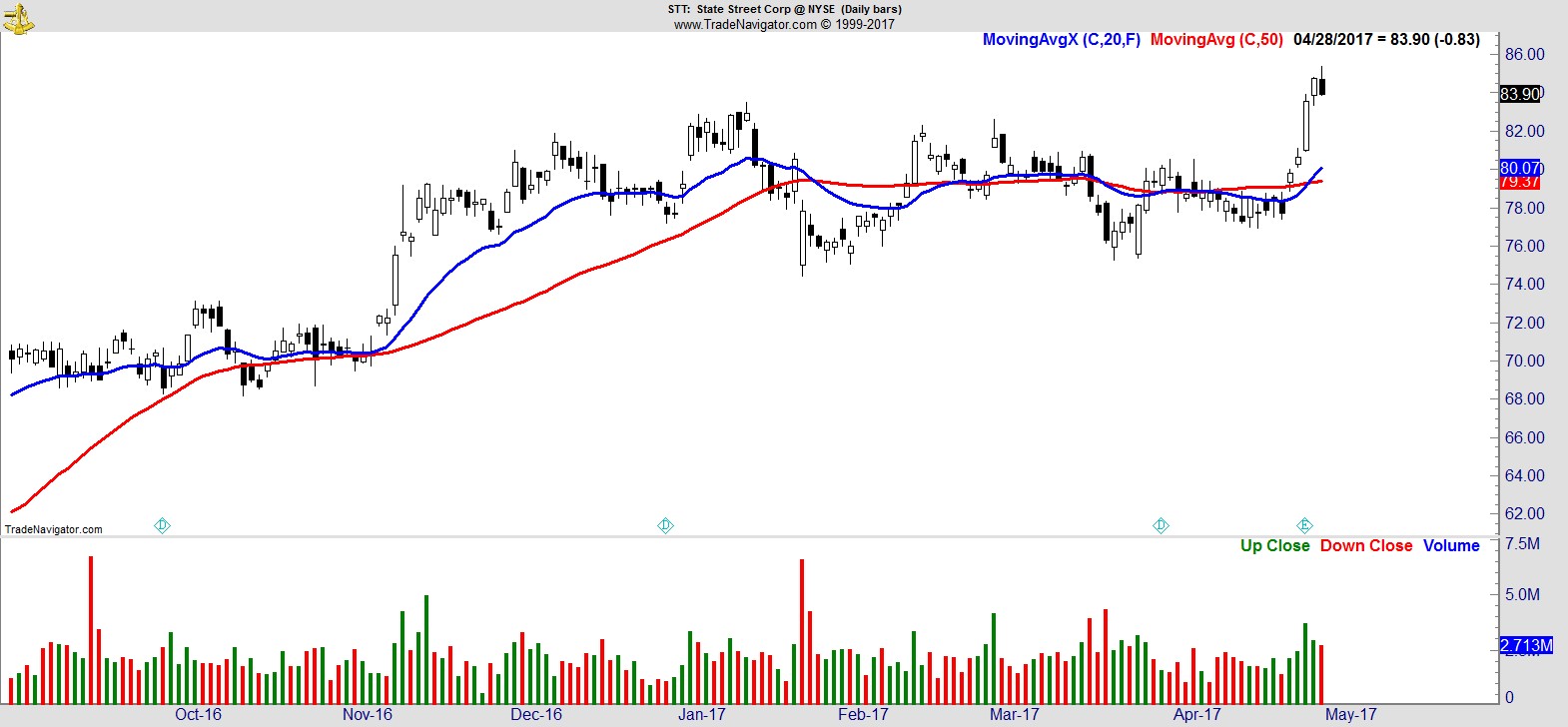

$STT

.

