The primary goal of my oftentimes meandering morning market missive is to attempt to identify the key drivers of the stock market on a daily basis. The idea is to try and stay in tune with what "is" actually happening in the market and to avoid the trap of thinking about what "should" be happening. Trust me when I say that setting the ego aside and identifying what the actual drivers of the action is can be easier said than done!

Once you make the decision to leave your personal view of the world out of the equation, one of the tricks to achieving my daily goal is to recognize that the drivers of the markets often differ given the time frame being evaluated. For example, what is driving the market in the near-term (i.e. what traders and their computers are focused on today) may be completely different from the drivers of the action from a long-term perspective - such as the fundamental picture.

As such, let me start this morning's missive by stating that we are focused on the near-term outlook here, which I define as a few days to a couple weeks.

Watching the Greenback

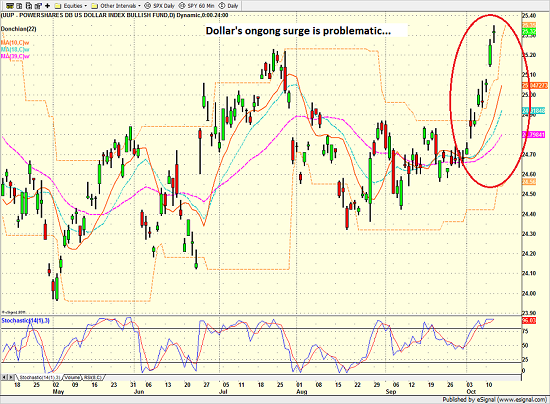

With the caveats out of the way, from my perch, there can be little argument that key driver to the stock right now is the recent surge in the U.S. dollar.

Powershares US Dollar ETF (UUP) - Daily

View Larger Image

While the daily correlation to the S&P 500 is not perfect on a minute-by-minute basis at this time, I can say that the intraday spikes in the stock market do appear to have been driven by the action in the dollar. It's as if somebody somewhere suddenly looks at a screen and say, "Geez, look at the darn dollar!"

Cutting to the ...