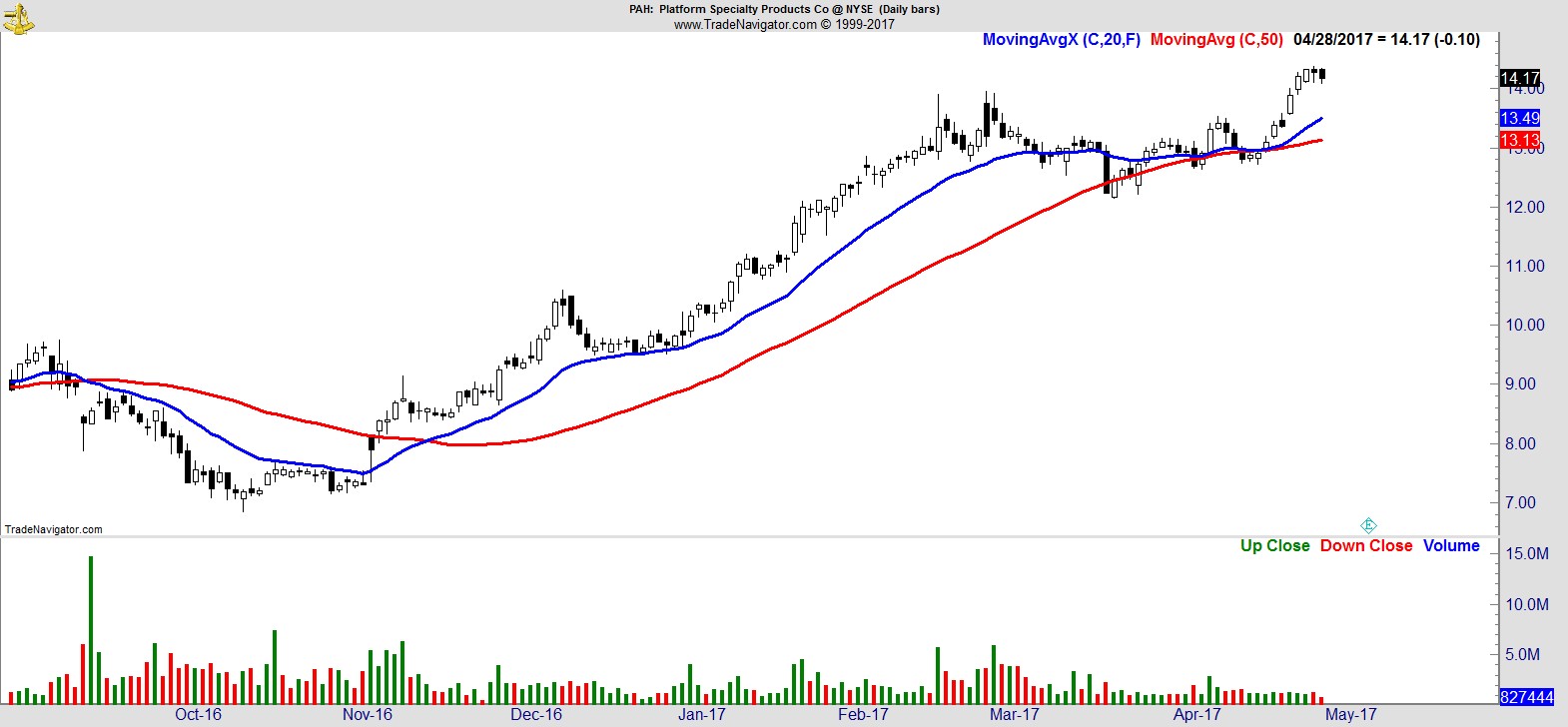

$PAH

.

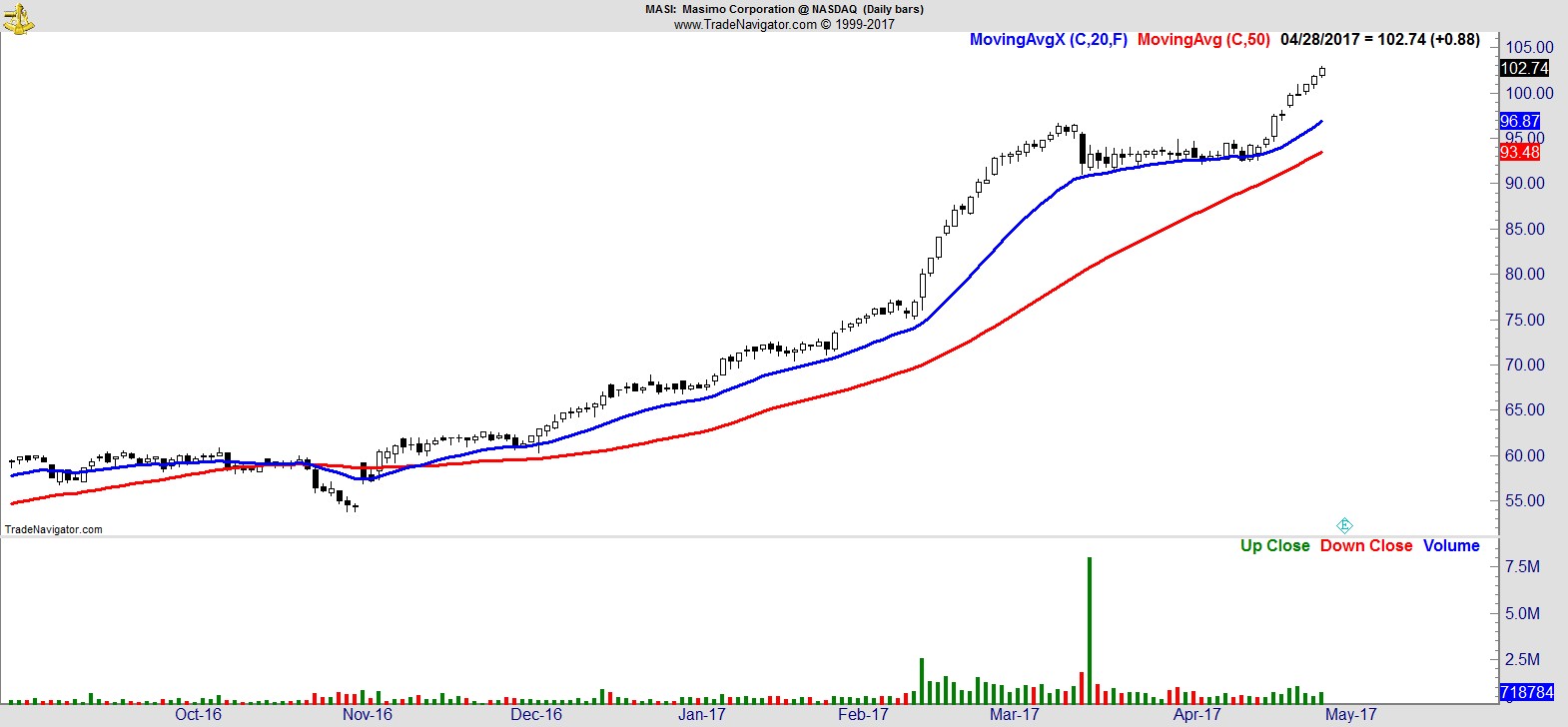

$MASI

.

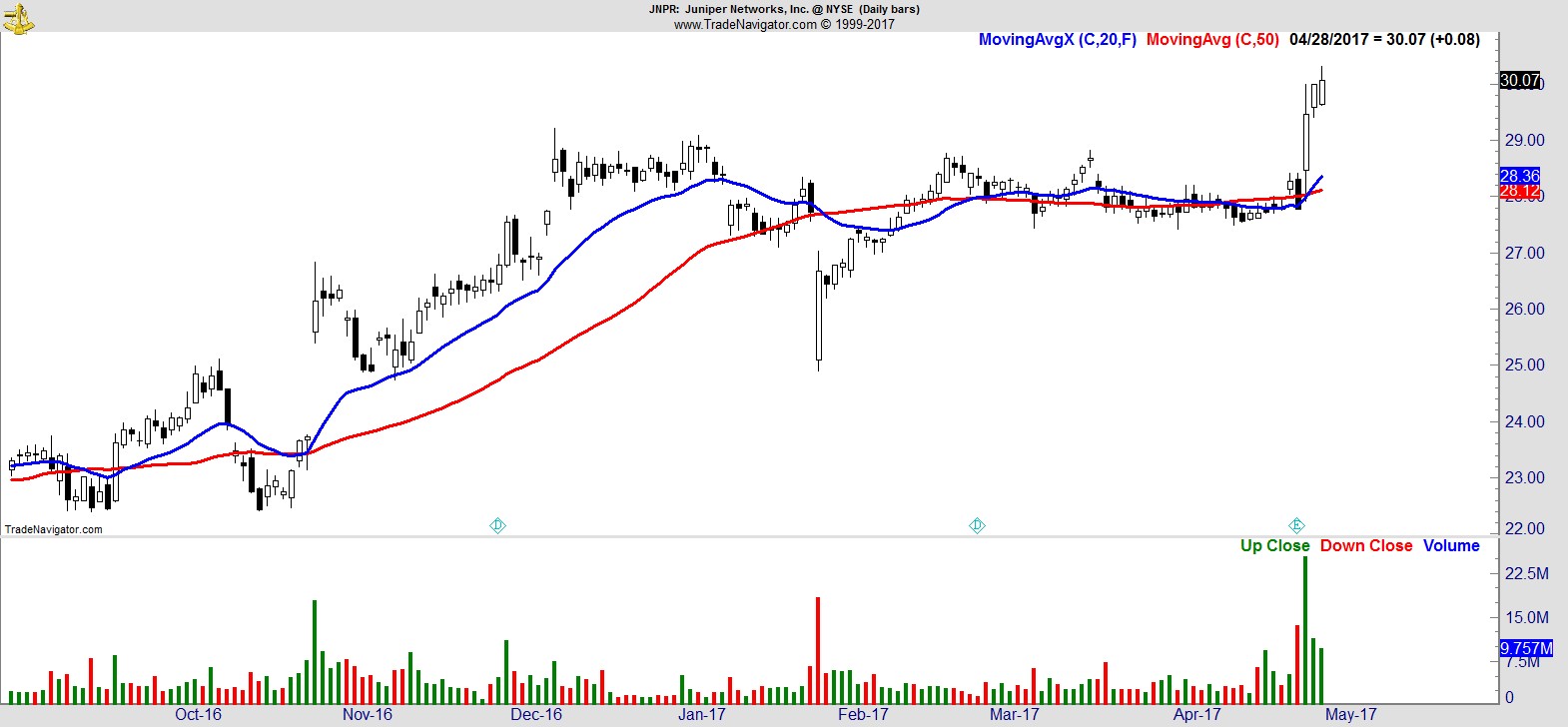

$JNPR

.

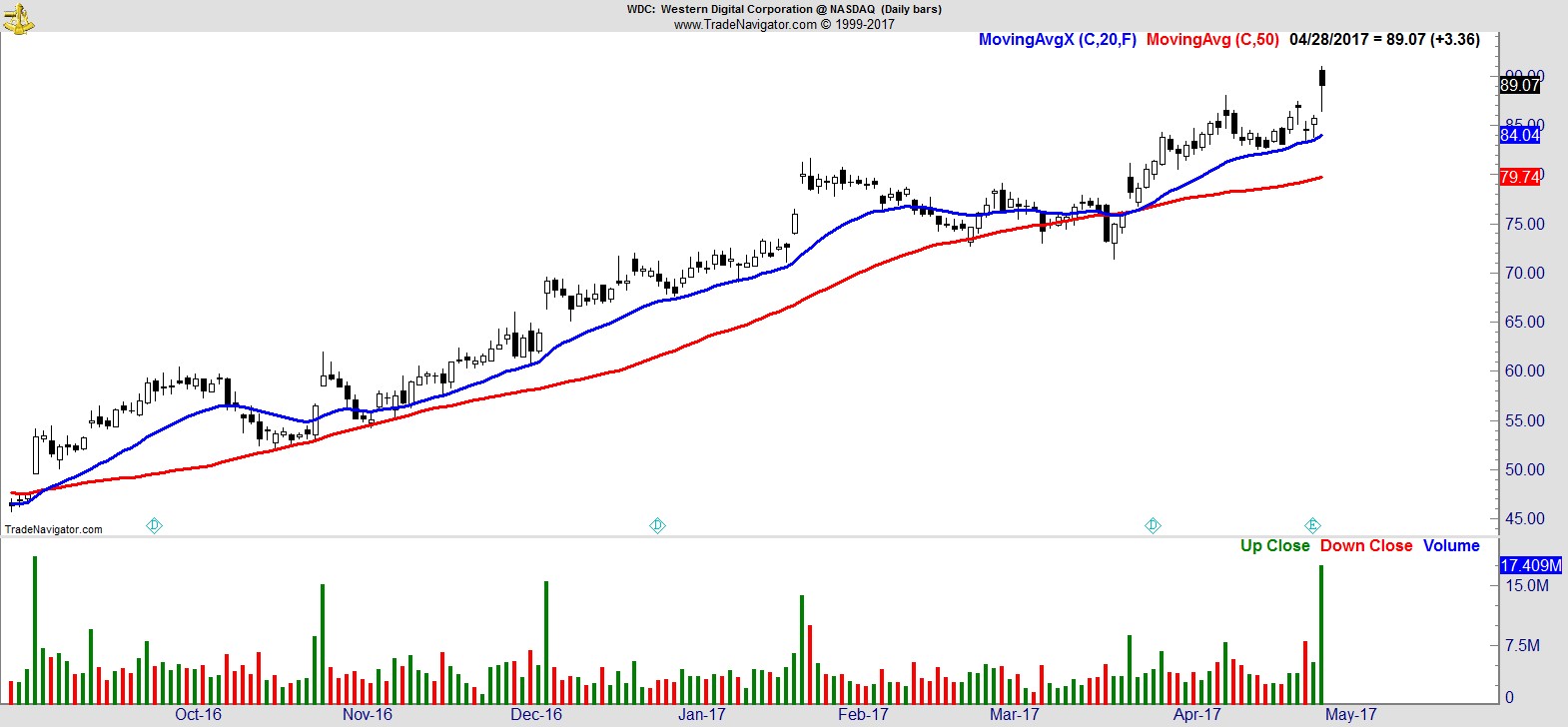

$WDC

.

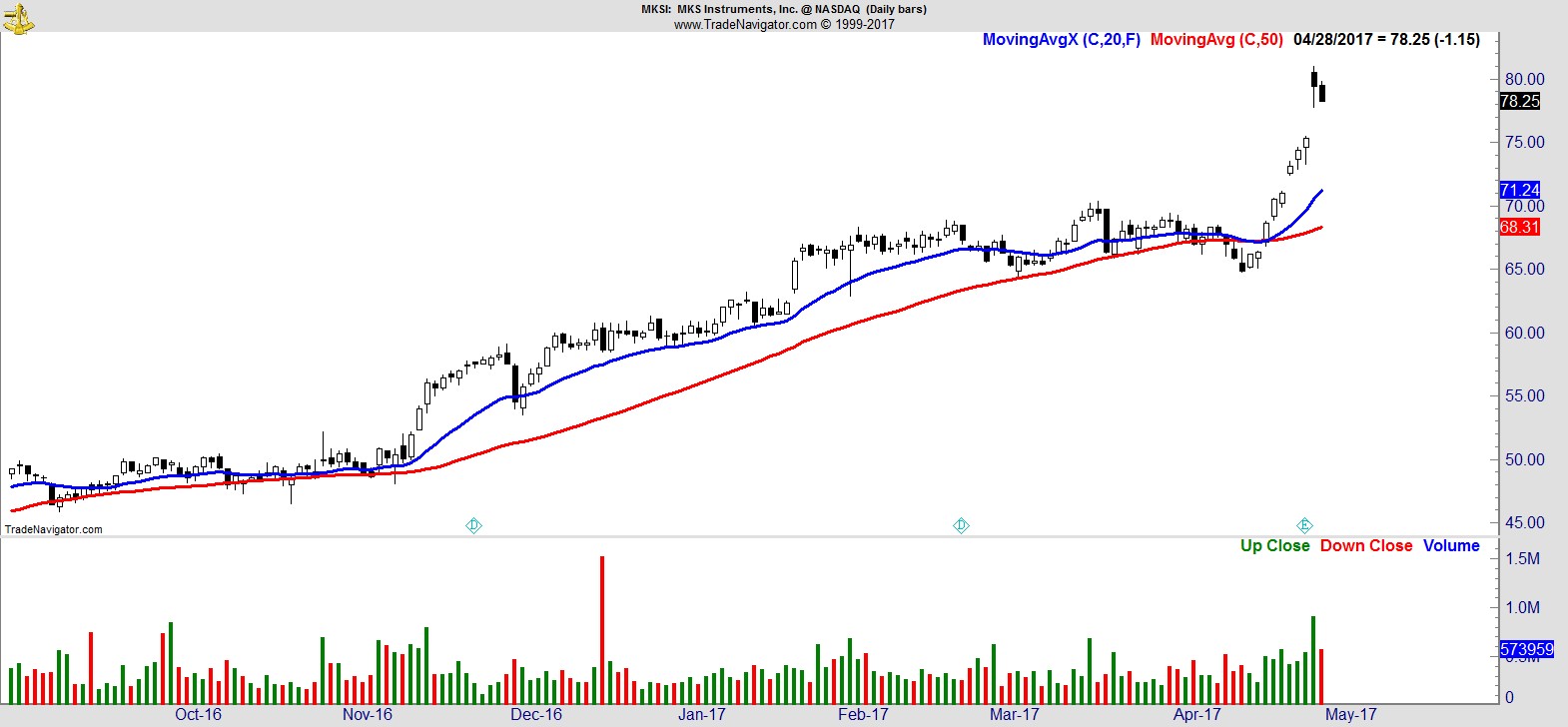

$MKSI

.

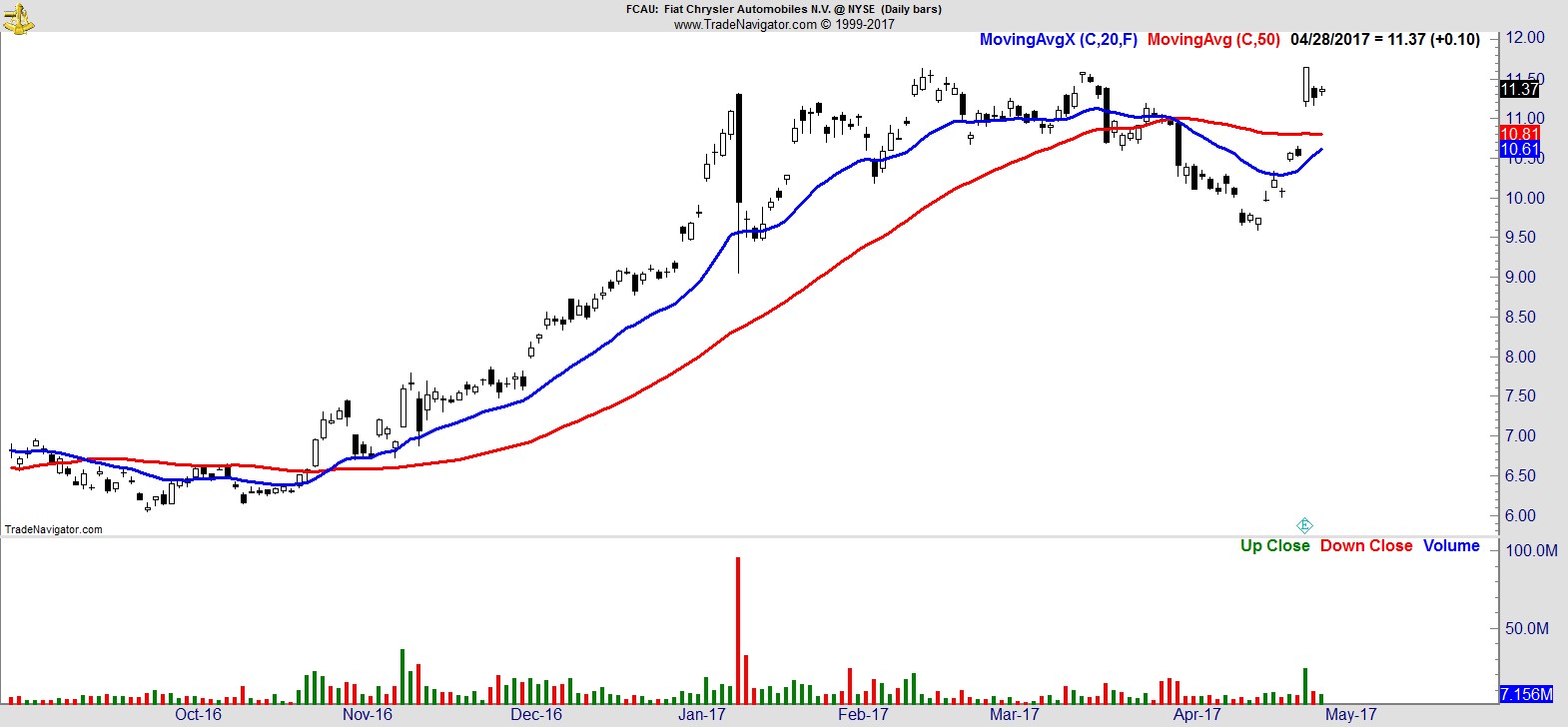

$FCAU

.

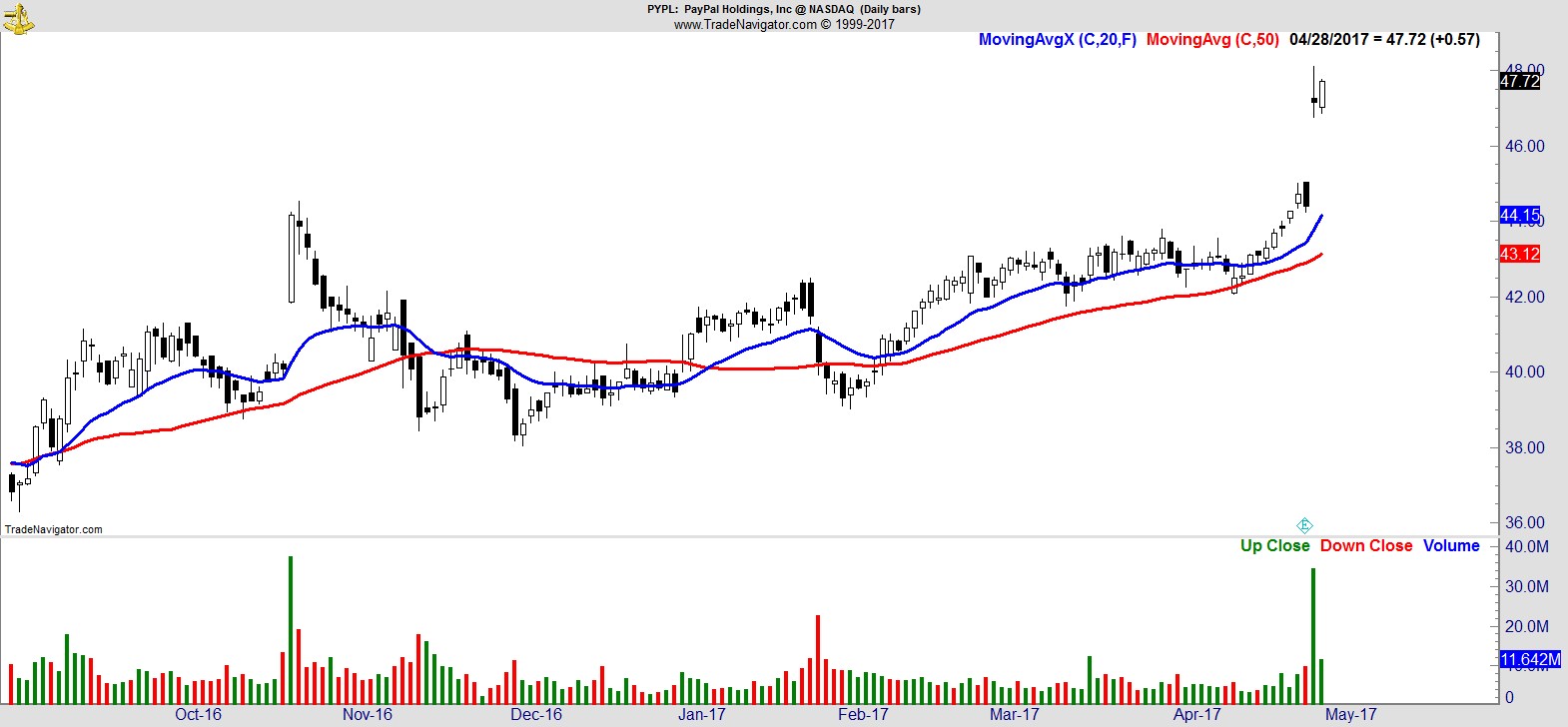

$PYPL

.

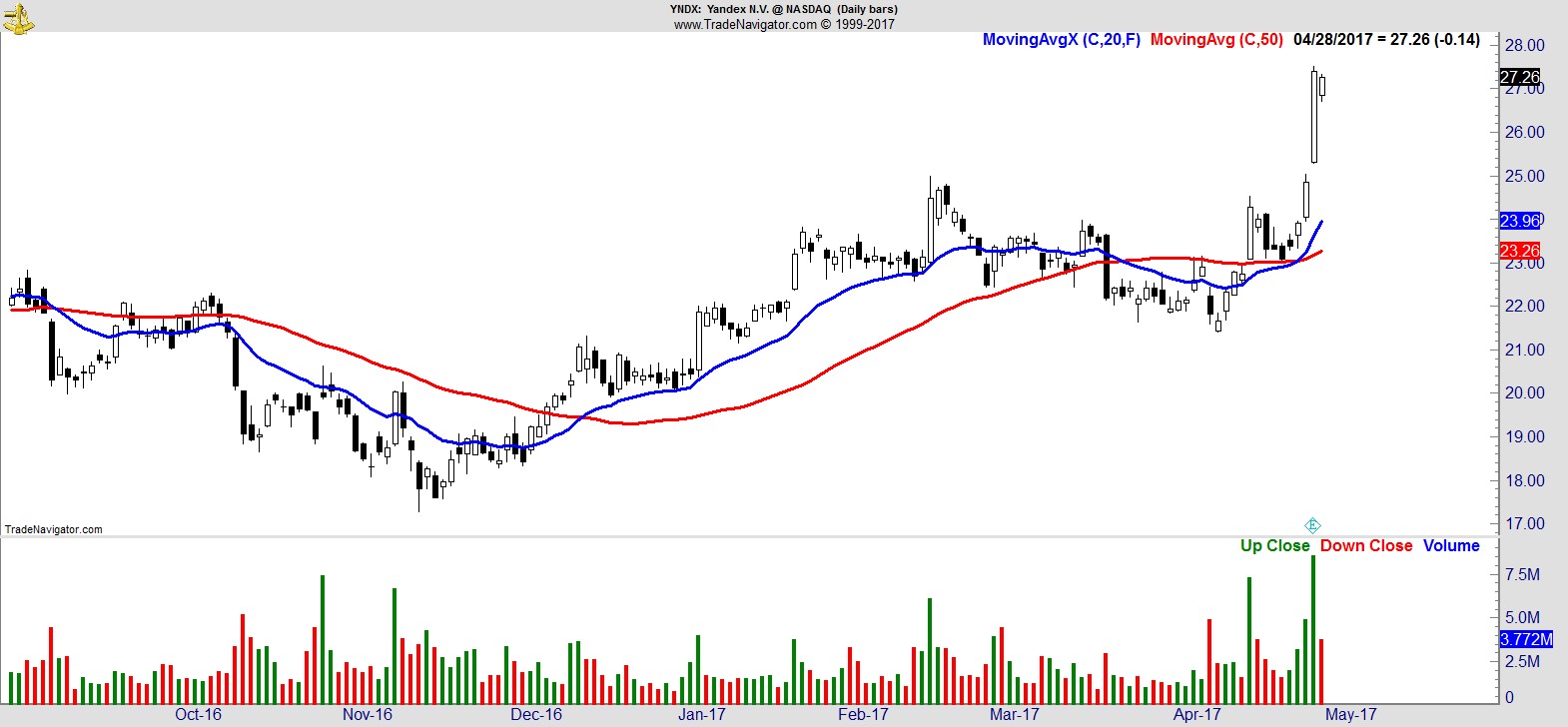

$YNDX

.

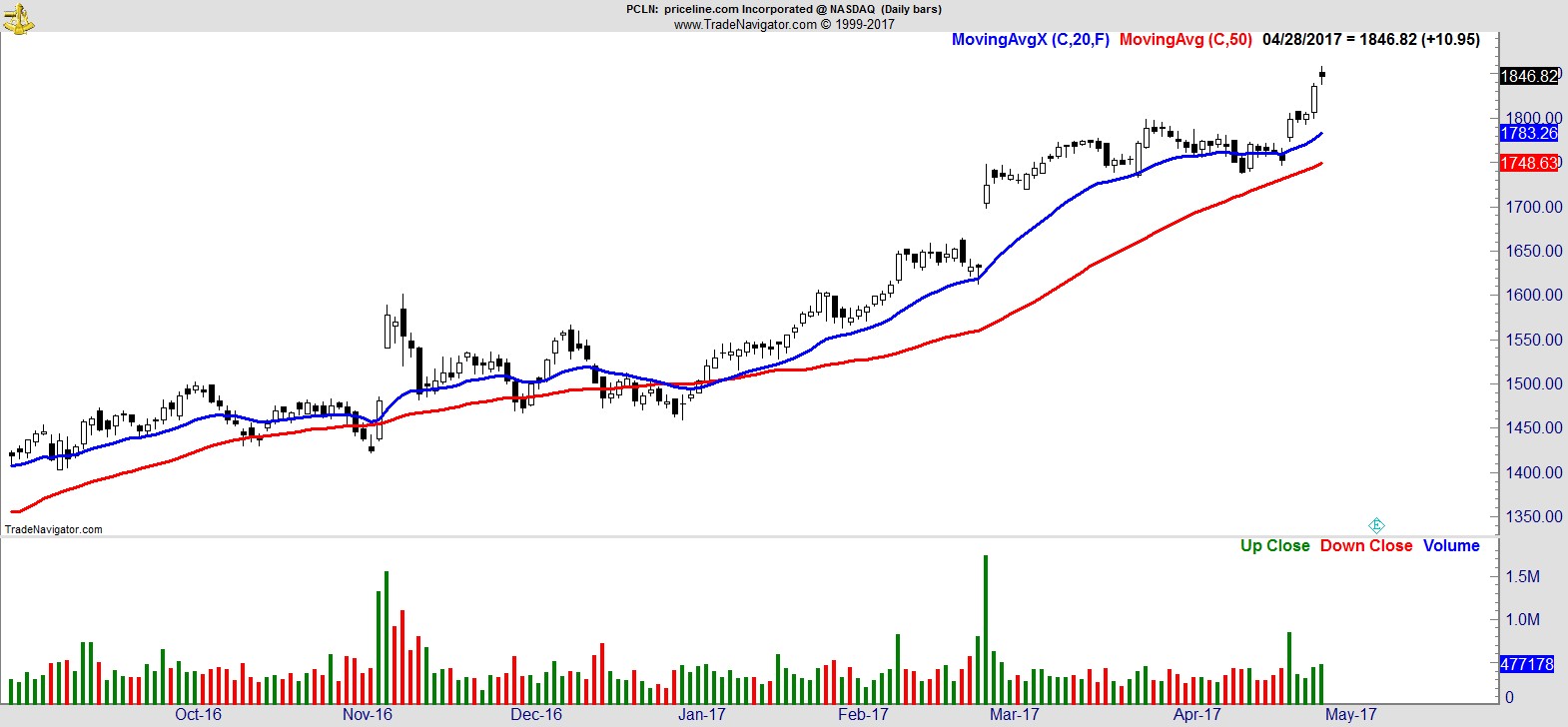

$PCLN

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17